If you’ve ever wondered, “What is variable universal life insurance?” you’re in the right place! Let’s dive into this topic and explore the ins and outs of this intriguing financial product. Variable universal life insurance combines the benefits of life insurance with the flexibility of investment options. It’s like having a two-in-one package deal that can provide financial security for your loved ones while offering potential growth through investment opportunities.

You might be thinking, “But how does it work?” Unlike traditional life insurance policies offering fixed premiums and a set death benefit, variable universal life insurance allows policyholders to allocate a portion of their premiums towards investment accounts. These investment accounts are typically tied to various market-based instruments such as stocks, bonds, and mutual funds. The performance of these investments will affect the cash value of the policy, which can fluctuate over time.

So, in a nutshell, variable universal life insurance offers the policyholder the flexibility to adjust their premium payments and investment allocations based on their financial goals and risk tolerance. It’s like having a customized financial tool that adapts to your needs. However, it’s important to note that the performance of the investments is not guaranteed, and there is always a level of risk involved. Nonetheless, variable universal life insurance can be a robust long-term financial planning and protection tool if managed wisely.

In the next section, we’ll delve deeper into the benefits and considerations of variable universal life insurance, so stick around to learn more!

What is Variable Universal Life Insurance?

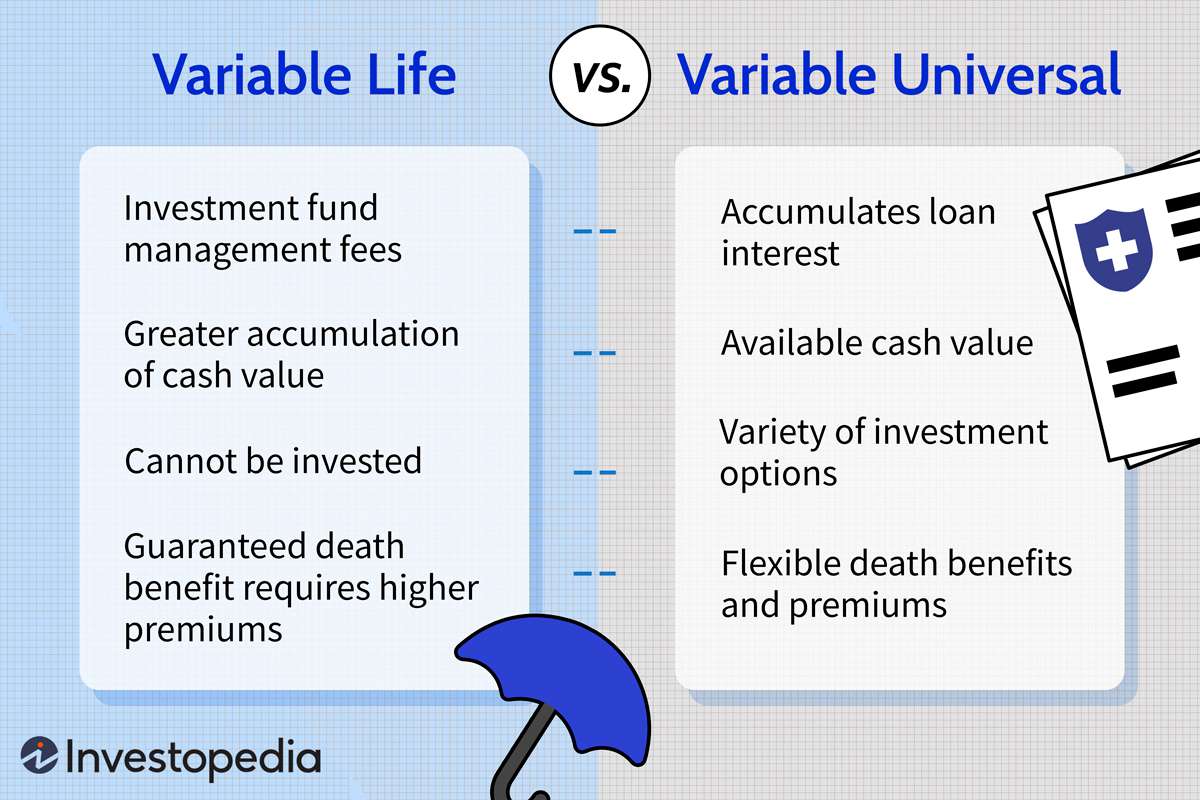

Variable universal life insurance (VUL) is a type of permanent life insurance that offers both a death benefit and an investment component. It combines the flexibility of universal life insurance with the potential for growth through investment options. With VUL, policyholders can allocate a portion of their premium payments into various investment accounts, such as stocks, bonds, and mutual funds. The policy’s cash value can fluctuate based on the performance of these investments.

How Does Variable Universal Life Insurance Work?

When you purchase a variable universal life insurance policy, you pay regular premiums, which are used to cover the insurance cost and fund the policy’s investment component. The insurance company deducts administrative fees and mortality charges from your premium payments, and the remaining amount is invested according to your chosen allocation. The investments grow tax-deferred, meaning you won’t pay taxes on any investment gains until you withdraw the funds.

The cash value of a variable universal life insurance policy can increase or decrease based on the performance of the underlying investments. The cash value can grow if the investments perform well, providing potential tax-free income through policy loans or withdrawals. However, if the investments perform poorly, the cash value may decrease, potentially requiring additional premium payments to keep the policy active.

Benefits of Variable Universal Life Insurance

