You’re not alone if you’ve ever wondered about the average monthly life insurance cost. It’s a common question that many people have when considering their financial security and protection for their loved ones. Life insurance is a crucial investment that can provide peace of mind and economic stability in the face of unexpected events. So, let’s dive in and explore the factors that influence the cost of life insurance and how you can determine what might be the right fit for you.

When it comes to life insurance, various factors can affect the cost. Age, health, lifestyle choices, and the type of policy you choose all play a role in determining the monthly premium. Insurance providers also consider your occupation, hobbies, and medical history to assess the level of risk they take by insuring you. By understanding these factors and researching, you can better understand what to expect regarding cost and coverage. So, let’s explore the world of life insurance and find out how to secure your financial future while keeping your budget in mind.

Understanding the Average Life Insurance Cost per Month

Life insurance is an essential financial tool that provides financial security to your loved ones in the event of your untimely demise. However, many individuals are unsure about the average cost of life insurance per month. The cost of life insurance can vary depending on several factors, including age, health, lifestyle, and coverage amount. In this article, we will delve into the factors that influence the average life insurance cost per month and provide valuable insights to help you make an informed decision.

Factors that Influence the Average Life Insurance Cost per Month

Several key factors come into play when determining the average monthly life insurance cost. Let’s take a closer look at these factors:

Age

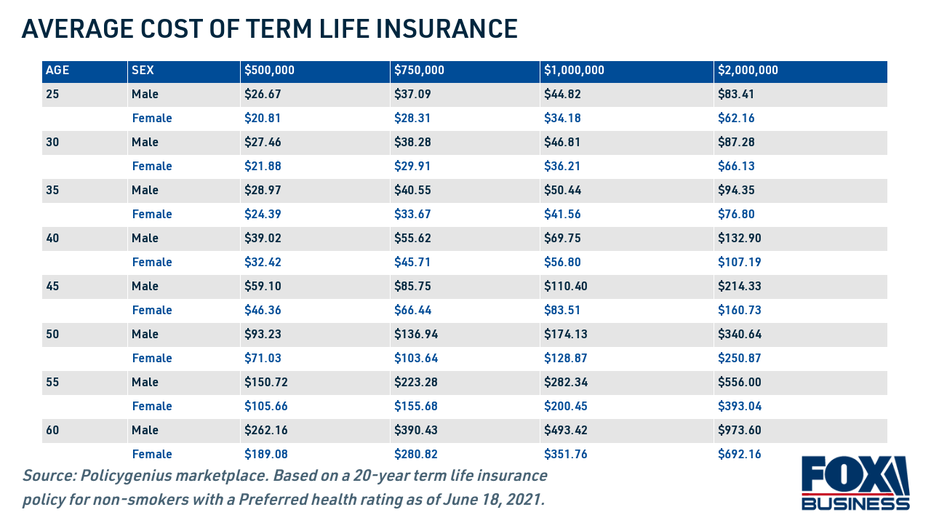

Your age is one of the most significant factors influencing life insurance costs. Typically, the younger you are, the lower the premiums will be. This is because more youthful individuals are generally considered to be at a lower risk of developing health issues or passing away.

However, the average monthly life insurance cost increases as you age. This is because the likelihood of developing health complications or passing away increases as you get older. Therefore, securing a life insurance policy at a younger age is advisable to enjoy lower premiums.

Health

Your health plays a crucial role in determining the cost of life insurance. Insurance providers generally require applicants to undergo a medical examination to assess their health. Factors such as pre-existing medical conditions, body mass index (BMI), and overall health status can impact your premiums.

If you have a clean bill of health, you can expect to pay lower premiums than individuals with underlying health issues. Insurance providers view individuals with pre-existing conditions as riskier, leading to higher premiums.

Lifestyle

Your lifestyle choices can also affect the average life insurance cost per month. Certain habits, such as smoking or excessive alcohol consumption, can increase the premiums you’ll pay. These habits are associated with a higher risk of developing health complications or passing away prematurely.

