Many people find life insurance daunting and confusing. With so many different types of life insurance available, it can be overwhelming to understand which is the best fit for you and your loved ones. But fear not—in this article, we will break down the different types of life insurance in a way that is easy to understand and digest. So, please grab a cup of coffee, sit back, and let’s dive into life insurance!

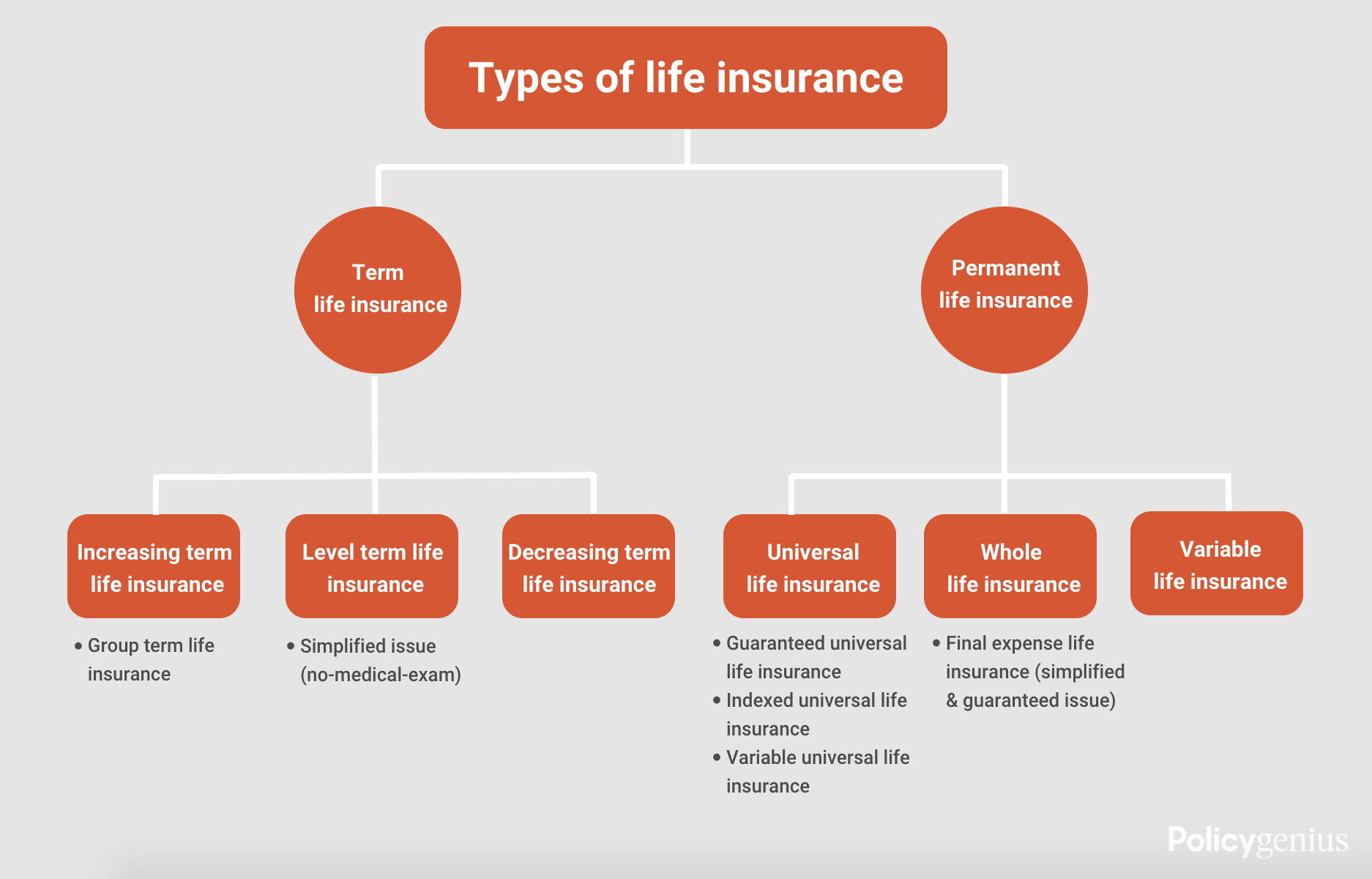

When it comes to life insurance, there are several options. The most common types include term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its unique features and benefits, so it’s essential to understand what sets them apart. Whether looking for a policy that provides coverage for a specific period or offers lifelong protection, a life insurance option can meet your needs. So, let’s explore each type in more detail and discover which one might be the perfect fit for you.

