If you’re like most people, you probably dread tax season. It can be a stressful time, filled with confusing forms and calculations. But what if I told you there’s a way to save some money on your taxes potentially? That’s right, I’m talking about health insurance tax deductions. In this article, we’ll dive into the world of tax deductions and explore whether or not your health insurance premiums can be deducted from your taxes.

When it comes to taxes, finding deductions is like discovering hidden treasure. And what better treasure to find than deductions for something as important as health insurance? Many people wonder if their health insurance premiums are tax-deductible, and the answer is… it depends. The tax rules surrounding health insurance deductions can be complex, but fear not! I’m here to break it down for you in plain and simple terms. So, please grab a coffee, put on your favorite thinking cap, and explore the wonderful world of health insurance tax deductions together.

Is Health Insurance Tax Deductible?

Health insurance is essential to our lives, providing financial protection during medical emergencies. But did you know that health insurance premiums may be tax deductible? This article will delve into whether health insurance is tax deductible and provide you with the necessary information to make informed decisions regarding your healthcare expenses and taxes.

Understanding Tax Deductibility of Health Insurance

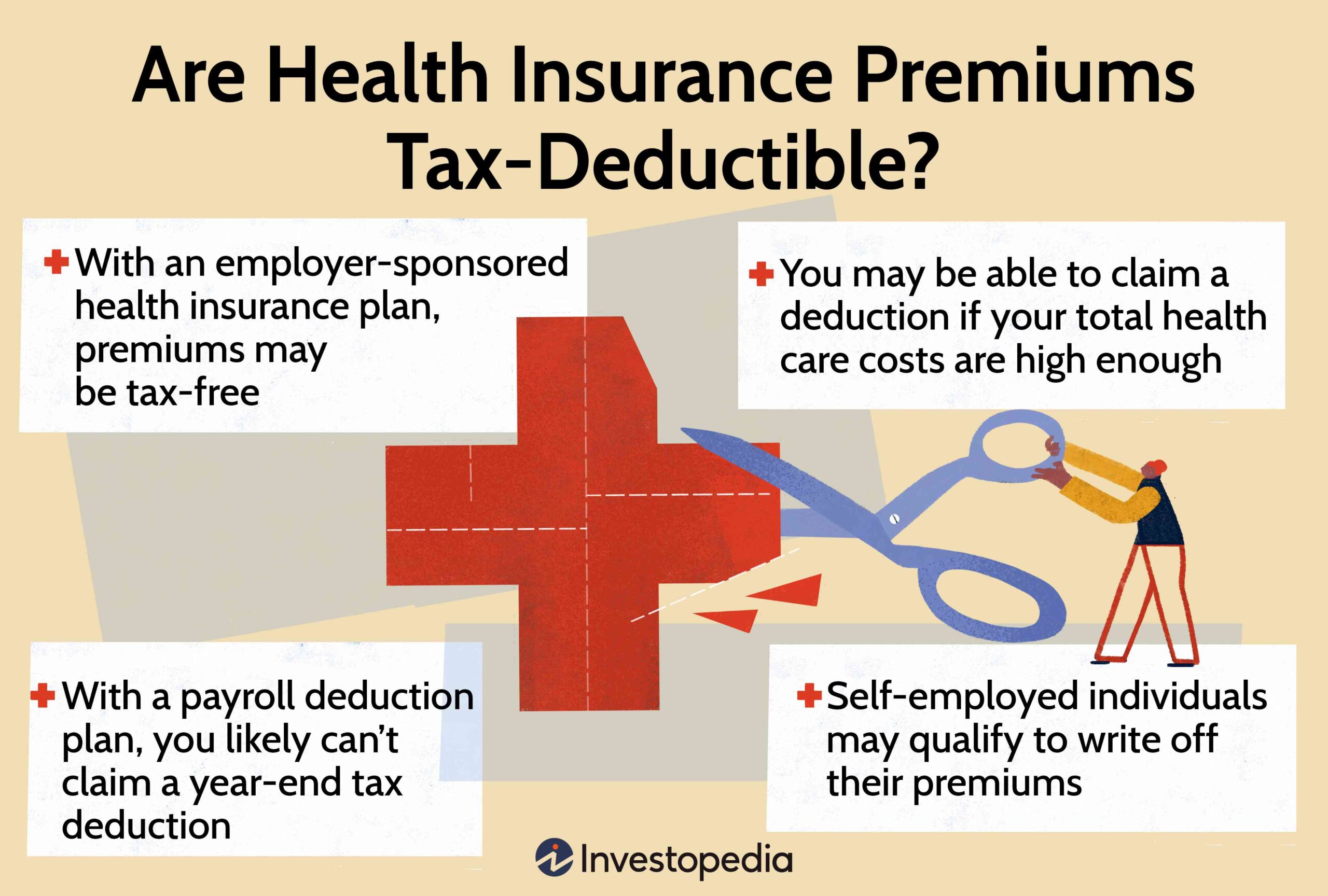

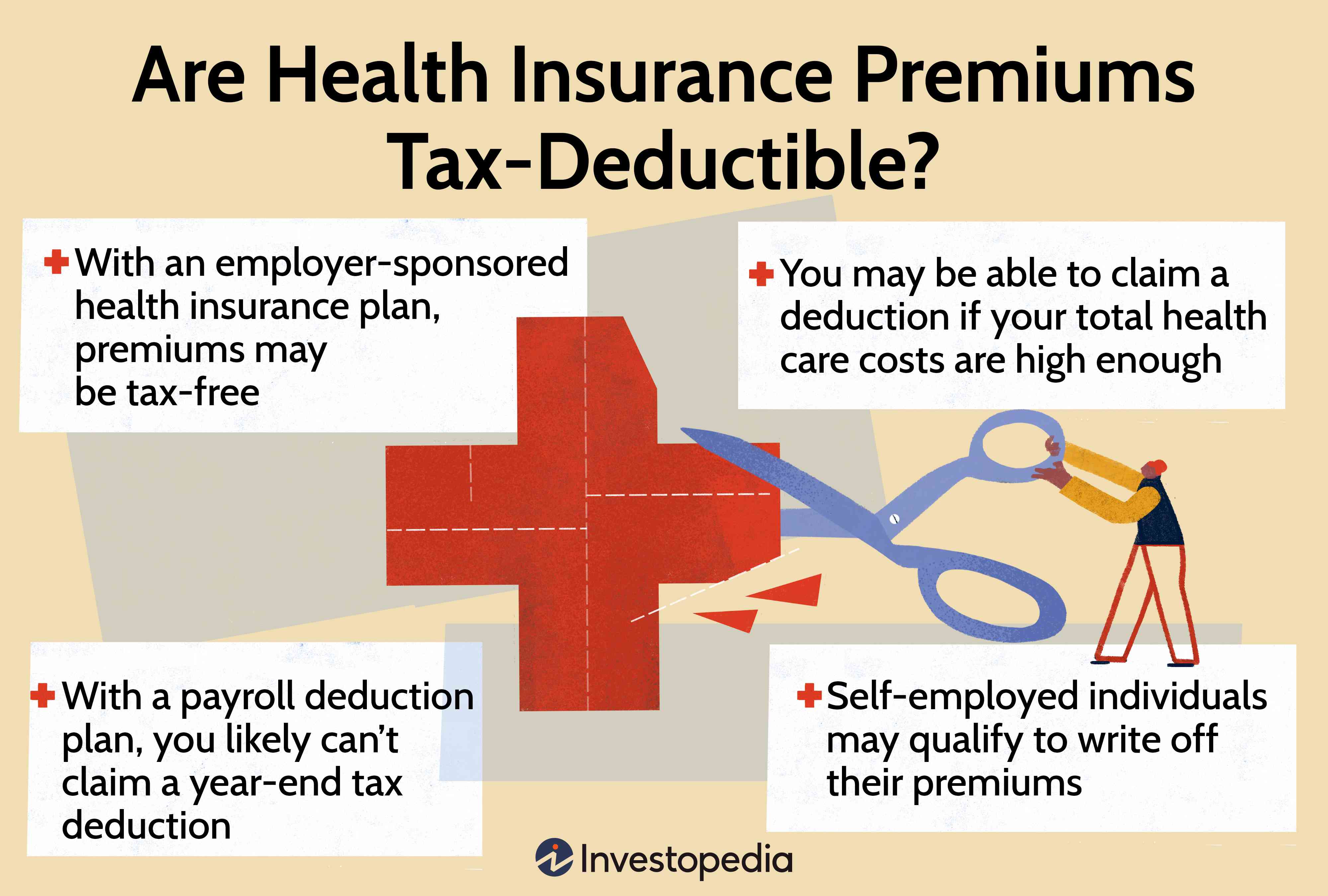

Regarding tax deductions for health insurance, several factors come into play. The deductibility of health insurance premiums depends on your type of health insurance plan, employment status, and whether you meet specific eligibility criteria.

