If you’re wondering whether small business health insurance is cheaper than individual coverage, you’ve come to the right place. Many entrepreneurs and employees ask this question when considering their healthcare options. Let’s explore the factors that can influence the cost of these insurance plans.

When it comes to the cost of health insurance, several variables are at play. Small business health insurance plans, often group plans, are typically purchased by employers for their employees. These plans offer a range of coverage options and can be more cost-effective due to the more significant risk pool and potential for group discounts. On the other hand, individual health insurance plans are purchased by individuals or families directly from insurance providers. These plans offer more flexibility and customization but may come at a higher price.

While it’s challenging to definitively answer whether small business health insurance is always cheaper than individual coverage, the answer ultimately depends on various factors such as the size of the business, the number of employees covered, and the specific benefits included in the plans. It’s important to carefully evaluate the costs and benefits of each option to determine the best fit for your unique situation. So, let’s dive deeper into the details and help you decide on your health insurance needs.

Several factors must be considered when comparing the cost of small business health insurance and individual health insurance. Generally, small business health insurance plans can be more affordable than individual plans due to the group purchasing power and potential tax advantages for businesses. However, the actual cost may vary depending on the business size, the coverage options chosen, and the location. Small business owners should explore different insurance providers and plans to find the most cost-effective option for their employees.

Is Small Business Health Insurance Cheaper Than Individual?

Small business owners often face the challenge of providing affordable health insurance options for their employees. One question frequently arises is whether small business health insurance is cheaper than individual plans. This article will explore the cost comparisons between small business health insurance and personal plans and the factors influencing these costs.

Understanding Small Business Health Insurance

Small business health insurance is coverage provided by employers to their employees. It typically includes a group plan with medical, dental, and vision benefits. Small business health insurance costs can vary depending on several factors, such as the number of employees, the level of coverage, and the business’s location.

One of the main advantages of small business health insurance is that it allows employers to negotiate lower premiums with insurance providers. By pooling the risk of multiple employees, insurers can offer lower rates compared to individual plans. Additionally, small business owners may be eligible for tax credits or deductions for providing health insurance to their employees, further reducing the overall cost.

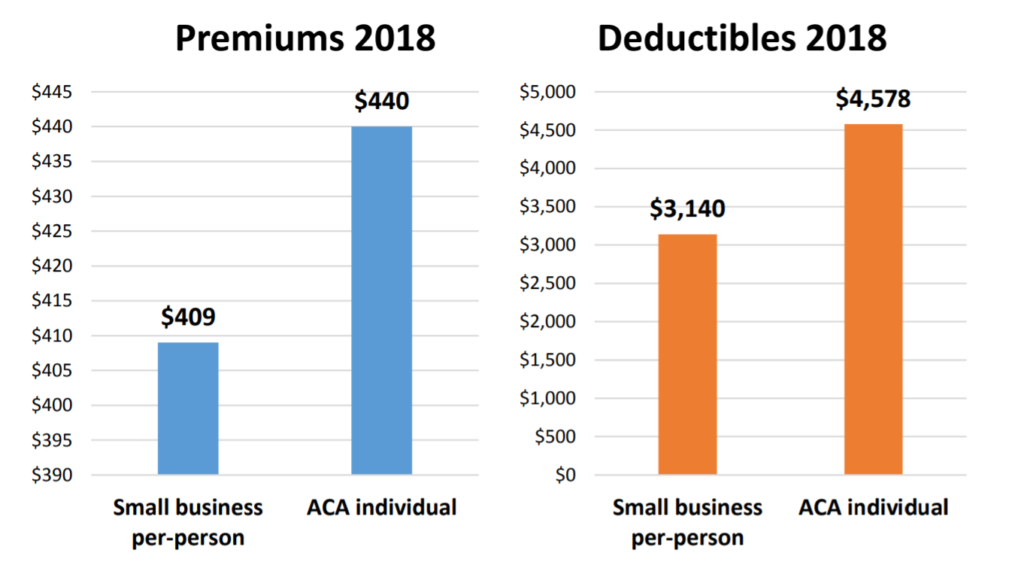

The Cost Comparison: Small Business Health Insurance vs. Individual Plans

Several factors come into play when comparing small business health insurance costs to individual plans. Here are some key considerations:

- Number of employees: The more employees a small business has, the more negotiating power it may have with insurance providers. Larger groups can often secure better rates than smaller groups.

- Level of coverage: Small business health insurance plans can vary in coverage. Plans with more comprehensive benefits may have higher premiums.

- Location: The cost of healthcare can vary depending on the region. Small businesses operating in areas with higher healthcare costs may face higher insurance premiums.

- Employee contributions: Small businesses may sometimes require employees to contribute towards their health insurance premiums. This can help offset the overall cost for the employer.

It’s important to note that individual plans are typically purchased by individuals and families rather than employers. The cost of individual plans can vary greatly depending on factors such as age, location, and desired coverage. While individual plans may offer more customization flexibility, they may also have higher premiums than group plans.

