You’re not alone if you’ve ever wondered about the differences between term and whole life insurance. These two policies may sound similar but have distinct characteristics that can significantly impact your financial planning and security. So, what exactly is the difference between term and whole life insurance? Let’s explore the nuances of these insurance options.

Term life insurance is like renting a home – you pay for coverage for a specific period, usually 10, 20, or 30 years. It provides a death benefit to your beneficiaries if you pass away during the term. On the other hand, whole-life insurance is more like owning a home – you have coverage for your entire life as long as you continue to pay the premiums. Whole life insurance offers a death benefit and accumulates cash value over time. So, while term life insurance is straightforward and covers a set period, whole life insurance provides lifelong protection and the potential for cash accumulation. Now that we have a general understanding of the difference between term and whole life insurance let’s dig deeper into the specifics of each type.

On the other hand, whole life insurance covers the insured’s entire lifetime. It also has a cash value component that grows over time. Whole life insurance premiums are higher, but the policy offers lifelong protection and the potential to accumulate cash value.In summary, term life insurance provides temporary coverage, while whole life insurance offers lifelong protection with a cash value component. The choice between the two depends on your specific needs and financial goals.

**What Is the Difference Between Term and Whole Life Insurance?**

Term and whole life insurance are widespread insurance policies with features and benefits. Understanding the differences between these two options can help you make an informed decision when choosing a life insurance policy. This article will explore the critical characteristics of term and whole life insurance and highlight the factors to consider when selecting the right policy for your needs.

**Term Life Insurance: Coverage for a Specific Period**

Term life insurance covers a specified period, typically 10 to 30 years. If you pass away during the policy’s term, your beneficiaries will receive a death benefit. Individuals who want coverage for a specific period, such as until their mortgage is paid off or their children are financially independent often select term life insurance.

One of the main advantages of term life insurance is its affordability. Premiums for term policies are generally lower than those for whole life insurance, making it an attractive option for individuals on a budget. Additionally, term life insurance offers flexibility, as you can choose the length of the term based on your specific needs. However, once the term expires, you will no longer have coverage unless you renew the policy or convert it to a permanent life insurance policy.

**Whole Life Insurance: Lifelong Coverage with Cash Value**

Whole life insurance covers your entire life as long as you continue to pay the premiums. Unlike term life insurance, whole life insurance offers a cash value component that grows over time. You can access this cash value during your lifetime and use it for various purposes, such as supplementing retirement income or paying off debts.

One of the critical advantages of whole life insurance is its permanence. With a whole-life policy, you have lifelong coverage, and the death benefit will be paid to your beneficiaries regardless of when you pass away. Additionally, whole life insurance offers a guaranteed cash value, meaning that the cash value component will continue to grow over time, providing a potential source of financial security.

However, whole life insurance typically has higher premiums than term life insurance. The cash value component and the lifelong coverage contribute to the higher costs. Therefore, carefully considering your financial situation and long-term goals is essential before opting for whole-life insurance.

