When it comes to life insurance policies, understanding the concept of insurable interest is crucial. You might wonder, “When must insurable interest exist in a life insurance policy?” Let’s dive into this fascinating topic and explore the answer together.

Insurable interest is the fundamental principle that ensures the validity of a life insurance policy. It refers to the financial or emotional stake an individual has in the insured person’s life. In other words, the relationship between the policyholder and the insured person justifies the need for insurance coverage.

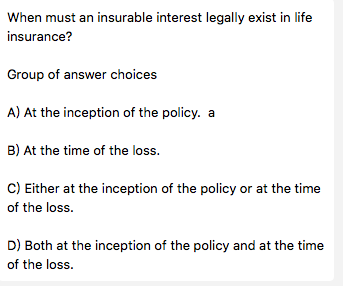

You might be thinking, “When exactly does insurable interest have to exist?” The answer lies in the time of policy inception. When purchasing a life insurance policy, the policyholder must have a valid reason to expect financial loss or emotional distress in the event of the insured person’s death. This could be a spouse, a family member, a business partner, or anyone else who has a direct involvement and would suffer adverse consequences if the insured person were to pass away.

It’s important to note that insurable interest generally needs to exist at the time of policy inception. Still, it doesn’t necessarily have to continue throughout the entire duration of the policy. Once the policy is in force, any changes in the relationship between the policyholder and the insured person won’t affect the policy’s validity. However, it’s crucial to establish an insurable interest at the beginning to ensure that the policy is legitimate and serves its intended purpose.

In conclusion, insurable interest is a vital requirement for a life insurance policy. It must exist when policy inception to validate the need for coverage. Understanding the concept of insurable interest helps ensure that the policyholder has a legitimate reason to protect their financial or emotional stake in the insured person’s life. So, next time you’re considering a life insurance policy, remember the significance of insurable interest and its role in safeguarding your loved ones or business partners.

When Must Insurable Interest Exist in a Life Insurance Policy?

Insurable interest is a fundamental concept in the world of life insurance. It refers to the financial or emotional stake that a policyholder has in the life of the insured individual. In simpler terms, you must have a valid reason to take out a life insurance policy on someone else’s life. So, when exactly must insurable interest exist in a life insurance policy? Let’s delve deeper into this topic and understand the critical factors involved.

Understanding Insurable Interest

Insurable interest is a prerequisite for purchasing life insurance coverage for another person. It ensures that individuals cannot take out policies on the lives of random strangers or those with whom they have no connection. Insurable interest serves as a safeguard against potential moral hazards and fraudulent activities in the insurance industry.

Insurable interest can arise in various situations. It can be based on a familial relationship, such as spouses, parents, or children. Business partners can also have insurable interest in each other’s lives due to the financial implications of one partner’s death. Additionally, creditors may have an insurable interest in the lives of their debtors to protect their financial investments.

When Must Insurable Interest Exist?

Insurable interest must exist when the life insurance policy is removed. This means the policyholder must have a valid reason for purchasing coverage on the insured individual’s life. Insurable interest ensures that the policyholder will suffer a financial loss or emotional distress in the event of the insured’s death.

One common scenario where insurable interest is required is when a person takes out a life insurance policy on their own life. In this case, the policyholder has a clear, insurable interest because they stand to financially protect their loved ones in the event of their death. Insurable interest also applies when a policyholder takes out coverage on the life of their spouse or child, as their emotional and financial well-being is directly linked to the insured individual.

Insurable Interest in Business and Creditor-Debtor Relationships

In addition to personal relationships, insurable interest is relevant in business partnerships and creditor-debtor relationships. Business partners often rely on each other’s expertise, skills, and financial contributions. The death of a business partner can significantly impact the surviving partners and the business’s overall stability. Therefore, insurable interest is necessary to protect the partners’ financial interests and the business’s continuity.

Creditors may also have insurable interest in the lives of their debtors. When someone borrows money from a creditor, they enter into a legal agreement and become obligated to repay the debt. In the event of the debtor’s death, the creditor may suffer a financial loss if the debt remains unpaid. Insurable interest allows creditors to protect their financial investments by taking out life insurance policies on their debtors.

The Importance of Insurable Interest

Insurable interest is a crucial aspect of life insurance policies as it ensures that policies are taken out for legitimate reasons. It prevents individuals from purchasing insurance on the lives of strangers or for speculative purposes, which could lead to fraudulent activities. Insurable interest helps maintain the integrity of the insurance industry. It ensures that policies provide financial protection to those with a legitimate interest in the insured individual’s life.

