If you’re a business owner, chances are you’ve considered the risks and uncertainties of running a company. One of these concerns may be employee theft or dishonesty. After all, no matter how carefully you hire and train your staff, there’s always a possibility that someone within your organization may engage in fraudulent activities. That’s where business insurance comes into play. But does business insurance cover employee theft or dishonesty? Let’s delve into this topic and find out.

When protecting your business from the financial repercussions of employee theft or dishonesty, it’s essential to understand the role of insurance. While policies vary, many business insurance policies offer coverage for these situations. However, it’s necessary to carefully review the terms and conditions of your specific policy to determine the extent of coverage provided. After all, every insurance policy is unique; what one policy covers, another may not. So, let’s dig deeper into business insurance and explore how it can safeguard your company against the unfortunate reality of employee theft or dishonesty.

Does Business Insurance Cover Employee Theft or Dishonesty?

Business insurance is essential for protecting your company from various risks and liabilities. One of the concerns that business owners may have is whether their insurance coverage extends to employee theft or dishonesty. This article will explore whether business insurance covers employee theft or dishonesty and provide valuable information to help you make informed decisions for your company.

Understanding Employee Theft and Dishonesty

Employee theft or dishonesty refers to any act of stealing, fraud, or dishonest behavior committed by an employee against their employer. This can include embezzlement, theft of company assets, misappropriation of funds, or any other form of unauthorized taking or misuse of company resources. Employee theft and dishonesty can have significant financial and reputational consequences for businesses, making having the right insurance coverage crucial.

Now that we understand what employee theft and dishonesty entail let’s delve into whether business insurance generally covers these incidents.

Types of Business Insurance Coverage

Business insurance typically consists of several types of coverage, including general liability, property, and crime insurance. While general liability insurance and property insurance protect your business from various risks, crime insurance explicitly covers losses resulting from criminal acts such as theft, embezzlement, and employee dishonesty.

Crime insurance policies often include coverage for employee theft or dishonesty, ensuring that businesses have financial protection in case such incidents occur. However, it is essential to carefully review your insurance policy to understand the specific terms and conditions of coverage for employee theft or dishonesty.

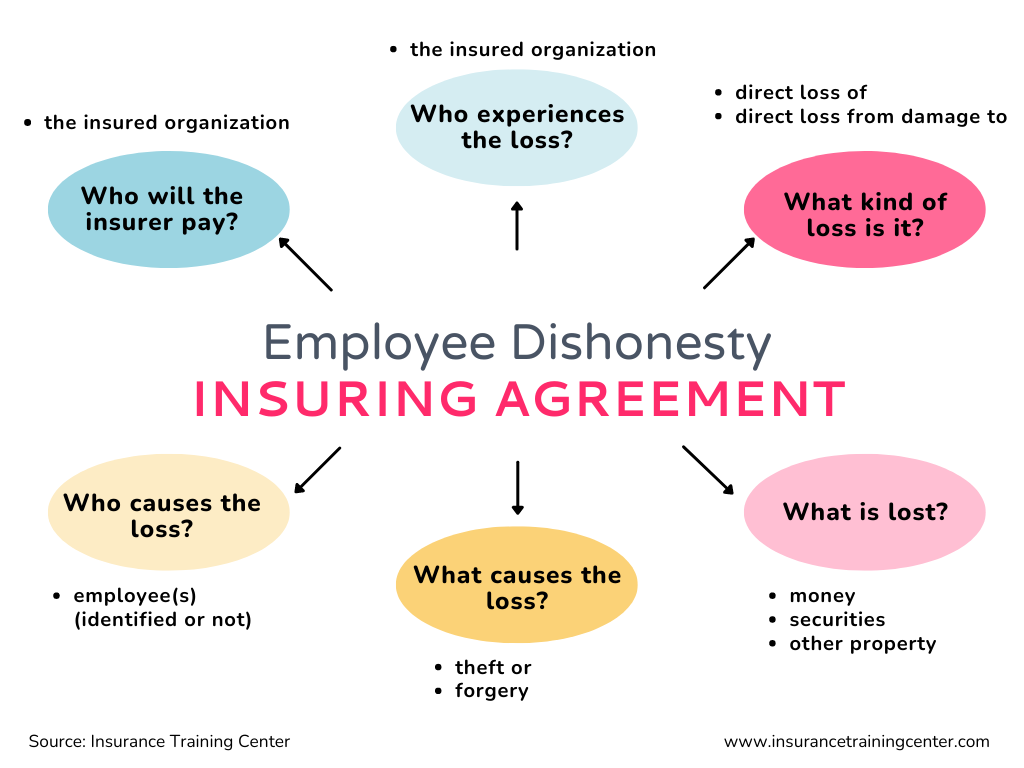

Understanding Employee Dishonesty Coverage

Employee dishonesty coverage is a specific type of crime insurance that protects businesses against financial loss caused by fraudulent acts committed by employees. This coverage typically includes theft, forgery, alteration, and other dishonest acts resulting in the employer’s financial loss. It is important to note that employee dishonesty coverage usually applies to acts committed by current employees but may not extend to former employees.

When purchasing crime insurance for your business, assessing your company’s risk exposure and selecting coverage limits that adequately protect your financial interests is crucial. Consulting with an insurance professional can help you determine the appropriate coverage for your business.

Benefits of Having Employee Theft or Dishonesty Coverage

Employee theft or dishonesty coverage as part of your business insurance policy offers several benefits. Firstly, it provides financial protection for employee theft or dishonesty losses. This coverage can help your business recover from the economic impact of such incidents, ensuring that your operations can continue smoothly.