The Benefits of Small Business Health Insurance

While cost is an important consideration, there are several benefits to choosing small business health insurance over individual plans. Here are some advantages:

- Group buying power: Small business health insurance plans can often negotiate better rates with insurance providers by pooling the risk of multiple employees.

- Tax advantages: Small business owners may be eligible for tax credits or deductions for providing health insurance to their employees, reducing the overall cost.

- Employee retention and satisfaction: Offering health insurance as part of a benefits package can help attract and retain talented employees, boosting morale and job satisfaction.

- Streamlined administration: Small business health insurance plans often come with administrative support, making it easier for employers to manage and administer benefits.

Tips for Choosing the Right Small Business Health Insurance

When selecting a small business health insurance plan, it’s essential to consider the specific needs of your employees and your budget. Here are some tips to help you make the right choice:

- Assess your budget: Determine how much you can afford to spend on health insurance premiums while providing comprehensive coverage for your employees.

- Evaluate your employees’ needs: Consider your workforce’s demographics and healthcare needs. This will help you choose a plan that offers the right level of coverage.

- Research insurance providers: Compare quotes from multiple insurance providers to ensure you get the best rates and coverage for your small business.

- Consider additional benefits: Look for plans that offer additional benefits such as dental, vision, or wellness programs to enhance the overall value of the insurance package.

You can find a health insurance plan that provides affordable employee coverage by carefully evaluating your options and considering your small business’s unique needs.

Conclusion

In conclusion, small business health insurance can often be more affordable than individual plans due to the group buying power and potential tax advantages. However, the cost of small business health insurance can vary depending on factors such as the number of employees, level of coverage, and location. It’s essential for small business owners to carefully assess their budget and the needs of their employees when selecting a health insurance plan. By doing so, they can provide valuable and affordable coverage to their employees while benefiting from group insurance plans’ advantages.

Key Takeaways: Is Small Business Health Insurance Cheaper Than Individual?

- Small business health insurance can be more affordable than individual health insurance in some cases.

- Group rates for small business health insurance are often lower than individual rates.

- Small business health insurance plans may offer more comprehensive coverage options.

- Employers may contribute towards the cost of small business health insurance, reducing the financial burden on individuals.

- However, small business health insurance costs can vary depending on the number of employees and the specific coverage options.

Frequently Asked Questions

Is small business health insurance cheaper than individual?

Several factors must be considered when comparing the cost of small business health insurance versus individual health insurance. While making a blanket statement about which option is cheaper is difficult, certain aspects can influence the overall cost. Let’s explore some of the common questions related to this topic.

1. How does the number of employees affect the cost of small business health insurance?

The number of employees in your small business can impact the cost of health insurance. Generally, the more employees you have, the lower the cost per employee may be. This is because insurance companies often offer group rates for larger employee pools. However, it’s important to note that the specific rates will vary based on factors such as the age and health of your employees and the coverage options you choose.

2. Are there any tax benefits for small businesses offering health insurance?

Yes, small businesses that provide health insurance to their employees can qualify for tax benefits. For example, the Small Business Health Care Tax Credit can help offset some of the costs associated with offering health coverage. Your business must meet specific criteria, such as having fewer than 25 full-time equivalent employees with average wages below a particular threshold. Consult with a tax professional or visit the IRS website for more information on the eligibility requirements and potential tax savings.

Can small business health insurance offer more coverage options?

Small business health insurance plans often provide a more comprehensive range of coverage options than individual health insurance plans. This is because group insurance plans are designed to cater to the needs of multiple employees who may have different healthcare requirements. Insurance companies can offer more comprehensive coverage options at potentially lower rates by pooling the risk. Additionally, small business health insurance plans may include benefits such as dental, vision, or prescription drug coverage, which may not be included in individual plans.

It’s important to carefully review different insurance providers’ coverage options and select a plan that meets your employees’ healthcare needs.

Final Thought: Is Small Business Health Insurance Cheaper Than Individual?

After comparing small business health insurance to individual health insurance, it’s clear that there is no definitive answer to whether one is cheaper. The cost of small business health insurance will depend on various factors, such as the business size, the number of employees, the coverage options chosen, and the location. Similarly, individual health insurance costs will vary based on factors like age, health condition, and the level of coverage desired.

While small business health insurance may offer potential cost savings through group rates and employer contributions, it may not always be the most affordable option for every business. Individual health insurance provides flexibility and customization but can be more expensive depending on the individual’s circumstances. Both individuals and small business owners should carefully consider their specific needs and budget when deciding.

In conclusion, there is no one-size-fits-all answer to whether small business health insurance is cheaper than individual health insurance. The affordability of each option depends on multiple factors and varies from case to case. It is advisable to consult with insurance professionals, compare different plans, and evaluate the specific needs and budget constraints before making a final decision. By doing so, individuals and small business owners can find the most suitable and cost-effective health insurance solution for themselves and their employees.