Understanding the Different Types of Life Insurance

Life insurance is a crucial financial product that provides protection and peace of mind for individuals and their loved ones. It is a safety net, ensuring beneficiaries are financially supported during the policyholder’s death. There are various types of life insurance, each with unique features and benefits. Understanding these different types of life insurance is essential in making an informed decision about the coverage that suits your needs. This article will explore the various kinds of life insurance, their key characteristics, and how they can benefit you and your family.

Term Life Insurance

Term life insurance is the most basic and straightforward type of life insurance. It covers a specific period, typically 10, 20, or 30 years. The beneficiaries pay the death benefit if the policyholder dies during the term. However, if the policyholder survives the term, there is no payout. Term life insurance is an affordable option, making it ideal for individuals who need coverage for a specific period, such as the duration of a mortgage or until their children are financially independent.

Term life insurance offers flexibility in terms of coverage amount and term length. Policyholders can choose the coverage amount based on their needs and financial obligations. Additionally, some term life insurance policies offer the option to convert to a permanent life insurance policy later on, providing added flexibility and long-term protection.

Key Features of Term Life Insurance

Term life insurance has several key features that make it a popular choice for many individuals:

1. Affordability: Term life insurance offers the most affordable premiums compared to other types of life insurance.

2. Flexibility: Policyholders can choose the coverage amount and term length that aligns with their needs.

3. Temporary Coverage: Term life insurance provides coverage for a specific period, making it suitable for short-term financial obligations.

4. Convertibility: Some term life insurance policies can be converted to permanent life insurance, ensuring long-term protection.

When considering term life insurance, assessing your current financial situation, future obligations, and the coverage amount needed to support your loved ones in the event of your passing is essential.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which has a specific term, whole life insurance offers lifelong protection as long as the premiums are paid. Whole life insurance provides a death benefit and accumulates cash value over time, which policyholders can access during their lifetime.

Whole life insurance premiums are typically higher than term life insurance premiums. However, the extra cost is justified by the lifelong coverage and the cash value component. The cash value grows over time through the insurance company’s investment, and policyholders can access it through policy loans or withdrawals. This can be particularly beneficial for individuals who want a life insurance policy as a savings or investment vehicle.

Key Features of Whole Life Insurance

Whole life insurance offers several key features that make it an attractive option for individuals seeking long-term protection and financial benefits:

1. Lifelong Coverage: Whole life insurance provides coverage for the entire lifetime of the insured individual, ensuring that beneficiaries receive the death benefit whenever the policyholder passes away.

2. Cash Value Accumulation: Whole life insurance policies accumulate cash value over time, which the policyholder can access during their lifetime.

3. Guaranteed Death Benefit: The death benefit of whole life insurance is guaranteed and will be paid out to the beneficiaries upon the insured individual’s death.

4. Fixed Premiums: Whole life insurance typically has fixed premiums throughout the policyholder’s lifetime, providing stability and predictability.

When considering whole life insurance, it is essential to assess your long-term financial goals and ability to afford the higher premiums associated with this type of coverage.

Universal Life Insurance

Universal life insurance is another permanent life insurance that combines a death benefit with a cash value component. It offers flexibility regarding premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their financial needs change.

One of the critical features of universal life insurance is the ability to accumulate cash value on a tax-deferred basis. Policyholders can also use the cash value to pay premiums or increase the death benefit. However, it is essential to note that universal life insurance is more complex than term or whole life insurance, and policyholders need to manage their policies to ensure they remain adequately funded actively.

