Life insurance is crucial when planning for the future. It provides financial security for your loved ones in the event of your passing. However, one critical decision you need to make is how to split the beneficiaries of your life insurance policy. It may sound like a daunting task, but fear not! In this article, we will explore the ins and outs of splitting life insurance beneficiaries, ensuring that your loved ones are cared for in the best possible way.

Deciding how to split life insurance beneficiaries is a deeply personal choice that depends on your circumstances and priorities. It’s essential to take the time to consider the needs and relationships of those involved. Whether it’s dividing the proceeds equally among your children, designating a specific percentage to each beneficiary, or even naming charitable organizations, there are various approaches you can take. We will delve into these options, discuss the importance of updating your beneficiaries regularly, and provide some expert tips to guide you through this process smoothly. So, let’s dive in and discover the best ways to split life insurance beneficiaries!

Splitting life insurance beneficiaries is a process that ensures your assets are distributed according to your wishes. Here’s how you can do it:

- Review your policy: Understand the terms and conditions of your life insurance policy regarding beneficiaries.

- Decide on the split: Determine how to divide the proceeds among multiple beneficiaries, specifying percentages or fixed amounts.

- Update your policy: Contact your insurance provider and complete the necessary paperwork to change your beneficiaries.

- Communicate with beneficiaries: Inform them about the split and ensure they know their respective shares.

- Regularly review and update: Life circumstances change, so periodically check your beneficiaries and make updates as necessary.

How Do You Split Life Insurance Beneficiaries?

Understanding Life Insurance Beneficiaries

Life insurance beneficiaries receive the policy’s proceeds upon the insured’s death. Choosing the proper beneficiaries is essential to ensure your loved ones are cared for financially after you leave. However, circumstances change, relationships evolve, and sometimes, you may need to split life insurance beneficiaries. So, how do you go about this process?

1. Review Your Policy

The first step in splitting life insurance beneficiaries is to review your policy. Take the time to carefully read through the terms and conditions to understand your options. Some policies allow you to name multiple primary beneficiaries, while others may require you to designate a single beneficiary. You may also be able to name contingent beneficiaries who will receive the proceeds if the primary beneficiaries are no longer alive.

2. Consider Your Goals

Before making any changes to your life insurance beneficiaries, it’s essential to consider your goals. Consider why you want to split the beneficiaries and what outcome you hope to achieve. Are you looking to provide for a new spouse or children from a previous marriage? Do you want to ensure that specific individuals receive a portion of the proceeds? Understanding your objectives will help guide your decision-making process.

Methods for Splitting Life Insurance Beneficiaries

Once you’ve reviewed your policy and identified your goals, there are several methods you can use to split your life insurance beneficiaries. Let’s explore some of these options:

1. Designating Different Percentage Amounts

One approach is to divide the beneficiaries by designating different percentage amounts. For example, if you have two children, you might assign 50% of the proceeds to each child. This method allows you to divide the benefit according to your wishes and your loved ones’ financial needs.

2. Naming Multiple Primary Beneficiaries

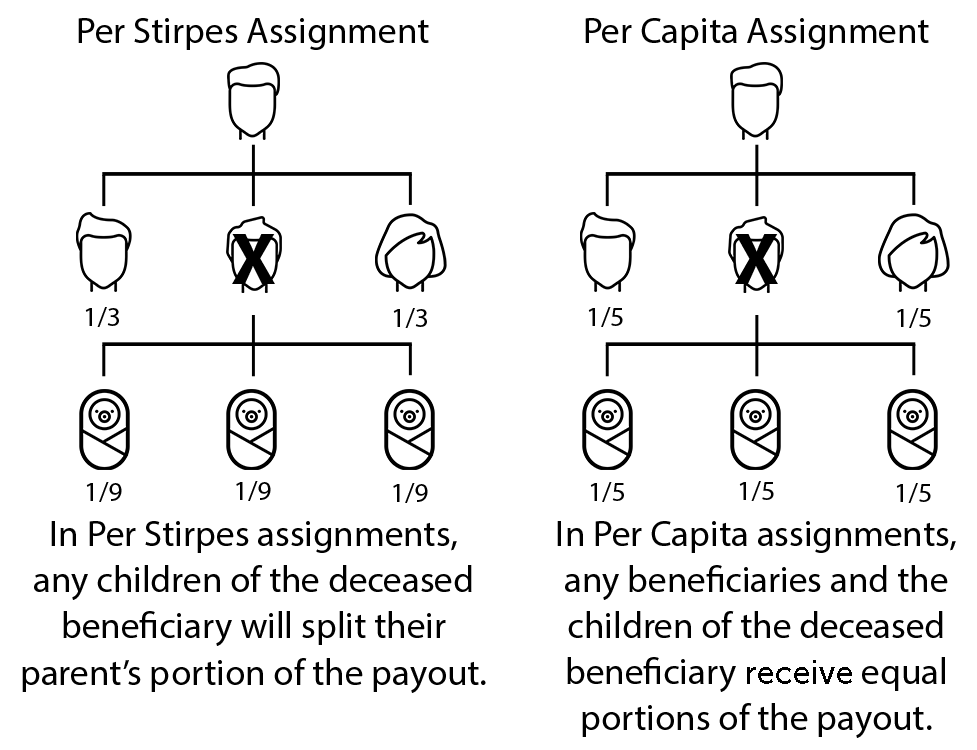

Another option is to name multiple primary beneficiaries. This means that each individual will receive an equal share of the proceeds. For instance, if you have three siblings, you can name all three as primary beneficiaries, ensuring they each receive one-third of the benefit.