Secondly, employee theft or dishonesty coverage can enhance your credibility and reputation with clients, partners, and investors. Demonstrating that your business has comprehensive insurance coverage, including protection against employee theft or dishonesty, can instill confidence in your stakeholders and strengthen your relationships.

Tips for Securing Employee Theft or Dishonesty Coverage

When seeking employee theft or dishonesty coverage, it is essential to consider the following tips:

- Thoroughly assess your business’s risk exposure to employee theft or dishonesty to determine the appropriate coverage limits.

- Review your policy to understand the specific terms and conditions of coverage for employee theft or dishonesty.

- Consider working with an insurance professional specializing in crime insurance to ensure you have the right coverage for your business.

- Implement strong internal controls and risk management practices to minimize the risk of employee theft or dishonesty.

- Regularly review and update your insurance coverage to adapt to changes in your business and industry.

By following these tips, you can ensure that your business is adequately protected against the financial risks of employee theft or dishonesty.

Conclusion

Business insurance can cover employee theft or dishonesty through crime insurance policies. Understanding the specific terms and conditions of coverage and selecting appropriate limits are essential for ensuring comprehensive protection for your business. By securing employee theft or dishonesty coverage and implementing robust risk management practices, you can safeguard your company’s financial interests and reputation.

Key Takeaways: Does business insurance cover employee theft or dishonesty?

- Business insurance typically covers employee theft or dishonesty through Employee Dishonesty Coverage.

- This coverage helps protect businesses from financial losses caused by fraudulent acts committed by employees.

- Employee Dishonesty Coverage may cover employee theft of money, securities, or property.

- However, it’s important to note that this coverage usually has certain limitations and exclusions.

- Business owners should carefully review their insurance policies and consider additional coverage options to protect against employee theft or dishonesty adequately.

Frequently Asked Questions

What does business insurance cover?

Business insurance typically covers a range of risks and liabilities that a business may face. This can include coverage for property damage, liability claims, and even employee theft or dishonesty in some cases. However, reviewing your specific policy is essential to understand the extent of coverage provided.

Business insurance policies can vary, so it’s crucial to consult with your insurance provider to ensure you have the appropriate coverage for your needs. They can help you understand your policy’s specific inclusions and exclusions and guide you on any additional coverage you may require.

Does business insurance cover employee theft?

Yes, specific business insurance policies can cover employee theft or dishonesty. This type of coverage is commonly known as employee dishonesty insurance or crime insurance. It protects in case an employee engages in theft, embezzlement, or any other dishonest act that causes financial harm to your business.

It’s important to note that employee theft coverage may have specific limitations and conditions outlined in your policy. For example, there may be a requirement to provide evidence of the theft or dishonest act or limit the maximum amount of coverage provided. Reviewing your policy and discussing it with your insurance provider will help you understand the scope of coverage for employee theft.

What should I do if I suspect employee theft?

If you suspect employee theft in your business, handling the situation carefully and professionally is essential. Here are a few steps you can take:

1. Gather evidence: Collect evidence supporting your suspicions, such as financial records, video footage, or witness statements.

2. Consult legal counsel: Seek advice from an attorney or legal expert specializing in employment law to ensure you follow the correct procedures.

3. Report the incident: Notify your insurance provider about the suspected employee theft and follow their instructions.

4. Conduct an internal investigation: Conduct a thorough internal investigation to gather more evidence and identify the responsible party.

Handling these situations carefully and respecting all employees’ rights is crucial. Professional guidance can help you navigate the process correctly and protect your business.

Can business insurance cover losses from employee dishonesty?

Yes, business insurance can provide coverage for losses resulting from employee dishonesty. This coverage protects businesses from financial harm caused by fraudulent activities committed by employees, such as theft, forgery, or embezzlement.

Reviewing your insurance policy to understand the specific terms and conditions related to employee dishonesty coverage is essential. Your insurance provider can guide you on the extent of coverage provided and any additional steps you may need to take to claim in the event of employee dishonesty.

Is employee theft covered under general liability insurance?

No, employee theft is not typically covered under general liability insurance. Public liability insurance primarily covers third-party claims for bodily injury, property damage, and personal injury. It does not usually cover losses resulting from employee theft or dishonesty.

For coverage related explicitly to employee theft, businesses must obtain a separate policy, such as employee dishonesty or crime insurance. These policies are designed to address the risks associated with employee dishonesty and provide coverage for financial losses resulting from such acts.

Final Summary: Does Business Insurance Cover Employee Theft or Dishonesty?

So, we’ve delved into business insurance and explored whether it covers employee theft or dishonesty. The short answer is yes, it can! Business insurance policies often include coverage for these unfortunate situations because, let’s face it, you can never be too careful when protecting your business from internal risks. However, it’s important to note that not all policies are created equal, and the extent of coverage may vary.

When safeguarding your business against employee theft or dishonesty, having the right insurance policy can provide peace of mind. It’s like having a safety net that catches you when things go awry. While we all hope for the best, it’s essential to be prepared for the worst, and that’s where business insurance comes into play.

When selecting a policy, it’s crucial to carefully review the terms and conditions to ensure that employee theft and dishonesty are covered. Some policies may have specific exclusions or limitations, so it’s essential to clearly understand what is included and what falls outside the scope of coverage. Additionally, it’s advisable to implement strong internal controls and security measures to prevent such incidents in the first place.

In conclusion, business insurance can cover employee theft or dishonesty, but choosing a policy that suits your needs and provides adequate coverage is vital. Remember, prevention is better than cure, so take proactive steps to protect your business and foster an environment of trust and integrity among your employees. With the right insurance and preventive measures, you can focus on growing your business with confidence and peace of mind.