Key Features of Universal Life Insurance

Universal life insurance offers several key features that make it a flexible and customizable option for individuals:

1. Flexibility: Universal life insurance allows policyholders to adjust their premium payments and death benefit amounts as their financial circumstances change.

2. Cash Value Accumulation: Like whole life insurance, universal life insurance policies accumulate cash value over time, which can be used to pay premiums or increase the death benefit.

3. Tax-Advantaged Growth: The cash value of universal life insurance grows tax-deferred, potentially allowing policyholders to accumulate significant savings over time.

4. Investment Options: Some universal life insurance policies offer investment options, potentially allowing policyholders to earn higher cash value returns.

When considering universal life insurance, it is essential to carefully review the policy terms and investment options and understand the potential risks and benefits of this type of coverage.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that combines a death benefit with investment options. It allows policyholders to allocate a portion of their premiums to various investment accounts, such as stocks, bonds, or mutual funds. The policy’s cash value fluctuates based on the performance of these investment accounts.

Variable life insurance offers the potential for higher returns compared to other types of life insurance. However, it carries more risk, as the cash value can decrease if the investments perform poorly. Policyholders need to have a good understanding of investment principles and be comfortable with the potential volatility of the cash value.

Key Features of Variable Life Insurance

Variable life insurance offers several key features that make it suitable for individuals seeking investment opportunities within their life insurance policy:

1. Investment Options: Variable life insurance allows policyholders to allocate a portion of their premiums to investment accounts, providing the potential for higher returns.

2. Cash Value Growth: The cash value of variable life insurance fluctuates based on the performance of the underlying investments.

3. Death Benefit Protection: Variable life insurance provides a death benefit to beneficiaries, paid out upon the insured individual’s death.

4. Risk and Reward: Variable life insurance carries more investment risk compared to other types of life insurance, but it also offers the potential for higher returns.

When considering variable life insurance, it is essential to carefully assess your risk tolerance, investment knowledge, and long-term financial goals.

Additional Considerations

Choosing the Right Type of Life Insurance

When selecting a life insurance policy, it is crucial to consider your specific needs, financial goals, and budget. Each type of life insurance offers different features and benefits, so assessing which one aligns with your priorities is essential. Consider factors such as the duration of coverage needed, the desired cash value accumulation, and your ability to pay premiums over time.

Working with an Insurance Professional

Navigating the world of life insurance can be complex, especially with the various types and options available. Working with an experienced insurance professional can help you understand the intricacies of each type of life insurance and guide you in making the right decision for your financial future. An insurance professional can assess your needs, provide personalized recommendations, and ensure you have the coverage that best suits your circumstances.

Reviewing and Updating Your Coverage

Life insurance needs can change over time due to various factors, such as marriage, the birth of children, or changes in financial circumstances. Therefore, it is essential to regularly review your life insurance coverage and make any necessary updates to ensure that it still aligns with your current needs. This may involve increasing or decreasing coverage, adjusting the policy term, or exploring additional riders or benefits.

Conclusion

Choosing the right type of life insurance is a significant decision that requires careful consideration. By understanding the different types of life insurance available, their key features, and benefits, you can make an informed choice that provides the necessary protection for you and your loved ones. Whether you opt for term life insurance, whole life insurance, universal life insurance, or variable life insurance, having life insurance coverage in place ensures that your family’s financial well-being is safeguarded in the event of the unexpected. Work with an insurance professional to explore your options and find the policy that best suits your needs and goals.

Key Takeaways: What Are the Different Types of Life Insurance?

- Term life insurance covers a specific period, usually 10, 20, or 30 years.

- Whole life insurance offers lifelong coverage and includes a savings component called cash value.

- Universal life insurance provides flexibility in premium payments and death benefits.

- Variable life insurance allows policyholders to invest in different investment options.

- Final expense insurance, or burial insurance, covers funeral and burial expenses.

Frequently Asked Questions

Question 1: What is term life insurance?

