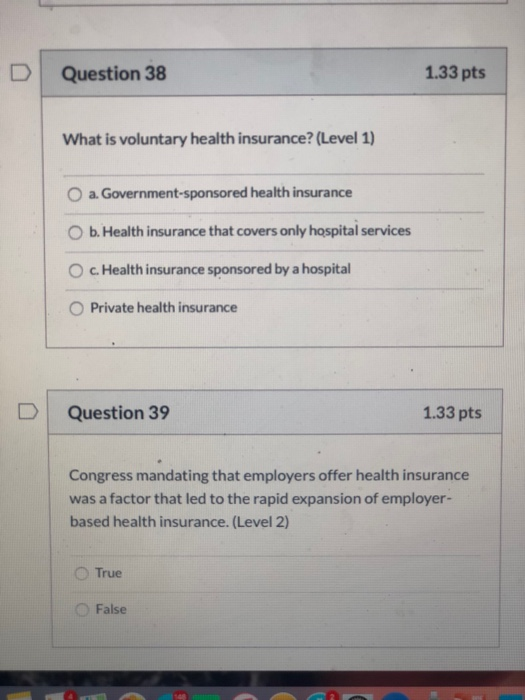

Voluntary or private health insurance is a type of coverage individuals can choose to purchase independently. It provides additional benefits and services beyond what is typically covered by government-funded or employer-provided health insurance plans. So, what is voluntary health insurance all about?

Imagine this: You’re at a carnival with a long line for the Ferris wheel. You can either wait in line with everyone else, or you can choose to purchase a special pass that allows you to skip ahead and get on the ride faster. Voluntary health insurance is kind of like that special pass. It will enable you to access extra healthcare benefits and services that may not be included in your regular insurance plan. It’s like having a VIP ticket to better healthcare.

You can tailor your coverage to meet your specific needs with voluntary health insurance. You can choose from various plans and options, such as dental and vision coverage, prescription drug benefits, and alternative therapies. It’s like having a buffet of healthcare options where you can pick and choose what you want to include in your plan. So, whether you’re looking for extra peace of mind or additional services not covered by your primary insurance, voluntary health insurance can be a valuable addition to your healthcare arsenal.

Understanding Voluntary Health Insurance: A Comprehensive Guide

Voluntary or private health insurance is an insurance plan that individuals or families can purchase independently to cover medical expenses not typically covered by government-funded health insurance programs. While mandatory health insurance provides basic coverage for essential medical services, voluntary health insurance offers additional benefits and a higher level of coverage.

Many people choose to invest in voluntary health insurance to have more control over their healthcare options and to gain access to a broader range of medical services. This article will explore voluntary health insurance, its benefits, coverage options, and how it differs from mandatory health insurance.

The Benefits of Voluntary Health Insurance

Voluntary health insurance offers several advantages to policyholders. Firstly, it allows individuals to choose their preferred doctors, hospitals, and medical facilities. This means that policyholders can receive treatment from specialists or healthcare providers of their choice, ensuring they receive the best possible care.

Additionally, voluntary health insurance often covers services and treatments not covered by mandatory health insurance, such as dental care, vision care, and alternative medicine. This comprehensive coverage allows individuals to address their unique health needs and access broader healthcare services.

Expanded Coverage Options

One of the critical differences between mandatory and voluntary health insurance is the level of coverage provided. While compulsory health insurance typically covers essential medical services, voluntary health insurance offers expanded coverage options. This includes coverage for prescription medications, preventive care, mental health services, and elective procedures.

Individuals can tailor their coverage to suit their needs with voluntary health insurance. For example, if someone requires regular prescription medications, they can opt for a generous pharmaceutical coverage plan. This flexibility ensures that individuals have access to the medical services and treatments that are most important to them.

Access to Specialized Care

Voluntary health insurance often grants policyholders access to specialized care that may not be readily available through mandatory health insurance. This can include treatments from renowned specialists, access to cutting-edge medical technologies, and participation in clinical trials.

By having voluntary health insurance, individuals can seek the best medical care available, even if it means traveling to a different city or country. This can particularly benefit individuals with complex medical conditions requiring highly specialized treatments.

