Hey there! Have you ever wondered if you can borrow against your life insurance? You’re lucky because today, we’re diving into this fascinating topic. Life insurance is not just about providing financial security for your loved ones after you’re gone; it can also offer some unique benefits while you’re still alive. So, let’s explore the possibilities and find out if you can tap into your life insurance policy to borrow some funds when you need them the most.

Life insurance is like a safety net, protecting your loved ones in the event of your passing. But did you know it can also be a financial resource while you’re still alive? Yes, you heard that right! You can borrow against your life insurance policy to access cash when needed. It’s like having a secret savings account that grows over time, allowing you to tap into its value during life’s unexpected moments. So, if you’re curious to learn more about how this works and its potential benefits, grab a cup of coffee, sit back, and let’s explore the world of borrowing against life insurance together.

Can You Borrow Against Life Insurance?

Life insurance is a financial tool that provides a death benefit to your beneficiaries upon your passing. However, did you know that some life insurance policies also offer the option to borrow against the cash value? This can be a valuable feature for policyholders who find themselves in need of funds for various reasons. This article will explore borrowing against life insurance and discuss the benefits and considerations associated with this option.

Understanding Life Insurance Policy Loans

Life insurance policy loans allow policyholders to borrow money against the cash value of their life insurance policies. The cash value is a component of specific life insurance policies that accumulate over time, typically on a tax-deferred basis. It represents the savings portion of the policy and can be used for various purposes, including borrowing.

When you borrow against your life insurance policy, you essentially take out a loan from the insurance company using your policy’s cash value as collateral. The loan must be repaid with interest, and if it is not refunded during your lifetime, the outstanding balance will be deducted from the death benefit payable to your beneficiaries.

