If you’ve ever wondered, “What is a deductible in health insurance?” you’re not alone. Understanding this concept is essential for navigating the world of healthcare coverage. So, let’s break it down in a way that’s easy to grasp.

Simply put, a deductible is the money you must pay out of pocket before your health insurance kicks in. It’s like reaching a threshold or crossing a financial milestone before your coverage starts to lend a helping hand. Imagine it as a hurdle you must jump over before fully benefiting from your insurance plan. But don’t worry; once you’ve met your deductible, your insurance company will typically start covering a portion or all of your eligible medical expenses. Now that we have a basic understanding of a deductible let’s dive deeper into how it works and why it’s essential.

Understanding Deductibles in Health Insurance

Health insurance can be complex, and one term that often confuses people is “deductible.” In this article, we will break down what a deductible is in health insurance and how it works. We’ll also explore different types of deductibles and provide tips for understanding and managing them effectively.

What is a Deductible in Health Insurance?

A deductible is the amount of money you, as the policyholder, must pay out of pocket before your health insurance coverage kicks in. You are responsible for the initial cost before your insurance company contributes to your medical expenses. Deductibles can vary widely depending on your insurance plan, but they are typically an annual amount that resets each calendar year.

When you receive medical care, whether it’s a doctor’s visit, diagnostic test, or hospital stay, you will be required to pay for the services up to the amount of your deductible. Once you reach your deductible amount, your insurance coverage will begin, and your insurer will start sharing the cost of covered services according to the terms of your policy.

Types of Deductibles

Health insurance has different types of deductibles, and it’s essential to understand each one to make informed decisions about your coverage. Here are some common types of deductibles:

1. Individual Deductible: This is the amount that an individual policyholder must pay before their insurance coverage begins. It applies to each person covered under the policy.

2. Family Deductible: If you have a family health insurance plan, it may have a family deductible. The entire family must meet the total deductible before insurance coverage starts.

3. Embedded Deductible: In some family plans, each individual may have an embedded deductible. This means that if one family member reaches their deductible, their insurance coverage for their medical expenses will begin, even if the family deductible hasn’t been met yet.

4. High Deductible Health Plan (HDHP): HDHPs are insurance plans with higher deductibles and lower monthly premiums. These plans are often paired with Health Savings Accounts (HSAs), which allow individuals to save and invest money for medical expenses on a tax-advantaged basis.

Understanding How Deductibles Work

To illustrate how deductibles work, let’s consider an example. Suppose you have a health insurance plan with a $1,000 deductible. If you visit the doctor and the total cost is $200, you will be responsible for paying the full $200 out of pocket since it is less than your deductible.

Now, imagine you require surgery that costs $5,000. In this case, you must pay the $1,000 deductible, and your insurance coverage will begin for the remaining $4,000. Your insurance policy determines the percentage of coverage after meeting the deductible and may vary depending on the type of services received.

It’s important to note that not all services count towards the deductible. Some insurance plans may cover preventive care, such as vaccinations or an annual wellness check-up, without requiring you to meet the deductible first. However, any services beyond preventive care will typically need you to pay toward your deductible.

Why Do Deductibles Exist?

Deductibles serve several purposes in health insurance. Firstly, they help control healthcare costs by ensuring individuals have some financial responsibility for their care. Requiring policyholders to contribute towards their medical expenses encourages them to be more cost-conscious and avoid unnecessary or excessive healthcare utilization.

Secondly, deductibles play a role in risk-sharing between the insurance company and the policyholder. Insurance companies can offer more affordable premiums by requiring individuals to pay a certain amount before coverage begins. This helps balance the risk and cost of providing coverage to many individuals.

Benefits of Deductibles

While deductibles may seem like an added financial burden, they also offer several benefits to policyholders. Here are a few advantages of having a deductible in your health insurance plan:

1. Lower Premiums: Plans with higher deductibles often have lower monthly premiums. This can make health insurance more affordable, especially for individuals who are generally healthy and require fewer medical services.

2. Encourages Cost-Consciousness: Individuals with some financial responsibility for healthcare expenses are more likely to be mindful of costs. This can lead to more informed decisions about medical treatments and services.

3. Protection from Catastrophic Expenses: Deductibles help protect policyholders from high healthcare costs in the event of a significant illness or injury. Once the deductible is met, insurance coverage begins, providing financial protection for more extensive medical expenses.

