Health insurance is essential to our lives, providing financial protection when we need it most. But have you ever wondered what qualifies as an event that allows you to enroll in or change your health insurance coverage? Well, in this article, we’ll dive into qualifying events for health insurance and help you understand the ins and outs of this critical aspect. So, let’s get started!

Regarding health insurance, a qualifying event is a specific circumstance or life event that allows you to change your coverage outside the regular enrollment period. These events can range from changes in your family status, such as getting married or having a baby, to changes in your employment status, like losing your job or experiencing a reduction in work hours. Other qualifying events may include moving to a new state, losing eligibility for additional health coverage, or sharing specific income changes. Understanding what qualifies as a qualifying event is crucial because it can determine whether you’re eligible to enroll in a health insurance plan or make changes to your existing coverage. So, let’s explore the qualifying events in more detail and empower you with the knowledge you need to confidently navigate the world of health insurance.

Understanding Qualifying Events for Health Insurance

When it comes to health insurance, understanding the concept of qualifying events is crucial. A qualifying event is a specific life event that allows you to change your health insurance coverage outside the annual open enrollment period. These events may include changes in your life circumstances, such as marriage, divorce, or childbirth. They can also have changes in your employment status, such as losing or starting a new job. In this article, we will explore the various qualifying events for health insurance and how they can impact your coverage.

Marriage, Divorce, and Birth of a Child

One of the most common qualifying events for health insurance is marriage. When you get married, you can add your spouse to your health insurance plan or vice versa. This allows both of you to have coverage under one policy and can often be more cost-effective than having separate plans. On the other hand, divorce is also considered a qualifying event. If you and your spouse divorce, you must change your health insurance coverage, such as removing your ex-spouse from your policy or finding new coverage for yourself.

The birth of a child is another qualifying event that can impact your health insurance. When you have a baby, you must add them to your policy within a specific timeframe. This will ensure that they have coverage for their medical needs. It’s important to note that some health insurance plans may have particular requirements or waiting periods for adding a newborn, so familiarize yourself with your plan’s guidelines.

Changing Employment Status

Changes in your employment status can also trigger qualifying events for health insurance. For instance, if you lose your job, you may be eligible for COBRA coverage, allowing you to continue your health insurance under your previous employer’s plan for a certain period. It’s essential to understand the deadlines and requirements for electing COBRA coverage, as missing them can result in a gap in your coverage.

Starting a new job is another qualifying event impacting your health insurance. When you begin a new job, you may have the option to enroll in your employer’s health insurance plan. This typically occurs during a designated enrollment period, but starting a new job outside the regular enrollment period can also trigger a qualifying event, allowing you to enroll in coverage.

Other Qualifying Events

In addition to marriage, divorce, the birth of a child, and changes in employment status, other qualifying events can affect your health insurance coverage. These can include the death of a spouse or dependent, a change in your immigration status, or a change in your residence that affects the availability of your current health insurance plan. It’s essential to familiarize yourself with the specific qualifying events that apply to your health insurance plan, as they can vary depending on the provider and policy.

When a qualifying event occurs, taking action within the designated timeframe is essential. This may involve contacting your health insurance provider to notify them of the event and make the necessary changes to your coverage. Failure to do so could result in a lapse in coverage or the inability to make changes until the next open enrollment period.

Benefits of Understanding Qualifying Events

Understanding qualifying events for health insurance can give you greater flexibility and control over your coverage. By knowing when and how to make changes to your plan, you can ensure that you have the appropriate coverage for your needs. This can be especially important during significant life events, such as getting married, having a child, or experiencing a change in employment status.

Additionally, knowing qualifying events can help you make informed decisions about your health insurance. It allows you to explore different options and compare plans to find the best fit for you and your family. By taking advantage of qualifying events, you can navigate the complexities of health insurance and ensure you have the coverage you need when needed.

Conclusion

In conclusion, qualifying events for health insurance play a significant role in allowing individuals to change their coverage outside of the annual open enrollment period. Events such as marriage, divorce, the birth of a child, and changes in employment status can trigger these events. It’s essential to understand the specific qualifying events that apply to your health insurance plan and take action within the designated timeframe to avoid lapses in coverage. By understanding and utilizing qualifying events, you can ensure that your health insurance coverage meets your needs throughout life’s various changes and transitions.

