Supplemental life insurance, huh? You might be wondering what in the world that is. Well, let me break it down for you in a way that’s easy to understand. Picture this: you already have a life insurance policy in place, but there’s a little something extra you can add to give yourself even more protection. That’s where supplemental life insurance comes in. It’s like the cherry on top of the sundae, the extra layer of armor shielding you and your loved ones from life’s unexpected twists and turns.

Now, I know what you’re thinking. Why would I need additional coverage if I already have life insurance? Great question! Supplemental life insurance is designed to fill in the gaps your primary policy leaves. It provides extra financial support if the unexpected happens and you need more coverage than your current policy offers. Think of it as a safety net that catches you when you least expect it. So, whether you’re worried about unforeseen medical expenses or want to ensure your loved ones are cared for no matter what, supplemental life insurance has your back. It’s like having an extra layer of protection in this crazy rollercoaster called life.

Understanding Supplemental Life Insurance: A Comprehensive Guide

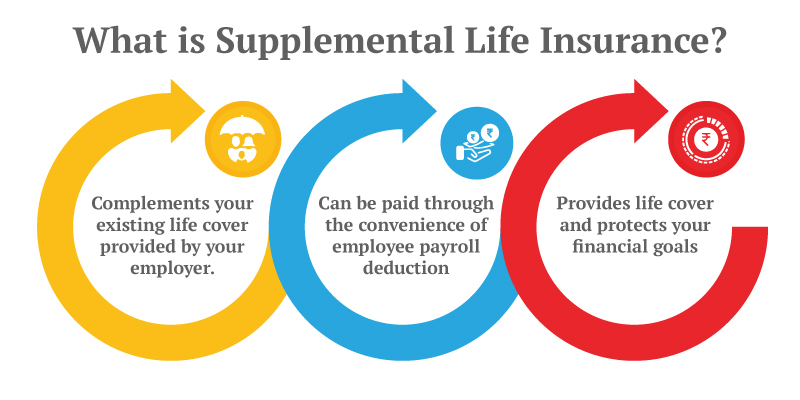

What is Supplemental Life Insurance?

Supplemental life insurance is an additional policy you can purchase on top of your primary life insurance coverage. It provides an extra layer of financial protection to your loved ones in the event of your untimely death. While the leading life insurance policy typically offers a death benefit to your beneficiaries, supplemental life insurance provides additional coverage that can help cover expenses such as medical bills, funeral costs, and outstanding debts.

Unlike traditional life insurance policies, supplemental life insurance is often offered as a voluntary benefit through your employer. It allows you to customize your coverage and choose the additional protection you want. This type of insurance is especially beneficial for individuals who may have unique circumstances or financial obligations that require extra coverage beyond what their primary life insurance policy provides.

How Does Supplemental Life Insurance Work?

Supplemental life insurance works as an add-on to your existing life insurance policy. It is typically offered as a rider or an additional option to select when enrolling in your employer-sponsored benefits program. The coverage amount and cost of the supplemental policy will vary depending on the insurance provider and the policy’s specific terms.

When you enroll in supplemental life insurance, you will typically have the option to choose a coverage amount that suits your needs. This amount can be a multiple of your annual salary or a fixed amount you designate. The premiums for the supplemental policy are usually deducted from your paycheck on a pre-tax basis, making it a convenient and cost-effective way to secure additional coverage.

The Benefits of Supplemental Life Insurance

There are several benefits to having supplemental life insurance:

- Added Financial Protection: Supplemental life insurance provides your loved ones an extra layer of financial security, ensuring they have the resources they need in the event of your passing.

- Customizable Coverage: With supplemental life insurance, you can choose the coverage that aligns with your needs and financial goals.

- Portability: In some cases, supplemental life insurance policies can be portable, meaning you can take them with you if you change jobs or leave your current employer.

- No Medical Exam: Depending on the policy, supplemental life insurance may not require a medical exam for enrollment, making it accessible to individuals with pre-existing conditions or health concerns.

