Curious about how life insurance works? Well, you’ve come to the right place! Life insurance is like a safety net that provides financial protection to your loved ones in the event of your passing. It’s a topic that often gets pushed to the side, but understanding how life insurance works is crucial for ensuring the well-being of your family and peace of mind for yourself. So, let’s dive in and unravel the mysteries of life insurance together!

Life insurance is a contract between you and an insurance company, where you pay regular premiums in exchange for a lump sum payment, known as a death benefit, that is paid out to your beneficiaries upon your death. Think of it as a financial parachute that softens the fall for your loved ones when you’re no longer around. Your beneficiaries can use the death benefit to cover funeral costs, mortgage payments, college tuition, or everyday living expenses. It’s a way of providing financial stability and support during a difficult time.

Now that you have a general understanding of life insurance, let’s explore the different types of policies and how they work. Whether you’re a young professional just starting your career or a seasoned individual with a growing family, there’s a life insurance policy that suits your needs. So, buckle up and get ready to embark on a journey through the world of life insurance!

Understanding How Does Life Insurance Work

Life insurance is a crucial financial tool that provides protection and financial security to your loved ones during your death. It is a contract between you and an insurance company, where you pay regular premiums in exchange for a lump-sum payment, known as the death benefit, to your beneficiaries upon your passing.

How Does Life Insurance Work: The Basics

Life insurance works by pooling policyholders’ premiums to create a fund that benefits beneficiaries when the insured dies. When you purchase a life insurance policy, you choose the coverage amount and the length of the policy, also known as the term. The beneficiaries receive the death benefit if the insured person dies during the policy term. If the insured person outlives the term, the policy expires, and there is no payout.

Types of Life Insurance Policies

Several life insurance policies are available, each with its features and benefits. The two main categories are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance covers a specific period, typically 10, 20, or 30 years. It is the most affordable type of life insurance and offers pure protection without any cash value component. If the insured person passes away during the term, the beneficiaries receive the death benefit. However, there is no payout if the insured person outlives the term.

Term life insurance is an excellent choice for those who have temporary financial obligations, such as a mortgage or children’s education expenses. It provides a safety net during the policy term and can be renewed or converted to permanent life insurance.

Permanent Life Insurance

Permanent life insurance provides lifelong coverage and a cash value component that grows over time. There are three main types of permanent life insurance: whole life, universal life, and variable life.

Whole life insurance offers a guaranteed death benefit, fixed premiums, and a cash value component that grows at a predetermined rate. Universal life insurance provides flexibility in premium payments and death benefit amounts. Variable life insurance allows policyholders to invest the cash value portion in various investment options, potentially increasing the policy’s value.

How Premiums Are Determined

Life insurance premiums are determined based on several factors, including age, gender, health, lifestyle, and the coverage amount. Younger individuals typically pay lower premiums since they are less likely to pass away. Non-smokers and those with a healthy lifestyle may also enjoy lower premiums compared to smokers or individuals with pre-existing medical conditions.

It’s important to note that the premium amount remains fixed throughout the term of a term life insurance policy. However, with permanent life insurance, the premiums are typically higher but remain level throughout the insured person’s life.

Understanding the Benefits of Life Insurance

Financial Protection for Loved Ones

Life insurance’s primary benefit is its financial protection for your loved ones. In the event of your death, the death benefit can help cover funeral expenses, outstanding debts, mortgage payments, and other financial obligations. It ensures that your family can maintain their standard of living and avoid financial hardship during a difficult time.

Income Replacement

Life insurance can also serve as an income replacement for your family. If you are the primary breadwinner, your death could leave your family without a source of income. The death benefit from your life insurance policy can help replace your lost income, ensuring your loved ones can meet their daily expenses and maintain their quality of life.

Estate Planning

Life insurance can play a crucial role in estate planning. It can help cover estate taxes and ensure your assets are distributed according to your wishes. By naming specific beneficiaries in your life insurance policy, you can bypass the probate process, allowing your loved ones to receive the death benefit promptly.

Coverage for Business Owners

If you are a business owner, life insurance can be essential for protecting your business and ensuring its continuity. It can help cover business debts, provide funds for business succession planning, and compensate for losing a key employee or business partner.

Key Considerations When Buying Life Insurance

Determining the Coverage Amount

When buying life insurance, carefully considering the coverage amount you need is crucial. Consider your outstanding debts, future financial obligations, and your dependents’ needs. A general rule of thumb is to aim for coverage at least 10-15 times your annual income.

