Are you curious about whether universal life insurance premiums increase with age? Well, buckle up because I’ve got all the juicy details for you! Universal life insurance is a popular option for many people, offering flexibility and lifelong coverage. But as we age, it’s natural to wonder if our premiums will start to creep up. So, let’s dive in and find out!

Regarding universal life insurance, one of the critical factors determining your premium is your age. As we age, our risk of health issues tends to increase, and insurance companies consider this when setting our premiums. However, it’s important to note that not all universal life insurance policies work the same way. Some policies have level premiums, meaning they stay the same throughout the policy’s life, while others have premiums that can increase over time. So, the answer to whether universal life insurance premiums increase with age is: it depends!

Now, you might be wondering why some policies have increasing premiums. Well, insurance companies design these policies with the understanding that the cost of coverage increases as we age. They factor in inflation, mortality rates, and investment returns to ensure they can continue offering coverage as we grow older. So, while it may seem like a bummer to see your premiums go up, it’s all part of the insurance game. Remember, the peace of mind with lifelong coverage can be well worth it in the long run. So, if you’re considering universal life insurance, research, compare policies, and find the one that best fits your needs and budget.

Do Universal Life Insurance Premiums Increase with Age?

Universal life insurance is a type of permanent life insurance that offers flexibility and cash value accumulation. One common question when considering universal life insurance is whether the premiums increase with age. This article will explore this topic in detail and provide the information you need to make an informed decision about universal life insurance.

