If you’ve ever wondered, “What is evidence of insurability for life insurance?” then you’ve come to the right place! Life insurance is an essential financial tool providing your loved one protection and peace of mind. But before you can secure coverage, insurance companies typically require proof of your insurability. This article will explore what evidence of insurability means, why it’s necessary, and how to navigate this process smoothly.

When it comes to life insurance, evidence of insurability refers to the documentation or information demonstrating an individual’s coverage eligibility. Insurance companies use this evidence to assess the risk associated with insuring someone and determine the premium rates. This evidence can come in various forms, such as medical records, personal statements, and sometimes even a medical examination. Understanding what evidence of insurability entails is crucial for anyone considering life insurance, as it plays a significant role in underwriting.

Now that we have a general understanding of what evidence of insurability is let’s delve deeper into why insurance companies require it and how it affects your life insurance application. By familiarizing yourself with the key concepts and considerations surrounding evidence of insurability, you’ll be better equipped to navigate the world of life insurance and make informed decisions that protect yourself and your loved ones. So, let’s dive in and explore the fascinating world of evidence of insurability for life insurance!

Understanding Evidence of Insurability for Life Insurance

Life insurance is an essential financial tool that provides protection and financial security to your loved ones during your untimely death. When applying for a life insurance policy, you may come across the term “evidence of insurability.” But what exactly does it mean? In this article, we will explore the concept of evidence of insurability for life insurance and its significance in the underwriting process.

What is Evidence of Insurability?

When you apply for life insurance, the insurance company assesses various factors to determine your eligibility and the premium rates you will be charged. Evidence of insurability refers to the proof or documentation the insurance company requires to evaluate your risk profile and determine whether you are insurable.

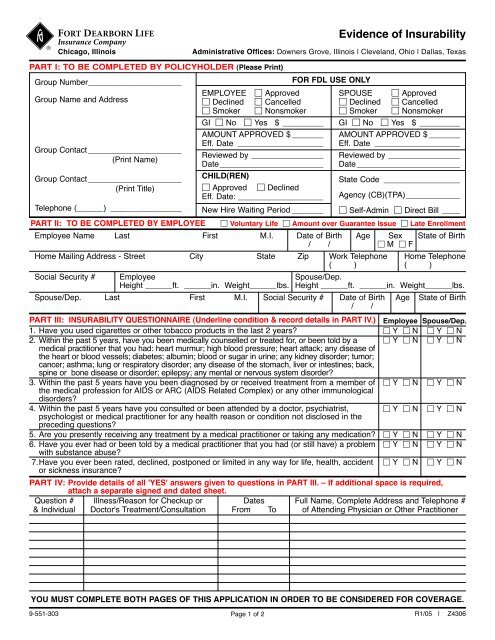

This evidence typically includes medical records, health questionnaires, and medical examinations. It helps the insurance company evaluate your current health condition, lifestyle habits, and pre-existing medical conditions. By reviewing this evidence, the insurer can assess the level of risk you present and make an informed decision about your eligibility for coverage.

The Importance of Evidence of Insurability

Evidence of insurability is crucial for life insurance underwriters as it helps them assess the risk associated with providing coverage to an individual. The insurance company must evaluate your health and medical history to determine your likelihood of claiming the future.

By reviewing your evidence of insurability, the insurance company can determine the premium rates you will be charged. If you are considered a high-risk individual due to pre-existing medical conditions or unhealthy lifestyle habits, you may be charged higher premiums or even denied coverage altogether.

Additionally, evidence of insurability is essential for ensuring fairness in the insurance industry. By evaluating the risk profiles of applicants, insurance companies can maintain a balanced risk pool and offer competitive rates to individuals who pose a lower risk.

Types of Evidence of Insurability

Insurance companies may require several types of evidence of insurability as part of the underwriting process. Let’s take a closer look at some common types:

1. Medical Records: Insurance companies often request access to your medical records to assess your overall health. These records provide valuable information about your medical history, existing conditions, and previous treatments.

2. Health Questionnaires: Many insurance applications include detailed health questionnaires. These questionnaires inquire about your medical history, lifestyle choices, and family medical history. Your answers help the insurer evaluate your risk profile.

3. Medical Examinations: In some cases, insurers may require you to undergo a medical examination by a healthcare professional. These examinations typically involve a physical check-up, blood tests, and other diagnostic procedures.

4. Laboratory Tests: Insurance companies may request specific laboratory tests, such as blood or urine analyses, to gather additional information about your health status.

It’s important to note that the specific evidence of insurability requirements can vary between insurance companies and policy types. Some policies, such as guaranteed issue life insurance, may have minimal or no evidence of insurability requirements.

Why is Evidence of Insurability Necessary?

Evidence of insurability is necessary for insurance companies to assess risk accurately and determine the appropriate premium rates. By evaluating an applicant’s health and medical history, insurers can determine the likelihood of future claims and price their policies accordingly.