**Term vs. Whole Life Insurance: A Comparison**

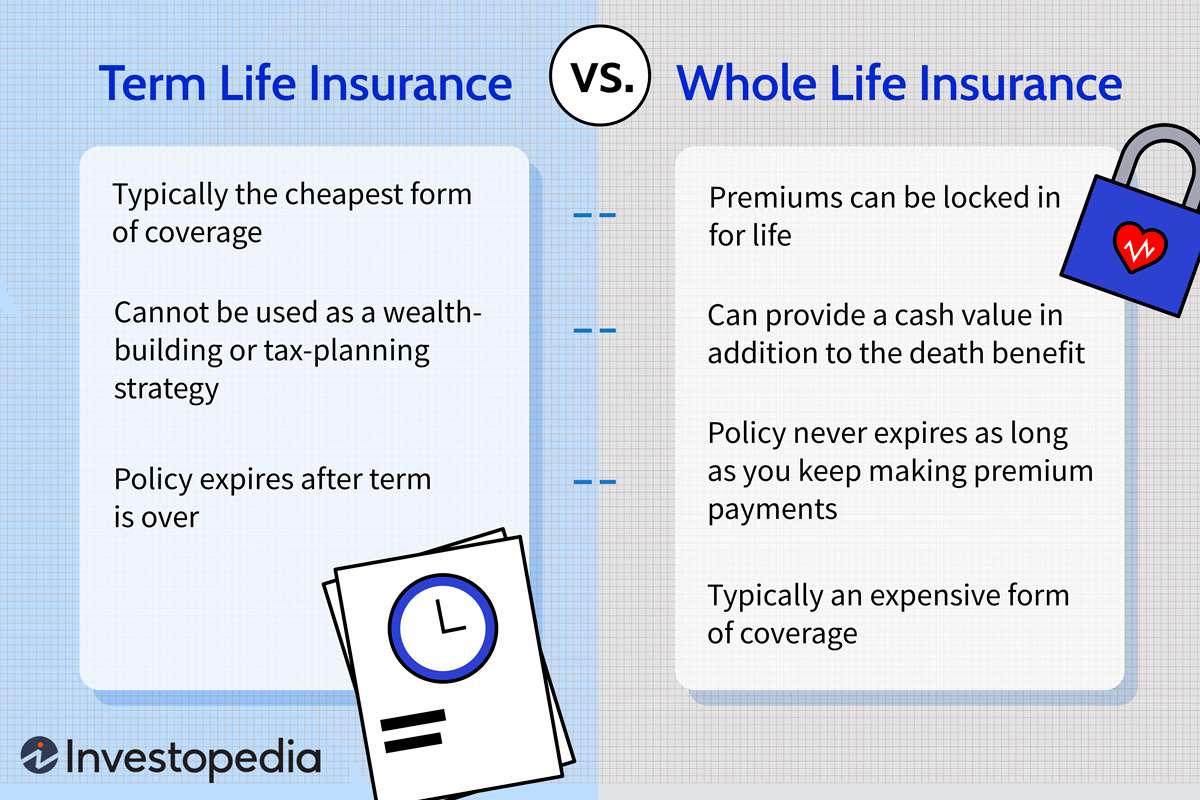

Now that we have explored the critical characteristics of term and whole life insurance, let’s compare the two options in more detail. Here are some essential points to consider when deciding between term and whole life insurance:

1. **Affordability:** Term life insurance generally has lower premiums than whole life insurance, making it more affordable for many individuals.

2. **Coverage Duration:** Term life insurance provides coverage for a specified period, while whole life insurance offers lifelong coverage.

3. **Cash Value:** Whole life insurance includes a cash value component that grows over time and can be accessed during your lifetime. Term life insurance does not accumulate cash value.

4. **Flexibility:** Term life insurance offers flexibility in policy length, allowing you to choose a term that aligns with your needs. Whole life insurance is more rigid.

5. **Investment Potential:** Whole life insurance provides an investment component through cash value growth, while term life insurance does not offer investment opportunities.

In summary, term life insurance is a cost-effective option for individuals seeking coverage for a specific period, while whole life insurance offers lifelong coverage and a cash value component. When choosing between these two types of life insurance, consider your financial goals, budget, and long-term needs.

**Factors to Consider When Choosing a Life Insurance Policy**

When selecting a life insurance policy, there are several factors to consider beyond the differences between term and whole life insurance. Here are some additional considerations:

1. **Financial Goals:** Determine your short-term and long-term financial goals and choose a policy that aligns with those goals.

2. **Budget:** Evaluate your budget to ensure you can comfortably afford your chosen policy premiums.

3. **Coverage Amount:** Determine the coverage you need to adequately protect your loved ones in the event of your passing.

4. **Health and Age:** Your health and age can impact the cost of life insurance premiums and the availability of specific policies.

5. **Additional Riders:** Explore the availability of optional riders, such as a critical illness rider or a disability income rider, to enhance your policy’s coverage.

By carefully considering these factors and understanding the differences between term and whole life insurance, you can make an informed decision that suits your unique circumstances and financial goals.

**In Conclusion**

Choosing the right life insurance policy is an important decision that requires careful consideration. Term and whole life insurance are popular options, each with advantages and considerations. Term life insurance offers coverage for a specified period at an affordable cost, while whole life insurance provides lifelong coverage with a cash value component. By understanding the differences between these two types of policies and considering your financial goals and needs, you can select the life insurance policy that best suits your situation.

Key Takeaways: What is the Difference Between Term and Whole Life Insurance?

- Term life insurance covers a specified period, while whole life insurance provides lifelong coverage.

- Term life insurance is generally more affordable than whole life insurance.

- Whole life insurance offers a cash value component that grows over time, while term life insurance does not.

