Life insurance contracts can be complex, with various terms and conditions that initially seem overwhelming. One crucial aspect is a collateral assignment. Now, you may wonder what a collateral assignment is and how it impacts a life insurance policy. Well, fret not! This article will delve into the world of collateral assignment and shed light on its significance in life insurance.

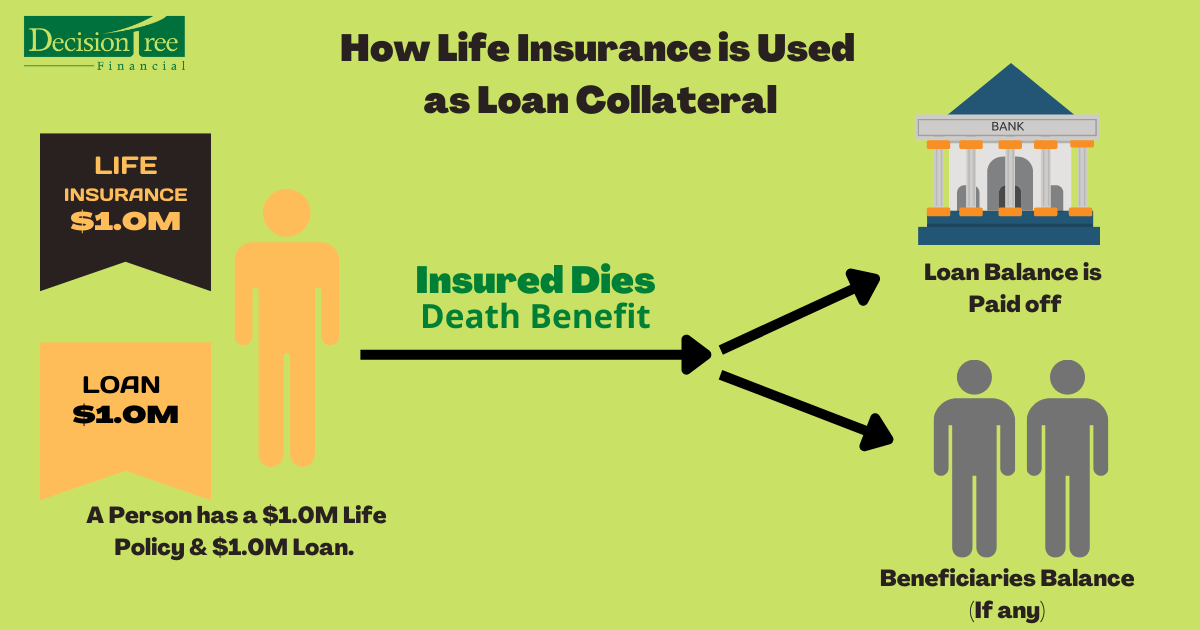

Regarding life insurance, collateral assignment refers to using a life insurance policy as collateral for a loan. Essentially, it allows the policyholder to assign the rights of the policy to a lender as security for a loan. If the policyholder fails to repay the loan, the lender can collect the outstanding amount from the life insurance policy proceeds. It’s like giving the lender a safety net to ensure they can recoup their money if things go awry. But how exactly is a collateral assignment used? And what are the implications for the policyholder? Join us as we delve deeper into the intricacies of collateral assignment in a life insurance contract. So please sit back, relax, and dive into this fascinating topic together!

Understanding Collateral Assignment in a Life Insurance Contract

Life insurance provides financial protection for your loved ones in the event of your untimely death. It ensures that they are cared for financially and can maintain their quality of life. However, there are situations where you may need to use your life insurance policy as collateral for a loan or to secure another financial transaction. This is where collateral assignment comes into play.

A collateral assignment is a legal arrangement that allows you to assign the rights and benefits of your life insurance policy to a creditor as collateral for a loan or other financial obligation. In simpler terms, you are using your life insurance policy as security for a debt. Let’s examine how collateral assignment works and why it is used in life insurance contracts.

How Does Collateral Assignment Work?

When you assign your life insurance policy as collateral, you essentially give the creditor the right to receive the policy’s death benefit in the event of your passing. In return, the creditor agrees to release their claim on the policy once the loan or financial obligation is repaid. If you default on your loan, the creditor can use the proceeds from your life insurance policy to recover the outstanding debt.

