Understanding Whole Life Insurance: Benefits, Features, and Considerations

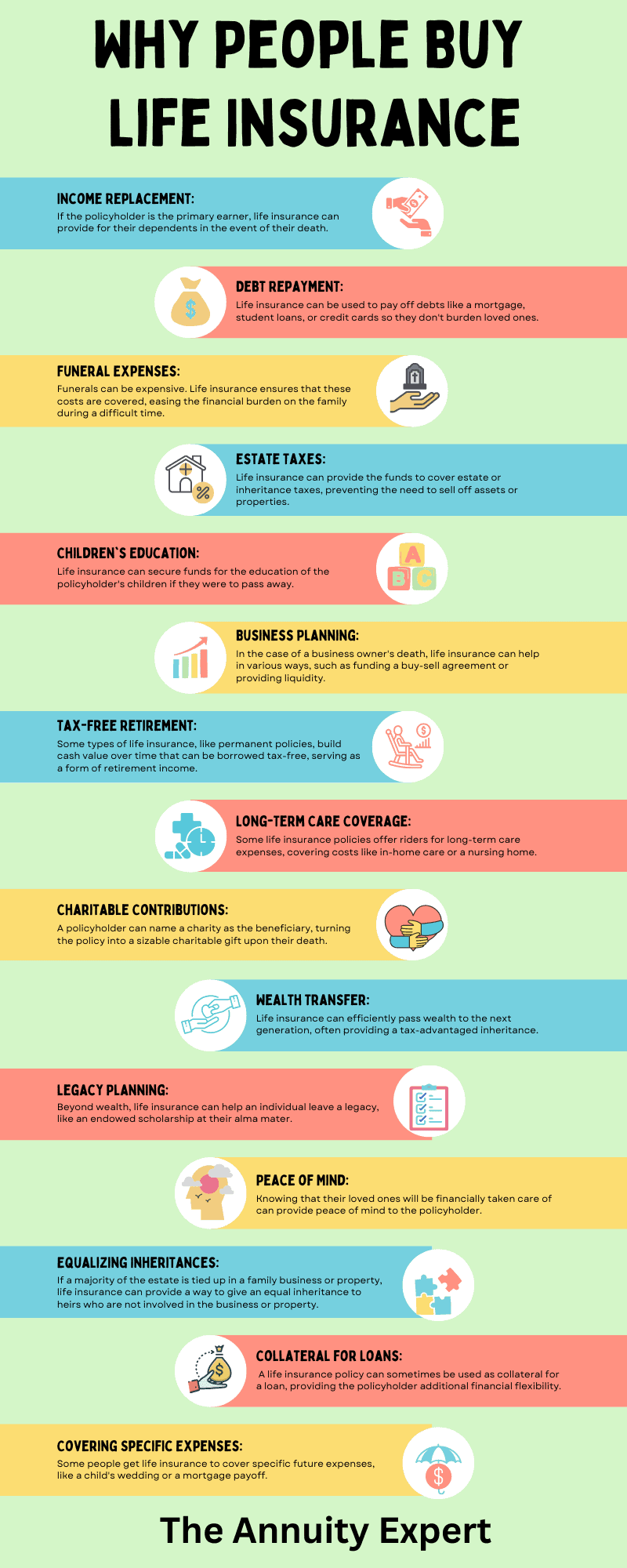

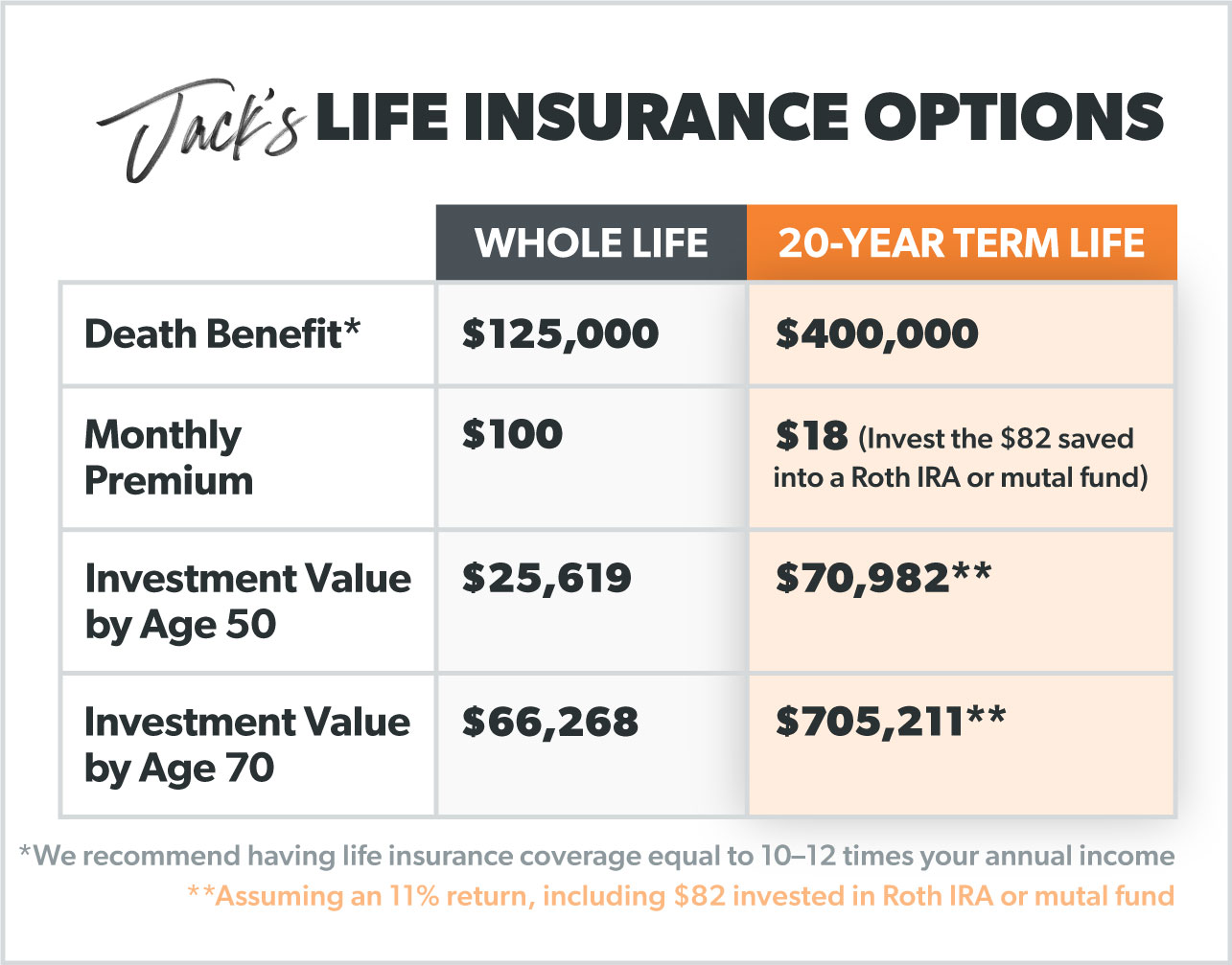

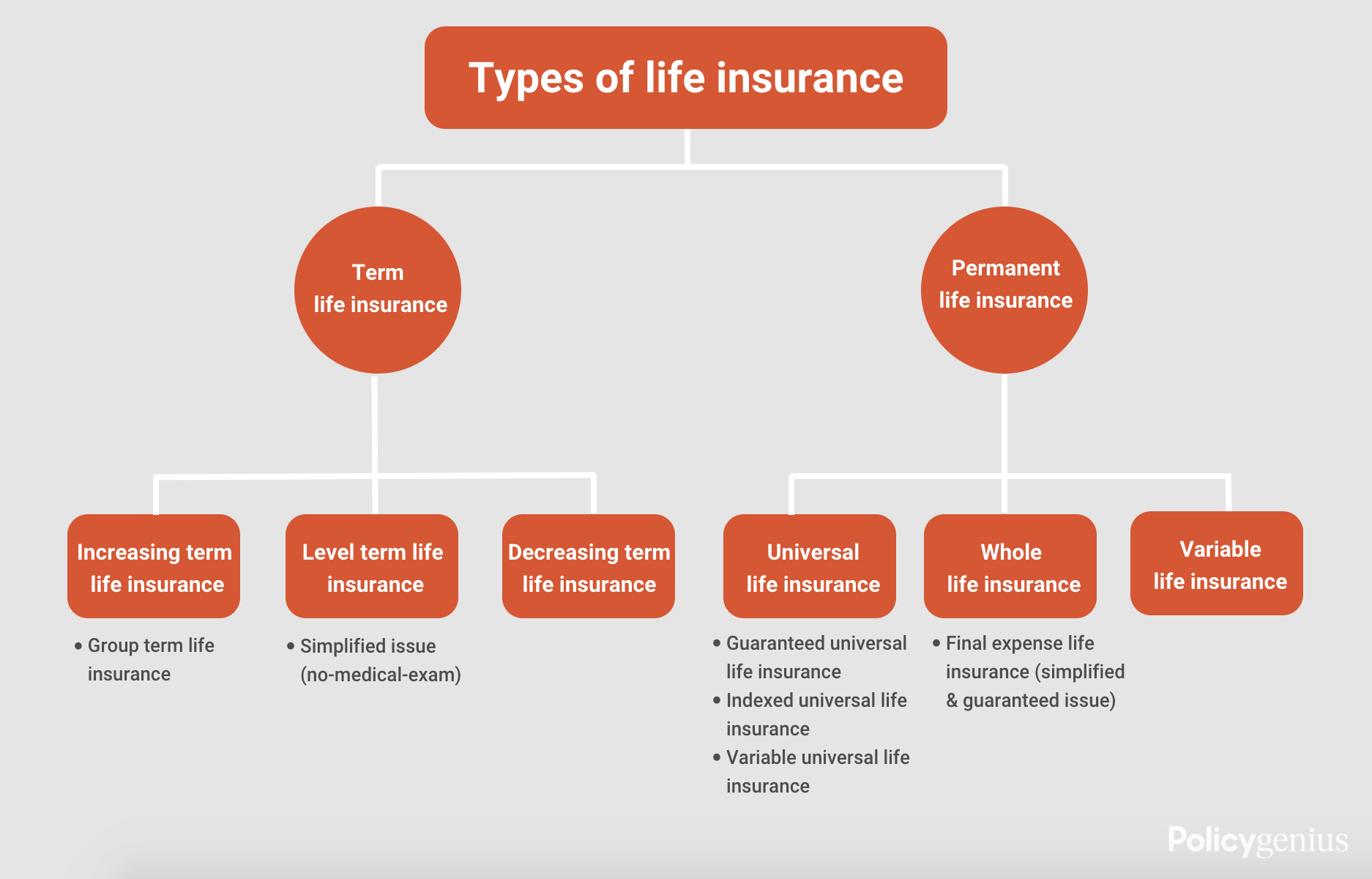

