Are you wondering how to get affordable health insurance? Well, you’re in luck because I’ve got some great tips to help you navigate the complex world of healthcare coverage without breaking the bank. Health insurance is a crucial investment for protecting your well-being, but finding an affordable plan can sometimes feel like searching for a needle in a haystack. But fear not, because I’m here to guide you through the process and show you how to secure the best coverage at a price that won’t leave you feeling financially drained.

Nowadays, healthcare costs are skyrocketing, and it’s more important than ever to find a health insurance plan that fits your budget. So, how do you go about it? First and foremost, it’s essential to do your research and compare different insurance providers. Look for companies that offer affordable premiums, comprehensive coverage, and a good track record of customer satisfaction. Additionally, consider exploring government-sponsored programs or employer-sponsored plans, as they may offer more affordable options. By taking the time to explore your options and weigh the pros and cons of each, you can find a health insurance plan that meets your needs without breaking the bank. So, let’s dive in and discover the secrets to getting affordable health insurance that will give you peace of mind without draining your bank account.

- Research different insurance providers and compare their plans and prices.

- Check if you qualify for any government assistance programs or subsidies.

- Consider a high-deductible plan or health savings account to lower monthly premiums.

- Shop around and negotiate with insurance brokers to get the best deal.

- Look for group or association plans that offer lower rates.

- Consider bundling your health insurance with other types of insurance for potential discounts.

- Take advantage of preventive care services to reduce long-term healthcare costs.

How to Get Affordable Health Insurance: A Comprehensive Guide

Health insurance is a necessity in today’s world, but it can often come with a hefty price tag. However, there are ways to find affordable health insurance options that fit your budget. In this article, we will explore various strategies and resources to help you get the coverage you need without breaking the bank.

1. Understand Your Health Insurance Needs

Before diving into the search for affordable health insurance, it’s important to assess your personal healthcare needs. Consider factors such as your age, existing medical conditions, and the frequency of doctor visits. This evaluation will help you determine what coverage you require and what you can afford.

It’s also worth noting that different health insurance plans may have varying coverage options, so understanding your needs will allow you to choose a plan that provides adequate coverage at an affordable price.

Assessing Your Budget and Affordability

Once you understand your health insurance needs, it’s time to evaluate your budget. Determine how much you can comfortably spend on monthly premiums, deductibles, and out-of-pocket costs. This will help you narrow down your options to plans that align with your financial situation.

Additionally, consider any potential subsidies or tax credits that you may qualify for based on your income. These financial aids can significantly reduce your healthcare expenses, making it more affordable to obtain the coverage you need.

2. Explore Health Insurance Marketplaces

Health insurance marketplaces, such as the Affordable Care Act’s Health Insurance Marketplace, are a valuable resource for finding affordable health insurance options. These marketplaces offer a wide range of plans from different insurance providers, allowing you to compare prices and coverage details.

When using a health insurance marketplace, be sure to enter accurate information about your healthcare needs and income. This will help the marketplace generate personalized plan recommendations and determine if you qualify for any subsidies or tax credits.

Understanding Metal Tiers

Health insurance plans offered on marketplaces are categorized into metal tiers: Bronze, Silver, Gold, and Platinum. Each tier represents the level of coverage and cost-sharing between you and the insurance provider.

Bronze plans generally have lower monthly premiums but higher deductibles and out-of-pocket costs. On the other hand, Platinum plans have higher monthly premiums but lower deductibles and out-of-pocket costs. Consider your healthcare needs and budget when selecting a metal tier that suits you best.

3. Consider Medicaid and CHIP

If you have a limited income or have dependents, you may be eligible for Medicaid or the Children’s Health Insurance Program (CHIP). These government-funded programs provide free or low-cost health insurance to individuals and families who meet specific income requirements.

Medicaid and CHIP offer comprehensive coverage that includes doctor visits, hospital stays, prescription medications, and preventive care. To determine if you qualify for these programs, visit your state’s Medicaid website or healthcare.gov.

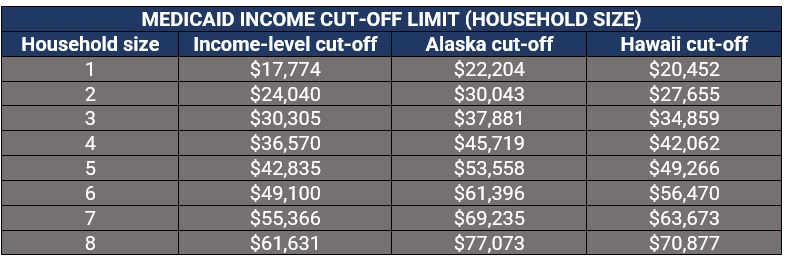

Income Requirements for Medicaid and CHIP

The income requirements for Medicaid and CHIP vary by state. Typically, Medicaid eligibility is based on a percentage of the federal poverty level (FPL). For example, in 2021, the income threshold for Medicaid eligibility for a family of four is around $36,000 or less, while CHIP eligibility extends to families with incomes up to 200% of the FPL.

