Hey there! Have you ever wondered what qualifies as a domestic partner for health insurance? It’s a question that often comes up when individuals are exploring their options for coverage. Whether you’re in a committed same-sex relationship or a heterosexual partnership, understanding the criteria for being considered a domestic partner can make a big difference in accessing the benefits you need. So, let’s dive into this topic and shed some light on what it means to be a domestic partner regarding health insurance.

I know this might sound like a technical and confusing subject, but fret not! I’m here to break it down for you in a way that’s easy to understand. We’ll explore the requirements that insurance companies typically look for when determining domestic partnership eligibility. Specific criteria need to be met, from establishing shared financial responsibilities to providing proof of a committed and exclusive relationship. So, if you’re ready to unravel what qualifies as a domestic partner for health insurance, let’s get started!

Understanding Domestic Partner Eligibility for Health Insurance

Health insurance is crucial to our lives, providing financial protection and access to necessary medical care. While most individuals obtain health insurance through their employers, many policies also offer coverage for domestic partners. But what exactly qualifies as a domestic partner for health insurance purposes? This article will explore the criteria and requirements for domestic partner eligibility, ensuring you comprehensively understand this vital topic.

Defining Domestic Partnership

Before delving into the specifics of domestic partner eligibility for health insurance, defining what constitutes a domestic partnership is essential. A domestic partnership is a legally recognized relationship between two individuals who live together and share a domestic life but are not married. This type of partnership acknowledges and validates the commitment and responsibilities shared by unmarried couples.

In health insurance, domestic partnerships allow individuals to extend coverage to their partners, ensuring they can access the same healthcare benefits as married couples. However, each insurance provider may have its requirements and guidelines for determining domestic partner eligibility.

Criteria for Domestic Partner Eligibility

Insurance providers typically consider several factors when determining eligibility for domestic partner health insurance coverage. While the specific requirements may vary between providers, some standard criteria include:

- Shared residence: To qualify as domestic partners, individuals usually must live together in a shared residence. This demonstrates the commitment and stability of the partnership.

- Financial interdependence: Insurance providers often require evidence of economic interdependence, such as joint bank accounts, shared bills, or joint ownership of assets.

- Duration of the partnership: Many insurance companies require a minimum duration for the domestic partnership to ensure the long-term relationship is stable.

- Exclusivity: Some providers may require that domestic partners do not have any other legal spouses or domestic partners.

It is important to note that these criteria are not exhaustive, and providers may have additional requirements or variations. It is crucial to consult with your specific insurance company to understand their eligibility guidelines.

Benefits of Domestic Partner Health Insurance

Obtaining health insurance coverage for your domestic partner can offer numerous advantages and benefits. Some of the key benefits include:

- Access to healthcare: Domestic partner health insurance ensures that your partner has access to essential healthcare services, including preventive care, doctor visits, and prescription medications.

- Financial protection: Health insurance protects against unexpected medical expenses, reducing the financial burden on both partners.

- Peace of mind: Knowing that your partner has adequate health insurance coverage brings peace of mind, allowing you to focus on your shared life without worrying about healthcare costs.

- Support during emergencies: In a medical emergency, having health insurance for your domestic partner ensures they can receive prompt and necessary medical attention without incurring exorbitant out-of-pocket expenses.

These benefits highlight the importance of securing health insurance coverage for your domestic partner, ensuring their health and well-being are protected.

How to Obtain Domestic Partner Health Insurance

Obtaining coverage is relatively straightforward if you meet the eligibility criteria for domestic partnership health insurance. Here are the general steps involved:

- Check with your employer: If you have health insurance coverage through your employer, inquire about their policies regarding domestic partner eligibility. Many employers offer coverage for domestic partners, but it is crucial to understand the specific requirements and documentation needed.

- Submit necessary documentation: Once you have verified the eligibility requirements, gather the required documentation, such as proof of shared residence, financial interdependence, and duration of the partnership. Your insurance provider will specify the exact documents needed.

- Complete the enrollment process: Follow the instructions provided by your employer or insurance provider to enroll your domestic partner in the health insurance plan. This may involve filling out forms, providing documentation, and designating your partner as a beneficiary.

- Review the coverage details: Take the time to review the coverage details and ensure that your domestic partner’s healthcare needs are adequately addressed. Familiarize yourself with the benefits, deductibles, copayments, and any limitations or exclusions.