Additionally, engaging in high-risk activities, such as extreme sports or occupations that involve significant danger, may result in higher premiums. Insurance providers consider these factors to assess the risk associated with your lifestyle.

Coverage Amount

The amount of coverage you choose will significantly impact the average life insurance cost per month. You can expect to pay higher premiums if you opt for higher coverage. A higher coverage amount implies a greater financial risk for the insurance provider.

On the other hand, if you choose a lower coverage amount, your premiums will be comparatively lower. It’s essential to balance the coverage amount you need and the premiums you can comfortably afford.

Comparing Different Life Insurance Policies

Now that we have explored the factors influencing the average life insurance cost per month let us compare different life insurance policies. This will help you better understand the options available and select the most suitable policy for your needs.

Term Life Insurance vs. Whole Life Insurance

Term and whole life insurance are two common types of life insurance policies. Understanding the differences between these policies is crucial in making an informed decision.

Term Life Insurance: Term life insurance covers a specific term, usually 10 to 30 years. This type of policy offers a death benefit to your beneficiaries if you pass away within the specified term. Term life insurance is generally more affordable than whole life insurance, making it a popular choice among individuals seeking temporary coverage.

Whole Life Insurance: Whole life insurance provides coverage for your entire lifetime. It offers your beneficiaries a death benefit and accumulates cash value over time. The premiums for whole life insurance are typically higher than those for term life insurance. However, the policy provides lifelong coverage and offers additional benefits such as potential dividends and the ability to borrow against the cash value.

Comparing Premiums and Benefits

When comparing different life insurance policies, it’s crucial to consider the premiums and the benefits they offer. While term life insurance may have lower premiums, whole life insurance provides lifelong coverage and additional benefits. Assessing your long-term financial goals and determining which policy aligns with your needs is essential.

Tips for Finding Affordable Life Insurance

Now that you have a better understanding of the average life insurance cost per month and the different policy options let’s explore some tips for finding affordable life insurance:

1. Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare premiums and coverage. This will help you identify the most competitive rates and ensure you get the best value for your money.

2. Maintain a Healthy Lifestyle

Adopting a healthy lifestyle can positively impact your life insurance premiums. Quitting smoking, exercising regularly, and maintaining a balanced diet can contribute to lower premiums and better overall health.

3. Consider Bundling Policies

If you already have other insurance policies, such as auto or home insurance, consider bundling them with your life insurance policy. Many insurance providers offer discounts for bundling, resulting in cost savings.

4. Seek Professional Guidance

If you’re unsure about life insurance’s intricacies or need assistance navigating the options, consider seeking guidance from a licensed insurance professional. They can provide personalized advice tailored to your needs and help you find the most affordable life insurance policy.

5. Review and Update Your Policy Regularly

Life circumstances change over time, and you must review and update your life insurance policy accordingly. As you achieve significant milestones or experience life events, such as marriage, the birth of a child, or purchasing a home, ensure that your coverage aligns with your evolving needs.

In Summary

Understanding the average monthly life insurance cost is crucial in making informed decisions about your financial future. Factors such as age, health, lifestyle, and coverage amount all play a role in determining the premiums you’ll pay. By comparing different policies, considering your long-term goals, and implementing strategies to find affordable coverage, you can secure a life insurance policy that provides financial security to your loved ones.

Key Takeaways: What is the Average Life Insurance Cost per Month?

- Life insurance costs vary depending on several factors, such as age, health, and coverage amount.

- A healthy 30-year-old can expect to pay around $25 to $30 monthly for a term life insurance policy.

- As you grow older, the cost of life insurance tends to increase.

- Factors like smoking, pre-existing medical conditions, and high-risk occupations can also affect the cost of life insurance.

- It’s essential to compare quotes from multiple insurance providers to find the best rate for your specific needs.

Frequently Asked Questions

Question 1: What factors affect the average life insurance cost per month?

Several factors come into play when determining the average monthly life insurance cost. The primary factors that affect the price include:

1. Age: Generally, the younger you are when you purchase life insurance, the lower your monthly premiums will be. As you age, the risk of health issues and mortality increases, which can lead to higher premiums.