Key Takeaways: What is a Qualifying Event for Health Insurance?

- A qualifying event is a specific circumstance allowing you to enroll in or change your health insurance outside the regular enrollment period.

- Examples of qualifying events include getting married, having a baby, or losing your job-based coverage.

- Qualifying events can also include moving to a new state, experiencing a change in income, or becoming eligible for Medicaid or CHIP.

- If you experience a qualifying event, you typically have a limited time to take action and enroll in or modify your health insurance coverage.

- It’s essential to understand the qualifying events that apply to you and the specific rules and deadlines associated with each event.

Frequently Asked Questions

What is a qualifying event for health insurance?

Regarding health insurance, a qualifying event refers to a specific circumstance or life event that allows you to enroll in or change your health insurance coverage outside the usual enrollment period. These events are typically significant life changes that may affect your healthcare needs or eligibility for coverage.

Qualifying events can vary depending on the type of health insurance plan you have. Some common examples include getting married or divorced, having a baby or adopting a child, losing your job, moving to a new state, or aging out of your parent’s insurance plan. These events trigger a particular enrollment period during which you can change your health insurance coverage.

Can you provide some examples of qualifying events for health insurance?

Certainly! Qualifying events for health insurance can include marriage or divorce, birth or adoption of a child, losing or gaining a dependent, moving to a new state, losing job-based coverage, aging out of a parent’s plan, and becoming eligible for Medicare or Medicaid. These events typically allow you to enroll or change your health insurance coverage outside the regular enrollment period.

It’s important to note that each health insurance plan may have specific requirements and qualifying events, so it’s best to check with your insurance provider or employer to understand what qualifies as a qualifying event for your particular plan.

What steps should I take if I experience a qualifying event?

If you experience a qualifying event, the first step is to notify your health insurance provider or employer immediately. They will guide you through enrolling in or changing your health insurance coverage. Acting promptly is essential, as there are usually time limits for making these changes.

Sometimes, you may need to provide documentation or proof of the qualifying event, such as a marriage or birth certificate. Your insurance provider or employer will inform you of any required documentation and guide you through the necessary steps to ensure your coverage is updated accordingly.

How long do I have to make changes after experiencing a qualifying event?