Choosing the Right Policy Type

Consider your financial goals and needs when choosing between term and permanent life insurance. If you have temporary financial obligations and want affordable coverage, term life insurance may be the better option. Permanent life insurance may be more suitable for lifelong coverage and potential cash value growth.

Reviewing Policy Riders and Options

Life insurance policies often offer additional riders and options to enhance your coverage. Everyday riders include an accelerated death benefit, which allows you to access a portion of the death benefit if diagnosed with a terminal illness, and a waiver of premium, which waives your premiums if you become disabled.

Comparing Quotes from Multiple Insurers

Before purchasing life insurance, comparing quotes from multiple insurers is essential to ensure you get the best coverage at the most competitive price. Consider working with an independent insurance agent who can provide unbiased advice and help you navigate the insurance market.

Conclusion

Life insurance is a crucial financial tool that provides your loved ones peace of mind and financial security. By understanding how life insurance works and carefully considering your needs, you can make informed decisions when purchasing a policy. Remember to review your coverage periodically and adjust as needed to ensure that your life insurance meets your changing circumstances.

Key Takeaways

- Life insurance is a contract between you and an insurance company.

- It provides financial protection to your loved ones in case of your death.

- You pay regular premiums to the insurance company.

- If you pass away during the policy term, the insurance company pays a death benefit to your beneficiaries.

- Life insurance can help cover funeral expenses, pay off debts, and provide income replacement.

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between an individual and an insurance company. The individual pays regular premiums to the insurance company, and in return, the company provides a death benefit to the individual’s beneficiaries upon their death. This financial protection can help to ensure that loved ones are taken care of financially in the event of the insured individual’s passing.

Life insurance can provide peace of mind by offering financial security to family members and covering expenses such as funeral costs, outstanding debts, and ongoing living expenses. It is an essential tool for estate planning and can provide a safety net for loved ones during difficult times.

What are the types of life insurance?

There are several types of life insurance policies available. The most common ones include term life insurance, whole life insurance, and universal life insurance.

Term life insurance covers a specific term or period, usually 10 to 30 years. It offers a death benefit to beneficiaries if the insured individual passes away during the policy term. On the other hand, whole life insurance provides coverage for the entire lifetime of the insured individual. It also includes a cash value component that grows over time. Universal life insurance combines term and whole life insurance features, offering flexibility in premium payments and death benefit amounts.

How does the premium for life insurance work?

The premium for life insurance is the amount of money the insured individual pays to the insurance company in exchange for coverage. The premium amount is determined based on age, health, lifestyle, and the type and coverage they choose.

Typically, younger and healthier individuals have lower premiums as they are considered lower risk. The premium can be paid monthly, quarterly, semi-annually, or annually, depending on the policy terms. Paying the premiums on time is essential to keep the policy active and ensure continuous coverage.

How does the payout for life insurance work?

The payout for life insurance, also known as the death benefit, is the amount paid to the beneficiaries upon the insured individual’s death. The insured typically chooses the beneficiaries, family members, friends, or other designated individuals.