4. Health Savings Account (HSA) Contributions: If you have a high deductible health plan paired with a Health Savings Account (HSA), you can contribute pre-tax dollars to your HSA. These funds can be used to pay for qualified medical expenses, providing additional tax advantages.

In conclusion, understanding deductibles in health insurance is essential for making informed decisions about your coverage. Deductibles are the initial out-of-pocket costs that policyholders must pay before insurance coverage begins. They come in different types and serve various purposes in controlling healthcare costs and sharing risks between policyholders and insurance companies. While deductibles may require individuals to bear some financial responsibility, they also offer benefits such as lower premiums, cost-consciousness, and protection from catastrophic expenses. By understanding how deductibles work and considering your healthcare needs, you can make the most of your health insurance coverage.

Key Takeaways: What is a Deductible in Health Insurance?

- A deductible is the amount you must pay out of pocket before your health insurance coverage kicks in.

- It is like a threshold you must meet before your insurance starts covering your medical expenses.

- Higher deductibles usually mean lower monthly premiums, but you’ll have to pay more upfront if you need medical care.

- Lower deductibles mean higher monthly premiums, but you’ll have to pay less out of pocket when you receive medical services.

- Understanding your deductible is essential as it helps you plan for healthcare expenses and choose the right insurance plan for your needs.

Frequently Asked Questions

What is a health insurance deductible?

A health insurance deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It is a fixed dollar amount that you are responsible for paying for covered medical services or prescriptions. Deductibles can vary depending on your insurance plan and range from a few hundred to several thousand dollars.

For example, you have a health insurance plan with a $1,000 deductible. If you need medical care covered by your insurance, you must pay the first $1,000 before your insurance starts paying for any portion of the care. Once you have met your deductible, your insurance will cover some or all of the costs, depending on your plan’s coverage.

How does a deductible affect my health insurance costs?

The amount of your health insurance deductible can significantly impact your overall healthcare costs. Generally, plans with lower deductibles tend to have higher monthly premiums, while plans with higher deductibles have lower monthly premiums.

If you have a higher deductible, you may have to pay more out of pocket before your insurance coverage begins. However, your monthly premium may be lower, saving you money in the long run if you don’t require frequent medical care. On the other hand, a lower deductible means you will have higher monthly premiums, but you will reach your deductible faster, and your insurance coverage will start sooner.

What expenses count towards my deductible?

Most health insurance plans consider a variety of medical expenses to count towards your deductible. This can include doctor’s visits, hospital stays, surgeries, lab tests, prescription medications, and other covered services. However, checking your specific insurance plan is essential as some expenses may be excluded or have separate deductibles.

Remember that certain services, such as preventive care services like vaccinations or screenings, may not count towards your deductible. Your insurance may cover These services fully without requiring you to meet your deductible first.

Is there a limit on how much I must pay towards my deductible?

