Oh no, what happens if you miss a premium payment? It’s a question that can cause some anxiety and uncertainty. Life can get busy, and sometimes things slip through the cracks. But when it comes to insurance premiums, missing a payment can have consequences. In this article, we will explore the potential outcomes of missing a premium payment and guide on handling the situation. So, let’s dive in and find out what happens if you miss a premium payment.

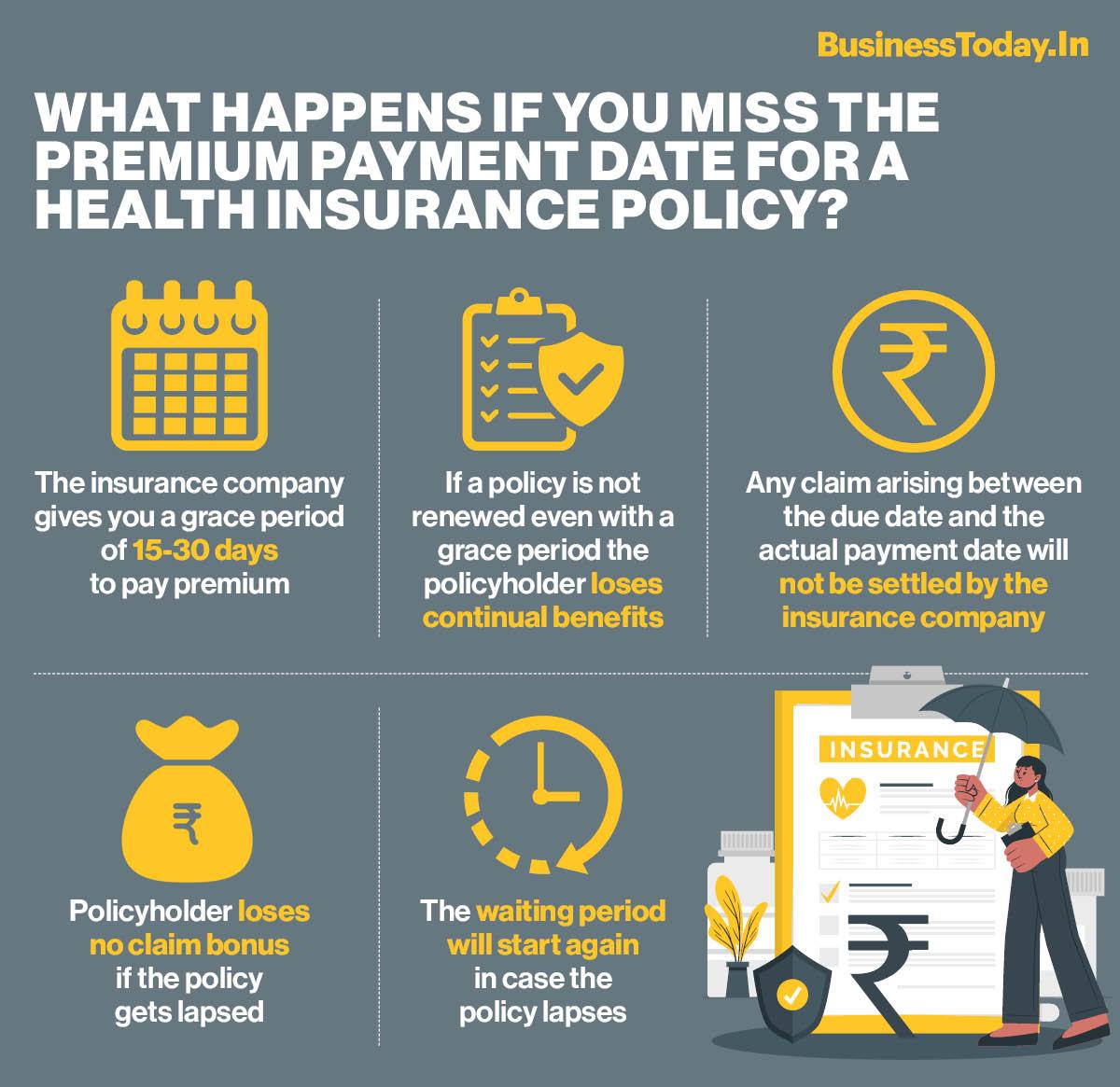

When life gets hectic, it’s easy to forget about those recurring bills, including insurance premiums. However, missing a premium payment can have some severe repercussions. Insurance companies typically have specific grace periods for premium costs, usually around 30 days. However, once that grace period expires, different scenarios can unfold. Your policy may lapse, meaning you no longer have coverage, leaving you vulnerable in case of an unfortunate event.

Additionally, the insurance company may impose financial penalties or late fees. It’s crucial to be aware of the terms and conditions of your policy to understand the potential consequences of missing a premium payment. So, let’s explore the various scenarios that may occur and how you can navigate them effectively.

What Happens if I Miss a Premium Payment?

Life is full of unexpected twists and turns, and sometimes, we may find ourselves in a situation where we are unable to make our premium payments for insurance policies. Whether due to financial difficulties, forgetfulness, or other reasons, missing a premium payment can have consequences. This article will explore what happens if you miss a premium payment and how it can impact your insurance coverage.

1. Loss of Coverage

One of the most significant consequences of missing a premium payment is the potential loss of coverage. Insurance policies are contractual agreements between you and the insurance company; part of that agreement is the timely payment of premiums. If you fail to pay within the grace period, typically 30 days, your coverage may be terminated.

Without insurance coverage, you are vulnerable to financial risks and potential loss. Whether it’s health insurance, auto insurance, or any other type, not having coverage can result in significant expenses if you encounter an unexpected event or accident.

