If you’ve ever found yourself in a financial bind and wondered, “Can you borrow from life insurance?” you’re in the right place. Life insurance policies offer more than just financial protection for your loved ones in the event of your passing. They can also provide you with a valuable resource during your lifetime. In this article, we’ll explore the ins and outs of borrowing from a life insurance policy and how it can potentially help you in times of need. So please sit back, relax, and dive into this topic together.

Life insurance is often associated with providing a safety net for your loved ones after you’re gone. But did you know that some policies allow you to access the accumulated cash value over time? That’s right, you can borrow from your life insurance policy and use the funds for various purposes, such as paying off debt, financing a major purchase, or even funding your retirement. However, it’s essential to understand your policy’s specific terms and conditions, as each insurance company may have different rules regarding borrowing against the cash value. So, if you’re curious about tapping into your life insurance policy for extra financial flexibility, keep reading to discover all the details.

Life insurance policies often have a feature called cash value, which allows policyholders to borrow against the accumulated cash value of their policy. This can be a convenient option if you need funds for various purposes, such as paying for education, covering medical expenses, or even starting a business. The borrowed amount is typically repaid with interest; if the loan is not repaid, it may reduce the death benefit. It’s essential to consult your insurance provider to understand the terms and conditions of borrowing from your specific policy.

Can You Borrow from Life Insurance?

Life insurance is often considered a financial safety net, protecting your loved ones in the event of your passing. But did you know that in certain circumstances, you may be able to borrow from your life insurance policy? This unique feature of life insurance can offer a solution for individuals needing immediate cash for various purposes. In this article, we will explore the concept of borrowing from life insurance, how it works, and the potential benefits and considerations to keep in mind.

How Does Borrowing from Life Insurance Work?

You can include a cash value component when you purchase a life insurance policy. This cash value grows over time as you pay your premiums and can be accessed through policy loans. Policy loans allow you to borrow against your policy’s cash value, using it as collateral. The loan amount is typically limited to a percentage of the cash value, and interest is charged on the borrowed amount.

Borrowing from your life insurance policy differs from a traditional bank loan. No credit check is required, and the process is generally quicker and more straightforward. The loan is not subject to income taxes, as it is considered a loan rather than income. However, it is essential to note that if the loan is not repaid, it will be deducted from the death benefit paid to your beneficiaries upon passing.

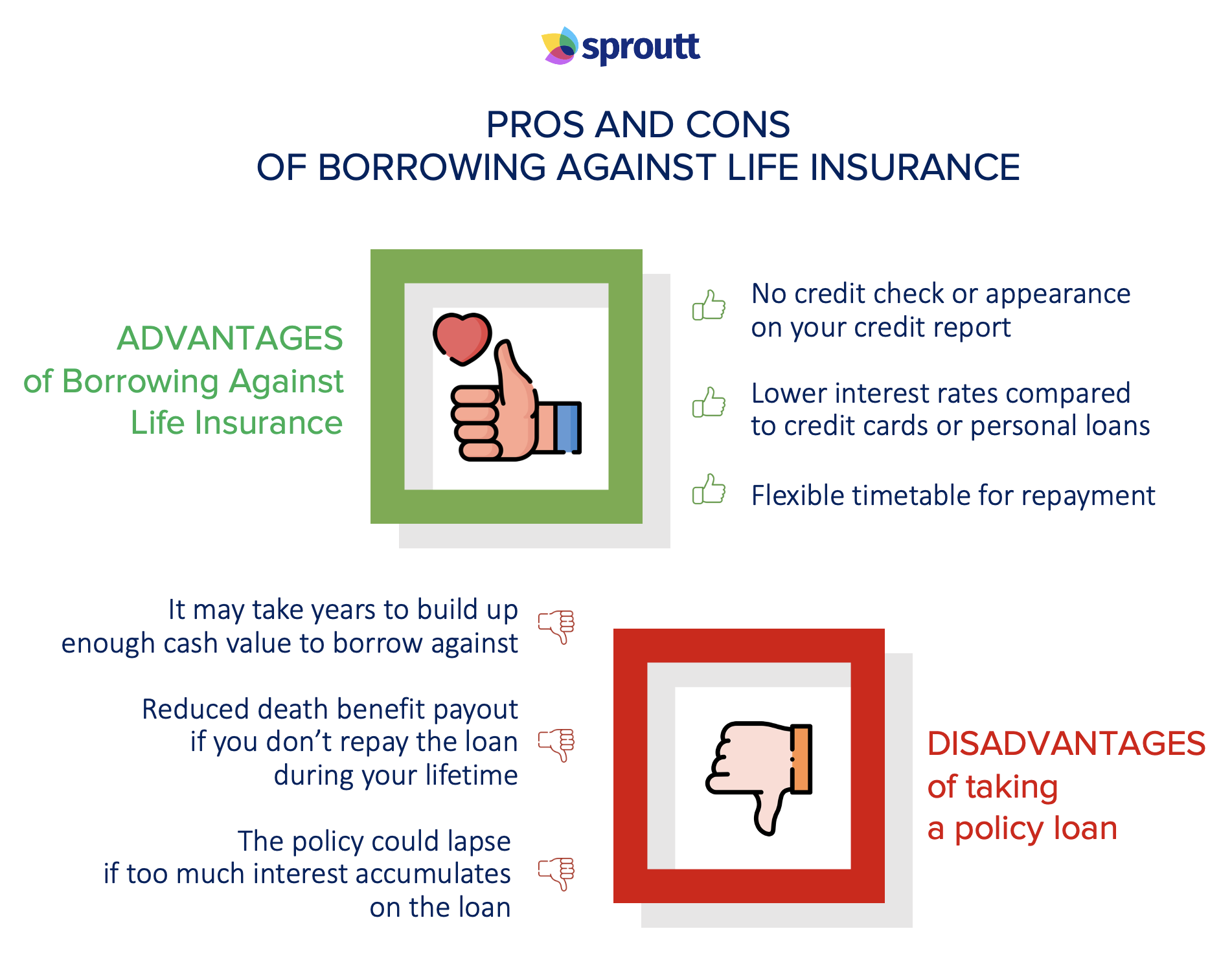

Benefits of Borrowing from Life Insurance

1. Access to Immediate Cash: One of the main advantages of borrowing from your life insurance policy is the ability to access funds quickly. The loan can be processed within days, solving unexpected expenses or financial emergencies.