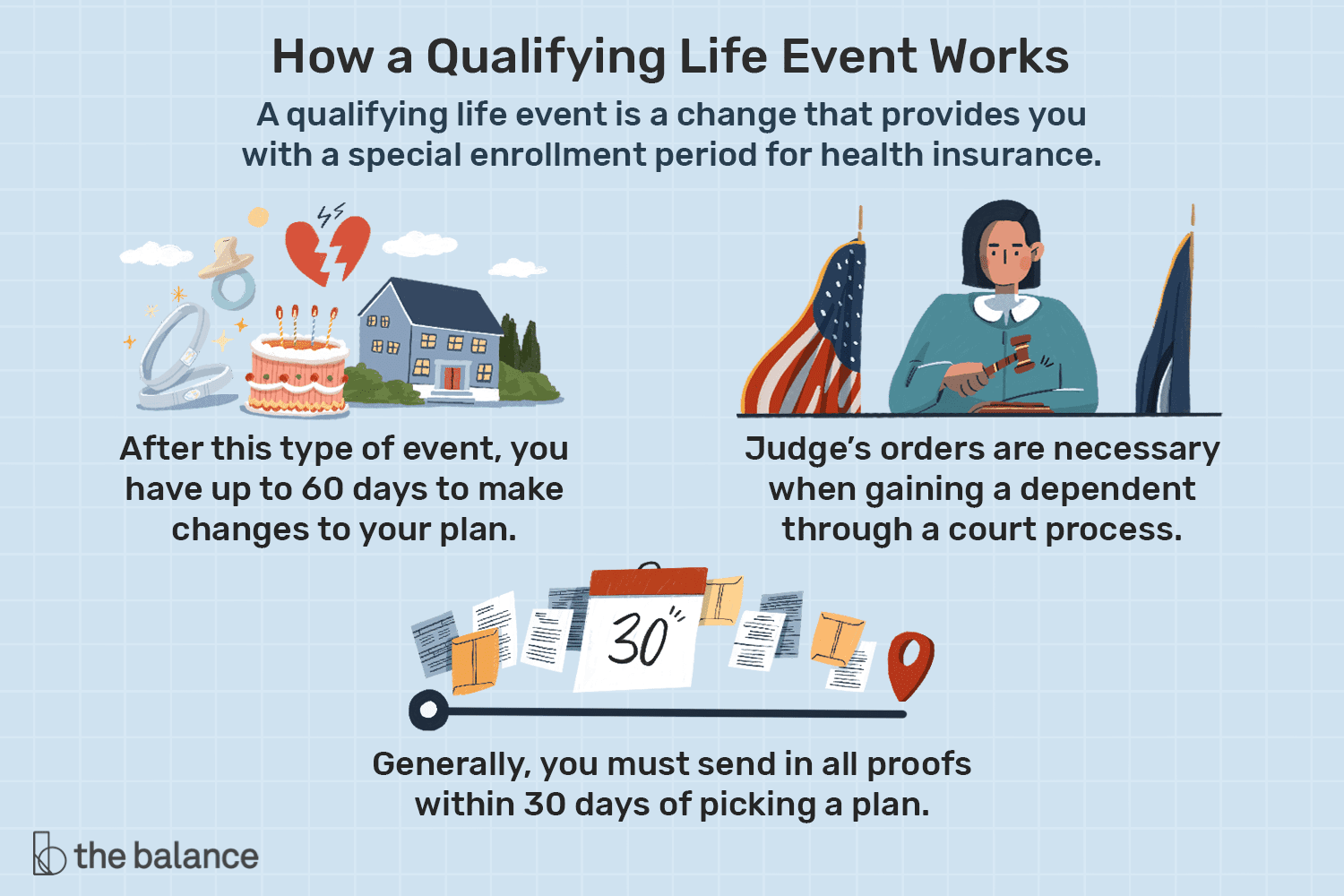

The timeframe for making changes after experiencing a qualifying event can vary depending on your health insurance plan. You typically have a limited window of time, usually around 30 to 60 days, to change your coverage.

Reviewing your plan’s specific guidelines and deadlines is essential to ensure you don’t miss the opportunity to enroll in or change your health insurance coverage. If you have any questions or concerns about the timeframe, it’s best to contact your insurance provider or employer for clarification.

What happens if I miss the deadline to make changes after a qualifying event?

Suppose you miss the deadline to make changes after experiencing a qualifying event. In that case, you may have to wait until the next open enrollment period to enroll in or change your health insurance coverage. Available enrollment periods typically occur once a year and allow individuals to sign up for or make changes to their health insurance plans.

However, exceptions or exceptional circumstances may allow for a late enrollment or change, such as if you experienced a qualifying event within a specific timeframe. Still, you could not make the necessary changes due to unforeseen circumstances. It’s best to contact your insurance provider or employer to discuss your situation and explore any available options.

Final Thought: Understanding Qualifying Events for Health Insurance

In conclusion, knowing what qualifies as a qualifying event for health insurance is crucial for individuals and families seeking to change their coverage outside the regular enrollment period. These events serve as gateways to access special enrollment periods, allowing individuals to enroll in or modify their health insurance plans. Understanding these qualifying events empowers individuals to make informed decisions about their healthcare coverage, whether it’s a marriage, the birth or adoption of a child, losing employer-sponsored coverage, or moving to a new state.

By recognizing the importance of qualifying events, individuals can take advantage of the opportunities they provide. It’s like having a secret key unlock the door to additional coverage options. So, if you find yourself experiencing a significant life event that qualifies as a qualifying event, don’t hesitate to explore your health insurance options outside of the regular enrollment period. Remember, staying informed and proactive about your healthcare coverage can lead to better peace of mind and financial security for you and your loved ones.

In conclusion, understanding qualifying events for health insurance is vital for navigating the complex world of healthcare coverage. By harnessing the power of these events, individuals can make informed decisions about their health insurance plans and ensure that their coverage aligns with their changing needs. So, the next time you experience a qualifying event, seize the opportunity to explore your options and make the most of the particular enrollment period. Your health and financial well-being are worth the effort. Stay informed, stay proactive, and stay covered!