One key factor is whether you have an employer-sponsored or individual health insurance plan. Employer-sponsored plans generally offer more favorable tax benefits compared to individual plans. If you have an employer-sponsored plan, the premiums you pay for the coverage may be eligible for tax deductions.

However, if you have an individual health insurance plan, you may still be eligible for tax deductions, but certain conditions must be met. These conditions include the percentage of your income spent on healthcare expenses and whether you itemize deductions on your tax return.

Employer-Sponsored Health Insurance and Tax Deductions

If you have an employer-sponsored health insurance plan, the premiums you pay for your coverage are typically deducted from your paycheck before taxes. This means the amount paid towards health insurance is considered a pre-tax expense, reducing your taxable income.

In addition to the pre-tax deductions, some employer-sponsored plans offer the option to contribute to a Health Savings Account (HSA) or a Flexible Spending Account (FSA). These accounts allow you to set aside pre-tax dollars to cover eligible healthcare expenses, reducing your taxable income.

It’s important to note that the tax benefits associated with employer-sponsored health insurance are not realized when filing your tax return. Instead, these benefits are recognized yearly as your taxable income is reduced. Therefore, it’s crucial to review your paycheck and consult with your employer’s human resources department to understand the specific tax benefits associated with your health insurance plan.

Individual Health Insurance and Tax Deductions

If you have an individual health insurance plan, you may still be eligible for tax deductions, but the process is slightly different. To deduct health insurance premiums as an individual, you must itemize deductions on your tax return rather than taking the standard deduction.

To be eligible for the deduction, the total amount you spend on healthcare expenses, including health insurance premiums, must exceed a certain percentage of your adjusted gross income (AGI). This percentage can vary based on age and other factors, so it’s essential to consult the current tax laws or seek advice from a tax professional.

It’s worth noting that the deduction for health insurance premiums is subject to certain limitations and may not cover the total amount you paid. However, every deduction can help lower your taxable income and potentially result in a smaller tax bill.

Benefits of Health Insurance Tax Deductions

The tax deductions associated with health insurance premiums can provide significant financial benefits. By reducing your taxable income, you may be able to lower your overall tax liability, resulting in more money in your pocket.

Furthermore, the tax savings from health insurance deductions can offset other healthcare expenses. Whether it’s prescription medications, doctor visits, or medical procedures, the extra funds can help alleviate the financial burden of healthcare costs.

Additionally, the availability of tax deductions for health insurance premiums encourages individuals to prioritize their health and obtain coverage. By making health insurance more affordable, tax incentives promote greater access to healthcare and contribute to overall public health.

Tips for Maximizing Health Insurance Tax Deductions

If you want to maximize your health insurance tax deductions, here are a few tips to consider:

1. Keep detailed records: Maintain accurate records of your healthcare expenses, including health insurance premiums, medical bills, and prescription receipts. These records will be crucial when it’s time to prepare your tax return.

2. Consult a tax professional: Tax laws can be complex, and it’s always wise to consult a tax professional who can help you navigate the intricacies of health insurance tax deductions. They can provide personalized advice based on your specific situation.

3. Evaluate your options: Consider different health insurance plans and their tax implications. Employer-sponsored plans often provide more favorable tax benefits, but individual plans can still offer deductions if you meet the eligibility criteria.

4. Stay informed: Tax laws and regulations can change over time, so staying updated on the latest developments is essential. Regularly review IRS publications and consult reliable sources to ensure you know of any changes that may impact your health insurance tax deductions.

