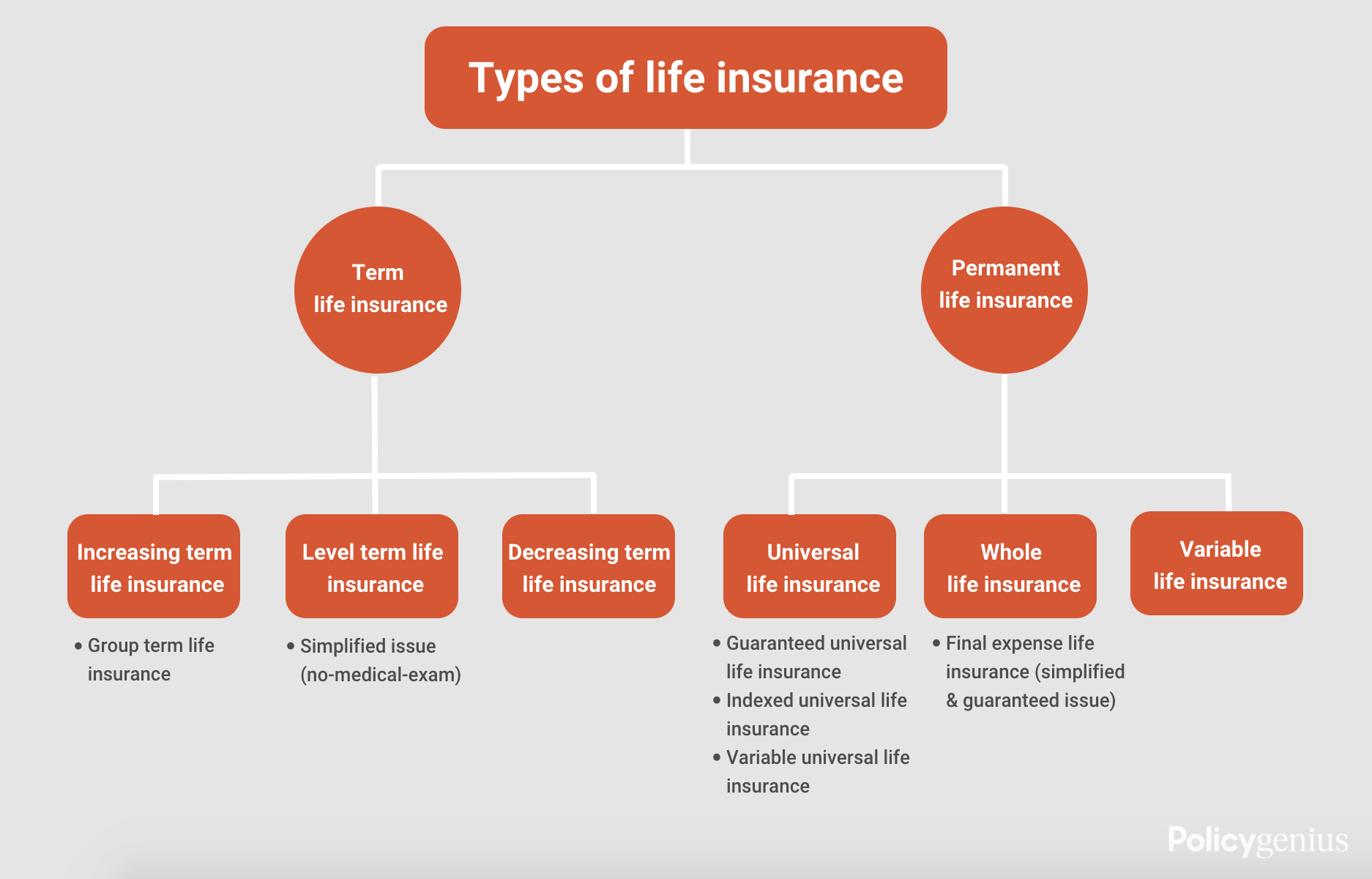

Life insurance is essential for anyone looking to protect their loved ones and provide financial security in the event of their passing. But with so many options available, it can be overwhelming to navigate the world of life insurance. That’s why it’s crucial to understand the three main life insurance types commonly offered. Knowing the differences between these types allows you to make an informed decision that suits your needs.

The three primary types are whole life insurance, term life insurance, and universal life insurance. Whole life insurance provides coverage for the entirety of your life and includes a cash value component that grows over time. On the other hand, term life insurance offers coverage for a specified term, such as 10, 20, or 30 years. Finally, universal life insurance is a flexible option that combines aspects of both whole and term life insurance, allowing for adjustments to the death benefit and premium payments. Understanding the nuances of each type of life insurance will empower you to choose the best option for yourself and your loved ones. So, let’s dive into the details and explore the benefits and considerations of these three main types of life insurance.

2. Whole life insurance provides coverage for your entire life. It also includes a cash value component that grows over time, which you can borrow against or withdraw.

3. Universal life insurance combines the features of term and whole life insurance. It offers flexibility in premium payments and death benefit amounts.

