Are you interested in pursuing a career in the insurance industry? One of the first steps is obtaining your life and health insurance license. This license is essential for anyone looking to sell or advise on life and health insurance policies. But you might wonder, how exactly do you get your life and health insurance license? Don’t worry; I’ve got you covered!

Getting your life and health insurance license is a straightforward process that requires a combination of education and passing a licensing exam. The first step is to complete a pre-licensing course that covers the necessary topics and prepares you for the exam. These courses can be taken online or in person, allowing you to choose the option that best fits your schedule and learning style. Once you’ve completed the course, you must schedule and pass the licensing exam. This exam will test your knowledge of insurance laws, policies, and ethical practices. With some dedication and preparation, you’ll be well on your way to obtaining your life and health insurance license and embarking on a rewarding career in the insurance industry. So, let’s dive in and explore the steps in more detail!

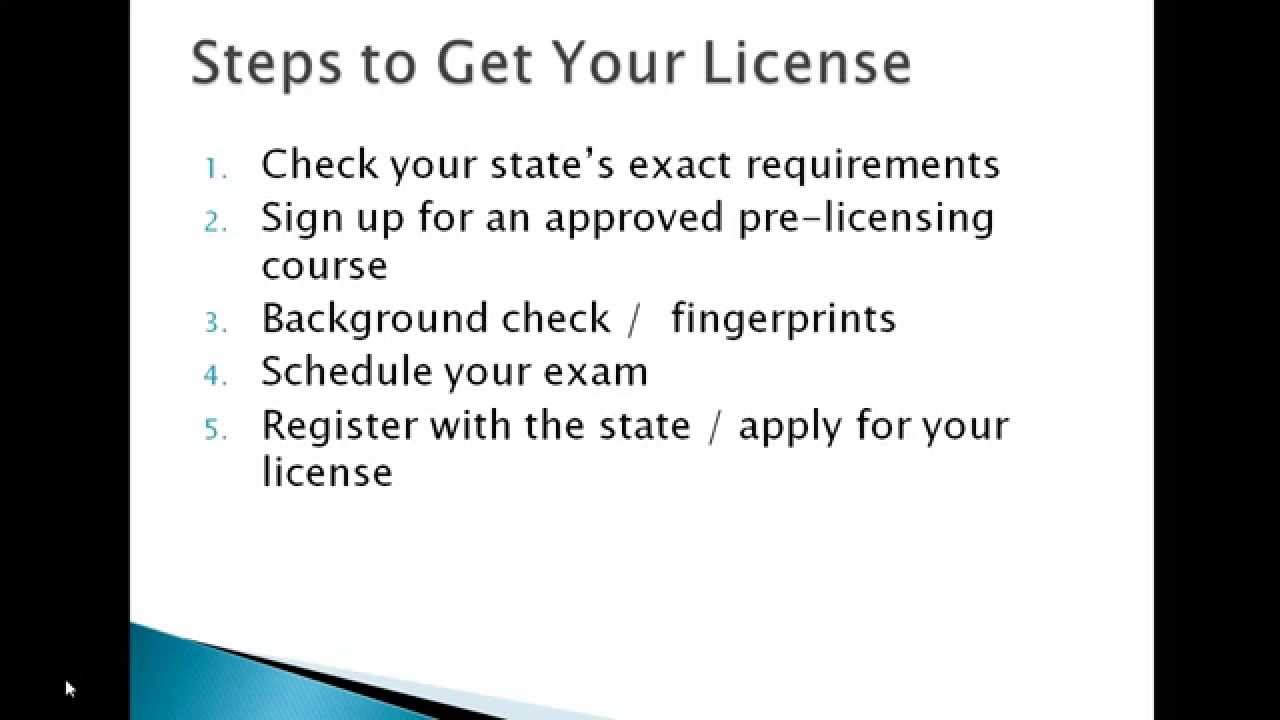

- Research your state’s requirements for obtaining a life and health insurance license.

- Complete any necessary pre-licensing education courses or training programs.

- Prepare for the licensing exam by studying the relevant materials and taking practice tests.

- Schedule and take the life and health insurance licensing exam.

- Submit an application to the state insurance department along with any required fees.

- Undergo a background check and provide any additional documentation or information as requested.

- Wait for the state insurance department to approve and issue your license.

How to Get a Life and Health Insurance License: A Comprehensive Guide

Are you interested in pursuing a career in the insurance industry? Obtaining a life and health insurance license is essential to success in this field. It would help if you were licensed by the appropriate regulatory authorities to sell life and health insurance policies. This article will provide the necessary information and steps to obtain your license.