1.1 Consequences of Health Insurance

The consequences can be particularly severe if you miss a premium payment for your health insurance. Without coverage, you may have to pay for medical expenses out of pocket, which can quickly add up. This can be especially concerning if you have a chronic medical condition or require regular medical care.

Additionally, if you miss your premium payment and later decide to reinstate your policy, you may be subject to a waiting period before certain benefits are covered. This waiting period can leave you without coverage for a specific period, during which you may be responsible for all medical costs.

1.2 Consequences of Auto Insurance

Regarding auto insurance, missing a premium payment can have legal consequences. Most states require drivers to carry a minimum level of auto insurance coverage. If your policy lapses due to missed payments, you may be driving illegally and could face penalties if caught without insurance.

Furthermore, you may be personally liable for any damages or injuries caused if you are uninsured in an accident. This can result in significant financial burdens and legal consequences.

2. Late Fees and Penalties

In addition to the potential loss of coverage, missing a premium payment can also result in late fees and penalties. Insurance companies often charge a late fee if payment is not received by the due date. These fees can vary depending on the insurance company and policy.

Insurance companies may sometimes impose penalties or higher premiums if you have a history of missed payments. This can make it more challenging to find affordable insurance coverage in the future.

2.1 Negotiating with the Insurance Company

If you cannot make a premium payment, you must contact your insurance company as soon as possible. Sometimes, they may be willing to work with you and offer a grace period or alternative payment options. It’s always worth exploring these options before your coverage is terminated.

However, it’s important to note that the insurance company is not obligated to provide these accommodations, and they may still proceed with canceling your coverage if no payment is received within the grace period.

3. Impact on Credit Score

Missing a premium payment can also have an impact on your credit score. Insurance companies may report missed payments to credit bureaus, which can lower your credit score. A lower credit score can make it more challenging to obtain credit or loans in the future and may result in higher interest rates.

Prioritizing your insurance premium payments is crucial to avoid negative impacts on your credit score.

4. Reinstating Coverage

If your insurance coverage is terminated due to missed premium payments, you may have the option to reinstate it. However, the process and requirements for reinstatement can vary depending on the insurance company and policy.

Sometimes, you may be required to pay any missed premiums, applicable late fees, and penalties. Additionally, the insurance company may impose a waiting period before coverage is reinstated, during which you will not have any insurance protection.

5. Preventing Missed Premium Payments

While missing a premium payment can have significant consequences, there are steps you can take to prevent it from happening:

- Set up automatic payments to ensure premiums are paid on time.

- Keep track of payment due dates and set reminders.

- Communicate with your insurance company if you are experiencing financial difficulties.

- Create a budget that includes insurance premiums as a priority expense.

- Consider switching to a payment plan that aligns better with your financial situation.

By being proactive and responsible with your premium payments, you can avoid the potential negative consequences of missed payments.

Conclusion

Missing a premium payment can have significant consequences, including the potential loss of coverage, late fees and penalties, impact on credit score, and the need to reinstate coverage. Prioritizing your insurance premium payments and exploring options with your insurance company if you cannot pay is essential. Taking proactive steps to prevent missed payments can ensure you have insurance coverage to protect yourself and your loved ones.

Key Takeaways: What happens if I miss a premium payment?

– Missing a premium payment can lead to canceling your insurance policy.

– You may be given a grace period to make the payment, but paying as soon as possible is essential.

– Your coverage typically ends if you don’t pay within the grace period.

– Reinstating a canceled policy may require paying any missed premiums and additional fees.

– Staying on top of your premium payments is crucial to ensure continuous coverage.

Frequently Asked Questions

What happens if I miss a premium payment?

Missing a premium payment can have consequences for your insurance policy. Here are some essential things to know:

1. Policy cancellation: If you miss a premium payment, your insurance company may cancel your policy. This means you will no longer have coverage, and any claims you make after the cancellation will not be paid. Making your premium payments on time is essential to avoid this situation.

2. Grace period: Some insurance policies have a grace period after a missed payment. You can still pay without your policy being canceled during this period. However, it’s important to note that additional fees or penalties may be involved if you make the payment during the grace period.

What happens if I can’t afford to make a premium payment?

If you’re facing financial difficulties and can’t afford a premium payment, contacting your insurance company as soon as possible is essential. Here are some options that may be available to you:

1. Payment arrangements: Some insurance companies may be willing to work with you to set up a payment plan. This can help you spread the cost of your premium over a more extended period, making it more manageable for your budget.

2. Temporary suspension: In certain situations, your insurance company may temporarily suspend your policy. This means you won’t have to make premium payments for a specific period, but your coverage will also be temporarily suspended.

What Happens If You Miss A Life Insurance Premium

Final Thoughts

Now that we’ve explored what happens if you miss a premium payment, it’s essential to understand the potential consequences. Falling behind on your premium payments can seriously affect your insurance coverage. You may face a lapse in coverage, meaning you won’t be protected if an unexpected event occurs. This can leave you vulnerable and financially exposed, which no one wants to find themselves in.

It’s crucial to prioritize making your premium payments on time to ensure your insurance policy remains active and influential. If you do happen to miss a payment, don’t panic! The best action is to contact your insurance provider as soon as possible. They may be able to offer options to reinstate your coverage or provide guidance on how to rectify the situation.

Remember, insurance provides you with peace of mind and protection. By staying on top of your premium payments, you can continue enjoying the benefits and security of insurance. So, make it a priority to keep your payments up to date and safeguard yourself from any surprises down the road.

In conclusion, missing a premium payment can have serious consequences, including a potential lapse in coverage. However, by being proactive and reaching out to your insurance provider, you can work towards resolving the issue and ensuring that your policy remains intact. So, stay vigilant, prioritize your payments, and enjoy the peace of mind of knowing you’re protected.