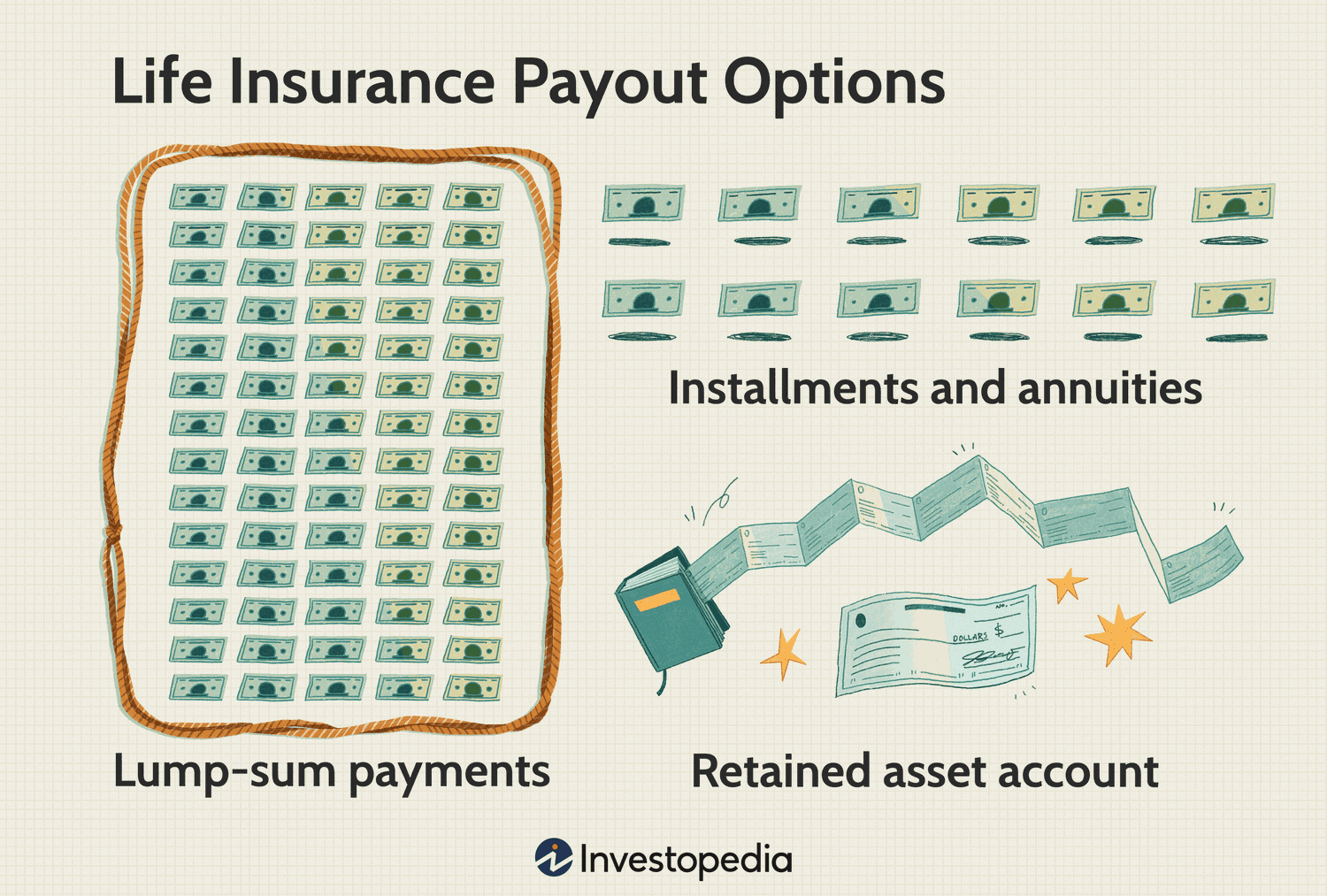

When the insured individual passes away, the beneficiaries must file a claim with the insurance company and provide the necessary documents, such as a death certificate. Once the claim is approved, the insurance company will release the death benefit to the beneficiaries. The payout can be received as a lump sum or in installments, depending on the policy terms and the beneficiaries’ preferences.

Can the life insurance policy be canceled or changed?

Yes, a life insurance policy can be canceled or changed depending on the policy terms and the individual’s needs. If the insured no longer requires coverage or wants to switch to a different policy, they can choose to cancel the existing policy or make changes to it.

Canceling a policy may result in the loss of any premiums paid, depending on the policy terms. Making changes to a policy, such as increasing or decreasing coverage, may require adjusting premiums. It’s essential to review the policy terms and consult with the insurance company or a financial advisor before making any changes to ensure the individual’s needs are met.

How Does Life Insurance Work?

Final Summary: How Does Life Insurance Work?

So there, you have a comprehensive understanding of how life insurance works. Life insurance is like a safety net for your loved ones, providing financial protection in the event of your passing. By paying regular premiums, you secure a death benefit that can cover expenses such as funeral costs and outstanding debts and even provide for your family’s future needs.

One key aspect of life insurance is the concept of beneficiaries. You choose These individuals to receive the death benefit upon your passing. It’s essential to carefully consider who you designate as your beneficiaries, as they will be the ones who benefit from the policy. Additionally, you can choose between term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers coverage for your entire life.

When purchasing life insurance, assessing your needs and financial situation is crucial. Consider factors such as your age, health, and the financial obligations you have. By working with a reputable insurance provider, you can explore different policy options and find the one that best suits your circumstances.

Remember, life insurance is a valuable tool that provides peace of mind, knowing your loved ones will be cared for financially. It’s never too early to start thinking about life insurance, so take the time to research and make an informed decision.