Have you ever wondered what a flexible premium adjustable life insurance policy is? It might sound like a mouthful but don’t worry; I’m here to break it down for you in a fun and engaging way. Picture this: you’re sitting at a coffee shop, sipping your favorite latte, and a friendly stranger talks about life insurance. They mention this intriguing term, and you can’t help but be curious. Well, my friend, I’ve got you covered. Let’s dive into the world of flexible premium adjustable life insurance policies and unravel their mysteries.

Life insurance can be a complex topic, but it becomes much easier to understand with the proper guidance. A flexible premium adjustable life insurance policy is a type of life insurance that allows policyholders to customize their coverage to fit their changing needs. It’s like having a personalized insurance plan that adapts to your unique circumstances. With this policy, you can adjust your premium payments and coverage over time. It’s like having the freedom to tailor your policy to match your financial situation and goals. So, whether you’re starting a family, buying a house, or planning for retirement, a flexible premium adjustable life insurance policy can provide the peace of mind you need. Now, let’s explore this fascinating insurance world together and discover how it can work for you.

What is a Flexible Premium Adjustable Life Insurance Policy?

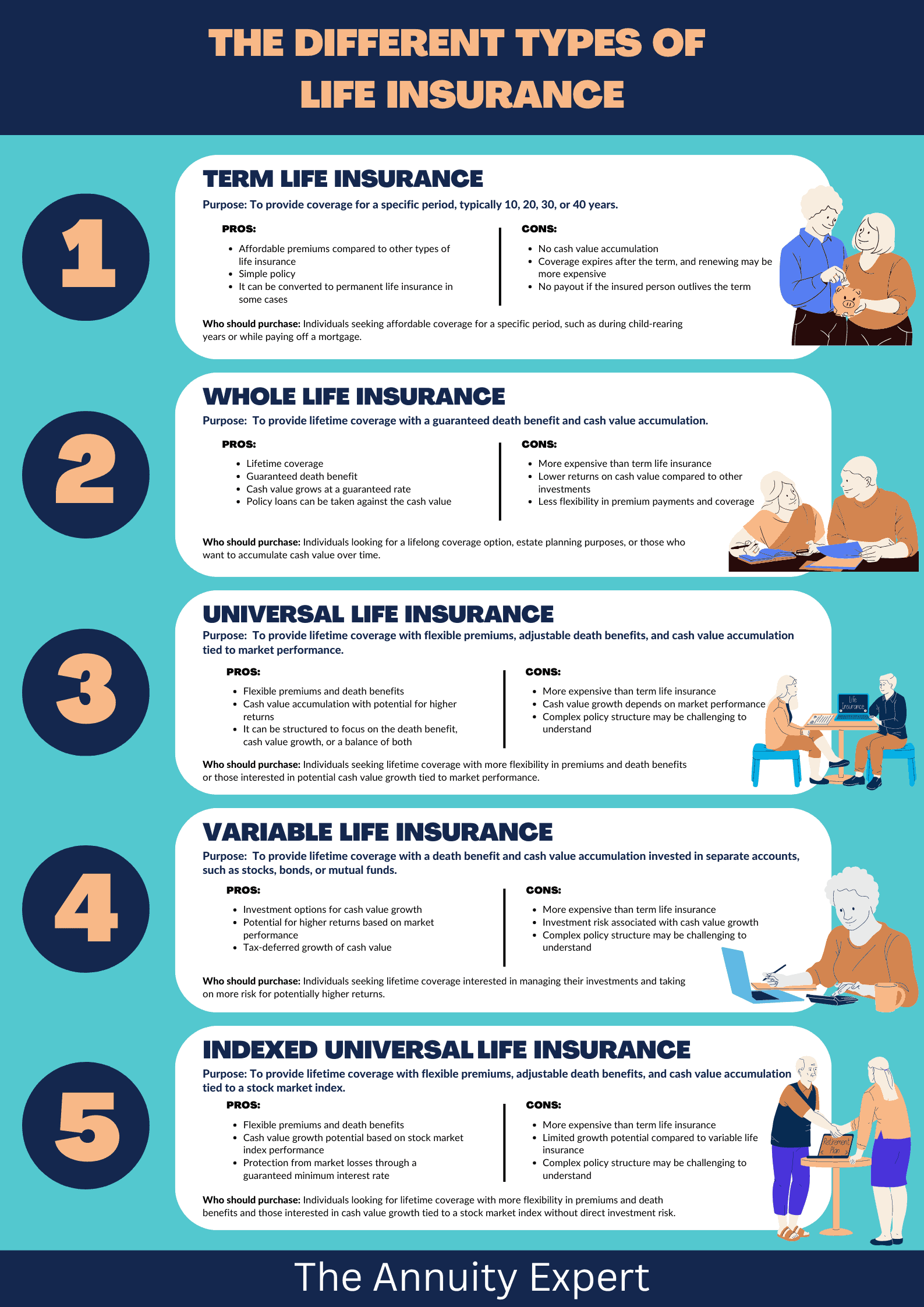

A flexible premium adjustable life insurance policy, also known as a universal life insurance policy, offers both a death benefit and a cash value component. Unlike traditional whole life insurance policies with fixed premiums and a set death benefit, flexible premium adjustable life insurance policies allow policyholders to adjust their premium payments and death benefits as their needs change.

