Have you ever wondered what would happen to your business if a key person suddenly couldn’t work? It’s a scary thought, but luckily, there’s a solution: critical person insurance. So, what exactly is key person insurance, and how does it protect your business? Let’s dive in and find out.

Critical person insurance is a type of life insurance that provides financial protection to a business if a key employee or owner passes away. This insurance policy is specifically designed to cover the loss of a crucial individual whose skills, knowledge, or expertise are vital to the company’s success. Think of it as a safety net for your business, ensuring your company can thrive if the unexpected happens. But how does it work? Well, when a key person covered by the insurance policy passes away, the company receives a payout from the insurance company. This payout can help the business navigate through the difficult transition period, providing funds for things like hiring and training a replacement, paying off debts, or even covering losses in revenue. So, it’s not just about protecting your business financially but also ensuring its stability and continuity in the face of adversity. Now that we better understand critical personal insurance let’s explore its importance and benefits in more detail.

Critical person insurance is a policy that protects your business by providing financial support if you lose a crucial employee or business partner. It covers expenses like recruitment costs, loss of profits, and debt repayment. This insurance ensures your business can continue operating smoothly during difficult transitions. Safeguarding against the potential financial impact of losing a key person allows your business to focus on recovery and minimize disruption.

Understanding Key Person Insurance and its Importance for Business Protection

Critical person insurance is a type of life insurance policy that is specifically designed to protect a business in the event of the death or disability of a key employee or owner. This insurance policy provides financial compensation to the industry to help cover the costs of finding, hiring, and training a replacement and mitigate the potential loss of revenue and clients during the transition period.

What is Key Person Insurance?

Critical person insurance, also known as key man or necessary employee insurance, is a crucial risk management tool for businesses of all sizes. It recognizes the significant contributions and value that specific individuals bring to a company and aims to safeguard the business against the financial impact of losing them. The business typically takes out This type of insurance on the key employee’s life, with the company named as the beneficiary.

How Does Key Person Insurance Work?

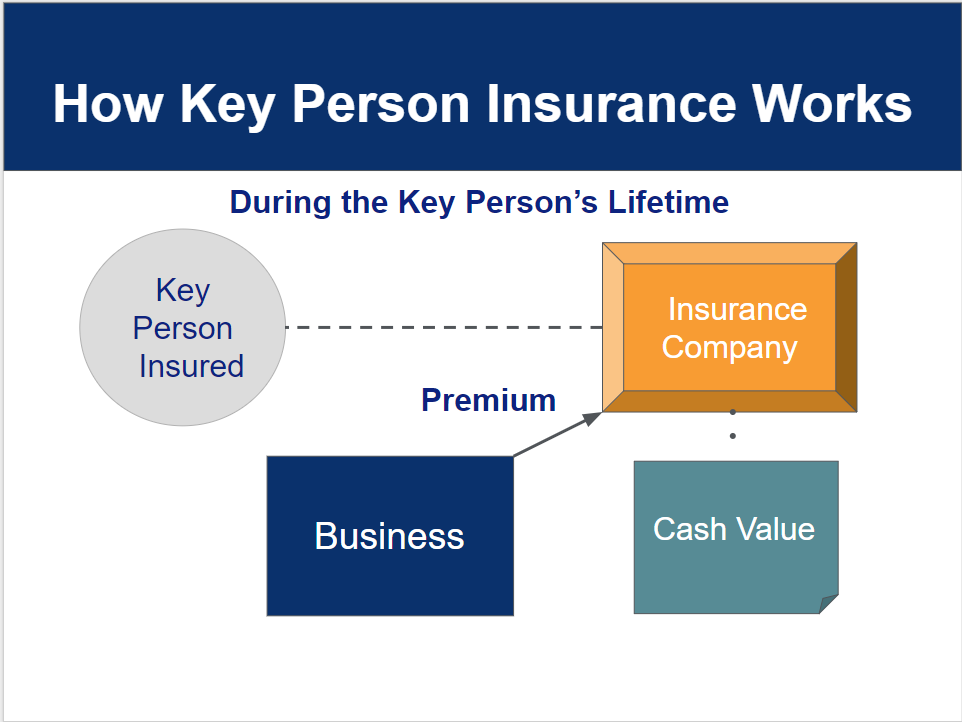

Critical person insurance works by providing a payout to the business in the event of the death, disability, or critical illness of the insured key person. The industry owns the policy, and the company pays the premiums. In the event of a covered incident, the insurance proceeds can be used by the business to cover various expenses, such as recruiting and training a replacement, paying off debts, compensating for lost profits, or even buying out the deceased or disabled person’s shares.