Insurance is a business based on risk assessment, and evidence of insurability helps insurers make informed decisions. Without this information, insurers would be operating blindly, potentially leading to higher premiums for everyone or unsustainable business practices.

In addition to protecting the insurance company’s financial stability, evidence of insurability also protects policyholders. By evaluating the risk profiles of applicants, insurance companies can prevent individuals from obtaining coverage after a diagnosis or event that would likely result in a claim.

In conclusion, evidence of insurability is a crucial aspect of the life insurance underwriting process. It helps insurance companies assess an applicant’s risk profile and determine the appropriate premium rates. By providing accurate and detailed evidence of insurability, you can ensure a fair evaluation of your application and potentially secure more favorable coverage and premium rates.

Key Takeaways: What is Evidence of Insurability for Life Insurance?

- Evidence of insurability proves that an individual is in good health and a low risk for the insurance company.

- It may include medical exams, blood tests, and medical history questionnaires.

- Insurers require evidence of insurability to assess the applicant’s risk and determine premiums.

- Some policies may offer guaranteed insurability, which allows policyholders to increase coverage without providing additional evidence of insurability.

- Evidence of insurability is essential for obtaining life insurance coverage and ensuring financial protection for loved ones.

Frequently Asked Questions

What is evidence of insurability for life insurance?

When applying for life insurance, insurance companies may require evidence of insurability. This is a way for insurers to assess the risk associated with insuring an individual. Evidence of insurability typically involves providing information about your health, lifestyle, and medical history.

This evidence aims to determine if you are eligible for life insurance coverage and at what premium rate. Insurance companies want to ensure that they provide coverage to individuals likely to live a long and healthy life. By evaluating your insurability, they can determine the level of risk they are taking by insuring you.

What information is typically required for evidence of insurability?

When providing evidence of insurability, insurance companies may ask for various pieces of information. This often includes details about your medical history, such as any pre-existing conditions, surgeries, or medications you currently take. They may also inquire about your lifestyle choices, such as smoking, alcohol consumption, or participation in hazardous activities.

Additionally, insurance companies may request a medical examination as part of the evidence of insurability process. This can involve measurements of your height, weight, blood pressure, and blood tests. The specific requirements may vary depending on the insurance company and the policy you are applying for.

Why do insurance companies require evidence of insurability?

Insurance companies require evidence of insurability to assess the risk of insuring an individual. By evaluating your health, lifestyle, and medical history, they can determine the likelihood of you experiencing health issues or premature death. This information helps insurers determine the premium rate they will charge for coverage.

Insurance is based on the principle of pooling risk. The premiums paid by policyholders cover the costs of claims made by those who experience an insured event. By assessing the insurability of individuals, insurance companies can ensure that the premiums collected are sufficient to cover potential claims.

How can I provide evidence of insurability?

To provide evidence of insurability, you will typically need to complete a detailed application form provided by the insurance company. This form will provide information about your medical history, lifestyle choices, and other relevant details. It is essential to answer these questions honestly and accurately.

In addition to the application form, you may be required to undergo a medical examination. This can involve visiting a healthcare professional who will assess your overall health and perform various tests. The insurance company will use the medical examination results to evaluate your insurability.

What happens if I am deemed uninsurable?

If you are deemed uninsurable based on the evidence provided, the insurance company is unwilling to offer you coverage at the standard premium rates. However, being deemed uninsurable does not mean you cannot obtain any life insurance.

Specialized insurance products are available for individuals who may have difficulty obtaining traditional life insurance due to health issues or other factors. These products may have different requirements and higher premium rates. It is recommended to consult with an insurance professional who can guide you toward suitable options if you are deemed uninsurable.

Final Summary: Understanding Evidence of Insurability for Life Insurance

So, there you have it! We’ve delved into the fascinating world of evidence of insurability for life insurance. This crucial concept determines whether an individual is eligible for coverage and at what premium rate. From medical exams and questionnaires to financial assessments, the evidence of insurability process ensures that insurance companies have a clear picture of an individual’s health and financial situation.

Throughout this article, we’ve explored the various requirements and factors that come into play when determining evidence of insurability. We’ve learned that it’s about physical health, financial stability, and lifestyle choices. By understanding these essential elements, individuals can be better prepared when applying for life insurance and ensure that they provide the necessary evidence to support their application.

Remember, evidence of insurability is not meant to be a barrier but rather a way for insurance companies to assess risk and provide coverage accordingly. By being transparent and proactive in providing the required information, individuals can secure the life insurance coverage they need to protect themselves and their loved ones.

So, whether you’re considering getting life insurance or simply curious about the topic, now you understand what evidence of insurability entails. As always, it’s essential to consult with a licensed insurance professional who can guide you through the process and help you find the best policy for your specific needs.

In conclusion, evidence of insurability is a vital component of the life insurance application process, and understanding its significance can empower individuals to make informed decisions regarding protecting their financial future. With this knowledge, you can confidently navigate the world of life insurance and ensure you have the coverage you need to safeguard your loved ones.