1. Flexibility: VUL policies allow policyholders to adjust their premium payments and death benefit amounts to meet changing needs and financial circumstances. This flexibility can be especially beneficial if you experience significant life events, such as marriage, the birth of a child, or starting a business.

2. Investment Potential: With VUL, you have the opportunity to invest in a variety of options, including stocks, bonds, and mutual funds. This gives you the potential for higher returns than other life insurance policies with fixed interest rates.

3. Tax Advantages: The cash value growth in a variable universal life insurance policy is tax-deferred, meaning you won’t owe taxes on any investment gains until you withdraw the funds. Additionally, the death benefit is generally paid out tax-free to your beneficiaries.

4. Protection and Savings Combined: VUL provides both a death benefit and an investment component, allowing you to protect your loved ones financially while potentially growing your savings.

Drawbacks of Variable Universal Life Insurance

1. Market Risk: The performance of the investments in a VUL policy is subject to market fluctuations. If the market experiences a downturn, your policy’s cash value may decrease, potentially impacting your ability to maintain the policy or access funds.

2. Fees and Expenses: VUL policies often incur higher fees and expenses than other life insurance types. These fees include administrative, mortality, and investment management fees. It’s important to carefully review the costs associated with the policy before purchasing.

3. Complexity: VUL policies can be more complex than traditional life insurance options. Working with a knowledgeable insurance professional who can explain the features, benefits, and risks associated with VUL is essential.

4. Potential Loss of Coverage: If the cash value of a VUL policy decreases significantly due to poor investment performance or insufficient premium payments, there is a risk that the policy may lapse, resulting in a loss of coverage.

In conclusion, variable universal life insurance offers a unique protection and investment potential combination. It can be a suitable option for individuals looking for a flexible life insurance policy with opportunities for growth through investments. However, it’s crucial to carefully consider the risks and fees associated with VUL before deciding. Working with a trusted financial advisor can help you determine if variable universal life insurance aligns with your financial goals and risk tolerance.

Key Takeaways: What is Variable Universal Life Insurance?

- Variable universal life insurance is a type of life insurance that combines a death benefit with investment options.

- It allows policyholders to invest their premiums in various investment options, such as stocks, bonds, or mutual funds.

- Policyholders can adjust the amount and frequency of their premium payments.

- Variable universal life insurance offers potential for cash value growth but comes with investment risks.

- It is essential to carefully review and understand the policy’s terms and investment options before purchasing.

Frequently Asked Questions

Question 1: How does variable universal life insurance work?