4. Consider Short-Term Health Insurance

If you’re in between jobs or need temporary coverage, short-term health insurance may be a viable option. Short-term plans typically provide coverage for a limited period, ranging from a few months to a year. While they may not offer the comprehensive coverage of long-term plans, they can provide essential protection during transitional periods.

It’s important to note that short-term health insurance plans may have limitations and exclusions, so carefully review the terms and conditions before enrolling. Additionally, these plans may not cover pre-existing conditions or preventive care, so evaluate your healthcare needs before considering this option.

Benefits and Limitations of Short-Term Health Insurance

One of the main benefits of short-term health insurance is its affordability. These plans often have lower premiums compared to long-term plans. However, they may not cover essential health benefits mandated by the Affordable Care Act, such as mental health services or maternity care. It’s crucial to weigh the benefits and limitations before deciding if short-term health insurance is right for you.

5. Utilize Health Insurance Brokers

Health insurance brokers can be a valuable resource when searching for affordable health insurance. These professionals are knowledgeable about different insurance plans and can help you navigate the complex world of healthcare coverage.

Brokers can provide personalized advice based on your specific needs, budget, and eligibility. They can also assist with enrollment and help you understand the fine print of insurance policies. Utilizing a health insurance broker can save you time and effort in finding the most suitable and affordable coverage.

Choosing a Reputable Health Insurance Broker

When selecting a health insurance broker, ensure they are licensed and reputable. Look for brokers who have experience in the health insurance industry and positive reviews from previous clients. This will help you find a trustworthy professional who can guide you through the process of obtaining affordable health insurance.

6. Compare Health Insurance Plans

Comparing health insurance plans is crucial to finding the most affordable option. Take the time to research and compare different plans, considering factors such as premiums, deductibles, copayments, and out-of-pocket maximums.

Online tools and resources can simplify the comparison process by providing side-by-side comparisons of different plans. These tools often allow you to filter plans based on your specific needs and budget, helping you make an informed decision.

Consider Non-Traditional Insurance Providers

In addition to traditional insurance companies, consider exploring non-traditional insurance providers. Some organizations, such as professional associations or unions, offer group health insurance plans at discounted rates. These plans may provide affordable coverage options for individuals who meet the eligibility criteria.

7. Seek Assistance from Non-Profit Organizations

Non-profit organizations dedicated to improving access to healthcare can provide valuable assistance in finding affordable health insurance. These organizations often offer resources, guidance, and enrollment support to individuals and families in need.

Some non-profit organizations also operate clinics or healthcare centers that provide low-cost or free medical services to uninsured or underinsured individuals. Utilizing these resources can help you access affordable healthcare while navigating the complexities of health insurance.

Researching Local Non-Profit Organizations

To find non-profit organizations in your area, conduct online research or reach out to local community centers or healthcare facilities. These organizations can provide information on available programs and services that can help you obtain affordable health insurance.

8. Consider Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are another option to consider when trying to obtain affordable health insurance. HSAs are tax-advantaged savings accounts that allow you to set aside funds specifically for medical expenses.

Contributions to HSAs are tax-deductible, and any interest or investment earnings accumulate tax-free. These funds can be used to cover eligible healthcare expenses, including deductibles, copayments, and prescription medications. HSAs can help you save money on healthcare costs while providing a financial safety net.

Eligibility and Contribution Limits for HSAs

To be eligible for an HSA, you must be enrolled in a high-deductible health insurance plan. The contribution limits for HSAs vary each year, so make sure to stay informed about the current limits. Maximize your HSA contributions to take advantage of the tax benefits and build a financial cushion for future healthcare expenses.

9. Consider Health Care Sharing Ministries

Health care sharing ministries are organizations that facilitate the sharing of medical expenses among members who share similar religious or ethical beliefs. These ministries operate similarly to insurance, but they are not subject to the same regulations.

Joining a health care sharing ministry can provide a more affordable alternative to traditional health insurance. Members contribute a monthly share, which is then used to cover medical expenses of other members. However, it’s important to carefully review the guidelines and coverage limitations of each ministry before enrolling.

Eligibility and Guidelines for Health Care Sharing Ministries

Each health care sharing ministry has its own eligibility requirements and guidelines. These requirements may include adhering to specific religious beliefs, abstaining from certain practices, or maintaining a healthy lifestyle. Review the guidelines of different ministries to find one that aligns with your values and offers the coverage you need.

10. Stay Informed About Open Enrollment Periods

Open enrollment periods are specific times during the year when individuals can enroll in or make changes to their health insurance plans. It’s crucial to stay informed about these periods to ensure you have access to affordable health insurance.

Missing the open enrollment period may limit your options and result in a gap in coverage. However, certain life events, such as getting married, having a baby, or losing other healthcare coverage, may qualify you for a special enrollment period outside of the regular open enrollment period.