In conclusion, health insurance premiums may be tax deductible, depending on various factors such as the type of plan and your eligibility. Employer-sponsored health insurance plans generally offer more favorable tax benefits, while individual plans require meeting specific conditions. By understanding the tax deductibility of health insurance and following the tips mentioned above, you can maximize your tax savings and make informed decisions regarding your healthcare expenses. Consult a tax professional for personalized advice based on your unique circumstances.

Key Takeaways: Is Health Insurance Tax Deductible?

- Health insurance premiums can be tax-deductible if you meet certain criteria.

- You can deduct medical expenses that exceed a certain percentage of your income.

- Self-employed individuals may qualify for additional deductions.

- Employer-sponsored health insurance is usually not taxed as income.

- Consult a tax professional to ensure you qualify for health insurance tax deductions.

Frequently Asked Questions

Question 1: Can I deduct health insurance premiums from my taxes?

Yes, you can deduct health insurance premiums on your taxes. However, certain conditions need to be met. Firstly, the health insurance must be paid for out of your pocket, not by your employer. Secondly, you can only deduct the premiums if you itemize your deductions on your tax return.

It’s important to note that the deduction is subject to certain limitations. For example, your medical expenses, including health insurance premiums, must exceed a certain percentage of your adjusted gross income (AGI) before you can claim the deduction. Additionally, specific rules apply to self-employed individuals and small business owners.

Question 2: What types of health insurance premiums are tax deductible?

Most health insurance premiums are tax-deductible, including those for individual health insurance plans, employer-sponsored plans, and government-sponsored plans such as Medicare and Medicaid. The critical factor is that the premiums must be paid out of pocket, not by your employer.

However, there are some exceptions. Premiums for certain types of insurance, such as long-term care insurance or disability income insurance, may have different tax treatment. It’s always a good idea to consult with a tax professional or refer to the IRS guidelines to determine if your specific health insurance premiums are tax deductible.

Question 3: What expenses can I include in the medical expense deduction?

In addition to health insurance premiums, you can include a wide range of medical expenses in the deduction. This can include costs such as doctor’s visits, prescription medications, hospital stays, and even specific medical equipment or supplies.

However, it’s important to note that not all medical expenses are deductible. The expenses must be considered “qualified medical expenses” as defined by the IRS. Additionally, your medical expenses must exceed a certain percentage of your adjusted gross income (AGI) before you can claim the deduction.

Question 4: Are there any limitations on the health insurance deduction?

Yes, there are limitations on the health insurance deduction. Firstly, as mentioned earlier, you can only deduct health insurance premiums if you itemize your deductions on your tax return. If you take the standard deduction, you cannot claim the deduction for health insurance premiums.

Additionally, certain income limits may affect your ability to claim the deduction. The specific limitations can vary depending on your filing status and other factors. It’s best to consult with a tax professional or refer to the IRS guidelines to determine if you qualify for the health insurance deduction.

Question 5: Can self-employed individuals deduct health insurance premiums?

Yes, self-employed individuals can deduct health insurance premiums as a business expense. This deduction is available even if you don’t itemize your deductions on your tax return. The self-employed health insurance deduction can help offset the cost of health insurance for individuals not covered by an employer-sponsored plan.

However, specific requirements need to be met to qualify for the deduction. For example, you must be self-employed and not eligible for health insurance coverage through any other source. Additionally, the deduction is generally limited to your net profit from self-employment. It’s recommended to consult with a tax professional or refer to the IRS guidelines for more information on the self-employed health insurance deduction.

Final Summary: Is Health Insurance Tax Deductible?

After exploring whether health insurance is tax deductible, we can conclude that the answer is not a simple yes or no. While health insurance premiums themselves are not typically tax deductible for individuals, there are certain circumstances where you may be able to claim a deduction.

One key factor to consider is whether you have a qualified high-deductible health plan (HDHP) eligible for a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, and the funds can be used to pay for qualified medical expenses. This can provide a tax advantage and help offset the cost of health insurance. Additionally, if you are self-employed or a small business owner, you may be able to deduct health insurance premiums as a business expense.

It’s essential to consult with a tax professional or refer to the IRS guidelines to understand the specific rules and qualifications for deducting health insurance premiums. You can save money on your healthcare expenses by staying informed and taking advantage of eligible deductions. Remember to keep accurate records and receipts to support your deductions and ensure compliance with tax regulations.