With a flexible premium adjustable life insurance policy, policyholders can increase or decrease their premium payments and death benefits as their financial situation changes. This type of policy is popular among individuals who want the security of life insurance coverage but also want the flexibility to adjust their policy to meet their changing needs.

Benefits of a Flexible Premium Adjustable Life Insurance Policy

There are several benefits to having a flexible premium adjustable life insurance policy:

- Flexibility: As the name suggests, this type of policy offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits to align with their financial goals and needs.

- Cash Value Accumulation: A portion of the premium payments made towards a flexible premium adjustable life insurance policy goes towards a cash value component. This cash value can grow over time and can be accessed by the policyholder through loans or withdrawals.

- Death Benefit Protection: Like other life insurance policies, a flexible premium adjustable life insurance policy provides a death benefit to the policyholder’s beneficiaries upon their death. This death benefit can provide financial protection and support for loved ones.

How Does a Flexible Premium Adjustable Life Insurance Policy Work?

A flexible premium adjustable life insurance policy combines a death benefit with a cash value component. When a policyholder pays their premium, a portion goes towards the insurance cost, while the remaining amount is allocated towards the policy’s cash value.

The cash value component of a flexible premium adjustable life insurance policy grows over time based on the performance of the policy’s underlying investments. The policyholder can choose how the cash value is invested, including options such as stocks, bonds, or mutual funds.

The policyholder can also adjust their premium payments and death benefit as needed. For example, if they experience financial hardship, they can lower their premium payments to a minimum to keep the policy in force. On the other hand, if their financial situation improves, they can increase their premium payments and death benefits to provide additional coverage.

Comparison: Flexible Premium Adjustable Life Insurance vs. Traditional Whole Life Insurance

While both flexible premium adjustable life insurance and traditional whole life insurance provide life insurance coverage, there are some critical differences between the two:

| Flexible-Premium Adjustable Life Insurance | Traditional Whole Life Insurance | |

|---|---|---|

| Premium Payments | Can be adjusted by the policyholder | Fixed for the life of the policy |

| Death Benefit | Can be changed by the policyholder | Set for the life of the policy |

| Cash Value | Grows based on policy performance | Grows at a guaranteed rate |

| Flexibility | Offers more flexibility in premium payments and death benefit amounts | Offers less flexibility in premium payments and death benefit amounts |

Choosing between a flexible premium adjustable life insurance policy and a traditional whole life insurance policy depends on an individual’s specific needs and financial goals.

Critical Considerations for Choosing a Flexible Premium Adjustable Life Insurance Policy

When considering a flexible premium adjustable life insurance policy, there are several factors to keep in mind:

- Financial Situation: Assess your current and future financial situation to determine if the flexibility of premium payments and death benefit adjustments align with your needs.

- Investment Options: Understand the options available within the policy’s cash value component and consider your risk tolerance and investment preferences.

- Policy Terms: Review the terms and conditions of the policy, including any fees or charges associated with premium adjustments or cash value withdrawals.

- Insurance Provider: Research and compare different insurance providers to ensure you choose a reputable company with a solid financial standing.

By carefully considering these factors, you can decide whether a flexible premium adjustable life insurance policy is the right choice for you.

Conclusion

In conclusion, a flexible premium adjustable life insurance policy allows individuals to adjust their premium payments and death benefit amounts as their needs change. This type of policy provides both a death benefit and a cash value component, allowing policyholders to accumulate savings that can be accessed during their lifetime. Before choosing a flexible premium adjustable life insurance policy, it’s essential to carefully consider your financial situation, investment options, policy terms, and the insurance provider’s reputation. Doing so can ensure that you make the right decision for your long-term financial security.

Key Takeaways: What is a Flexible Premium Adjustable Life Insurance Policy?

- A flexible premium adjustable life insurance policy is a type of life insurance that allows policyholders to adjust their premium payments and death benefit amounts.

- With this policy, policyholders can increase or decrease their premium payments based on their financial situation.

- The death benefit amount can also be adjusted, allowing policyholders to increase or decrease the coverage as needed.

- This policy provides financial protection for the policyholder’s loved ones in the event of their death.

