So, are you interested in getting a health insurance license? Well, you’ve come to the right place! In this article, we will dive into the world of health insurance licensing and explore the steps you need to take to obtain that coveted license. Whether you want to start a career in the insurance industry or expand your existing expertise, getting a health insurance license is a crucial first step.

Now, you might be wondering why you need a health insurance license in the first place. Well, let me tell you, my friend, having a license allows you to sell health insurance policies legally and opens up a world of opportunities for you. It’s like having a key to a treasure chest filled with potential clients and commission checks. But don’t worry; we’ll guide you through the entire process, from understanding the requirements to passing the licensing exam with flying colors. So, please grab a cup of coffee, sit back, and embark on this exciting journey together!

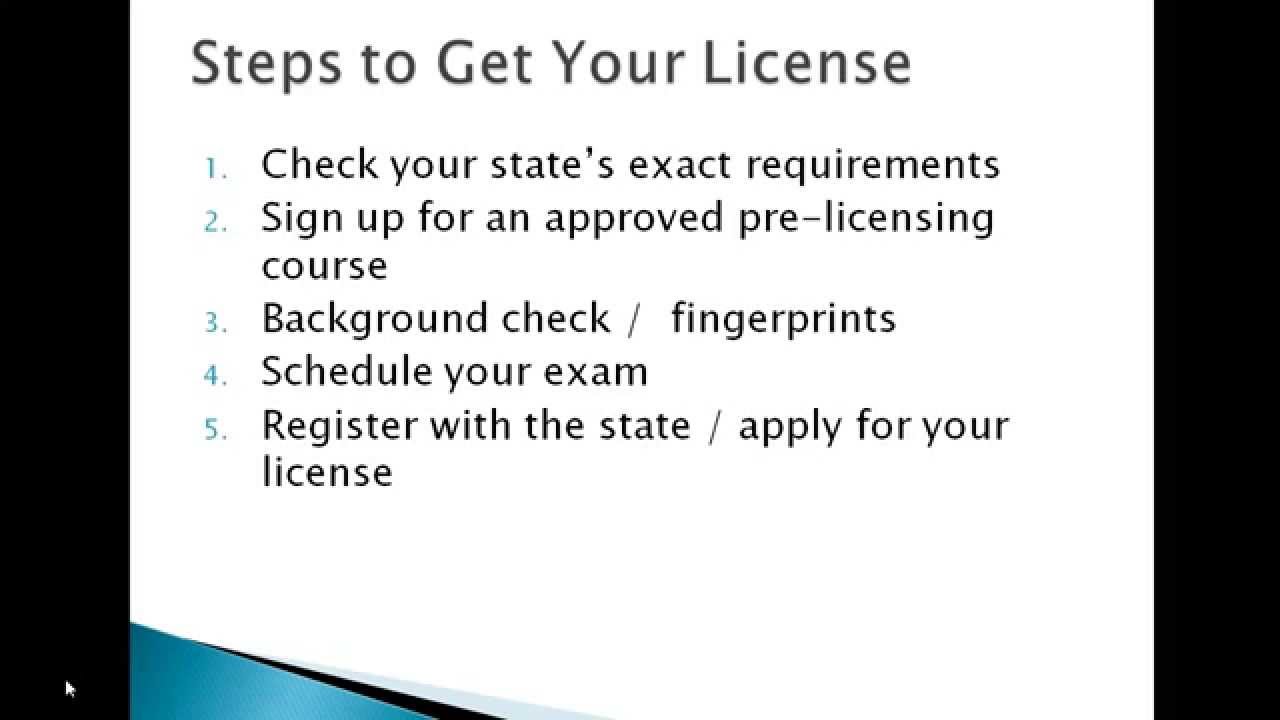

- Research the requirements: Each state has different health insurance license requirements. Visit your state’s insurance department website to learn about the specific requirements.

- Complete pre-licensing education: Most states require you to complete a certain number of hours of pre-licensing education. Find an approved course provider and complete the required hours.