Understanding the Requirements

Before you embark on your journey to obtain a life and health insurance license, you must understand the requirements set by the regulatory authorities. The specific requirements may vary from state to state, so it is crucial to research and familiarize yourself with your jurisdiction’s regulations. Generally, the requirements include:

- Minimum age: Most states require 18 years to apply for a life and health insurance license.

- Education: You must complete a pre-licensing education course approved by your state’s insurance department. The number of hours required may vary.

- Exam: After completing the pre-licensing education course, you must pass a licensing exam. The exam typically consists of multiple-choice questions, testing your knowledge of insurance concepts and regulations.

- Background check: You may be required to undergo a background check, including fingerprinting, to ensure your suitability for the insurance industry.

- Licensing fees are associated with applying for and obtaining your life and health insurance license. The exact amount will depend on your state.

It is important to note that these requirements are subject to change, so staying updated with the latest regulations is essential. Now that you know the requirements, let’s dive into obtaining your life and health insurance license.

Step 1: Pre-Licensing Education

The first step towards obtaining your life and health insurance license is to complete a pre-licensing education course. This course provides the necessary knowledge and understanding of insurance concepts, regulations, and ethics. The required hours vary depending on your state but typically range from 20 to 40.

There are various options available to complete your pre-licensing education. You can attend in-person classes, participate in online courses, or even opt for self-study materials. Selecting an approved course provider recognized by your state’s insurance department is essential. Ensure the course covers all the required topics and adequately prepares you for the licensing exam.

Tips for Pre-Licensing Education

Here are some tips to make the most out of your pre-licensing education:

- Stay organized: Create a study schedule and allocate dedicated time for studying. This will help you stay on track and cover all the necessary material.

- Take practice exams: Practice exams are a great way to familiarize yourself with the format and questions you may encounter in the licensing exam. They will also help you identify areas where you need to focus your studying.

- Ask questions: If you have any doubts or need clarification on specific topics, don’t hesitate to contact your course instructor or fellow students. Understanding the material thoroughly is crucial for success in the licensing exam.

You can take the licensing exam once you have completed your pre-licensing education.

Step 2: Licensing Exam

The licensing exam is a significant milestone in your journey toward obtaining your life and health insurance license. It typically consists of multiple-choice questions and assesses your knowledge of insurance concepts, regulations, and ethical practices.

Before taking the exam, thoroughly review the material covered in your pre-licensing education course. This includes understanding insurance terms, policy provisions, underwriting processes, and state-specific regulations. Practice exams can help you familiarize yourself with the exam format and identify areas that require further study.

Tips for the Licensing Exam

Here are some tips to help you succeed in the licensing exam:

- Review the material: Review your pre-licensing education material multiple times to ensure you understand the concepts and regulations.

- Manage your time: The exam is time-limited, so you must pace yourself and allocate sufficient time to each question. Don’t spend too much time on a single question.

- Eliminate wrong answers: If unsure about a question, try eliminating the incorrect answers. This will increase your chances of selecting the correct answer.

- Stay calm and focused: Feeling nervous before and during the exam is normal. Take deep breaths, remain quiet, and stay focused on each question.

Congratulations on successfully passing the licensing exam! You are one step closer to obtaining your life and health insurance license. The next step is to apply for it.

Step 3: License Application

Once you have passed the licensing exam, you can proceed with the license application process. This typically involves submitting an application to your state’s insurance department and paying the required fees. The application will require you to provide personal information, education details, and relevant background information.

Along with the application, you may be required to undergo a background check, including fingerprinting. This ensures you meet the suitability requirements for working in the insurance industry and helps identify any criminal history or disciplinary actions that may affect your eligibility for a license.

After submitting your application and completing the background check, you must wait for your license to be approved. The processing time may vary depending on your state’s insurance department. Once approved, you will receive your life and health insurance license, allowing you to legally sell life and health insurance policies.

Benefits of Obtaining a Life and Health Insurance License

Obtaining a life and health insurance license opens up a range of opportunities and benefits:

- Job prospects: With a license, you can pursue a career as an insurance agent, broker, or consultant. The insurance industry offers diverse job opportunities and growth potential.

- Financial rewards: An insurance career can be financially rewarding. Your earning potential increases as you build your client base and gain experience.

- Helping others: Selling life and health insurance allows you to impact people’s lives positively. By providing individuals and families with the protection they need, you contribute to their financial security and well-being.