It’s essential to assess your financial needs and goals to determine which type of life insurance is right for you.

Understanding the 3 Main Types of Life Insurance

Life insurance is an essential financial tool that provides financial protection and peace of mind for individuals and their families. It serves as a safety net, ensuring that loved ones are cared for in the event of the policyholder’s death. However, with the variety of options available, choosing the right type of life insurance can be overwhelming. This article will explore the three main types of life insurance: term life insurance, whole life insurance, and universal life insurance.

1. Term Life Insurance

Term life insurance is the simplest and most affordable form of life insurance. It covers a specific period, typically 10, 20, or 30 years. The beneficiaries receive a death benefit if the policyholder passes away during the term. However, if the policyholder outlives the term, the coverage expires, and no benefits are paid.

Term life insurance is ideal for individuals who have temporary financial obligations, such as a mortgage, student loans, or young children. It provides a straightforward and cost-effective way to protect loved ones during the most critical years. Additionally, term life insurance is often convertible, meaning it can be converted into a permanent policy without needing a medical exam.

Benefits of Term Life Insurance

– Affordable premiums: Term life insurance typically has lower premiums than permanent policies, making it more accessible for individuals on a budget.

– Flexibility: With term life insurance, individuals can choose the coverage length that aligns with their specific needs, such as the duration of a mortgage or until children are financially independent.

Drawbacks of Term Life Insurance

– No cash value: Unlike permanent life insurance policies, term life insurance does not accumulate cash over time. This means there is no potential for investment growth or borrowing against the policy.

– Limited coverage period: Once the term expires, the policyholder must reapply for coverage, which may come with higher premiums due to increased age and potential health issues.

2. Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire duration of the policyholder’s life as long as premiums are paid. It offers a death benefit and a cash value component, which grows over time. Whole life insurance premiums are typically higher than term life insurance premiums but remain level throughout the policyholder’s life.

One of the main advantages of whole life insurance is accumulating cash value, which can be accessed through policy loans or withdrawals. This cash value can be used for various purposes, such as supplementing retirement income, paying for education, or covering emergencies.

Benefits of Whole Life Insurance

– Lifetime coverage: Whole life insurance covers the policyholder’s entire life, ensuring that beneficiaries receive a death benefit regardless of when the policyholder dies.

– Cash value growth: The cash value component of whole life insurance grows over time, offering a potential source of funds for future financial needs.

Drawbacks of Whole Life Insurance

– Higher premiums: Whole life insurance typically has higher premiums than term life insurance. This can make it less affordable, especially for individuals with limited financial resources.

– Limited flexibility: Once a whole life insurance policy is in place, adjusting the coverage amount or premium payments may be challenging without additional fees or penalties.

3. Universal Life Insurance

Universal life insurance is another permanent life insurance that combines a death benefit with a cash value component. It offers more flexibility than whole life insurance, allowing policyholders to adjust the death benefit and premium payments throughout the policy’s duration.

With universal life insurance, policyholders can allocate their premium payments to the cash value component, which earns interest based on market rates. This allows the policyholder to accumulate more cash value over time potentially. Additionally, universal life insurance policies often offer the option to invest the cash value in various investment vehicles, such as stocks or bonds.

Benefits of Universal Life Insurance

– Flexibility: Universal life insurance offers flexible premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their financial needs change.

– Potential for cash value growth: The cash value component of universal life insurance can grow based on market performance, potentially providing policyholders with a higher cash value accumulation.

Drawbacks of Universal Life Insurance

– Market risk: The cash value component of universal life insurance is subject to market fluctuations. If the investments underperform, it may impact the growth potential of the cash value.

– Complexity: Universal life insurance policies can be more complex than term or whole insurance policies, requiring a deeper understanding of the policy’s features and investment options.

Understanding the three main types of life insurance is crucial when deciding which policy best fits your needs. Whether you opt for the simplicity and affordability of term life insurance, the lifelong coverage and cash value growth of whole life insurance, or the flexibility and potential market growth of universal life insurance, having life insurance in place provides financial protection and peace of mind for you and your loved ones.

Key Takeaways: What Are the 3 Main Types of Life Insurance?

- Term life insurance provides coverage for a specific period.

- Whole life insurance offers lifelong coverage and builds cash value over time.

- Universal life insurance combines life insurance coverage with an investment component.

- Life insurance provides financial protection for your loved ones during your death.

- Understanding the different types of life insurance can help you choose the right policy for your needs.

Frequently Asked Questions

What are the different types of life insurance policies?

Life insurance is an essential financial tool that provides protection and peace of mind for individuals and their families. There are three main types of life insurance policies:

1. Term Life Insurance: This type of insurance covers a specific period, typically 10 to 30 years. It offers a death benefit to the policyholder’s beneficiaries if they pass away during the policy term. Term life insurance is generally more affordable than other life insurance types.

