In this digital age, where cyber-attacks and data breaches are rising, businesses must protect themselves from potential threats. But the question on everyone’s mind is, “Does business insurance cover cyber-attacks and data breaches?” Well, fear not because I’m here to shed some light on this critical topic.

When safeguarding your business from cyber threats, having the right insurance coverage can make all the difference. Cyber insurance, or cyber liability insurance, protects businesses from the financial losses and liabilities associated with cyber-attacks and data breaches. It’s like a superhero cape for your business, swooping in to save the day when things go awry in the digital realm.

Now, you might be wondering what cyber insurance covers. It typically includes expenses related to investigating and managing a cyber incident, such as hiring forensic experts, notifying affected parties, and offering credit monitoring services. It can also help cover legal fees and settlements if your business is sued due to a cyber incident. In addition, cyber insurance may provide coverage for business interruption losses, where you can receive compensation for income lost during the downtime caused by a cyber-attack or data breach.

So, if you’re worried about the potential financial impact of a cyber-attack or data breach on your business, it’s time to consider cyber insurance as your trusty sidekick. With the right coverage in place, you can have peace of mind knowing that your business is protected against the ever-evolving threats lurking in the digital world.

Does Business Insurance Cover Cyber-Attacks and Data Breaches?

Businesses today face numerous risks, including the ever-present threat of cyber-attacks and data breaches. These incidents can result in significant financial and reputational damage, making it crucial for businesses to protect themselves. One important consideration is whether business insurance covers these types of incidents. In this article, we will explore whether business insurance policies typically provide coverage for cyber-attacks and data breaches.

Understanding Cyber Insurance

Cyber insurance, also known as cyber liability insurance or data breach insurance, is a type of insurance coverage designed to protect businesses from the financial consequences of cyber-attacks and data breaches. This coverage can help companies recover from the costs of responding to an incident, such as legal expenses, notification and credit monitoring services for affected individuals, public relations efforts, and even regulatory fines.

It’s important to note that cyber insurance is not typically included in standard commercial general liability (CGL) policies. Instead, it is usually offered as a separate policy or an endorsement of existing policies. This specialized coverage addresses the unique risks and exposures associated with cyber incidents.

What Does Cyber Insurance Cover?

Cyber insurance policies can vary in coverage and exclusions, so it’s essential to review the specifics of each policy carefully. However, some common coverages provided by cyber insurance policies include:

- Data Breach Response: Coverage for the costs associated with responding to a data breach, such as forensic investigations, legal expenses, notification services, and credit monitoring for affected individuals.

- Third-Party Liability: Protection against claims and lawsuits resulting from a cyber incident, such as allegations of negligence or failure to safeguard sensitive information.

- Business Interruption: Coverage for lost income and additional expenses from a cyber incident that disrupts business operations.

- Extortion and Ransomware: Coverage for expenses related to cyber extortion threats, including ransom payments.

- Reputation Management: Coverage for public relations efforts and other expenses to preserve and restore the business’s reputation following a cyber incident.

It’s important to note that cyber insurance policies may have specific conditions and exclusions, so it’s crucial to read the policy carefully and understand its terms and limitations.

Benefits of Cyber Insurance

Investing in cyber insurance can provide several benefits for businesses:

- Financial Protection: Cyber insurance can help protect businesses from the significant costs of a cyber-attack or data breach. These include legal fees, notification expenses, and even regulatory fines.

- Risk Mitigation: Cyber insurance coverage can demonstrate to clients, partners, and stakeholders that a business takes cyber risk management seriously. This can help build trust and credibility.

- Response Assistance: Many cyber insurance policies also provide access to resources and support to help businesses respond effectively to cyber incidents. This can include incident response teams, legal counsel, and public relations experts.

- Peace of Mind: Knowing that insurance coverage is in place can give business owners peace of mind, allowing them to focus on running their business rather than worrying about the potential financial consequences of a cyber incident.

Cyber Insurance vs. Other Insurance Policies

While some traditional insurance policies may provide limited coverage for certain aspects of cyber risks, they are not designed to comprehensively address the unique risks associated with cyber-attacks and data breaches. For example, a commercial property policy may cover physical damage to computer equipment but may not cover the costs associated with recovering from a cyber-attack.

It’s important to carefully review existing insurance policies to understand what coverage, if any, they may provide for cyber risks. In many cases, businesses must supplement their existing coverage with a dedicated cyber insurance policy to protect them adequately.

The Importance of Cyber Security Measures

While having cyber insurance coverage is essential, it should not be the only defense against cyber-attacks and data breaches. Implementing robust cyber security measures is crucial for preventing and mitigating the risks associated with these incidents. Here are some critical steps businesses can take:

1. Regularly Update Software and Systems

Keeping software and systems up to date is essential for addressing known vulnerabilities and protecting against cyber threats. Regularly install updates and patches provided by software vendors and ensure that all systems are correctly configured and secured.

2. Train Employees on Cyber Security Best Practices

Employees play a critical role in maintaining cyber security. Provide training on topics such as password hygiene, recognizing phishing emails, and the importance of reporting any potential security incidents or concerns.