It’s important to note that the specific benefits and features of supplemental life insurance can vary depending on the insurance provider and policy terms. It’s advisable to review the policy details carefully and consult with an insurance professional to ensure that you select the right coverage for your needs.

Supplemental Life Insurance vs. Basic Life Insurance: Understanding the Difference

While supplemental life insurance may sound similar to basic life insurance, there are some critical differences between the two:

- Primary Coverage: Basic life insurance is the primary coverage that provides a death benefit to your beneficiaries. Supplemental life insurance adds an extra layer of coverage on top of the primary policy.

- Coverage Amount: Basic life insurance typically offers a fixed coverage amount, often based on a multiple of your annual salary. Supplemental life insurance allows you to choose an additional coverage amount beyond what is provided by the primary policy.

- Enrollment: Employers often automatically provide basic life insurance as part of a benefits package. Supplemental life insurance is voluntary and requires separate enrollment.

- Cost: The employer usually fully or partially funds basic life insurance. Supplemental life insurance is typically employee-funded, meaning you pay the premiums.

Understanding the differences between primary and supplemental life insurance can help you determine what type of coverage is right for you and your loved ones. When deciding on the appropriate coverage, assessing your financial needs and considering factors such as dependents, outstanding debts, and future financial goals is essential.

Is Supplemental Life Insurance Worth It?

Whether supplemental life insurance is worth it depends on your circumstances and financial goals. Here are a few factors to consider:

- Current Life Insurance Coverage: Evaluate the coverage provided by your primary life insurance policy. If it falls short of meeting your financial obligations, supplemental life insurance can provide the added protection you need.

- Financial Responsibilities: Consider your current financial responsibilities, such as mortgages, loans, or supporting dependents. Supplemental life insurance can help ensure that these obligations are met in the event of your passing.

- Employer Benefits: Assess the benefits offered by your employer. Some employers may offer generous basic life insurance coverage, making supplemental insurance unnecessary. However, additional insurance can fill the gaps if the basic coverage is limited.

Ultimately, purchasing supplemental life insurance should be based on your unique needs and priorities. It’s advisable to consult with a financial advisor or insurance professional who can provide personalized guidance based on your specific situation.

How to Choose the Right Supplemental Life Insurance Policy

When selecting a supplemental life insurance policy, consider the following factors:

- Coverage Amount: Determine the coverage you need based on your financial obligations and long-term goals.

- Policy Terms: Review the terms and conditions of the policy, including the length of coverage, renewal options, and any exclusions or limitations.

- Cost: Compare the premiums for different policies and ensure the cost aligns with your budget.

- Insurance Provider: Research the reputation and financial stability of the insurance provider to ensure that they can fulfill their obligations in the future.

Additionally, reading the fine print and asking questions to understand the policy before deciding fully is essential. Consulting with an insurance professional can also provide valuable insights and guidance in selecting the right supplemental life insurance policy.

Top Providers of Supplemental Life Insurance

When considering supplemental life insurance, choosing a reputable provider is important. Here are some of the top providers in the industry:

- Company A: Company A offers comprehensive supplemental life insurance options with customizable coverage amounts and affordable premiums.

- Company B: Company B is known for its excellent customer service and a wide range of supplemental life insurance policies to suit different needs.

- Company C: Company C provides competitive rates and flexible policy terms, making it a popular choice among individuals seeking supplemental life insurance.

Remember that this list is not exhaustive; many other reputable insurance providers offer supplemental life insurance. Researching and comparing different options is essential to find the provider and policy that best aligns with your needs.

Final Thoughts

Supplemental life insurance can be a valuable addition to your financial plan, providing extra protection for your loved ones. By understanding how it works, the benefits it offers, and how to choose the right policy, you can make an informed decision that aligns with your individual needs and priorities.

Remember to carefully assess your current life insurance coverage, evaluate your financial responsibilities, and consider the benefits your employer offers. Consulting with professionals in the insurance industry can also provide valuable guidance in selecting the right supplemental life insurance policy.

Ultimately, purchasing supplemental life insurance is a proactive step towards securing the financial future of your loved ones and providing peace of mind for yourself.