- Term life insurance is often chosen to cover temporary financial obligations, while whole life insurance is considered a long-term investment.

- The choice between term and whole life insurance depends on individual needs and financial goals.

Frequently Asked Questions

Question 1: Which type of insurance is better for me: term or whole life insurance?

There isn’t a one-size-fits-all answer to choosing between term and whole life insurance. It depends on your individual needs and circumstances. Term life insurance is typically more affordable and provides coverage for a specific period, usually 10, 20, or 30 years. It’s a good option if you have temporary financial responsibilities, such as a mortgage or children’s college tuition, and want to protect your loved ones during that time.

On the other hand, whole life insurance is a lifelong policy providing a death benefit and cash value component. It’s more expensive than term insurance but offers lifelong coverage and the opportunity to build cash value over time. Whole life insurance is suitable for those who have long-term financial goals, such as estate planning or leaving a legacy, and can afford the higher premiums.

Question 2: What are the main differences between term and whole life insurance?

The key differences between term and whole life insurance are their duration, cost, and cash value components. Term life insurance offers coverage for a specific term, while whole life insurance covers your entire life. Term insurance premiums are generally lower but increase with age at each renewal, making it more expensive in the long run.

On the other hand, whole life insurance has higher premiums but remains at a level throughout the policy’s duration. It also accumulates a cash value that grows over time and can be accessed through policy loans or withdrawals, while term life insurance does not build cash value. Additionally, whole life insurance offers flexibility regarding policy customization and potential dividends.

Question 3: Can I convert a term life insurance policy into a whole life insurance policy?

Yes, many term life insurance policies offer the option to convert to a whole life insurance policy. The conversion typically needs to be done within a specific timeframe, such as during the initial term or before a certain age. Converting to a whole-life policy allows you to extend your coverage beyond the initial term and take advantage of the cash value component and lifelong benefits of whole-life insurance.

It’s important to note that conversion may come with additional costs, such as higher premiums, due to the increased coverage and added features of whole life insurance. It’s advisable to consult with your insurance provider to understand the terms and conditions of conversion and evaluate whether it aligns with your long-term financial goals.

Question 4: Is term life insurance a good option for estate planning?

Term life insurance can be helpful in estate planning, especially if you have temporary financial obligations or want to provide a financial safety net for your loved ones. It can help cover estate taxes, outstanding debts, and other immediate financial needs that may arise upon your passing. However, it’s essential to consider that term life insurance expires after a specific term, so it may not be the most suitable option for long-term estate planning.

If your estate planning goals involve leaving a legacy or providing ongoing financial support for your heirs, whole life insurance may be more appropriate. It offers lifelong coverage and the potential to accumulate cash value, which can supplement your estate and provide financial stability for future generations.

Question 5: How do I determine the term or whole life insurance coverage?

Determining the appropriate coverage amount for term or whole life insurance depends on various factors, including financial obligations, income, and long-term goals. For term life insurance, consider the duration of your financial responsibilities, such as mortgage payments, children’s education, and outstanding debts. It is generally recommended that you have coverage at least 5-10 times your annual income.

When it comes to whole life insurance, you may need to consider immediate financial needs and long-term goals. Evaluate your desired level of coverage for estate planning, legacy creation, and any potential cash value accumulation. Consulting with a financial advisor or insurance professional can help you determine the appropriate coverage amount based on your circumstances.

Final Thoughts on the Difference Between Term and Whole Life Insurance

After exploring the ins and outs of term and whole life insurance, it’s clear that these two types of policies offer distinct benefits and considerations. Term life insurance covers a specific period, typically 10 to 30 years, making it a popular choice for those seeking temporary protection. On the other hand, whole life insurance offers lifelong coverage and includes a cash value component that grows over time.

In Conclusion, the choice between term and whole life insurance ultimately depends on your unique circumstances and financial goals. If you’re looking for affordable coverage for a specific time frame, term life insurance may be the right fit. On the other hand, if you value lifelong protection and the potential to build cash value, whole life insurance could be the better option. When making this critical decision, it’s essential to carefully consider your needs, budget, and long-term objectives.

Remember, when it comes to insurance, there’s no one-size-fits-all solution. It’s crucial to assess your situation, consult a trusted financial advisor, and choose the policy that aligns with your needs. So, whether you opt for term or whole life insurance, you can have peace of mind knowing that you’re taking a proactive step towards protecting your loved ones and securing their financial future.