- Pass the licensing exam: Schedule and take the health insurance licensing exam. Study the exam content outline provided by your state to ensure you are well-prepared.

- Apply: Once you have passed the exam, apply to your state’s insurance department and any required fees and documentation.

- Maintain your license: After obtaining your health insurance license, fulfill continuing education requirements and keep your license active.

How to Get a Health Insurance License: A Step-by-Step Guide

Are you interested in a career in the insurance industry? If so, obtaining a health insurance license is crucial to success. With a health insurance license, you can sell policies and help individuals and families find the necessary coverage. This comprehensive guide will walk you through obtaining a health insurance license, from meeting the requirements to passing the required exams.

Understanding the Requirements

Before obtaining a health insurance license, you must familiarize yourself with the requirements set by your state’s insurance department. Each state has specific requirements, but some commonalities can give you a general idea of what to expect.

To start, you must generally meet certain age and residency requirements. Most states require you to be 18 years old and a state resident where you plan to sell insurance. Additionally, you will need to undergo a background check and provide proof of your good character.

Educational Requirements

In addition to the basic requirements, you must complete the necessary education to qualify for a health insurance license. This typically involves pre-licensing courses covering insurance fundamentals, ethics, and state-specific regulations.

These courses can usually be completed online or in a classroom setting, and the length of the courses can vary depending on your state’s requirements. Once you have completed the required coursework, you will receive a certificate of completion that you must submit along with your license application.

The Licensing Exam

After completing the required education, you must pass a licensing exam to obtain your health insurance license. A third-party testing provider typically administers the exam and covers insurance laws, policy provisions, and ethical practices.

It is essential to thoroughly prepare for the exam to increase your chances of success. Study materials, practice exams, and online resources can all be helpful tools in your preparation. Once you feel confident in your knowledge, you can schedule your exam and take the next step toward becoming a licensed health insurance agent.

Applying for Your License

Once you have successfully passed the licensing exam, it is time to apply for your health insurance license. The exact process can vary depending on your state, but there are some common steps that you will likely need to follow.

Start by completing the license application form your state’s insurance department provided. This form will require you to provide personal information, such as your name, address, and social security number, as well as information about your education and any previous licenses you may hold.

You must also submit any required supporting documents, such as your certificate of completion from the pre-licensing courses and proof of passing the licensing exam. Be sure to carefully review the application requirements to ensure that you have included all necessary documentation.

Fees and Renewal

Along with your application, you will need to pay the required fees. The fees can vary depending on your state and the type of license you are applying for. It is essential to submit the correct fee amount and payment method to avoid delays in processing your application.

You will receive your health insurance license once your application has been reviewed and approved. Remember that permits are typically valid for a set period, often two years, and must be renewed before expiration. Renewal requirements may include completing continuing education courses to stay current with industry regulations and best practices.

Benefits of a Health Insurance License

Obtaining a health insurance license can open up opportunities in the insurance industry. With your license, you can work as an independent agent, representing multiple insurance carriers and helping clients find the best health insurance policies for their needs.

Being a licensed health insurance agent also allows you to build relationships with clients and provide them with valuable guidance and support. You can help individuals and families navigate the often complex world of health insurance, ensuring they have the coverage they need to protect their health and financial well-being.

Job Security and Earning Potential

The insurance industry offers stability and job security, as people will always need insurance coverage. With a health insurance license, you can enjoy a rewarding career with the potential for significant earning potential. As you gain experience and build a client base, your income can grow, and you may have the opportunity to earn commissions based on the policies you sell.

In addition, having a health insurance license can also open doors to other insurance-related careers. You may have the opportunity to work in underwriting, claims adjusting, or risk management, further expanding your professional options within the industry.

Tips for Success

Obtaining a health insurance license requires dedication and hard work. Here are some tips to help you succeed in the process:

1. Research your state’s requirements: Make sure you are familiar with the specific requirements set by your state’s insurance department.