Variable universal life insurance is a type of life insurance policy that combines variable and adaptable life insurance features. It allows policyholders to invest a portion of their premium payments into various investment options such as stocks, bonds, and mutual funds. The policy’s cash value can fluctuate based on the performance of these investments. However, it also provides a death benefit to beneficiaries in the event of the policyholder’s death.

This type of insurance offers flexibility regarding premium payments and death benefits. Policyholders can adjust their premium payments, and death benefit amounts within certain limits to meet their changing needs. It also provides potential for growth as the cash value can increase based on the performance of the investment options chosen by the policyholder.

Question 2: What are the advantages of variable universal life insurance?

Variable universal life insurance offers several advantages. Firstly, it provides the opportunity for potential cash value growth through investments. This means that policyholders have the potential to accumulate more wealth over time. Secondly, it offers flexibility in premium payments and death benefit amounts. Policyholders can increase or decrease their premiums and death benefits based on their financial situation and needs.

Additionally, variable universal life insurance offers tax advantages. The cash value growth is tax-deferred, meaning that policyholders do not have to pay taxes on the investment gains until they withdraw the funds. This can be advantageous for long-term financial planning. Lastly, this type of insurance allows policyholders to access the cash value through policy loans or withdrawals, providing a source of liquidity in times of need.

Question 3: What are the risks of variable universal life insurance?

While variable universal life insurance offers potential for growth and flexibility, it also comes with certain risks. The policy’s cash value is directly tied to the performance of the policyholder’s selected investment options. If these investments underperform, the cash value may decrease, affecting the policy’s ability to cover future premiums or provide the desired death benefit.

Additionally, variable universal life insurance is subject to market fluctuations. If the market experiences a downturn, the cash value may be negatively impacted. Policyholders should carefully consider their risk tolerance and investment knowledge before choosing this type of insurance. It is essential to regularly review the investment options and adjust them as needed to mitigate risks and maximize potential returns.

Question 4: Can I change my variable universal life insurance investment options?

One of the critical features of variable universal life insurance is the ability to change investment options. Policyholders can typically choose from various investment options the insurance company offers, including stocks, bonds, and mutual funds. They can also reallocate their investments among these options based on their investment strategy and market conditions.

It is important to note that changing investment options may involve fees and potential tax consequences. Policyholders should consult with their financial advisor or insurance company to understand the specific rules and implications of changing investment options within their variable universal life insurance policy.

Question 5: How can I determine if variable universal life insurance is right for me?

Determining if variable universal life insurance is right for you depends on various factors, including your financial goals, risk tolerance, and investment knowledge. It is essential to carefully assess your needs and objectives before committing to this type of insurance.

If you seek potential cash value growth and flexibility in premium payments and death benefits, variable universal life insurance may be worth considering. However, it is crucial to understand the risks involved, including the potential for investment losses and the impact of market fluctuations on the cash value. Consulting with a financial advisor can help you evaluate your options and make an informed decision based on your circumstances.

Final Summary: Understanding Variable Universal Life Insurance

So there you have a comprehensive overview of what variable universal life insurance is all about. It’s a unique type of insurance policy that offers both protection and investment opportunities. The ability to customize your policy and invest in various investment options provides flexibility and potential growth for policyholders.

Variable universal life insurance allows you to allocate funds to different investment accounts, such as stocks, bonds, or mutual funds. This gives you the chance to earn higher returns based on the performance of these investments. However, it’s essential to remember that higher returns come at higher risk. The value of your policy can fluctuate depending on the performance of your investments, so it’s crucial to monitor and adjust your allocations regularly.

While variable universal life insurance offers growth potential, it’s not the right choice for everyone. It requires careful consideration of your financial goals, risk tolerance, and investment knowledge. It’s always a good idea to consult a financial advisor or insurance professional to determine if this policy aligns with your needs and objectives.

In conclusion, variable universal life insurance can be a powerful tool for those seeking insurance protection and investment opportunities. With its flexibility and potential for growth, it offers a unique approach to financial planning. However, it’s crucial to understand the risks involved and make informed decisions based on your circumstances. So, take the time to explore your options and seek professional guidance to make the best choice for your future.