So, you’re planning a one-time event or project for your business and wondering if you can purchase insurance specifically for that occasion. Well, I’ve got some good news for you! In this article, we’ll explore the answer to the question, “Can I purchase business insurance for a one-time event or project?” and provide you with all the information you need to make an informed decision. So, let’s dive right in!

Insurance is a crucial aspect that should never be overlooked when protecting your business. Whether organizing a special event, launching a new product, or embarking on a short-term project, having the right insurance coverage can provide peace of mind and protect you from potential risks and liabilities. The good news is that many insurance providers offer policies tailored explicitly for one-time events or projects. These short-term or event insurance policies can be customized to meet your unique needs and provide coverage for various scenarios. So, whether hosting a conference, planning a trade show, or organizing a charity fundraiser, you can find insurance to safeguard your business during the event or project. Now, let’s explore the types of coverage you can obtain and the benefits they offer.

Can I Purchase Business Insurance for a One-Time Event or Project?

When starting a new business or taking on a temporary project, one of the questions that often arises is whether it is possible to purchase business insurance for a one-time event or project. This is an important consideration, as insurance can protect your business and its assets. In this article, we will explore the options for obtaining insurance coverage for short-term ventures and discuss the benefits and considerations of doing so.

Understanding Business Insurance

Before delving into the specifics of purchasing insurance for a one-time event or project, it is crucial to have a solid understanding of what business insurance entails. Business insurance is designed to protect your company from financial losses that may arise from unexpected events or liabilities. It typically covers a range of risks, including property damage, legal claims, and accidents.

Business insurance policies can be tailored to suit the unique needs of your business, offering protection against specific risks relevant to your industry. While some insurance policies are ongoing and cover your company for an extended period, short-term coverage options are available, such as one-time events or projects.

Options for One-Time Event or Project Insurance

Several options exist when obtaining insurance coverage for a one-time event or project. One common choice is event insurance, specifically designed to cover a single event, such as a conference, trade show, or festival. Event insurance can protect against risks such as property damage, liability claims, and cancellations.

Some insurance providers offer project-specific coverage, allowing you to obtain insurance for a temporary venture or assignment. This type of insurance can benefit businesses that take on short-term projects, such as construction companies or event planners.

Benefits of One-Time Event or Project Insurance

There are several benefits to purchasing insurance for a one-time event or project. Firstly, it provides financial protection in unexpected circumstances, such as property damage or legal claims. This can help mitigate the financial burden on your business and ensure that you can continue operating smoothly.

Furthermore, having insurance coverage can enhance your credibility and professional reputation. Clients and partners may feel more confident working with your business, knowing you have taken steps to protect yourself and mitigate potential risks. This can lead to increased opportunities and a more positive brand image.

Considerations for One-Time Event or Project Insurance

While there are many benefits to obtaining insurance for a one-time event or project, there are also some essential considerations to remember. Firstly, it is crucial to carefully assess the risks associated with your specific event or project and ensure that the insurance policy you choose adequately covers those risks.

Additionally, it is essential to review the terms and conditions of the insurance policy, including any exclusions or limitations. Understanding the scope of coverage and potential gaps can help you make an informed decision and ensure you have the necessary protection.

Lastly, comparing insurance quotes and policies from different providers is essential to ensure you get the best coverage at the most competitive price. Taking the time to research and compare options can save you money and provide you with peace of mind.

In Summary

Purchasing business insurance for a one-time event or project is possible and can provide valuable protection for your business. Whether through event insurance or project-specific coverage, options are available to suit your needs. By carefully considering the benefits and considerations, you can make an informed decision and ensure that your business is adequately protected.

Key Takeaways:

- Yes, you can purchase business insurance for a one-time event or project.

- Insurance coverage can protect your business from financial loss due to accidents or damages during the event or project.

- It is essential to assess the specific risks associated with the event or project and choose insurance coverage accordingly.

- Insurance policies for one-time events or projects are often customizable to meet your needs.

- Consulting with an insurance agent or broker can help you navigate the options and find the right coverage for your business.

Frequently Asked Questions

1. Can I purchase business insurance for a one-time event or project?

Yes, you can purchase business insurance for a one-time event or project. Many insurance companies offer short-term policies to cover businesses for a limited period. These policies provide coverage against potential risks and liabilities that may arise during the event or project.

Assessing risks is essential when considering insurance for a one-time event or project. Different types of events or projects may have additional insurance requirements. For example, if you are organizing a public event, you may need liability insurance to protect against accidents or injuries that may occur on-site. On the other hand, if you are working on a construction project, you may require construction insurance to cover potential damages or injuries at the site.

2. What coverage can I get for a one-time event or project?

The types of coverage you can get for a one-time event or project depend on the nature of the event or project and the specific risks involved. Some common types of coverage include general liability insurance, property insurance, event cancellation insurance, and equipment insurance.

