Are you wondering if you can deduct life insurance premiums? Well, my friend, you’ve come to the right place! Life insurance is a significant investment that provides financial protection for your loved ones in the event of your passing. But can you get any tax benefits from paying those premiums? Let’s dive into the world of tax deductions and find out if you can save some money while securing your family’s future.

Before we get into the details, I want to ensure we’re on the same page. Life insurance premiums are your regular payments to keep your policy active. They ensure your beneficiaries receive a death benefit if you pass away during the policy term. Deductions, on the other hand, are expenses that you can subtract from your taxable income, reducing the amount of tax you owe. So, can you deduct life insurance premiums from your taxes? Let’s find out together and unravel the mysteries of the tax code!

Can You Deduct Life Insurance Premiums?

Life insurance provides financial protection for your loved ones during your death. Many consider it a significant investment to ensure their family’s financial security. But can you deduct life insurance premiums on your taxes? The answer is generally no, but there are a few exceptions to be aware of.

Understanding Life Insurance Premiums

Life insurance premiums are the regular payments you make to your insurance provider to maintain your policy. These premiums are typically not tax-deductible because the Internal Revenue Service (IRS) considers life insurance a personal expense rather than a business expense. Personal expenses are generally not eligible for tax deductions.

However, there are some situations where life insurance premiums may be partially or wholly tax-deductible. These exceptions are usually limited to specific circumstances, such as when the life insurance policy is used for estate planning or business purposes. It’s essential to consult with a tax professional or financial advisor to determine if you qualify for any deductions related to your life insurance premiums.

Exceptions for Estate Planning

If you have a large estate and are concerned about estate taxes, life insurance can be a valuable tool for managing your estate. Sometimes, the premiums paid for life insurance policies used in estate planning can be tax-deductible. However, certain conditions must be met for this deduction to apply.

First, the estate or an irrevocable trust must own the life insurance policy. The policy should also be included in the estate for federal tax purposes. Additionally, the policy’s intent must be to provide liquidity to pay estate taxes or other expenses related to the estate. It’s crucial to consult with an estate planning attorney or tax advisor to ensure you meet the requirements for deducting life insurance premiums in estate planning.

Using Life Insurance for Business Purposes

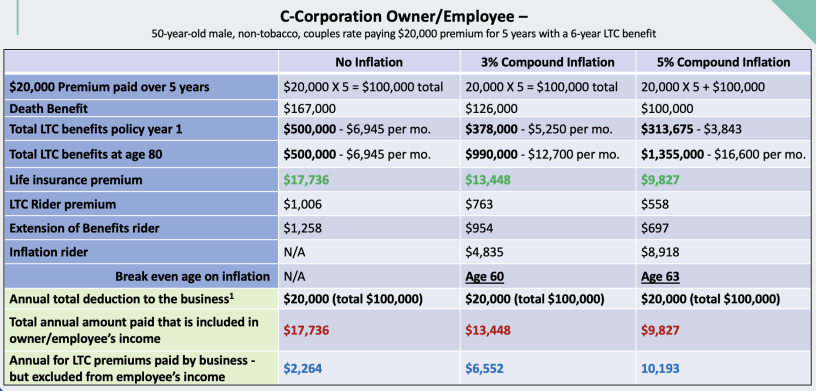

Sometimes, life insurance policies can be used for business purposes, and the premiums may be tax-deductible. This typically applies to policies that protect a business or its owners. The critical factor is that the life insurance must be directly related to the company and not for personal reasons.

For example, the premiums may be tax-deductible if you’re a business owner and take out a life insurance policy to fund a buy-sell agreement. However, keeping detailed records and documentation to support the deduction is necessary. Consulting with a tax professional specializing in small business taxes can help you navigate the complexities of deducting life insurance premiums for business purposes.

Benefits of Life Insurance

While life insurance premiums may not be tax-deductible for most individuals, there are still numerous benefits to having a life insurance policy. Here are some key advantages to consider:

1. Financial Protection: Life insurance provides a death benefit to your beneficiaries, ensuring they are financially secure after your passing. This can help cover funeral expenses and outstanding debts and provide income replacement for your loved ones.

2. Estate Planning: Life insurance can be part of your estate planning strategy to provide liquidity and cover estate taxes. This can help preserve the value of your estate and ensure your assets are distributed according to your wishes.

3. Business Continuity: Life insurance can protect your company if you’re a business owner. It can help fund a buy-sell agreement, fund business expenses in the event of your death, or serve as collateral for business loans.

4. Tax-Free Death Benefit: In most cases, the death benefit paid to your beneficiaries is not subject to income tax. Your loved ones can receive the total benefit amount without tax implications.

5. Cash Value Accumulation: Some life insurance policies, such as whole or universal life, have a cash value component that grows over time. This cash value can be accessed during your lifetime for various purposes, such as supplementing retirement income or funding education expenses.