3. Implement Multi-Factor Authentication

Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of identification, such as a password and a unique code sent to their mobile device. This can help prevent unauthorized access to sensitive data and systems.

4. Regularly Back Up Data

Regularly backing up data is crucial for ensuring critical information is not lost during a cyber incident. Implement a robust backup system and periodically test the restoration process to ensure data can be recovered effectively.

5. Use Strong Passwords

Encourage employees to use strong, unique passwords for all accounts and systems. Passwords should be complex, consisting of a combination of letters, numbers, and special characters. Implementing a password management tool can help employees generate and securely store strong passwords.

6. Encrypt Sensitive Data

Encrypting sensitive data adds a layer of protection by encoding information in a way that can only be accessed with a unique encryption key. This can help prevent unauthorized access to sensitive information in a breach.

7. Conduct Regular Security Audits

Regularly assess and evaluate the effectiveness of your cyber security measures through comprehensive security audits. This can help identify vulnerabilities and areas for improvement, allowing you to address potential risks proactively.

In conclusion, while business insurance policies may not automatically cover cyber-attacks and data breaches, specialized cyber insurance can provide financial protection. However, it’s essential for businesses to also focus on implementing strong cyber security measures to prevent and mitigate the risks associated with these incidents.

Key Takeaways

- Business insurance can provide coverage for cyber-attacks and data breaches.

- Businesses need to have a comprehensive insurance policy that includes cyber liability coverage.

- Cyber insurance can help cover costs related to data breaches, including legal fees and notification expenses.

- Businesses should review their insurance policies to ensure adequate coverage for cyber risks.

- Cyber insurance can provide businesses financial protection and peace of mind during a cyber-attack or data breach.

Frequently Asked Questions

Question 1: How does business insurance protect against cyber-attacks and data breaches?

Depending on the specific policy, Business insurance can cover cyber-attacks and data breaches. Cyber liability insurance protects businesses from financial losses and legal liabilities resulting from cyber incidents. It typically covers expenses related to data breaches, such as forensic investigations, notification costs, credit monitoring, and legal fees.

In addition, cyber liability insurance may also provide coverage for business interruption losses, extortion attempts, and reputation management expenses. It is essential for businesses to carefully review their insurance policies and consult with an insurance professional to ensure they have adequate coverage for cyber risks.

Question 2: What types of businesses should consider purchasing cyber liability insurance?

In today’s digital age, almost every business faces cyber risks regardless of its size or industry. Any company that handles sensitive customer information, such as credit card details or personal data, should consider purchasing cyber liability insurance. This includes businesses in finance, healthcare, retail, and technology sectors.

However, businesses that do not directly handle sensitive data can still be at risk. Cyber-attacks can target any organization seeking to disrupt operations, steal intellectual property, or exploit system vulnerabilities. It is always better to be proactive and have proper insurance coverage to mitigate the potential financial and reputational damage caused by a cyber incident.

Question 3: Are there any exclusions or limitations to cyber liability insurance coverage?

Cyber liability insurance may have specific exclusions and limitations like any insurance policy. Typical exclusions may include losses caused by acts of war, intentional acts, or fraudulent activities. It is essential for businesses to carefully review their policy documents to understand the specific exclusions and limitations that apply to their coverage.

Additionally, cyber liability insurance may have sub-limits for certain types of losses, such as fines and penalties imposed by regulatory authorities. Businesses should also be aware that coverage may vary depending on the insurance provider, so comparing policies and selecting the one that best suits their needs is essential.

Question 4: Can business insurance help recover from a cyber-attack or data breach?

Yes, business insurance can be crucial in helping a company recover from a cyber-attack or data breach. Insurance coverage can provide financial support to cover the costs of investigating the incident, notifying affected parties, and restoring systems and data.

Furthermore, some policies may offer access to specialized services, such as incident response teams and public relations experts, to assist with managing the aftermath of a cyber incident. These resources can help businesses minimize the impact on their reputation and customer trust, allowing them to focus on returning to normal operations.

Question 5: How can businesses ensure adequate cyber liability insurance coverage?

To ensure they have adequate cyber liability insurance coverage, businesses should follow a few key steps:

1. Assess their cyber risks: Understand the potential threats and vulnerabilities specific to their industry and operations.

2. Review existing insurance policies: Determine if any policies provide coverage for cyber risks or if additional cyber liability insurance is needed.

3. Work with an insurance professional: Seek guidance from an experienced insurance professional who can help identify the right coverage options and tailor a policy to meet the business’s unique needs.

4. Regularly review and update coverage: As cyber risks evolve, it is essential for businesses to regularly review and update their insurance coverage to ensure it remains adequate and up-to-date.

By following these steps, businesses can enhance their cyber resilience and protect themselves against the financial and reputational consequences of cyber-attacks and data breaches.