General liability insurance covers third-party bodily injury or property damage claims that may arise during the event or project. Property insurance protects your business property, such as equipment or inventory, against theft, damage, or loss. Event cancellation insurance provides coverage if the event needs to be canceled or postponed due to unforeseen circumstances, such as extreme weather or a natural disaster. Equipment insurance covers repairing or replacing damaged or stolen equipment during the event or project.

3. How much does business insurance for a one-time event or project cost?

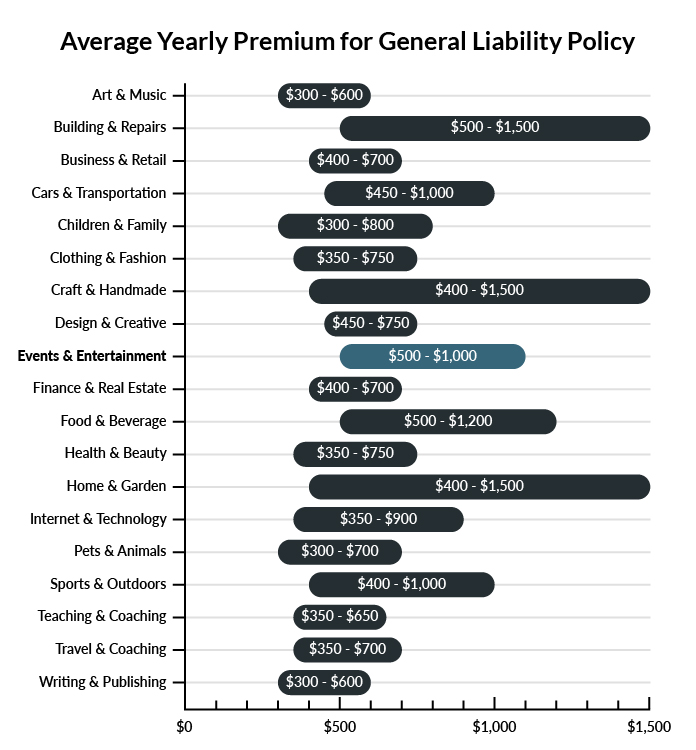

The cost of business insurance for a one-time event or project can vary depending on several factors. These factors include the type of event or project, the level of coverage required, the number of attendees or participants, the location, and the duration of the event or project.

Insurance companies typically calculate the cost of coverage based on these factors and provide a customized quote. Obtaining multiple quotes from different insurance providers to compare prices and coverage options is recommended. Doing so can ensure you get the best value for your insurance investment.

4. How do I choose the right insurance provider for my one-time event or project?

Choosing the right insurance provider for your one-time event or project is crucial to ensure that you have adequate coverage and support in case of any unforeseen incidents. Here are a few factors to consider when selecting an insurance provider:

1. Reputation and experience: Look for insurance companies with a good reputation and a track record of providing reliable coverage for similar events or projects.

2. Coverage options: Assess the types of coverage offered by different providers and choose one that aligns with your specific needs and risks.

3. Cost: Compare quotes from different insurance providers to find the most competitive price without compromising coverage.

4. Customer service: Consider the level of customer service the insurance company provides, including their responsiveness and willingness to answer your questions or address your concerns.

5. Can I change my insurance policy if my one-time event or project evolves?

You can change your insurance policy if your one-time event or project evolves or requires additional coverage. It is essential to inform your insurance provider about any changes or updates to ensure adequate protection.

However, reviewing your insurance policy before the event or project starts is recommended to ensure that it covers all the necessary risks and liabilities. Making changes to the policy during the event or project may require additional documentation or adjustments in coverage, which could cause delays or complications.

Final Summary: Can I Purchase Business Insurance for a One-Time Event or Project?

So, you’re planning a one-time event or project and wondering if you can purchase business insurance to protect yourself and your investment. Well, the answer is a resounding yes! While business insurance is typically associated with ongoing operations, many insurance providers offer policies tailored for one-time events or projects. These policies provide coverage for a limited period, protecting against unforeseen circumstances that could derail your plans.

When purchasing insurance for a one-time event or project, it’s essential to consider the specific needs and risks associated with your endeavor. Whether you’re organizing a large-scale conference, hosting a special event, or embarking on a short-term project, insurance options are available to suit your unique requirements. There are various coverage options, from general liability insurance to protect against bodily injury or property damage to event cancellation insurance to mitigate financial losses if your event is called off.

Not only does obtaining business insurance for a one-time event or project provide you with peace of mind, but it also demonstrates professionalism and a commitment to safeguarding your investment. By taking the necessary precautions and securing the right insurance coverage, you can focus on making your event or project successful without worrying about potential setbacks or liabilities. Remember, it’s always better to be prepared and protected, so don’t hesitate to explore your options and find the perfect insurance solution for your one-time event or project.