Key Points to Remember

– Life insurance premiums are generally not tax-deductible for individuals.

– There are exceptions for estate planning and business purposes, where the premiums may be partially or wholly tax-deductible.

– Consult with a tax professional or financial advisor to determine if you qualify for any deductions related to your life insurance premiums.

– While life insurance premiums may not be tax-deductible, there are many other benefits to having a life insurance policy, including financial protection, estate planning, and business continuity.

In conclusion, while you cannot typically deduct life insurance premiums on your taxes, exploring the exceptions that may apply to your situation is essential. Life insurance offers valuable financial protection and can be crucial to your overall financial plan. Consult with professionals to ensure you make informed decisions regarding your life insurance needs and tax implications.

Key Takeaways: Can You Deduct Life Insurance Premiums?

- Life insurance premiums are generally not tax-deductible.

- However, there are some exceptions if you meet specific criteria.

- You can deduct the premiums if you have a business and the life insurance is used as a business expense.

- You may be eligible for a deduction if you have a policy that includes a long-term care component.

- Consult with a tax professional or financial advisor to understand the rules and regulations regarding life insurance premium deductions.

Frequently Asked Questions

Life insurance premiums are an essential consideration for many individuals and families. However, when it comes to tax deductions, there are specific rules and guidelines to follow. Here are some commonly asked questions about deducting life insurance premiums.

1. Can life insurance premiums be deducted from your taxes?

Unfortunately, in most cases, life insurance premiums are not tax-deductible. The Internal Revenue Service (IRS) considers life insurance a personal expense rather than a business or investment expense, making it ineligible for tax deductions. This applies to both term life insurance and whole life insurance policies.

However, there are some exceptions to this rule. If you have a qualified long-term care insurance policy with a specific rider that provides life insurance coverage, you may be able to deduct a portion of the premiums. It’s essential to consult with a tax professional or refer to IRS guidelines to determine your eligibility for any deductions.

2. Are there any situations where life insurance premiums can be deducted?

While life insurance premiums are generally not tax-deductible, a few exceptions exist. If you are self-employed and use life insurance as part of a qualified retirement plan, you may be able to deduct a portion of the premiums. However, this only applies if the life insurance policy meets specific criteria and is used for retirement planning.

Additionally, suppose you are a business owner and provide life insurance coverage to your employees as part of a group life insurance plan. In that case, you may be able to deduct the premiums as a business expense. However, there are limitations and requirements for this deduction to apply. Consult with a tax professional to ensure you meet all the necessary criteria.

3. Can life insurance premiums be deducted for estate planning purposes?

No, life insurance premiums used for estate planning purposes are not tax-deductible. While life insurance can be a valuable tool for estate planning, the premiums are not eligible for tax deductions. However, the death benefit paid out to beneficiaries is generally tax-free, making it a potentially tax-efficient way to transfer wealth to future generations.

4. Are there any other tax benefits associated with life insurance?

While life insurance premiums may not be tax-deductible, other tax benefits are associated with life insurance. The death benefit paid out to beneficiaries is generally income tax-free, ensuring that your loved ones receive the total amount of the policy. Additionally, specific life insurance policies, such as cash value life insurance, may have tax advantages such as tax-deferred growth and the ability to take out tax-free loans against the policy’s cash value.

It’s essential to consult with a financial advisor or tax professional to understand your life insurance policy’s specific tax implications and benefits.

5. What should I do if I have questions about deducting life insurance premiums?

Consulting with a tax professional is best if you have specific questions or concerns about deducting life insurance premiums from your taxes. They can provide personalized advice based on your circumstances and help ensure you comply with IRS regulations. Reviewing the official IRS guidelines on life insurance deductions can further clarify eligibility and limitations.

Remember, seeking professional advice regarding tax matters is always important to ensure you make informed decisions and maximize potential tax benefits.

Final Summary: Can You Deduct Life Insurance Premiums?

So, can you deduct life insurance premiums? After exploring the topic in depth, it seems that the answer is not a straightforward yes or no. While there are some circumstances in which you may be able to deduct life insurance premiums, such as if you are a business owner or if the policy is used for estate planning, it is essential to consult with a qualified tax professional to understand the specific rules and regulations that apply to your situation.

When it comes to taxes, things can get quite complicated. Deducting life insurance premiums is no exception. The IRS has established guidelines and criteria for removing these expenses. It’s crucial to stay informed and seek expert advice to ensure you’re taking advantage of any potential deductions while staying within the bounds of the law.

In conclusion, if you’re considering deducting life insurance premiums, contact a tax professional who can guide you through the process and help you understand the specific rules that apply to your unique circumstances. While deducting these expenses in certain situations may be possible, it’s always best to consult an expert to ensure compliance and maximize your tax benefits. Remember, knowledge is power when navigating the complex world of tax deductions.