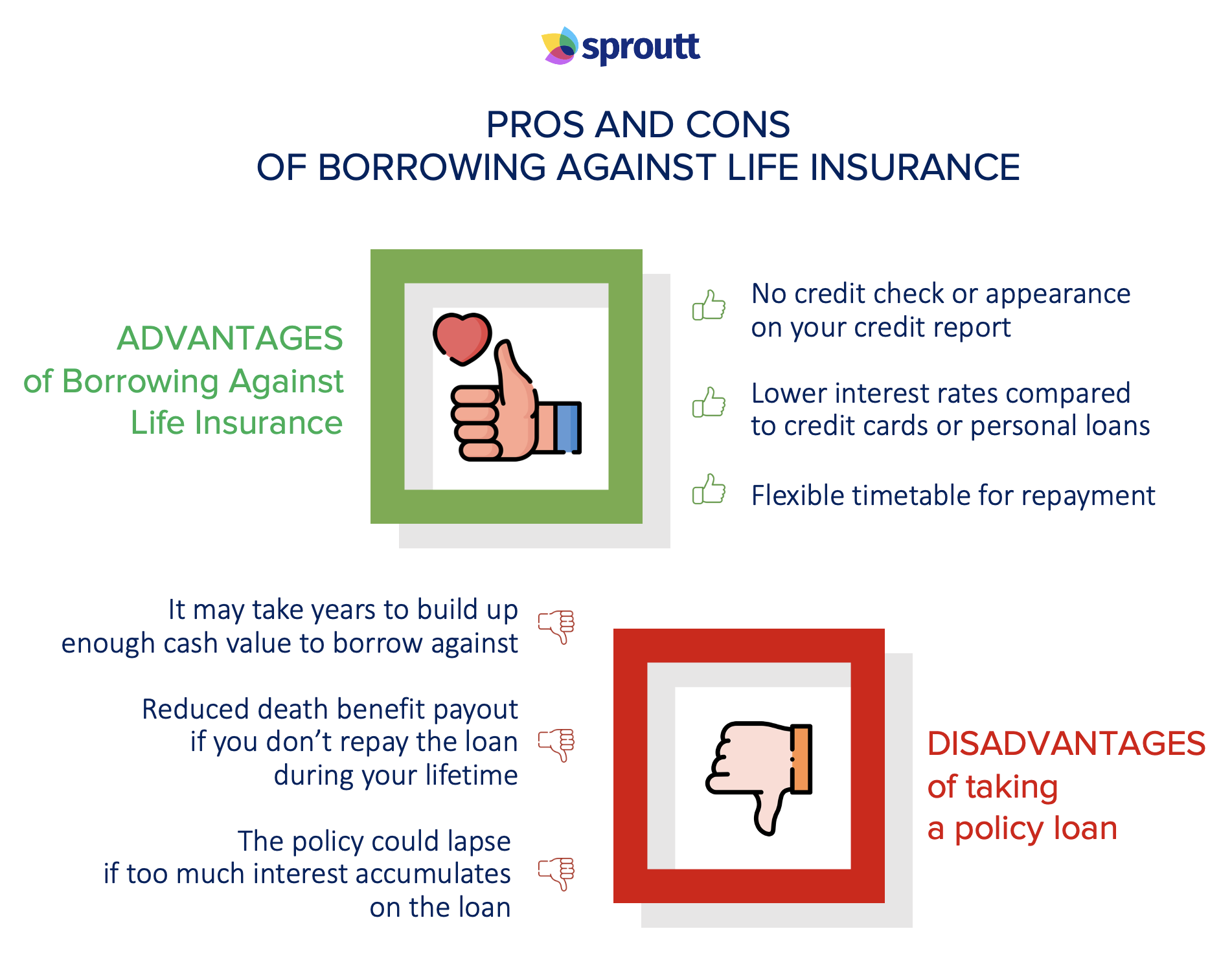

Benefits of Borrowing Against Life Insurance

Borrowing against your life insurance policy can offer several advantages compared to traditional loans or lines of credit. Here are some key benefits to consider:

1. Access to cash without credit checks: When borrowing against your life insurance policy, you essentially borrow from yourself. This means there are no credit checks or qualification requirements like there would be with other types of loans. You can access the funds if your policy has accumulated sufficient cash value.

2. Competitive interest rates: Life insurance policy loans often offer competitive interest rates compared to other forms of borrowing. The interest you pay on the loan goes back into your policy’s cash value, which can help offset the cost of borrowing.

3. Flexible repayment options: When you borrow against your life insurance policy, you have flexibility in how you repay the loan. You can make regular payments or pay it off in a lump sum. This flexibility can be particularly beneficial if you experience changes in your financial situation.

4. Tax advantages: The proceeds of the life insurance policy loan are generally not taxable as long as the policy remains in force. This can provide a significant advantage compared to other types of loans that may be subject to taxation.

Considerations When Borrowing Against Life Insurance

While borrowing against your life insurance policy can be a helpful option, there are some important considerations to keep in mind:

1. Impact on the death benefit: When you borrow against your life insurance policy, the outstanding loan balance is deducted from the death benefit payable to your beneficiaries. This means that if you pass away before repaying the loan, the amount received by your loved ones will be reduced.

2. Interest accrual: Like any loan, borrowing against your life insurance policy accrues interest. If you cannot repay the loan, the interest accumulates, potentially reducing the policy’s future cash value and death benefit.

3. Potential policy lapse: If you cannot repay the loan and the interest accumulates, it could eventually deplete your policy’s cash value. This could result in the policy lapsing, meaning you may lose the coverage and the accumulated cash value.

4. Impact on policy performance: Borrowing against your life insurance policy can affect its overall performance. The interest charged on the loan reduces the potential growth of the cash value, which may impact the policy’s ability to accumulate value over time.

5. Alternative borrowing options: Before borrowing against your life insurance policy, it’s essential to consider other borrowing options available to you. More suitable alternatives may offer lower interest rates or more favorable terms depending on your financial situation and needs.