The coverage amount of critical person insurance is typically determined based on the estimated financial impact the loss of the key person would have on the business. Factors such as the person’s role, responsibilities, expertise, and revenue generation potential are considered when calculating the coverage amount. Businesses must regularly reassess their crucial personal insurance coverage to ensure it aligns with the current value and impact of the insured individual.

The Benefits of Key Person Insurance

Critical person insurance offers several benefits to businesses, providing them with a safety net during challenging times. Here are some key advantages of having necessary personal insurance in place:

1. Financial Protection: Key person insurance provides financial protection to the business in the event of the loss of a key employee. The insurance payout can help the company manage the immediate economic impact and maintain stability during the transition period.

2. Business Continuity: Losing a key person can significantly disrupt the operations of a business. Critical person insurance helps ensure business continuity by providing funds for recruitment, training, and other expenses associated with finding a suitable replacement.

3. Creditor Protection: Key person insurance can protect the business from potential creditor claims. The insurance proceeds can be used to settle outstanding debts and obligations, reducing the risk of financial strain on the company.

4. Employee and Stakeholder Confidence: Having critical person insurance demonstrates to employees, stakeholders, and investors that the business has a plan to manage unforeseen events. This can instill confidence and trust in the company’s ability to navigate challenging circumstances.

Critical Person Insurance vs. Other Types of Business Insurance

Critical person insurance is often confused with other types of business insurance, such as group life insurance or general liability insurance. While these policies serve different purposes, they can complement each other to provide comprehensive coverage for the business. Here are some critical differences between crucial person insurance and other types of business insurance:

1. Key Person Insurance vs. Group Life Insurance: Group life insurance is typically offered to all company employees, providing a lump sum payout to the beneficiaries during an employee’s death. Critical: On the other hand, necessary person insurance focuses on protecting the business against losing a specific key individual crucial to its operations and success.

2. Key Person Insurance vs. General Liability Insurance: General liability insurance protects businesses against claims of negligence or damages caused to third parties. On the other hand, critical person insurance provides financial compensation to the company itself in the event of the loss of a crucial individual. These two types of insurance serve different purposes and address other risks.

Businesses must assess their specific insurance needs and consider a combination of policies to ensure comprehensive coverage.

Critical Considerations for Key Person Insurance

When considering critical person insurance for your business, there are a few essential factors to remember. Here are some key considerations:

1. Identify the Key Persons: Start by identifying the individuals within your organization who play a critical role in its success. These individuals may include key executives, business owners, top salespeople, or employees with specialized skills or knowledge.

2. Assess Financial Impact: Determine the potential financial impact of each key person’s loss on your business. Consider factors such as revenue generation, client relationships, expertise, and the time and cost associated with finding and training a replacement.

3. Determine Coverage Amount: Work with an insurance professional to determine the appropriate coverage amount for each key person based on the financial impact assessment. Consider factors such as salary, expected future earnings, and the cost of recruiting and training a replacement.

4. Regularly Review and Update Coverage: Reviewing and updating your critical person insurance coverage is essential as your business evolves. Changes in personnel, business growth, or shifts in responsibilities may warrant adjustments to the coverage amount or the addition of new key persons to the policy.

5. Seek Professional Guidance: Key person insurance can be complex, and it is advisable to seek professional guidance from an insurance specialist or financial advisor who can help you navigate the various options and ensure you have the right coverage in place.

In conclusion, key person insurance is critical to businesses’ comprehensive risk management strategy. It provides financial protection and stability in losing a key employee or business owner. By understanding the essential importance of person insurance and taking the necessary steps to assess your business’s specific needs, you can ensure that your company is well-prepared to navigate unexpected challenges and secure its long-term success.

Key Takeaways:

- Critical person insurance is a type of insurance that protects your business in the event of the death or disability of a key employee.

- It provides financial support to help cover the costs of hiring and training a replacement and any potential loss of revenue or clients.