2. Health: Your overall health and medical history play a significant role in determining the cost of life insurance. Insurance companies consider pre-existing conditions, lifestyle choices, and family medical history. Individuals with better health tend to have lower premiums.

3. Coverage Amount: The life insurance coverage you require also influences the cost. Typically, higher coverage amounts result in higher monthly premiums.

Question 2: Does the type of life insurance policy impact the monthly average cost?

Yes, the type of life insurance policy you choose can affect the monthly average cost. The two main types of life insurance are term life and whole life insurance:

1. Term Life Insurance: This type of policy covers a specific term, such as 10, 20, or 30 years. Term life insurance tends to have lower monthly premiums than whole life insurance.

2. Whole Life Insurance: Whole life insurance covers your entire life and includes a cash value component. Due to the lifelong coverage and additional benefits, whole life insurance generally has higher monthly premiums than term life insurance.

Question 3: Are there any additional factors that can impact the average cost per month?

Apart from age, health, and the type of policy, there are a few more factors that can influence the average life insurance cost per month:

1. Gender: Statistics show that women tend to live longer than men, leading to lower premiums for females. However, this difference is insignificant and may vary depending on other factors.

2. Smoking and Lifestyle Choices: If you are a smoker or have certain lifestyle habits that are considered risky, such as extreme sports or hazardous occupations, insurance companies may charge higher premiums to account for the increased risks.

Question 4: Can I get a personalized quote for the monthly life insurance cost?

To get an accurate estimate of the average life insurance cost per month, it’s recommended to contact insurance providers directly. Insurance companies consider various factors specific to each individual to provide personalized quotes, such as age, health, and coverage needs.

By providing detailed information about your circumstances and preferences, insurance providers can accurately estimate the monthly premiums you expect to pay for the desired coverage.

Question 5: How can I find affordable life insurance with reasonable monthly costs?

Finding affordable life insurance with reasonable monthly costs involves a few strategies:

1. Shop Around: It’s crucial to compare quotes from multiple insurance companies to find the most competitive rates. Each insurer has its underwriting guidelines and pricing structure, so shopping around can help you find the best deal.

2. Opt for Term Life Insurance: If you’re looking for lower monthly costs, term life insurance is often the more affordable. Assess your coverage needs and consider a term that aligns with your financial goals.

3. Maintain Good Health: Leading a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits like smoking, can help you secure better rates on life insurance. Insurance companies often offer lower premiums to individuals with good health habits.

Remember, when considering life insurance, it’s essential to balance affordability and adequate coverage to ensure your loved ones are financially protected in the event of your passing.

Final Summary: Unlocking the Mystery of Life Insurance Costs

So, we’ve dived into the intriguing world of life insurance costs, and what a journey it has been! Throughout this article, we’ve explored the factors that influence the average monthly price of life insurance, including age, health, coverage amount, and policy type. We’ve discovered no one-size-fits-all answer regarding pricing, as each individual’s circumstances are unique. However, with this newfound knowledge, you can navigate life insurance and make informed decisions that align with your needs and budget.

In this digital age, where information is at our fingertips, understanding the factors that impact life insurance costs is crucial. By optimizing your knowledge and utilizing online resources, you can find the best coverage to protect your loved ones without breaking the bank. Remember, it’s not just about the numbers; it’s about the peace of mind that comes with knowing you’ve safeguarded your family’s future.

As you embark on your life insurance journey, remember the importance of reviewing and comparing quotes from different providers. This will enable you to find the most competitive rates and secure a policy that suits your requirements. Don’t be afraid to ask questions, seek advice, and explore various options. After all, life insurance is a valuable investment that can provide financial security and a legacy for your loved ones.

So, go forth and conquer the world of life insurance costs! Armed with knowledge, curiosity, and determination, you have the tools to navigate the intricacies of coverage, premiums, and policy types. Remember, life insurance is not just about numbers; it’s about protecting the ones you cherish most. Leap, make informed decisions, and ensure a brighter future for you and your loved ones.