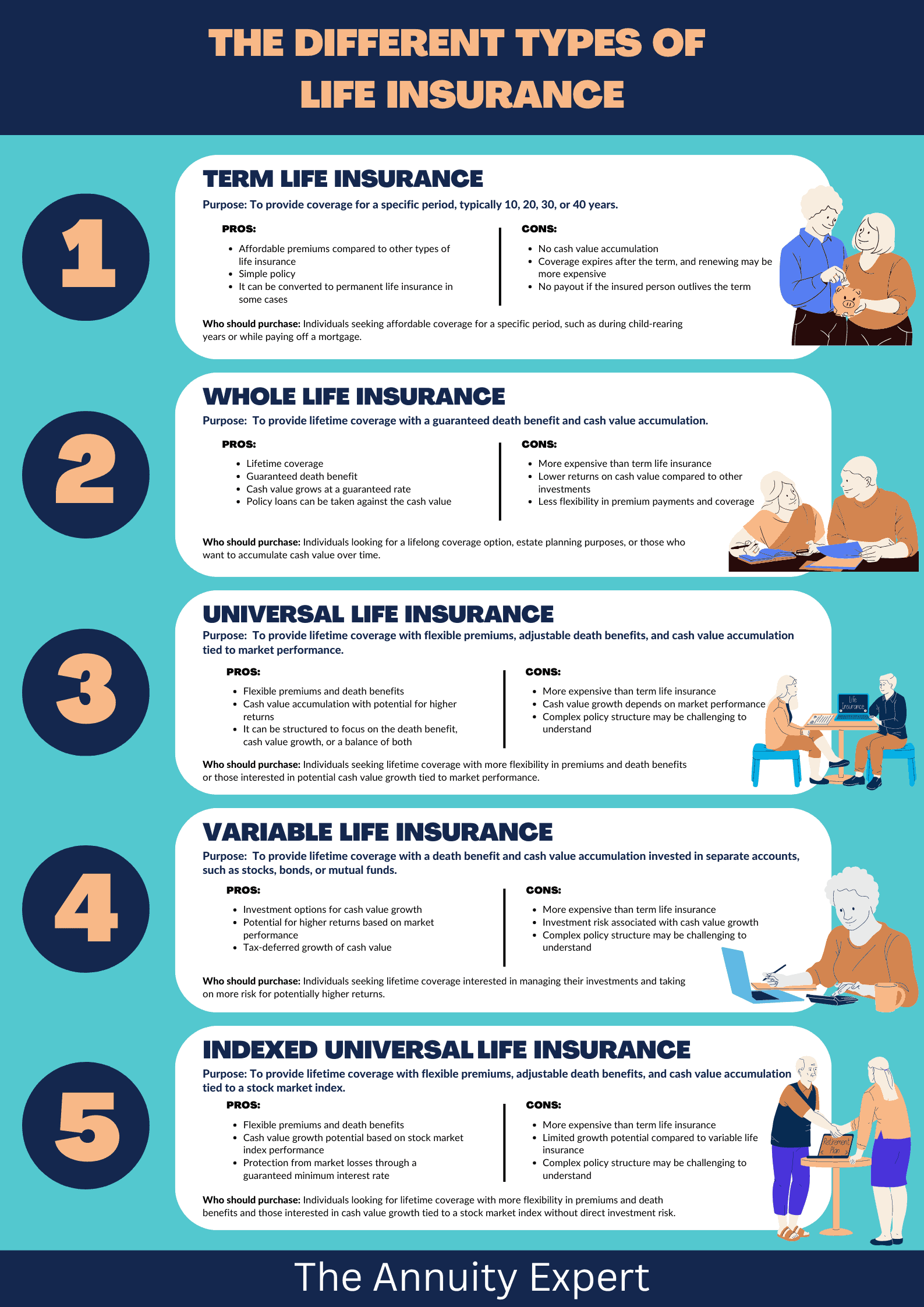

When it comes to planning for the future and ensuring the financial well-being of your loved ones, whole life insurance stands as a steadfast option that provides both protection and investment potential. Whole life insurance is a type of permanent life insurance offering coverage for the entire life, along with a built-in cash value component. …