Factors to Consider

When splitting life insurance beneficiaries, it’s essential to consider various factors to ensure your wishes are carried out effectively. Here are some key considerations:

1. Tax Implications

Before finalizing any changes to your life insurance beneficiaries, it’s crucial to consult with a tax professional. Depending on the policy amount, there may be tax implications for the beneficiaries. Understanding and addressing these tax considerations can help ensure that your loved ones receive the maximum benefit from the policy.

2. Legal Requirements

Different jurisdictions may have specific legal requirements for splitting life insurance beneficiaries. Familiarizing yourself with the laws in your area is essential to ensuring that you comply with all necessary regulations. Consulting with an attorney specializing in estate planning can give you the guidance you need to navigate these legal requirements.

Conclusion

Splitting life insurance beneficiaries can be a complex process. Still, by understanding your policy, considering your goals, and exploring different methods, you can ensure your loved ones are provided according to your wishes. Remember to review your policy regularly and update it as needed to reflect changes in your circumstances or relationships. By planning and making informed decisions, you can have peace of mind knowing that your life insurance proceeds will be distributed as you intended.

Key Takeaways: How to Split Life Insurance Beneficiaries

- Discuss your intentions with your beneficiaries openly and honestly.

- Consider the needs and financial situations of each beneficiary.

- Consult with a financial advisor or attorney for guidance on the best approach.

- Please regularly review and update your life insurance policy to ensure it aligns with your wishes.

- Keep records of your decisions and communicate them clearly to your beneficiaries.

Frequently Asked Questions

Question 1: Can I split my life insurance beneficiaries equally?

Yes, you have the option to split your life insurance beneficiaries equally. This means that you can divide the policy proceeds equally among multiple beneficiaries. For example, if you have three children, you can designate them to receive one-third of the life insurance payout.

It’s important to note that splitting the beneficiaries equally requires careful consideration and planning. You should communicate your wishes clearly in your life insurance policy and review them periodically to ensure they reflect any changes in your circumstances or family dynamics.

Question 2: What if I want to divide my life insurance beneficiaries unequally?

If you wish to divide your life insurance beneficiaries unequally, you have the flexibility to do so. Perhaps you have specific reasons for wanting to allocate different percentages or amounts to each beneficiary. For example, you may have one child who requires more financial support than the others or have a close friend you wish to include as a beneficiary.

When dividing your life insurance beneficiaries unequally, clearly state your intentions in your policy. Doing so can prevent potential misunderstandings or disputes among your beneficiaries after passing. Discussing your decision with your beneficiaries is also a good idea to ensure they understand your reasoning and can address any concerns.

Question 3: Can I change the beneficiaries on my life insurance policy?

Yes, you can change the beneficiaries on your life insurance policy. Life circumstances may change, and you may update your beneficiaries to reflect these changes. For example, if you initially designated your spouse as the primary beneficiary but have since divorced, you may want to remove them and designate your children as the new beneficiaries.

To change the beneficiaries on your life insurance policy, you typically need to contact your insurance provider and request a change of beneficiary form. This form will allow you to add, remove, or modify the beneficiaries listed on your policy. It’s essential to keep your beneficiaries up to date to ensure that the policy proceeds are distributed according to your wishes.

Question 4: What happens if I don’t specify beneficiaries on my life insurance policy?

If you don’t specify beneficiaries on your life insurance policy, the proceeds will typically be paid out according to the policy’s default provisions. These provisions may vary depending on your insurance provider and the laws in your jurisdiction.

In many cases, if no beneficiaries are specified, the proceeds will be paid to your estate. This means that the funds will be subject to probate and distributed according to your will or the laws of intestacy if you don’t have a will. It’s important to note that this process can be time-consuming and may result in delays and additional expenses.

Question 5: Can I name contingent beneficiaries in addition to primary beneficiaries?

You can name contingent and primary beneficiaries on your life insurance policy. Contingent beneficiaries will receive the policy proceeds if the primary beneficiaries cannot do so. They act as a backup plan if the primary beneficiaries pass away before or simultaneously as the policyholder.

Naming contingent beneficiaries ensures that the policy proceeds are distributed according to your wishes, even if unexpected circumstances arise. Reviewing and updating your contingent beneficiaries periodically is essential to ensure they reflect your current intentions. By doing so, you can have peace of mind knowing that your loved ones will be cared for in the event of your passing.

Life Insurance Beneficiary – Life Insurance Beneficiaries Explained

Final Summary: Splitting Life Insurance Beneficiaries Made Easy

When it comes to dividing your life insurance beneficiaries, it’s essential to approach the process with careful consideration and clarity. While there is no one-size-fits-all answer, there are a few key factors to consider. Firstly, reviewing your policy and making any necessary updates is crucial to reflect your wishes accurately. Secondly, communicating openly with your loved ones about your intentions can help avoid conflicts and misunderstandings. Finally, seeking the guidance of a financial advisor or estate planning attorney can provide valuable insights and ensure that your beneficiaries are set up for success. Remember, splitting life insurance beneficiaries doesn’t have to be daunting when approaching it with the right mindset and resources.

In conclusion, navigating the process of splitting life insurance beneficiaries may seem overwhelming initially, but it can be a manageable and even empowering experience with the right approach. By reviewing your policy, communicating openly, and seeking professional guidance, you can ensure your loved ones are cared for according to your wishes. Remember, each situation is unique, so it’s essential to tailor your approach to fit your circumstances. So, don’t hesitate to take the necessary steps to protect your loved ones and provide them with the financial security they deserve.