2. No Qualification Requirements: Unlike traditional loans, policy loans do not require a credit check or income verification. This makes it an attractive option for individuals with a lower credit score or irregular income.

3. Competitive Interest Rates: Policy loans often offer lower interest rates than other borrowing forms, such as credit cards or personal loans. This can result in significant cost savings over time.

4. Flexibility in Repayment: When you borrow from your life insurance policy, you can repay the loan on your terms. Depending on your financial situation, you can make regular payments or pay off the loan in a lump sum.

Considerations When Borrowing from Life Insurance

1. Impact on Death Benefit: It’s important to remember that any outstanding loan balance at the time of your passing will be deducted from the death benefit paid to your beneficiaries. Consider the long-term implications and ensure you have a plan to repay the loan to preserve the intended benefit for your loved ones.

2. Accumulated Interest: If the loan is not repaid promptly, interest will continue to accrue, potentially increasing the overall loan balance. This can impact the cash value growth of your policy and the amount available for future loans or withdrawals.

3. Policy Surrender Value: If you surrender your life insurance policy, any outstanding loans will be deducted from the surrender value. This may result in a lower cash value than anticipated, so it’s essential to carefully evaluate the potential consequences before deciding.

4. Policy Stability: Borrowing from your life insurance policy may affect the overall stability of the policy. If the loan balance becomes too large for the cash value, it could lead to the policy lapsing or being terminated. Monitoring the loan balance and ensuring it remains within sustainable limits is essential.

In conclusion, borrowing from your life insurance policy can be valuable in certain situations. It provides access to immediate cash, often at competitive interest rates, without needing a credit check. However, it’s crucial to consider the potential impact on the death benefit, accumulated interest, policy surrender value, and overall policy stability. By understanding the benefits and considerations, you can decide whether borrowing from life insurance is the right choice for your financial needs.

Key Takeaways: Can You Borrow from Life Insurance?

- You can borrow from your life insurance policy if it has a cash value.

- Borrowing from life insurance is like taking a loan from yourself.

- You will need to pay back the borrowed amount with interest.

- If you don’t repay the loan, it can reduce the death benefit for your beneficiaries.

- Before borrowing, consider the impact on your policy’s growth and potential tax consequences.

Frequently Asked Questions

Can you borrow from life insurance?

Life insurance policies often have a cash value component that policyholders can access. This means that in certain circumstances, you may be able to borrow from your life insurance policy. However, it’s important to note that borrowing from your policy can affect your coverage and beneficiaries. Here’s what you need to know:

1. Policy loans: Some life insurance policies allow you to take out a loan against your policy’s cash value. This loan is typically repaid with interest over time. It’s essential to understand the terms and conditions of the loan, including any interest rates, repayment schedules, and potential penalties for non-payment.

2. Collateral: When you borrow from your life insurance policy, your policy’s cash value serves as collateral for the loan. If you fail to repay the loan, the insurance company may deduct the outstanding balance from the death benefit paid to your beneficiaries.

Are there any advantages to borrowing from life insurance?

While borrowing from your life insurance policy may provide you with access to funds when you need them, it’s essential to carefully consider the advantages and disadvantages before making a decision:

1. No credit check: Unlike traditional loans, borrowing from your life insurance policy typically does not require a credit check. This can be advantageous if you have a less-than-perfect credit history or need funds quickly.

2. Lower interest rates: Life insurance policy loans often have lower interest rates than other borrowing forms, such as credit cards or personal loans. This can save you money in interest charges over the life of the loan.

When Can You Borrow Against Your Life Insurance Policy?

Final Thoughts

So, can you borrow from life insurance? The answer is yes, you can! Life insurance can serve as a valuable financial tool that provides protection for your loved ones and allows you to access funds when needed. By taking out a policy that includes a cash value component, such as whole life or universal life insurance, you can potentially borrow against the accumulated cash value.

Borrowing from your life insurance policy can be a convenient and flexible way to access funds for various purposes, covering unexpected expenses, financing a major purchase, or supplementing your retirement income. It allows you to tap into the cash value you’ve built up over time without needing a lengthy application process or credit check. Plus, the interest rates on these loans are typically lower than those offered by traditional lenders, making it a potentially cost-effective option.

However, it’s important to remember that borrowing from your life insurance policy is not without its implications. Any outstanding loan balance, including accrued interest, will be deducted from the death benefit paid to your beneficiaries upon passing. Additionally, if you cannot repay the loan, it can negatively impact the cash value growth and potentially result in policy lapses. Therefore, it’s crucial to carefully consider your financial circumstances and consult with a financial advisor before making any decisions.

In conclusion, while borrowing from life insurance can be a valuable strategy for accessing funds, weighing the pros and cons and making an informed decision based on your needs and goals is essential. By understanding the terms and conditions of your policy, consulting with professionals, and considering alternative options, you can leverage your life insurance to meet your financial needs while ensuring the long-term security of your loved ones. Remember, life insurance is not just about protection; it can also provide you with financial flexibility when you need it most.