2. Whole Life Insurance: Whole life insurance is a permanent life insurance policy that offers coverage for the entire lifetime of the insured individual. It provides a death benefit and accumulates cash value over time. The premiums for whole life insurance are generally higher than those for term life insurance, but the policy offers lifelong protection and potential for cash value growth.

3. Universal Life Insurance: Universal life insurance is another form of permanent life insurance that combines a death benefit with a savings component. It allows policyholders to adjust their death benefit and premium payments within certain limits. Universal life insurance offers more flexibility than whole life insurance but also carries more complexity.

Which type of life insurance policy is best for me?

The best type of life insurance policy for you depends on your unique circumstances, financial goals, and budget. Here are some factors to consider:

1. Financial Needs: If you have temporary financial obligations, such as a mortgage or education expenses, term life insurance may be a suitable choice. If you require lifelong coverage and want the potential for cash value growth, whole life insurance or universal life insurance could be more appropriate.

2. Budget: Consider how much you can afford for life insurance premiums. Term life insurance generally has lower premiums, making it more affordable for many individuals. Whole life insurance and universal life insurance have higher premiums, but they offer additional benefits and features.

3. Long-Term Goals: Assess your long-term financial goals and how life insurance fits your overall financial plan. If you have estate planning or wealth transfer objectives, permanent life insurance policies like whole or universal life insurance may be beneficial.

Ultimately, consulting with a qualified insurance professional to assess your needs and guide you toward the most suitable life insurance policy is essential.

Can I have multiple types of life insurance policies?

Yes, it is possible to have multiple types of life insurance policies. Some individuals choose to combine different policies to meet their specific needs. For example, you may opt for a term life insurance policy to cover temporary financial obligations, such as a mortgage, while having a whole life insurance policy for lifelong coverage and cash value accumulation.

It’s essential to carefully consider your overall life insurance needs and consult with an insurance professional to ensure that you have the right combination of policies to provide comprehensive coverage.

What factors should I consider when choosing a life insurance policy?

When choosing a life insurance policy, there are several factors to consider:

1. Financial Needs: Assess your financial obligations, including outstanding debts, mortgage, and education expenses, to determine your required coverage.

2. Policy Duration: Decide whether you need coverage for a specific period or your entire lifetime. This will help you determine whether a term or permanent life insurance policy is more suitable.

3. Premium Affordability: Consider your budget and determine how much you can pay for life insurance premiums. Compare quotes from different insurers to find the most cost-effective option.

4. Additional Features: Evaluate the additional features offered by different policies, such as cash value accumulation, policy loans, and flexible premium payments. These features can vary between different types of life insurance policies.

5. Insurer’s Reputation: Research the reputation and financial stability of the insurance company before purchasing a policy. Look for insurers with strong financial ratings and a prompt claims settlement track record.

By carefully considering these factors and seeking guidance from a qualified insurance professional, you can make an informed decision and choose a life insurance policy that meets your needs.

Can I switch between different types of life insurance policies?

In some cases, switching between different types of life insurance policies may be possible. However, the availability and terms of switching can vary depending on the insurance company and specific policy provisions.

Before considering a switch, it’s essential to thoroughly evaluate your current policy and the potential benefits and drawbacks of switching to a different type of life insurance. Consider surrender charges, possible loss of accumulated cash value, and new underwriting requirements.

Consulting with an insurance professional can provide valuable guidance on whether switching policies is viable for your situation. They can help you assess the potential costs, benefits, and implications of switching and ensure that it aligns with your long-term financial goals.

Final Summary: Understanding the 3 Main Types of Life Insurance

Now that we’ve explored the world of life insurance let’s recap the three main types you need to know about. Remember, life insurance is essential for protecting your loved ones’ financial future and providing peace of mind. So, without further ado, here are the three main types of life insurance:

Firstly, we have term life insurance. This type of policy provides coverage for a specific period, typically 10 to 30 years. It’s like renting insurance for a particular time frame. Term life insurance is popular for those who want affordable coverage to protect their loved ones during critical times, such as paying off a mortgage or financing a child’s education. Review your policy regularly to ensure it aligns with your changing needs.

Next up, we have whole life insurance. This type of policy offers lifelong coverage and builds cash value over time. It’s like owning insurance for your entire life. Whole life insurance is an excellent option if you’re looking for a policy that provides both protection and an investment component. While it may have higher premiums than term life insurance, the cash value growth can be used for emergencies, retirement, or even as a source of funds during your lifetime.

Lastly, we have universal life insurance. This type of policy combines the benefits of term and whole life insurance. Universal life insurance provides flexibility in premium payments and death benefit coverage. It allows you to adjust your coverage and premium amounts to suit your changing needs. You can accumulate cash value with universal life insurance while enjoying its protection.

In conclusion, choosing the right life insurance policy depends on your circumstances and goals. Whether you opt for term, whole, or universal life insurance, it’s crucial to evaluate your needs, conduct thorough research, and consult a reputable insurance professional. Remember, life insurance is a powerful tool that can provide financial security for your loved ones, so make an informed decision and protect what matters most.