It’s important to note that the collateral assignment is typically a temporary measure. Once the loan is repaid or the financial obligation is fulfilled, the assignment is released, and the policy rights and benefits revert to you. This means that your beneficiaries will receive the full death benefit if you pass away after the assignment has been released.

Benefits of Collateral Assignment in a Life Insurance Contract

Collateral assignment offers several benefits for both the policyholder and the creditor. Let’s explore some of these advantages:

- Access to funds: Collateral assignment allows you to unlock the value of your life insurance policy and use it as collateral for a loan or financial transaction. This can give you the funds you need for various purposes, such as starting a business, purchasing a home, or paying off existing debts.

- Lower interest rates: You may secure a loan with lower interest rates than other unsecured debt forms by using your life insurance policy as collateral. Collateral reduces the risk for the creditor, making them more willing to offer favorable terms.

- Flexibility: Collateral assignment allows you to use your life insurance policy as collateral for different financial transactions. Whether you need a personal loan, a line of credit, or a mortgage, you can leverage your policy to meet your specific needs.

Before proceeding, carefully consider the terms and conditions of the collateral assignment agreement and make sure you understand its potential impact on your life insurance coverage and beneficiaries.

How is Collateral Assignment Used in Different Scenarios?

Collateral assignment can be used to secure loans or financial transactions in various scenarios. Here are a few examples:

1. Bank Loans:

When applying for a bank loan, such as a personal or business loan, you may be required to provide collateral to secure the loan. Your life insurance policy can be assigned as collateral to assure the bank that it will be repaid in the event of default.

2. Mortgage Loans:

When purchasing a home, you may need to take out a mortgage loan. The lender may require collateral to secure the loan, and your life insurance policy can be assigned as collateral to provide that security.

3. Business Loans:

Entrepreneurs often need funding to start or expand their businesses. The collateral assignment allows them to use their life insurance policies as collateral to secure business loans and access the capital they need to grow their ventures.

4. Estate Planning:

In estate planning, collateral assignment can be used to cover estate taxes or provide liquidity for the settlement of your estate. By assigning your life insurance policy as collateral, you can ensure that your loved ones have the necessary funds to handle any financial obligations that arise after your passing.

These are just a few examples of how collateral assignments can be used in different scenarios. It’s essential to consult with a financial advisor or insurance professional to determine if collateral assignment is the right option for your specific needs.

Critical Considerations for Collateral Assignment in a Life Insurance Contract

Before proceeding with collateral assignment, it’s crucial to consider the following factors:

1. Impact on Coverage:

Assigning your life insurance policy as collateral may impact your coverage. Ensure you understand how it will affect the death benefit and any other benefits associated with the policy. Additionally, consider whether there are any exclusions or limitations related to the collateral assignment.

2. Repayment Obligations:

Collateral assignment means that you are using your life insurance policy to secure a debt. Ensure you have a clear plan for repaying the loan or fulfilling the financial obligation. Failure to do so may result in the loss of your policy or a reduced death benefit for your beneficiaries.

3. Tax Implications:

Collateral assignment may have tax implications, mainly if the policy is considered a modified endowment contract (MEC). Consult with a tax advisor to understand the potential tax consequences of collateral assignment.

4. Policy Ownership:

The collateral assignment does not transfer ownership of the policy. You remain the owner and retain control over the policy, including the ability to make changes, such as beneficiary designations or premium payments.

By carefully considering these factors and seeking professional advice, you can decide whether collateral assignment suits your circumstances.

The Bottom Line

Collateral assignment in a life insurance contract allows you to use your policy as collateral for loans or other financial transactions. This will enable you to access funds, secure lower interest rates, and meet your financial needs. However, before proceeding with collateral assignment, it’s essential to understand the impact on your coverage, repayment obligations, tax implications, and policy ownership. By weighing the pros and cons and seeking expert guidance, you can make an informed decision that aligns with your financial goals and priorities.

Key Takeaways: How is Collateral Assignment Used in a Life Insurance Contract?

- A collateral assignment is a way to secure a loan using a life insurance policy as collateral.

- It allows the policyholder to assign the policy to the lender as collateral.