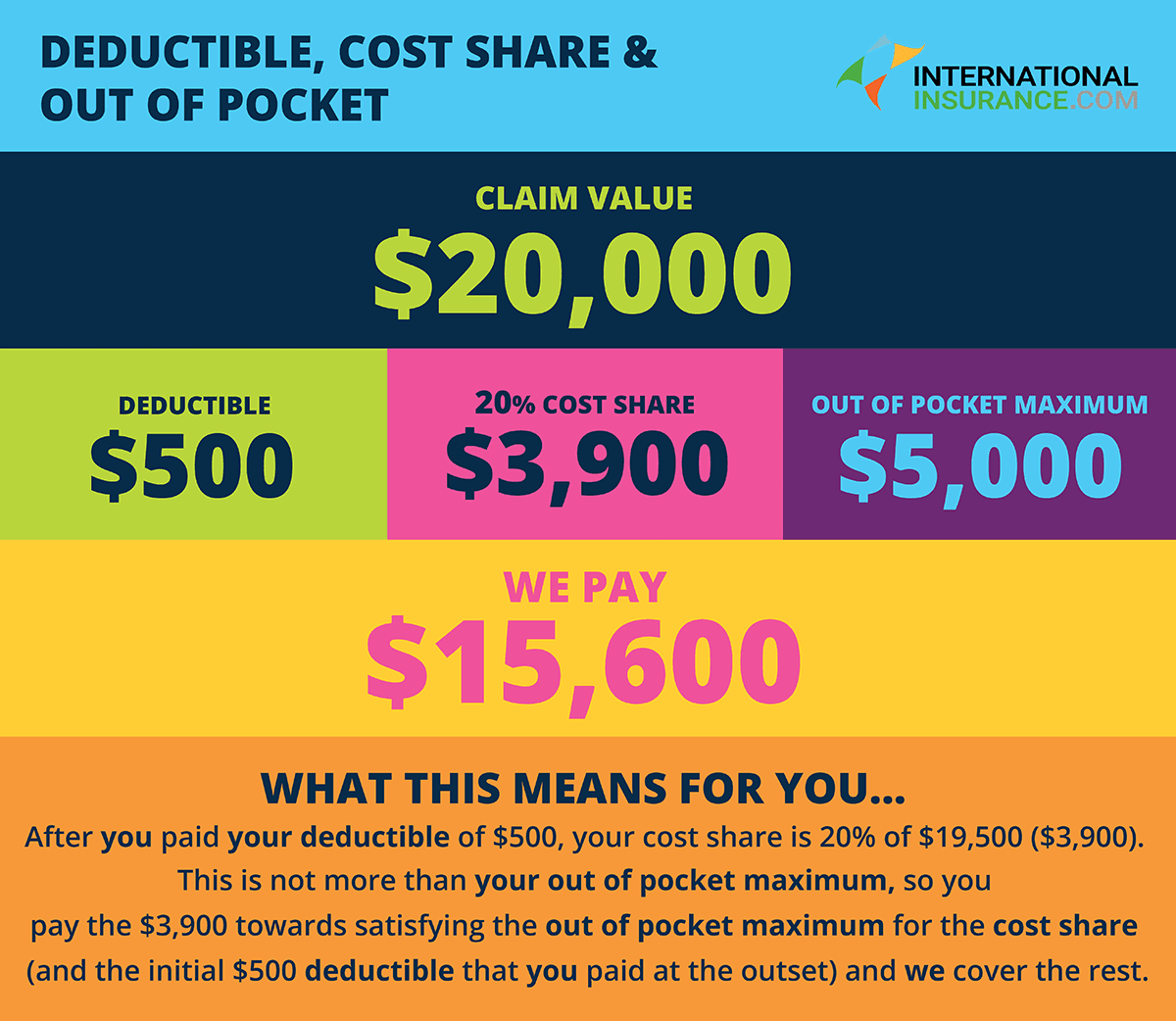

Yes, there is typically an out-of-pocket maximum that limits the amount you have to pay towards your deductible. Once you reach this maximum, your insurance will generally cover 100% of your hidden expenses for the rest of the policy year.

For example, suppose your out-of-pocket maximum is $5,000, and your deductible is $3,000 once you have paid $5,000 in deductible and coinsurance costs. In that case, your insurance will cover the remaining costs for covered services. It’s important to note that premiums and expenses not covered by your insurance plan do not count towards your deductible or out-of-pocket maximum.

Can I choose my deductible amount?

You can usually choose your deductible amount when selecting a health insurance plan. The amount of choice you have may depend on the specific plans available to you. Typically, plans with lower deductibles have higher premiums, while plans with higher deductibles have lower premiums.

When choosing your deductible, consider your healthcare needs, budget, and risk tolerance. A lower deductible may be more suitable if you anticipate needing frequent medical care or have ongoing health conditions. However, a higher deductible may be more cost-effective if you are generally healthy and rarely require medical attention.

Final Summary: Understanding Health Insurance Deductibles

So, now you know what a deductible in health insurance is and how it works. It’s like a threshold you must meet before your insurance kicks in and starts covering your medical expenses. Think of it as the entrance fee to accessing your insurance benefits.

The purpose of a deductible is to encourage individuals to be more mindful of their healthcare costs and to share financial responsibility with their insurance provider. It’s a way to help keep insurance premiums more affordable for everyone. By having a deductible, you have a stake in the game and are more likely to make informed decisions about your medical care.

But remember, not all health insurance plans have deductibles, and even if they do, the amount can vary widely. It’s essential to carefully review your health insurance policy and understand the details of your deductible, including how much it is and what types of services it applies to. This knowledge will empower you to make the best choices for your healthcare needs and budget.

In conclusion, while health insurance deductibles may seem like an added cost at first, they play a crucial role in the overall structure of your health insurance plan. Understanding how deductibles work and impact your coverage allows you to navigate the healthcare system more effectively and maximize your insurance benefits. So, next time you choose a health insurance plan or discuss options with your provider, don’t forget to consider the deductible and its implications for your healthcare journey. Stay informed, stay healthy!