- This insurance policy can help your business stay afloat during a difficult transition period and prevent financial hardship.

- You are identifying the critical person in your business and determining the appropriate coverage needed.

- Having critical person insurance in place can give you peace of mind and protect the future of your business.

Frequently Asked Questions

What is critical person insurance?

Critical person insurance is a type of life insurance policy that is taken out by a business on the life of a key employee or owner. It is designed to provide financial protection to the company in the event of the death or disability of the insured individual. The policy pays out a lump sum benefit to the business, which can cover expenses such as hiring and training a replacement, paying off debts, or even keeping the company afloat during a difficult transition period.

Critical person insurance is an important risk management tool for businesses, particularly those that rely heavily on the skills, knowledge, or relationships of a few key individuals. By having this insurance in place, companies can protect themselves from the financial impact of losing a key person and ensure the continuity of their operations.

How does critical person insurance protect my business?

Critical person insurance protects your business by providing a financial safety net in case of the loss of a key employee or owner. If the insured individual were to pass away or become disabled, the policy would pay the business a lump sum benefit. This benefit can be used to cover various expenses that may arise due to losing a critical person.

For example, the benefit can be used to hire and train a replacement for the key person, ensuring that the business can operate smoothly. It can also be used to pay off any outstanding debts or loans the business may have, reducing the financial burden on the company. Additionally, the benefit can help cover the costs of finding and retaining new clients or customers and provide a cushion to assist the business with any financial difficulties that may arise during the transition period.

Who should consider getting critical person insurance?

Any business that relies heavily on a key employee or owner’s expertise, knowledge, or relationships should consider getting critical person insurance. This includes companies of all sizes, from small startups to large corporations. Necessary person insurance can be essential for businesses that are highly dependent on the contributions of a few key individuals, as the loss of such individuals can have a significant impact on the company’s operations and financial stability.

It is also worth considering critical person insurance if your business has outstanding debts or loans that would need to be repaid if losing a key person. The insurance benefit can help cover these costs, ensuring the company does not face additional financial strain during a difficult time.

How is the premium for crucial personal insurance determined?

The premium for critical person insurance is determined based on several factors, including the insured individual’s age, health, occupation, and the coverage amount and duration of the policy. Generally, the younger and healthier the insured individual, the lower the premium.

Other factors that can influence the premium include the nature of the business, its financial stability, and the risk associated with the critical person. For example, a company in a high-risk industry may have to pay a higher premium compared to a business in a low-risk industry. Working with an insurance agent or broker specializing in critical person insurance is essential to determine the most appropriate coverage and premium for your business.

Can critical person insurance be tax deductible for my business?

Critical person insurance premiums are often considered a legitimate business expense and may be tax deductible. However, the tax treatment of necessary personal insurance can vary depending on the jurisdiction and specific circumstances. It is recommended to consult with a tax professional or accountant to understand the tax implications of critical person insurance for your business.

Additionally, the payout received from a key person insurance policy is generally not subject to income tax, as it is considered a return of capital rather than income. However, it is essential to note that tax laws and regulations can change, so it is always a good idea to stay informed and seek professional advice to ensure compliance with the current tax rules.

Final Summary: Key Person Insurance – Protecting Your Business

In conclusion, critical person insurance is a crucial safeguard for your business, providing financial protection and stability in the face of unforeseen circumstances. This type of insurance ensures that your company can thrive even if a key employee or executive can no longer contribute their expertise. Critical person insurance shields your business from potential setbacks by covering the financial impact of losing a key person, such as recruitment and training costs, loss of revenue, and loans or debts. It allows you to focus on maintaining operations and growth.

By investing in critical person insurance, you are taking proactive steps to mitigate risk and protect the future of your business. This insurance policy acts as a safety net, providing funds to navigate challenging times and facilitating a smooth transition during a critical person’s absence. It offers financial security and instills confidence in stakeholders, clients, and investors, showcasing your commitment to business continuity and resilience.

Remember, critical person insurance is an essential tool for protecting your business. It ensures your business can thrive and succeed even if your star player is temporarily out of the game. So, please don’t wait until it’s too late. Please take the necessary steps to safeguard your business’s future by considering critical personal insurance and enjoy the peace of mind it brings.