The requirement of insurable interest also encourages individuals to carefully consider their financial and emotional connections before taking out life insurance policies. It emphasizes protecting loved ones and preserving financial stability in unforeseen circumstances.

In conclusion, insurable interest must exist when a life insurance policy is taken out. It safeguards against fraudulent activities and ensures policies are purchased for legitimate reasons. Insurable interest can arise from personal relationships, such as spouses and family members, business partnerships, and creditor-debtor relationships. It is an essential aspect of life insurance that protects the policyholder’s financial and emotional stake in the insured individual’s life.

Key Takeaways: When Must Insurable Interest Exist in a Life Insurance Policy?

- Insurable interest must exist at the time the life insurance policy is purchased.

- Insurable interest means the policy owner has a financial or emotional relationship with the insured person.

- Family members, business partners, and creditors typically have an insurable interest in an individual’s life.

- Insurable interest is necessary to prevent people from taking out insurance policies on the lives of strangers for personal gain.

- Insurable interest requirements vary by jurisdiction, so it’s essential to understand the specific rules in your area.

Frequently Asked Questions

What is insurable interest in a life insurance policy?

Insurable interest refers to the financial or emotional stake that a person has in the life of the insured individual. In the context of a life insurance policy, insurable interest is the requirement that the policyholder must have a valid reason to insure another person’s life. This prevents people from taking out life insurance policies on individuals they have no connection with purely for financial gain.

Insurable interest can be established through various relationships, such as family ties, business partnerships, or financial obligations. It ensures that the policyholder would suffer a financial loss or hardship in the event of the insured person’s death, providing a legitimate reason for obtaining life insurance coverage.

When must insurable interest exist in a life insurance policy?

Insurable interest must exist at the time the life insurance policy is initiated. This means that the policyholder must have a valid reason for insuring the life of the insured individual at the time of application. Obtaining a life insurance policy for someone without an insurable interest is impossible.

Insurable interest is typically required for the entire duration of the policy. Suppose the insurable interest ceases to exist during the policy term, such as through the termination of a business partnership or divorce. In that case, the policyholder may no longer have a legitimate reason to maintain the coverage.

What happens if there is no insurable interest in a life insurance policy?

If there is no insurable interest in a life insurance policy, the policy may be considered void or unenforceable. Insurable interest is a fundamental requirement in life insurance contracts to protect against moral hazard and ensure that policies are not taken out solely for speculative purposes.

Suppose it is discovered that a life insurance policy was obtained without a legitimate insurable interest. In that case, the insurance company may refuse to pay the death benefit or cancel the policy altogether. It is essential to establish and maintain a valid, insurable interest to ensure the validity and enforceability of a life insurance policy.

Can insurable interest be established between unrelated individuals?

Yes, insurable interests can be established between unrelated individuals under certain circumstances. While insurable interest is usually found in familial relationships or business partnerships, unrelated individuals can reason to insure each other’s lives.

An example of an unrelated insurable interest could be a close friend who relies on the financial support of the insured individual or a caregiver who depends on the insured person’s daily assistance. In such cases, demonstrating financial or emotional dependency can establish a valid insurable interest, allowing for a life insurance policy issuance.

Why is the requirement of insurable interest significant in life insurance?

The requirement of insurable interest is essential in life insurance to prevent the potential for abuse and fraud. It ensures that life insurance policies are taken out for genuine reasons and not solely for speculative purposes. Without insurable interest, there would be a risk of individuals taking out policies on the lives of others without any legitimate financial or emotional connection.

By requiring insurable interest, life insurance companies can maintain the integrity of the insurance industry and ensure that policies are issued based on sound principles of risk assessment and fairness. Insurable interest protects the policyholder and the insurance company, ensuring policies are grounded in genuine need and reducing the likelihood of fraudulent claims.

Final Thought: Understanding the Importance of Insurable Interest in a Life Insurance Policy

Regarding life insurance policies, insurable interest is one crucial factor that must be considered. Insurable interest refers to an individual’s financial or emotional relationship with the insured person, which justifies their interest in protecting their life. This concept is the foundation for any life insurance policy and ensures the policyholder has a valid reason to secure coverage.

In conclusion, insurable interest is a fundamental requirement in life insurance policies. It protects the integrity of the insurance industry and ensures that policies are not being purchased solely for speculative purposes. By understanding the significance of insurable interest, policyholders and insurance companies can have confidence in the validity and purpose of life insurance coverage. So, whether you are considering purchasing a policy or working in the insurance industry, remember the importance of insurable interest in providing financial security and peace of mind.