Key Takeaways: What is Supplemental Life Insurance?

- Supplemental life insurance is an additional life insurance policy that can be purchased to supplement the coverage provided by a primary life insurance policy.

- It offers extra financial protection to loved ones in the event of the policyholder’s death.

- Supplemental life insurance can be obtained through an employer or purchased individually.

- It allows policyholders to increase their coverage beyond what is provided by their primary policy.

- The policyholder typically pays supplemental life insurance premiums.

Frequently Asked Questions

What is supplemental life insurance?

Supplemental life insurance is an additional coverage you can purchase on top of your existing life insurance policy. It provides extra financial protection for your loved ones during your death. This type of insurance is typically offered through your employer as an optional benefit, allowing you to customize your coverage based on your specific needs.

Supplemental life insurance policies usually have higher coverage limits than basic ones. They can provide a lump sum payment to your beneficiaries, which can be used to cover funeral expenses, outstanding debts, mortgage payments, or any other financial obligations your loved ones may have. It is important to note that supplemental life insurance is not a standalone policy and must be purchased in addition to a primary life insurance policy.

How does supplemental life insurance work?

Supplemental life insurance provides an extra layer of coverage on top of your existing life insurance policy. When you enroll in supplemental life insurance, you will typically have the option to choose a coverage amount that suits your needs. This additional coverage is then added to your primary life insurance policy.

If you pass away while covered under a supplemental life insurance policy, your beneficiaries will receive the death benefit from the primary and additional policies. This can give them a larger financial payout, which can be especially beneficial if you have significant financial obligations or dependents who rely on your income.

Who is eligible for supplemental life insurance?

Eligibility for supplemental life insurance varies depending on the insurance provider and the employer offering the coverage. In most cases, additional life insurance is provided as an optional benefit through an employer-sponsored group insurance plan.

Employees eligible for the group insurance plan are typically also eligible for supplemental life insurance. However, specific eligibility requirements, such as a waiting period or minimum hours worked, may exist before you can enroll in extra coverage. It is essential to review the specific eligibility criteria outlined by your employer or insurance provider to determine if you qualify for additional life insurance.

Can you have multiple supplemental life insurance policies?

Yes, in some cases, you may have the option to have multiple supplemental life insurance policies. This can be particularly beneficial if you have specific financial needs or want to protect your loved ones.

However, it is essential to note that there may be limitations on your total coverage amount across all your life insurance policies. Insurance providers typically have maximum coverage limits, and exceeding these limits may not be possible. Additionally, having multiple policies may result in higher premiums, so carefully considering your financial situation and needs before obtaining multiple supplemental life insurance policies is essential.

Is supplemental life insurance worth it?

Whether supplemental life insurance is worth it depends on your circumstances and financial goals. Supplemental life insurance can provide additional financial protection for your loved ones, especially if you have significant financial obligations or dependents who rely on your income.

If you already have a primary life insurance policy, supplemental coverage can enhance your overall coverage and provide a more considerable death benefit to your beneficiaries. It can offer peace of mind knowing that your loved ones will be financially supported in the event of your death. However, it is essential to evaluate the cost of the supplemental coverage and determine if it fits within your budget.

Final Thoughts

Supplemental life insurance can be a game-changer when protecting your loved ones and ensuring their financial security. Providing an additional layer of coverage on top of your primary life insurance policy offers you peace of mind, knowing that your family will be cared for in the event of your passing.

But supplemental life insurance goes beyond just the financial aspect. It allows you to customize your coverage to fit your unique needs and circumstances. Whether you want to increase your death benefit, add coverage for specific illnesses or accidents, or have the flexibility to adjust your policy as your life changes, supplemental life insurance offers you the freedom to tailor your coverage to your liking.

So, don’t overlook the importance of supplemental life insurance. It’s a valuable tool that can provide extra protection and give you the confidence that your loved ones will be supported when they need it most. Take the time to evaluate your insurance needs and consider adding supplemental life insurance to your financial plan. Your family will thank you for it.