2. Use study materials: Utilize study materials, practice exams, and online resources to prepare for the licensing exam.

3. Stay updated with industry changes: Health insurance regulations and policies can change, so stay informed about any updates or changes that may affect your work.

4. Build a strong network: Networking is vital in the insurance industry. Connect with other professionals, attend industry events, and join relevant associations to expand your professional network.

5. Continuously educate yourself: Keep learning and improving your insurance industry knowledge. Take advantage of continuing education courses to stay updated on industry trends and best practices.

In conclusion, obtaining a health insurance license is essential to a successful career in the insurance industry. By meeting the requirements, passing the licensing exam, and submitting a complete application, you can become a licensed health insurance agent and help individuals and families find the coverage they need. You can thrive in this rewarding field with dedication, hard work, and ongoing education. Start your journey towards a health insurance license today and unlock opportunities.

Key Takeaways: How to Get a Health Insurance License?

- Research the requirements for obtaining a health insurance license in your state.

- Complete any necessary pre-licensing education courses.

- Study and prepare for the licensing exam.

- Apply for the health insurance license.

- Pay any required fees and wait for approval.

Frequently Asked Questions

Question 1: What are the requirements to get a health insurance license?

Getting a health insurance license requires meeting specific requirements set by your state’s insurance department. Generally, you must be at least 18 years old and have a high school diploma or equivalent. You may also need to complete a pre-licensing education course and pass a licensing exam. Additionally, you might be required to undergo a background check and provide proof of financial responsibility.

Each state has specific requirements, so it’s essential to check with your state’s insurance department for the exact qualifications needed to obtain a health insurance license.

Question 2: How do I prepare for the health insurance licensing exam?

Preparing for the health insurance licensing exam is crucial to increase your chances of passing. Start by reviewing the exam content outline your state’s insurance department provided. This will give you an idea of the topics covered in the exam.

Next, consider enrolling in a pre-licensing education course. These courses are designed to provide you with the knowledge and skills necessary to pass the exam. They cover topics such as insurance regulations, policies, and ethics.

Question 3: Where can I take the health insurance licensing exam?

The health insurance licensing exam is typically administered by a third-party testing provider approved by your state’s insurance department. These providers often have various testing locations throughout the state.

To find out where to take the exam, visit your state’s insurance department website or contact their licensing division. They will provide you with information on approved testing providers and their testing locations.

Question 4: How long does it take to get a health insurance license?

The time it takes to get a health insurance license can vary depending on several factors. Completing the pre-licensing education course can take a few days to several weeks, depending on your chosen program.

After completing the education requirement, you must schedule and pass the licensing exam. The exam results are usually available within a few weeks. Once you pass the exam, you must submit your application for a license, which may take another few weeks to process.

Question 5: Can I sell health insurance without a license?

No, it is illegal to sell health insurance without a proper license. Insurance of sale without a permit violates state insurance laws and can result in hefty fines and penalties.

To legally sell health insurance, you must obtain the necessary license from your state’s insurance department. This ensures that you have met the required qualifications and have the knowledge and expertise to provide insurance services to clients.

Final Summary: How to Get a Health Insurance License?

So there you have it, a comprehensive guide on how to get a health insurance license. It may seem daunting at first, but with the proper preparation and determination, you can navigate the necessary steps and achieve your goal.

First and foremost, make sure you meet the eligibility requirements set by your state. This may include completing several pre-licensing courses and passing an exam. Don’t worry; with suitable study materials and dedication, you can ace the exam and move forward in the licensing process.

Once you obtain your license, you must continue your education and stay updated with industry trends and regulations. This will enhance your knowledge and skills and ensure you provide your clients with the best possible service.

Remember, getting a health insurance license is about fulfilling a requirement and positively impacting people’s lives by helping them navigate the complex world of healthcare coverage. So, stay motivated, stay informed, and embark on this rewarding journey to become a licensed health insurance professional.

Now, go out there, seize the opportunity, and make a difference in the lives of those who need it most!