Understanding Universal Life Insurance

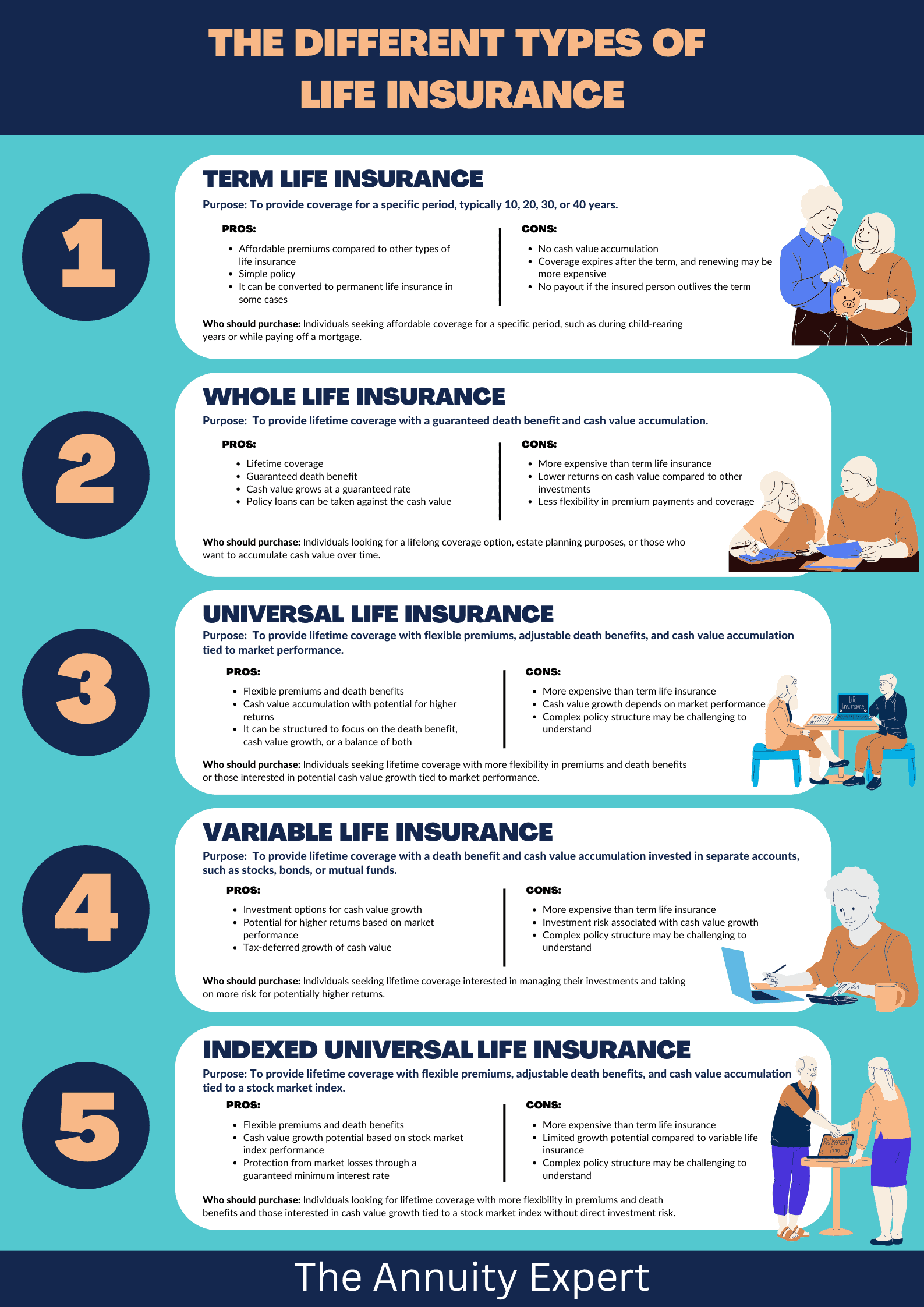

Universal life insurance is a form of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which only provides coverage for a specific period, universal life insurance offers lifelong protection. It combines a death benefit with a savings component known as the cash value.

The cash value component of universal life insurance allows policyholders to accumulate savings over time. A portion of the premium paid is allocated towards this cash value, which grows at a specified interest rate set by the insurance company. Policyholders can access these accumulated funds through loans or withdrawals, providing financial flexibility.

Factors Affecting Premiums

Several factors affect universal life insurance premiums. These include the policyholder’s age, health, gender, and coverage amount. Younger policyholders generally pay lower premiums than older individuals, as the risk of mortality increases with age.

As individuals age, their life expectancy decreases, leading to an increased likelihood of the insurance company having to pay out the death benefit. To compensate for this increased risk, insurance companies adjust the premiums accordingly. It is essential to note that the premium structure of universal life insurance can vary depending on the policy and the insurance company.

Premium Structure of Universal Life Insurance

Universal life insurance offers different premium structures that policyholders can choose from based on their needs and preferences. The three primary premium structures include level, increasing, and indexed.

Level premiums remain constant throughout the policy’s duration, providing stability and predictability for policyholders. This premium type is typically higher initially but remains the same as the policyholder ages.

As the name suggests, increasing premiums increase over time. This premium structure is often associated with policies that front-load the cash value component, allowing for lower premiums in the early years. However, as the policyholder ages, the premiums gradually rise to accommodate the increased risk.

Indexed premiums are tied to a specific index, such as the stock market or a bond index. The premiums can fluctuate based on the performance of the chosen index. This premium structure offers the potential for higher cash value accumulation but also carries more risk.

Do Universal Life Insurance Premiums Increase with Age?

Yes, universal life insurance premiums typically increase with age. As mentioned earlier, the risk of mortality increases as individuals age, leading to higher premiums. Insurance companies adjust the premiums to reflect this increased risk and ensure the policies’ financial viability.

It is important to note that the premium increase may not be linear. Some policies may have level premiums that remain constant throughout the policy’s duration, while others may have increasing premiums that rise gradually over time. The premium structure depends on the policy and the insurance company.

Factors to Consider

Various factors affecting the premiums must be considered when considering universal life insurance. These factors include age, health condition, gender, and the required coverage amount. Younger individuals generally pay lower premiums, while older individuals may face higher costs.

Your health condition also significantly affects the premium. Insurance companies typically require medical underwriting, which involves assessing your health history and current health status. Certain pre-existing conditions or lifestyle choices may result in higher premiums.

The coverage amount you need also affects premiums. Higher coverage amounts generally translate to higher premiums. Evaluating your insurance requires carefully choosing a coverage amount that aligns with your financial goals and obligations is essential.

Benefits of Universal Life Insurance

While universal life insurance premiums may increase with age, several benefits exist. Here are some of the advantages of universal life insurance:

1. Lifelong Coverage: Universal life insurance covers your entire lifetime, ensuring your loved ones are financially protected.

2. Cash Value Accumulation: The cash value component allows you to accumulate savings over time, which can be accessed through loans or withdrawals to pay for education or supplement retirement income.

3. Flexibility: Universal life insurance offers flexibility regarding premium payments and death benefit options. You can adjust your premium payments or the death benefit amount to align with your changing circumstances.

4. Tax Advantages: Cash accumulation within a universal life insurance policy grows tax-deferred. Additionally, the death benefit is generally paid out tax-free to the beneficiaries.

Tips for Choosing Universal Life Insurance

When choosing universal life insurance, consider the following tips:

1. Evaluate Your Needs: Assess your financial goals, obligations, and long-term plans to determine the coverage amount you need and the premium structure that suits your situation.

2. Compare Policies: Shop around and compare policies from different insurance companies. Look for competitive premiums, favorable policy terms, and strong financial ratings.