- Continuous learning: The insurance industry is constantly evolving. Obtaining a license opens up opportunities for ongoing professional development and education, ensuring you stay up-to-date with industry trends and regulations.

Now that you have a comprehensive understanding of obtaining a life and health insurance license, it’s time to take the first step toward your new career. Research the requirements in your state, enroll in a pre-licensing education course, and embark on this exciting journey. Good luck!

Key Takeaways: How to Get a Life and Health Insurance License?

- Completing pre-licensing education is the first step.

- Passing the state licensing exam is crucial.

- Applying for the license with the appropriate state department is necessary.

- Meeting any additional requirements, such as background checks or fingerprinting, may be necessary.

- Maintaining the license through continuing education is essential for renewal.

Frequently Asked Questions

Here are some common questions about how to get a life and health insurance license:

1. What are the requirements to obtain a life and health insurance license?

To obtain a life and health insurance license, you must meet specific requirements from your state’s insurance department. These requirements typically include completing a pre-licensing course, passing a licensing exam, and submitting an application with the necessary fees. Some states may also require a background check or fingerprinting. You must check with your state’s insurance department for specific requirements.

Additionally, most states require applicants to be at least 18 years old, have a high school diploma or equivalent, and be of good moral character. Some states may also require proof of residency or citizenship. Reviewing your state’s specific requirements is essential to ensure you can obtain a life and health insurance license.

2. How can I prepare for the life and health insurance licensing exam?

Preparing for the life and health insurance licensing exam is crucial to increase your chances of passing. Start by enrolling in a pre-licensing course that covers the necessary topics and provides study materials. These courses are often offered online or in person and can help you understand the key concepts and regulations related to life and health insurance.

In addition to the pre-licensing course, it’s essential to study and review the course materials thoroughly. Create a study schedule and allocate dedicated time each day to review the material—practice sample exam questions to familiarize yourself with the licensing exam’s format and content. Consider joining study groups or seeking guidance from experienced insurance professionals who can provide valuable insights and tips.

3. How long does getting a life and health insurance license take?

The time it takes to get a life and health insurance license can vary depending on several factors. These factors include completing the required pre-licensing course, scheduling and passing the licensing exam, and submitting the necessary application and fees. On average, the entire process can take anywhere from a few weeks to a few months.

Planning and allowing yourself enough time to complete the necessary steps is essential. To avoid delays, schedule your licensing exam and submit your application proactively. Remember that some states may have additional requirements or processing times, so you must check with your state’s insurance department for specific timelines.

4. Can I get a life and health insurance license with a criminal record?

A criminal record does not automatically disqualify you from obtaining a life and health insurance license. Each state has its own guidelines and regulations regarding criminal history. However, disclosing criminal convictions on your license application and providing any requested documentation or explanation is essential.

The state insurance department will review your application and criminal history case-by-case basis. Factors such as the nature of the offense, time elapsed since the conviction, and evidence of rehabilitation may be considered. To increase your chances of obtaining a license, it’s essential to be honest and transparent in your application and provide any necessary supporting documents.

5. What are my career options Once I have my life and health insurance license?

Obtaining a life and health insurance license opens up various career options within the insurance industry. You can work as an insurance agent, helping individuals and businesses find the proper life and health insurance policies to meet their needs. You can also pursue a career as a broker, representing multiple insurance companies and assisting clients in comparing and selecting insurance policies.

Other career options include insurance sales management, underwriting, claims adjusting, or risk management. You can work for an insurance company or an independent agency or even start your own insurance business. With a life and health insurance license, you can build a rewarding career in the insurance industry.

Final Summary

Are you interested in obtaining a life and health insurance license? Congratulations on taking the first step towards a rewarding career in the insurance industry! While the process may seem daunting initially, you can achieve your goal and become a licensed insurance professional with the proper guidance and preparation.

Getting a life and health insurance license involves several key steps. First, you’ll need to complete a pre-licensing education course that covers the necessary topics and prepares you for the licensing exam. These courses can be taken online or in person, allowing you to choose the option that best fits your schedule and learning style.

Once you’ve completed the education requirements, you must schedule and take the licensing exam. This exam evaluates your knowledge of insurance principles, laws, and regulations. Studying and reviewing the material thoroughly is essential to increasing your chances of success. After passing the exam, you must submit an application and any required documentation to your state’s insurance department.

In conclusion, obtaining a life and health insurance license requires dedication, study, and perseverance. However, the rewards are worth it. With your license, you can help individuals and families protect their health and financial well-being. So, embrace the journey and prepare to embark on a fulfilling career in the insurance industry. Good luck!