By following these steps, you can secure health insurance coverage for your domestic partner, providing them the same protection and access to healthcare as married couples.

The Bottom Line

Understanding the qualifications and requirements for domestic partner eligibility for health insurance is crucial for individuals in committed relationships. By meeting the criteria set by insurance providers and following the steps to enroll your partner, you can ensure they have access to essential healthcare services and the financial protection that comes with health insurance coverage. Consult with your insurance company to obtain accurate information and guidance tailored to your circumstances.

Key Takeaways: What Qualifies as a Domestic Partner for Health Insurance?

- A domestic partner is someone with whom you share a committed relationship and live together but are not married.

- Most insurance providers require proof of joint financial responsibility and cohabitation to qualify for health insurance coverage as a domestic partner.

- Some insurance companies may require additional documentation, such as a signed affidavit or domestic partnership agreement.

- Not all employers offer health insurance coverage for domestic partners, so checking with your employer’s benefits plan is essential.

- Suppose you and your domestic partner do not qualify for health insurance coverage. In that case, you may consider other options like individual health insurance plans or exploring domestic partner benefits offered by specific organizations.

Frequently Asked Questions

1. What is the definition of a domestic partner for health insurance purposes?

For health insurance purposes, a domestic partner is a person in a committed relationship with another person and shares a household and financial partnership. This typically includes unmarried couples of the same or opposite sex who live together and share a domestic life. Insurance companies may also require that the couple meets specific criteria, such as being above a certain age, not being related by blood, and not being legally married to someone else.

It’s important to note that the definition of a domestic partner may vary between insurance companies, so it’s essential to review the specific requirements of your health insurance provider to determine if you qualify as a domestic partner.

2. Can same-sex couples qualify as domestic partners for health insurance?

Yes, same-sex couples can qualify as domestic partners for health insurance coverage. In recent years, many insurance companies have expanded their definition of domestic partners to include same-sex couples, recognizing the legal recognition of same-sex relationships in many jurisdictions. This means that same-sex couples can enjoy the same benefits and coverage regarding health insurance as opposite-sex couples.

However, it’s essential to check with your specific insurance provider to ensure that they recognize and offer coverage for same-sex domestic partners.

3. Do domestic partners need to live together to qualify for health insurance?

In most cases, domestic partners are required to live together to qualify for health insurance coverage. The cohabitation requirement is often a way for insurance companies to ensure that the partnership is genuine and that the couple shares a domestic and financial relationship. Living together demonstrates a level of commitment and shared responsibilities.

However, the specific requirements may vary between insurance providers, so it’s crucial to review the policy guidelines of your health insurance provider to determine if living together is a requirement for domestic partner coverage.

4. Can domestic partners include children in their health insurance coverage?

Yes, in many cases, domestic partners can include children in their health insurance coverage. Insurance companies often extend coverage to children who are dependents of the policyholder, regardless of whether they are biological or legally adopted. This means that if domestic partners have children together or have legally adopted children, they can typically include them in their health insurance plans.

However, it’s essential to review the policy guidelines of your health insurance provider to understand the specific requirements and limitations regarding coverage for children of domestic partners.