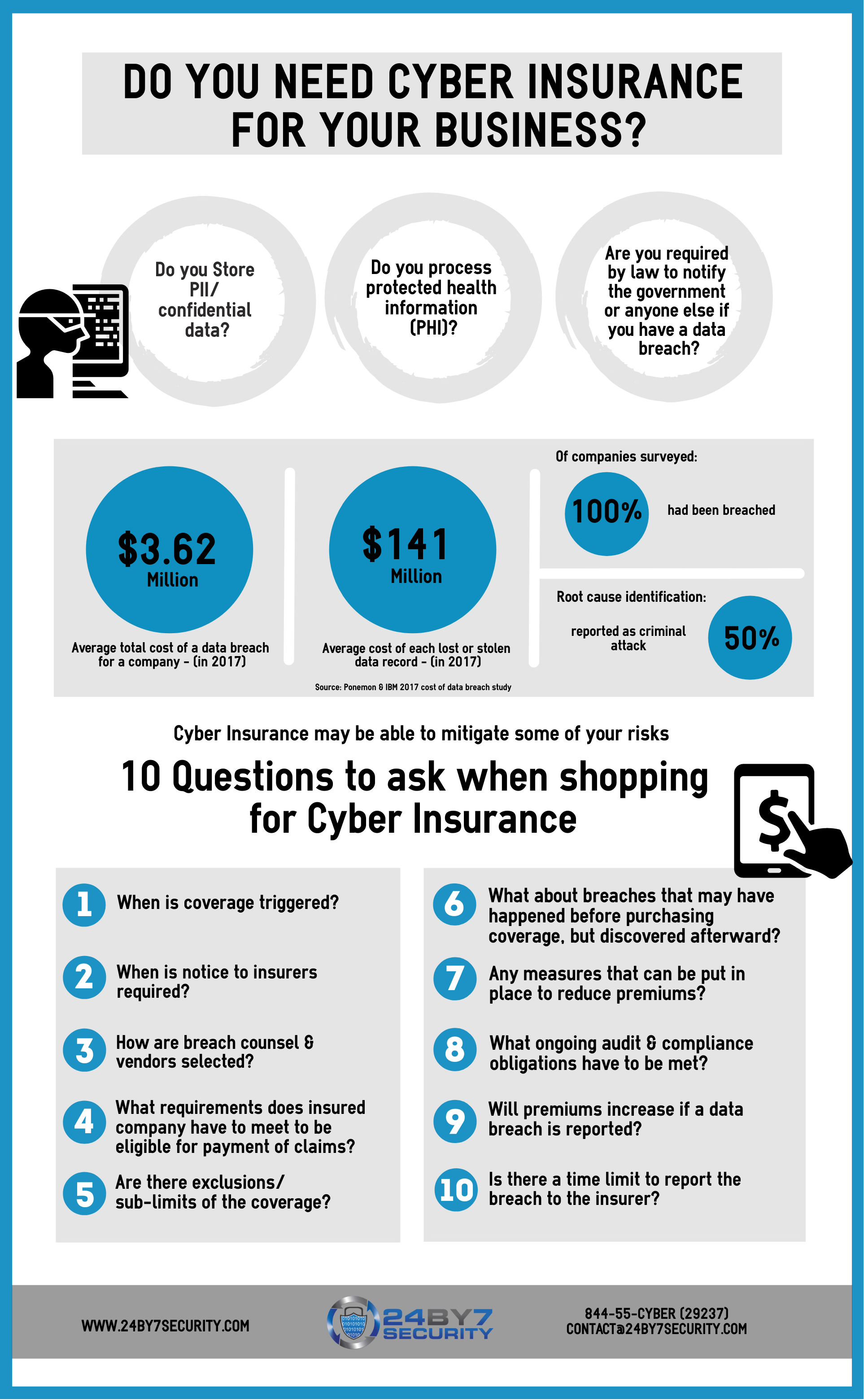

Does Your Company Need Cyber Insurance to Address Breach Risk?

Final Thought: Does Business Insurance Cover Cyber-Attacks and Data Breaches?

After exploring whether business insurance covers cyber-attacks and data breaches, it is clear that having the right insurance coverage is crucial in today’s digital landscape. While traditional business insurance policies may not explicitly cover cyber risks, specialized policies can provide the necessary protection. Businesses must assess their specific needs and risks and then work with an insurance provider to tailor a policy that adequately addresses cyber threats.

In this digital age, where cyber-attacks and data breaches are becoming increasingly common, businesses cannot afford to overlook the importance of insurance coverage. Cyber insurance policies can safeguard against financial losses from cyber incidents, including the costs of investigating and resolving breaches, legal expenses, and potential liability claims. By investing in a comprehensive cyber insurance policy, businesses can mitigate the financial and reputational damage that can result from cyber-attacks and data breaches.

Remember, prevention is always better than cure, and implementing robust cybersecurity measures should be a top priority for businesses. However, even with the best security measures, cyber incidents are always risky. That’s where cyber insurance comes in, providing extra protection and peace of mind. So, to safeguard your business from the potentially devastating consequences of cyber-attacks and data breaches, consider exploring the options available for cyber insurance coverage and working with a knowledgeable insurance provider to tailor a policy that meets your specific needs. Don’t let cyber threats catch you off guard; be proactive and protect your business with the right insurance coverage.