Marking Open Enrollment Periods on Your Calendar

Mark the open enrollment periods on your calendar and set reminders to ensure you don’t miss these important deadlines. Being proactive and prepared will allow you to explore the available options and secure affordable health insurance that meets your needs.

Conclusion

Obtaining affordable health insurance may require some research and evaluation, but it’s possible to find coverage that fits your budget. By understanding your healthcare needs, exploring different options, and utilizing available resources, you can secure the insurance you need without breaking the bank. Remember to stay informed about open enrollment periods and take advantage of subsidies, tax credits, and other financial aids that can make health insurance more affordable.

Sources:

– healthcare.gov

– Medicaid.gov

– Kaiser Family Foundation”

Key Takeaways: How to Get Affordable Health Insurance?

- Shop around and compare different health insurance plans.

- Consider choosing a plan with a higher deductible to reduce monthly premiums.

- Check if you qualify for government subsidies or assistance programs.

- Explore options for group health insurance through employers or professional organizations.

- Stay healthy and prevent illnesses to minimize healthcare costs.

Frequently Asked Questions

Looking for affordable health insurance? We’ve got you covered! Check out these frequently asked questions to find out how you can get the coverage you need without breaking the bank.

1. What factors should I consider when looking for affordable health insurance?

When searching for affordable health insurance, there are a few key factors to keep in mind. First, consider your budget and determine how much you can afford to spend on premiums and out-of-pocket costs. Next, evaluate your healthcare needs and the specific coverage options that are important to you. It’s also important to research different insurance providers and compare their rates and offerings. Finally, make sure to review the policy details, such as deductibles, copayments, and network restrictions, to ensure they align with your needs.

By considering these factors, you can find a health insurance plan that meets your budget and provides the coverage you need.

2. Are there any government programs that offer affordable health insurance?

Yes, there are several government programs that offer affordable health insurance options. One of the most well-known programs is Medicaid, which provides free or low-cost coverage to individuals and families with limited income. Another program is the Children’s Health Insurance Program (CHIP), which offers affordable health insurance for children in low-income households.

In addition, the Affordable Care Act (ACA) established healthcare marketplaces where individuals and small businesses can shop for health insurance plans. These marketplaces offer a range of coverage options, and individuals may qualify for subsidies or tax credits to help make their insurance more affordable.

3. Can I negotiate the cost of health insurance?

While the cost of health insurance is generally set by insurance providers, there may be some room for negotiation. It’s worth reaching out to different insurance companies and asking about any available discounts or promotions. Additionally, if you are purchasing insurance through a marketplace, you may be able to compare plans and find one that offers a better value for your money.

Remember, it’s important to carefully review the details of any insurance plan before making a decision. Cheaper premiums may come with higher deductibles or limited coverage, so consider your healthcare needs and financial situation when negotiating the cost of health insurance.

4. Can I get affordable health insurance if I have a pre-existing condition?

Yes, under the Affordable Care Act, insurance providers are not allowed to deny coverage or charge higher premiums based on pre-existing conditions. This means that individuals with pre-existing conditions can still access affordable health insurance options.

However, it’s important to note that the availability and cost of insurance may vary depending on your specific condition and the insurance provider. It’s recommended to research different insurance plans and compare their coverage and costs to find the best option for your needs.

5. Are there any alternatives to traditional health insurance that are more affordable?

Yes, there are alternative options to traditional health insurance that may be more affordable for some individuals. One option is a health savings account (HSA), which allows you to set aside pre-tax money for medical expenses. HSAs are typically paired with high-deductible health plans and can help you save money on premiums.

Another alternative is joining a healthcare sharing ministry, which is a group of individuals who pool their resources to cover each other’s medical costs. These ministries often have lower monthly costs compared to traditional insurance plans, but it’s important to carefully review the coverage and limitations before joining.

It’s worth exploring these alternatives and discussing them with a healthcare professional or insurance advisor to determine if they are the right fit for your unique situation.

Final Thoughts on Getting Affordable Health Insurance

Well, folks, we’ve reached the end of our journey on the quest for affordable health insurance. It’s been quite the ride, but hopefully, you’ve gained some valuable insights along the way. We’ve explored various strategies, tips, and tricks to help you navigate the complex world of healthcare costs and find a plan that won’t break the bank.

Remember, when it comes to finding affordable health insurance, knowledge is power. Take the time to research different plans, compare prices, and understand the coverage options available to you. Don’t be afraid to ask for help or seek guidance from professionals in the field. By being proactive and informed, you’ll be better equipped to make smart decisions that align with your budget and healthcare needs.

So, whether you’re a young professional starting out, a family looking to protect your loved ones, or an individual seeking coverage, there are options out there for you. With a little perseverance and some strategic planning, you can find affordable health insurance that provides the peace of mind you deserve. Remember, your health is your wealth, and investing in the right insurance can make all the difference in maintaining your well-being.