5. What documentation is required to prove a domestic partnership for health insurance purposes?

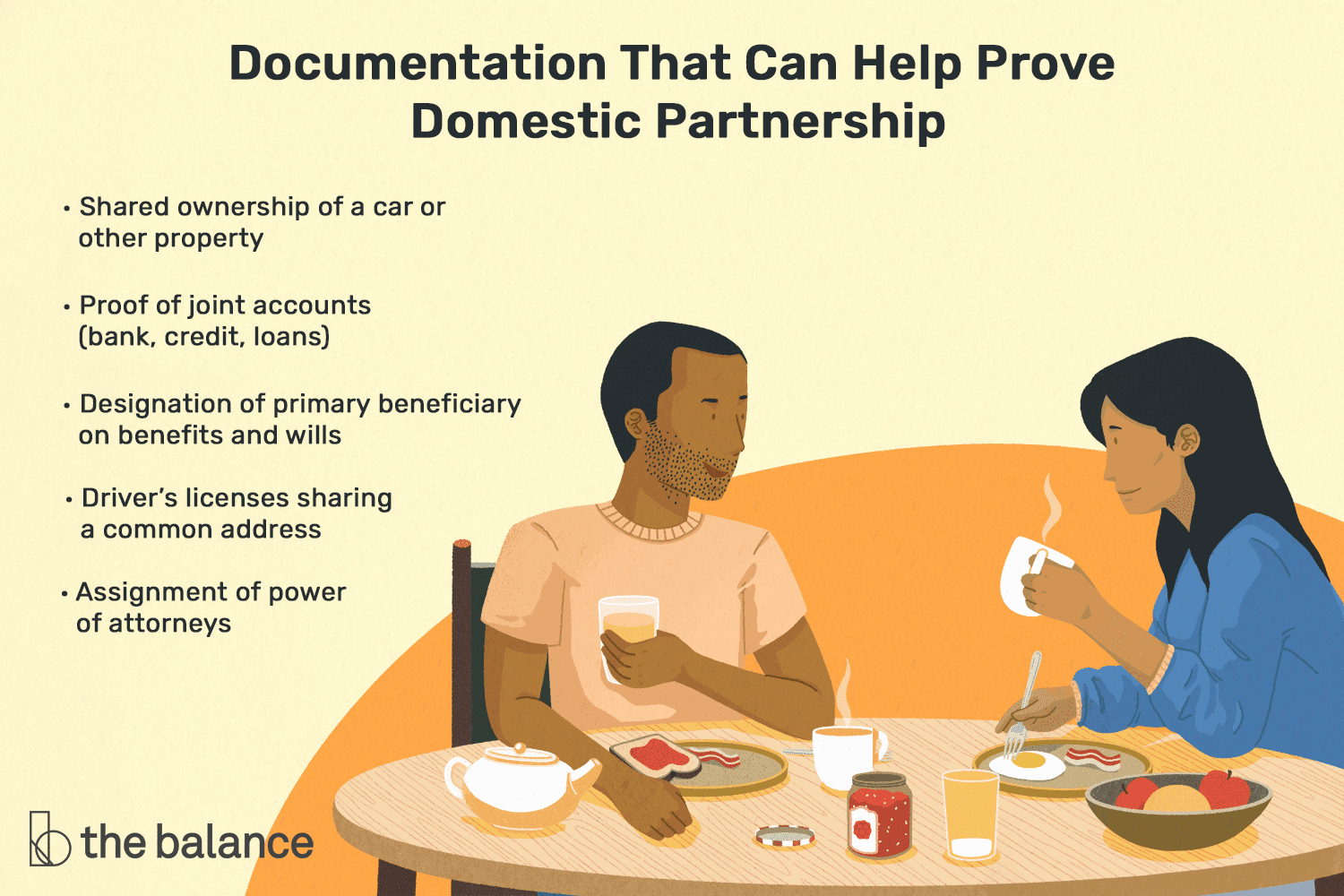

The documentation required to prove a domestic partnership for health insurance purposes may vary between providers. However, standard documents may be requested, including a signed affidavit of domestic partnership, proof of shared financial responsibilities (such as joint bank accounts or shared bills), and proof of cohabitation (such as a lease agreement or utility bills).

It’s essential to consult with your health insurance provider to understand their specific documentation requirements and ensure you have the necessary paperwork to prove your domestic partnership.

Final Thoughts: What Qualifies as a Domestic Partner for Health Insurance?

When determining what qualifies as a domestic partner for health insurance, understanding the specific requirements can be crucial. While the eligibility criteria may vary depending on the insurance provider, some common factors must be considered. Firstly, many health insurance companies require domestic partners to meet specific criteria, such as being in a committed relationship, sharing a residence, and being financially interdependent. Additionally, some providers may require proof of domestic partnership, such as joint bank accounts or shared bills.

It’s important to remember that the definition of a domestic partner can differ from state to state and even from company to company. Some states have legal recognition for domestic partnerships, while others do not. Therefore, it’s crucial to consult your insurance provider’s specific guidelines and requirements to determine if you and your partner meet the qualifications for domestic partner coverage.

In conclusion, while the requirements for domestic partner health insurance coverage may vary, it’s essential to thoroughly research and understand the guidelines set by your insurance provider. By meeting the necessary criteria and providing the required documentation, you and your domestic partner can ensure access to the health insurance coverage you need. Remember to consult your insurance provider directly to clarify any doubts or questions regarding eligibility and requirements.