Term life insurance is a type of life insurance that provides coverage for a specified period, usually between 10 and 30 years. It is designed to provide financial protection to your loved ones in the event of your death during the policy term. If you pass away during the term, the insurance company pays out a death benefit to your beneficiaries. However, if you survive the term, the policy expires, and no benefit is paid.

Term life insurance is often more affordable than other types of life insurance, making it a popular choice for individuals who want coverage for a specific period, such as while their children are growing up or they are paying off a mortgage. Unlike permanent life insurance policies, term life insurance does not accumulate cash value.

Question 2: What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime as long as you continue to pay the premiums. It not only offers a death benefit to your beneficiaries upon your death, but it also accumulates cash value over time. The cash value grows tax-deferred and can be accessed during your lifetime through policy loans or withdrawals.

Unlike term life insurance, whole life insurance does not have a specific term and provides lifelong coverage. It can be a more expensive option than term life insurance but offers the advantage of the cash value component, which can be used for various purposes, such as supplementing retirement income or funding education expenses.

Question 3: What is universal life insurance?

Universal life insurance is another permanent life insurance that combines a death benefit with a cash value component. It offers flexibility in terms of premium payments and death benefit amounts. With universal life insurance, you can adjust your premium payments and death benefits within certain limits throughout the policy’s life.

The cash value of a universal life insurance policy grows based on the performance of the underlying investments, such as stocks or bonds. Although it can earn higher returns than whole life insurance, it carries more risk. Universal life insurance can be suitable for individuals who want the flexibility to adjust their coverage and premiums over time.

Question 4: What is variable life insurance?

Variable life insurance is a type of permanent life insurance that allows you to invest a portion of your premium payments in various investment options, such as mutual funds. The policy’s cash value fluctuates based on the performance of these investments. With variable life insurance, you can accumulate higher cash value and investment growth than with other types of life insurance.

However, variable life insurance carries more risk as the cash value is subject to market fluctuations. If the investments perform poorly, it can negatively impact the cash value and potentially the death benefit. Variable life insurance is suitable for individuals who are comfortable with investment risk and want the potential for higher returns.

Question 5: What is final expense insurance?

Final expense insurance, also known as burial or funeral insurance, is a type of life insurance specifically designed to cover the costs associated with funeral and other end-of-life expenses. It is typically a minor policy with a lower death benefit than different life insurance types.

Final expense insurance is often easier to qualify for and has simplified underwriting, meaning no medical exams are typically required. It can provide peace of mind knowing that your loved ones will have the financial means to cover your funeral costs and any outstanding debts or medical bills. Final expense insurance is a popular choice for individuals who want to ensure their end-of-life expenses are taken care of.

Final Summary: Exploring the Different Types of Life Insurance

So, we’ve delved into life insurance and discovered the various available types. From term life to whole life, each option offers its unique benefits and considerations. As we wrap up our discussion, let’s recap the key takeaways.

Term life insurance provides coverage for a specific period, offering financial protection to your loved ones during that time frame. It’s a popular choice for those seeking affordable coverage while their dependents are still financially dependent. Whole life insurance offers lifelong protection and builds cash value over time. It provides peace of mind knowing that your loved ones will be taken care of regardless of when you pass away.

Additionally, variations within these types include universal life and variable life insurance. Universal life insurance allows for flexibility in premium payments and death benefits. In contrast, variable life insurance will enable you to invest in different assets and potentially grow your policy’s cash value.

Remember, when choosing a life insurance policy, it’s crucial to consider your circumstances, financial goals, and the needs of your loved ones. Whether you opt for term life or whole life, the most important thing is having a policy that provides the necessary protection and peace of mind.

In conclusion, life insurance is a vital tool for safeguarding your loved ones’ financial well-being. By understanding the different types available, you can make an informed decision that aligns with your needs and goals. So, take the time to explore the options, consult with a trusted insurance professional, and secure the coverage that will protect your family’s future. Life is unpredictable, but with the right life insurance policy, you know your loved ones will be cared for no matter what.