- Flexible premium adjustable life insurance policies can offer a combination of death benefit coverage and potential cash value accumulation.

Frequently Asked Questions

Life insurance policies come in various types, and one such type is a flexible premium adjustable life insurance policy. This type of policy provides flexibility in terms of premium payments and allows policyholders to adjust the death benefit and cash value. If you’re curious to know more about this policy, here are some frequently asked questions:

What are the key features of a flexible premium adjustable life insurance policy?

A flexible premium adjustable life insurance policy allows policyholders to adjust their premium payments based on their financial situation. If facing financial constraints, you can reduce your premium payments or even skip a payment without losing coverage. Additionally, this type of policy allows you to increase or decrease the death benefit and cash value over time to meet your changing needs. It provides the flexibility to adapt your life insurance coverage to evolving circumstances.

Furthermore, a flexible premium adjustable life insurance policy also offers the potential for cash value growth. The policy accumulates cash value over time, which can be accessed through policy loans or withdrawals. This can be beneficial if you need funds for emergencies or other financial needs.

How does a flexible premium adjustable life insurance policy work?

A flexible premium adjustable life insurance policy allows policyholders to determine the amount and frequency of their premium payments. You can pay higher premiums to build up the cash value faster or opt for lower premiums to maintain coverage without significant cash value accumulation. The policy also allows for modifying the death benefit and cash value based on your changing circumstances.

The policy’s cash value component grows over time through the accumulation of premiums and potential investment returns. This cash value can be utilized by policyholders through policy loans or withdrawals, providing a degree of financial flexibility. The death benefit, conversely, is the amount paid to beneficiaries upon the policyholder’s death and can be adjusted to meet your desired coverage level.

Who is a flexible premium adjustable life insurance policy suitable for?

A flexible premium adjustable life insurance policy is suitable for individuals who want the flexibility to adjust their premiums, death benefit, and cash value over time. It caters to those anticipating changes in their financial situation or coverage needs. This type of policy can be especially beneficial for young professionals who may experience fluctuations in income or individuals with variable income streams.

Additionally, if you value the ability to access cash in your life insurance policy, a flexible premium adjustable policy can provide that flexibility. It allows you to tap into the accumulated cash value through policy loans or withdrawals, providing a potential source of funds for various purposes.

What are the advantages of a flexible premium adjustable life insurance policy?

One of the advantages of a flexible premium adjustable life insurance policy is the ability to adapt the policy to your changing financial circumstances. You can adjust premium payments, death benefits, and cash value to align with your needs. This can be particularly useful during financial strain or when you require additional coverage.

Another advantage is the potential for cash value growth. As you make premium payments, the policy’s cash value accumulates over time. This cash value can be accessed through policy loans or withdrawals, providing a source of funds for emergencies or other financial needs. Additionally, the death benefit ensures that your loved ones are financially protected during your passing.

Are there any drawbacks to a flexible premium adjustable life insurance policy?

While a flexible premium adjustable life insurance policy offers flexibility, it’s essential to consider the potential drawbacks. One drawback is that modifying the policy may incur additional fees or charges. Administrative costs may be involved when adjusting the death benefit or cash value.

Additionally, the policy’s cash value growth is subject to market conditions and investment performance. If the investments within the policy do not perform well, the cash value growth may be lower than expected. Reviewing the policy’s terms and conditions and consulting with a financial advisor to understand the potential risks and limitations is essential.

Final Summary: Understanding the Flexibility of a Premium Adjustable Life Insurance Policy

In conclusion, a flexible premium adjustable life insurance policy allows individuals to customize their coverage and payments according to their changing needs. This type of policy will enable policyholders to adjust their premium amounts and coverage levels over time, allowing them to adapt to their evolving financial circumstances.

With a flexible premium adjustable life insurance policy, individuals can increase or decrease their premium payments based on their current financial situation. This means that if they experience economic hardship, they can reduce their premiums to alleviate some of the financial burden. On the other hand, if they find themselves in a more stable financial position, they can choose to increase their premium payments to enhance their coverage and potentially accumulate more cash value.

Moreover, this type of policy also allows policyholders to adjust their coverage levels as needed. They can increase their death benefit to ensure their loved ones are adequately protected or decrease it if they feel they no longer require as much coverage. This flexibility ensures individuals can tailor their life insurance policy to align with their goals and circumstances.

In summary, a flexible premium adjustable life insurance policy empowers individuals to have control over their coverage and premium payments. With the ability to adapt to changing financial situations and customize their policy, individuals can create a life insurance plan that meets their unique needs. Whether it’s adjusting premium amounts or coverage levels, this policy provides the freedom and flexibility individuals desire in their life insurance journey.