- If the policyholder defaults on the loan, the lender can access the policy’s cash value to recover the outstanding balance.

- Collateral assignment does not transfer ownership of the policy, only the rights to the policy’s cash value.

- Once the loan is repaid, the policyholder regains control over the policy’s cash value.

Frequently Asked Questions

What is a collateral assignment in a life insurance contract?

Collateral assignment in a life insurance contract refers to assigning the policy’s benefits to a lender or creditor as collateral for a loan. If the policyholder fails to repay the loan, the lender can claim the policy’s proceeds to recover the debt.

The collateral assignment provides security to the lender, as it guarantees that the loan will be repaid even if the borrower passes away before clearing the debt. It allows individuals to use their life insurance policy as a valuable asset to secure loans for various purposes, such as buying a house or starting a business.

How is a collateral assignment used in a life insurance contract?

When a borrower applies for a loan, the lender may require collateral to minimize non-payment risk. In such cases, the borrower can assign their life insurance policy as collateral. The borrower and lender will then enter into a collateral assignment agreement outlining the terms and conditions of the assignment.

Once the collateral assignment is in place, the lender becomes the assignee and gains the right to receive the policy’s benefits in the event of the borrower’s death. The assignee is typically listed as the primary beneficiary, and their claim to the policy’s proceeds takes priority over any other beneficiaries named in the policy.

What are the benefits of collateral assignment in a life insurance contract?

Collateral assignment offers several benefits for both borrowers and lenders. For borrowers, it allows them to leverage their life insurance policy to secure loans without liquidating other assets. This can be particularly advantageous when seeking large loan amounts or when the borrower’s creditworthiness is not strong.

For lenders, collateral assignment provides an added layer of security. The policy’s death benefit guarantees that the loan will be repaid, even if the borrower cannot fulfill their repayment obligations. This reduces the lender’s risk and may result in more favorable loan terms, such as lower interest rates.

Can the collateral assignment be revoked or modified?

Yes, collateral assignments can be revoked or modified under certain circumstances. The terms of the collateral assignment agreement will specify the conditions under which revocation or modification is allowed. Typically, the borrower retains the right to revoke or modify the assignment with the lender’s consent.

Revocation or modification may be necessary if the borrower wants to use the life insurance policy for a different purpose or to assign the collateral to a different lender. It is essential for borrowers to carefully review the terms of the collateral assignment agreement and consult with legal and financial professionals before making any changes.

What happens to the collateral assignment in a life insurance contract after the loan is repaid?

Once the loan is fully repaid, the collateral assignment is typically released. This means that the borrower regains complete control over their life insurance policy, and the assignee no longer has any claim to the policy’s benefits.

The release of the collateral assignment may require specific documentation and procedures to be followed, as outlined in the collateral assignment agreement. Borrowers must inform the lender once the loan is repaid to ensure a smooth release of the collateral assignment and avoid any confusion or delays.

Final Summary: Understanding the Importance of Collateral Assignment in a Life Insurance Contract

After diving into the intricacies of collateral assignment in a life insurance contract, it becomes clear that this valuable tool serves multiple purposes and provides financial security for policyholders. By assigning a collateral interest to a third party, individuals can secure loans, protect assets, and ensure the well-being of their loved ones.

The collateral assignment allows policyholders to leverage the cash value of their life insurance policy to obtain loans or finance other ventures. This arrangement provides a win-win situation, allowing able individuals to access funds when needed while maintaining the policy’s death benefit. Whether starting a business, funding education, or covering unexpected expenses, collateral assignment offers the flexibility and peace of mind that policyholders desire.

Furthermore, collateral assignment also serves as a protective measure for policyholders’ assets. Individuals can shield their assets from potential creditors by assigning the policy’s cash value as collateral. This strategy can benefit business owners or those with significant financial responsibilities. It ensures their life insurance policy remains intact and secure, even in challenging economic circumstances.

In summary, collateral assignment is crucial in life insurance contracts by providing policyholders with financial opportunities and asset protection. Whether accessing funds for personal or business needs or safeguarding assets from creditors, this mechanism offers a versatile and practical solution. By understanding and utilizing collateral assignments effectively, individuals can maximize the benefits of their life insurance policies and confidently achieve their financial goals.