3. Seek Professional Advice: Consult with a licensed insurance professional who can guide you through the process and help you make an informed decision based on your unique circumstances.

4. Review your universal life insurance policy regularly to ensure it meets your needs. Life circumstances can change, and making adjustments as necessary is essential.

In conclusion, due to the increased mortality risk, universal life insurance premiums tend to increase with age. However, the premium structure can vary depending on the policy and the insurance company. It is crucial to evaluate your insurance needs, consider different premium structures, and seek professional advice to make an informed decision. Universal life insurance offers lifelong coverage, cash value accumulation, flexibility, and potential tax advantages, making it a viable option for those seeking long-term financial protection.

Key Takeaways: Do Universal Life Insurance Premiums Increase with Age?

- 1. Universal life insurance premiums typically increase with age.

- 2. As you get older, insurance coverage becomes more expensive.

- 3. The increase in premiums is primarily due to mortality risk, as the likelihood of death increases with age.

- 4. It’s important to consider your long-term financial goals and budget when choosing a universal life insurance policy.

- 5. Regularly reviewing your policy and adjusting coverage as needed can help manage premium increases.

Frequently Asked Questions

Why do universal life insurance premiums increase with age?

Universal life insurance premiums increase with age for a few key reasons. First, as you age, the risk of mortality increases, and insurance companies adjust premiums to account for this increased risk. Additionally, insurance coverage costs also rise with age due to medical expenses and inflation.

Furthermore, universal life insurance policies often include an investment component accumulating cash value over time. As you age, the cost of insurance coverage tends to rise, and the investment returns may not be sufficient to cover these increasing costs. Therefore, premiums must be adjusted to ensure the policy remains adequately funded.

How much do universal life insurance premiums increase with age?

Universal life insurance premiums increase with age, depending on several factors, including the policyholder’s age at the time of purchase, the policy’s specific terms, and the insurance company’s pricing structure. Generally, premiums rise more significantly as policyholders enter their later years.

Reviewing the policy documents and consulting with your insurance agent to understand how the premiums may increase over time is essential. They can provide you with specific information regarding the premium adjustments based on your age and the duration of your policy.

Are there ways to mitigate the increase in universal life insurance premiums with age?

While universal life insurance premiums generally increase with age, there are some strategies you can consider to mitigate these increases potentially potentially. One option is to purchase a policy at a younger age when premiums are typically lower. By locking in a lower premium rate early on, you can save money in the long run.

Another strategy is to review your policy regularly and make adjustments as needed. For example, you may decrease the death benefit or modify the policy’s investment allocation to better align with your changing needs and financial situation. Consulting with a financial advisor or insurance professional can help you explore these options.

Will the increase in universal life insurance premiums with age make the policy unaffordable?

The increase in universal life insurance premiums with age can sometimes make the policy unaffordable for specific individuals, especially if they did not anticipate or plan for the rising costs. To avoid this situation, it is crucial to carefully consider your long-term financial goals and budget when purchasing a universal life insurance policy.

If the increasing premiums become burdensome, you may have options to mitigate the cost. These options could include reducing the death benefit, adjusting the coverage amount, or exploring other life insurance policies that suit your budget and needs better.

Is there a maximum age limit for purchasing universal life insurance?

While the maximum age limit for purchasing universal life insurance can vary among insurance companies, many providers have an age limit of around 80 years old. However, it’s important to note that the availability and terms of coverage may differ based on your age and health at the time of application.

If you are considering purchasing universal life insurance at an older age, consult with an insurance agent or financial advisor who can explain the options available and help you find the best coverage that suits your needs.

Final Thoughts on Universal Life Insurance Premiums and Age

So, we’ve explored the question: “Do universal life insurance premiums increase with age?” And the answer is a resounding yes. As we grow older, our life insurance premiums tend to increase. This is due to several factors, such as the increased risk of health issues and the higher likelihood of filing a claim as we age. However, it’s important to note that the rate of increase may vary depending on the specific policy and the insurance provider.

While it’s understandable that the prospect of rising premiums may be a concern, it’s crucial to remember the immense value that universal life insurance offers. It provides lifelong coverage and a cash value component that can grow over time. Plus, the earlier you secure a policy, the more affordable your premiums will likely be. So, although the cost may increase as you age, the peace of mind and financial protection it offers make it a worthwhile investment.

In conclusion, when considering universal life insurance, it’s essential to understand that premiums increase with age. However, this should not deter you from obtaining coverage. Instead, it should motivate you to take action sooner rather than later. By securing a policy early on, you can lock in lower premiums and have the peace of mind that you and your loved ones are protected. Remember, it’s never too early to start planning for the future and safeguarding your financial security.