Conclusion

Borrowing against life insurance can be a valuable financial tool for individuals who have accumulated cash value within their policies. It offers quick access to funds without credit checks, competitive interest rates, and flexible repayment options. However, it’s crucial to understand the potential impact on the policy’s death benefit, the accrual of interest, and the overall policy performance. Before deciding to borrow against your life insurance, it’s advisable to consult with a financial advisor to assess your specific circumstances and determine the best course of action.

Key Takeaways: Can You Borrow Against Life Insurance?

- Yes, you can borrow against your life insurance policy.

- It’s called a policy loan, allowing you to borrow money from your policy’s cash value.

- The borrowed amount accrues interest and needs to be paid back.

- Policy loans are generally tax-free but may reduce your policy’s death benefit.

- Not repaying the loan could result in a reduced death benefit or policy cancellation.

Frequently Asked Questions

What is the process for borrowing against life insurance?

When considering borrowing against your life insurance policy, there are a few steps you need to follow:

First, contact your insurance provider to inquire about their specific borrowing policies. They will be able to provide you with the necessary information and forms to initiate the process.

Next, you’ll need to complete the required paperwork, which typically includes a loan application and any supporting documentation requested by the insurance company. This may have proof of identification, policy details, and financial information.

How much can I borrow against my life insurance policy?

The amount you can borrow against your life insurance policy will depend on several factors, including your policy type and cash value. Generally, you can borrow up to your policy’s cash value, but it’s important to note that borrowing against your policy will reduce its death benefit.

It’s recommended to consult with your insurance provider to determine the maximum amount you can borrow and to understand the potential impact on your policy.

What are the advantages of borrowing against life insurance?

Borrowing against your life insurance policy can offer several advantages:

1. Quick access to funds: Borrowing against your policy can provide immediate access to cash without a lengthy loan approval process.

2. No credit check required: Since you are essentially borrowing against your policy, there is typically no need for a credit check or extensive financial documentation.

3. Potentially lower interest rates: Life insurance policy loans often have lower rates than other forms of borrowing, such as credit cards or personal loans.

Are there any risks involved in borrowing against life insurance?

While borrowing against your life insurance policy can be advantageous, there are also some risks to consider:

1. Reduced death benefit: When you borrow against your policy, the amount borrowed is deducted from the death benefit. This means that if you were to pass away before repaying the loan, your beneficiaries may receive a reduced payout.

2. Potential policy lapse: If you fail to repay the loan or the interest on time, it could lead to a policy lapse, resulting in the termination of your life insurance coverage.

It’s essential to carefully consider these risks and evaluate your ability to repay the loan before proceeding.

How do I repay a loan against my life insurance policy?

Repaying a loan against your life insurance policy typically involves making regular principal and interest payments. The repayment terms will be outlined in the loan agreement provided by your insurance provider.

It’s crucial to make timely payments to ensure that the loan does not negatively impact your policy. Failure to repay the loan can reduce your death benefit or even result in policy termination.

Final Thought: Can You Borrow Against Life Insurance?

So, can you borrow against life insurance? The answer is a resounding yes! Life insurance can be more than just a financial safety net for your loved ones. It can also provide you with a valuable asset you can tap into when you need it most. By borrowing against your life insurance policy, you can access funds for various purposes, such as paying off debts, covering medical expenses, or even funding your dream vacation.

But before you rush to take a loan against your life insurance, it’s essential to understand the implications. While it can be a convenient and accessible source of funds, borrowing against your policy will reduce the death benefit and may have tax implications. It’s crucial to weigh the pros and cons and consult a financial advisor to determine if it’s the right financial move for you. Remember, life insurance is meant to protect your loved ones, so borrowing against it should be done with careful consideration and planning.

In conclusion, life insurance provides financial security for your loved ones and can be a valuable resource during your lifetime. By borrowing against your policy, you can access funds when needed, offering flexibility and peace of mind. Remember to weigh the consequences, consult a financial advisor, and make an informed decision that aligns with your financial goals. Life is unpredictable, but with the right life insurance policy, you can have a safety net that extends beyond the traditional boundaries.