Choosing the Right Voluntary Health Insurance Plan

When selecting a voluntary health insurance plan, carefully considering your needs and budget is crucial. Here are some factors to keep in mind when comparing different plans:

1. Coverage Options

Review each plan’s coverage options to ensure they align with your healthcare needs. Consider specific services and treatments vital to you, such as maternity care, mental health services, or alternative therapies.

Some plans may also offer additional benefits, such as wellness programs, health screenings, or discounts on gym memberships. Evaluate these other perks to determine if they align with your health and wellness goals.

2. Network of Providers

Check the list of healthcare providers included in each plan’s network. Ensure that the plan covers your preferred doctors, hospitals, and specialists. This will allow you to continue receiving care from the providers you trust.

If you have a specific healthcare provider in mind, it is advisable to contact them directly to confirm whether they accept the insurance plan you are considering. This will help avoid any surprises or disruptions in your healthcare access.

3. Cost and Affordability

Compare the premiums, deductibles, and copayments associated with each plan. Selecting a plan that fits your budget and provides good value for the coverage offered is essential.

Consider your current health status and medical needs when evaluating costs. If you anticipate needing frequent medical care or have ongoing health conditions, you might benefit from a plan with higher premiums but lower out-of-pocket costs.

The Future of Voluntary Health Insurance

As healthcare needs continue to evolve, the demand for voluntary health insurance is expected to rise. With advancements in medical technology and the increasing cost of healthcare, individuals are seeking more comprehensive coverage options that cater to their specific needs.

Moreover, the COVID-19 pandemic has highlighted the importance of access to quality healthcare and the need for additional coverage options beyond mandatory health insurance. Voluntary health insurance can provide individuals with peace of mind, knowing they have enhanced coverage and greater control over their healthcare choices.

In conclusion, voluntary health insurance allows individuals to customize their healthcare coverage and gain access to a broader range of medical services. By carefully selecting a plan that aligns with their needs and preferences, individuals can enjoy the benefits of enhanced coverage, specialized care, and the flexibility to choose their healthcare providers. Whether for additional peace of mind or access to specific treatments, voluntary health insurance ensures individuals receive the necessary healthcare.

Key Takeaways: What is Voluntary Health Insurance?

- Voluntary health insurance is a type of health coverage individuals purchase independently.

- It provides additional benefits and coverage beyond what is offered by government-sponsored health insurance programs.

- Voluntary health insurance allows individuals to tailor their coverage to their needs and preferences.

- It can cover hospital stays, doctor visits, prescription medications, and preventive care.

- By having voluntary health insurance, individuals can have greater control over their healthcare and access to a broader range of healthcare providers.

Frequently Asked Questions

Voluntary health insurance is coverage that individuals purchase independently rather than through an employer or government program. It provides additional or supplementary coverage to the basic health insurance plan that a person may already have. Here are some commonly asked questions about voluntary health insurance:

1. What does voluntary health insurance cover?

Voluntary health insurance typically covers a range of medical services, including hospital stays, doctor visits, prescription medications, and preventive care. The specific coverage can vary depending on the insurance provider and the plan chosen by the individual. Some plans may offer additional benefits such as dental, vision, or mental health coverage.

It’s important to carefully review the details of the policy to understand what is covered and any limitations or exclusions that may apply.

2. Who can benefit from voluntary health insurance?

Voluntary health insurance can benefit individuals who may not have access to employer-sponsored health insurance or government programs. This includes self-employed individuals, freelancers, part-time workers, and those who are unemployed. It can also be a valuable option for individuals who want additional coverage beyond what their existing insurance plan provides.

Additionally, voluntary health insurance can offer peace of mind to individuals with specific health needs or who anticipate needing certain medical services. It provides an extra layer of financial protection against unexpected medical expenses.

3. How does voluntary health insurance work?

When individuals purchase voluntary health insurance, they typically pay a monthly premium to the insurance provider. In return, the provider agrees to cover a portion of the individual’s healthcare expenses as outlined in the policy. Depending on the plan’s terms, the individual may also be responsible for paying deductibles, copayments, or coinsurance.

It’s important to note that voluntary health insurance does not replace primary health insurance coverage. It is meant to supplement existing coverage or provide additional benefits. Individuals should carefully review the terms and conditions of the policy to understand how the coverage works and their financial responsibilities.

4. How can I choose the right voluntary health insurance plan?

When choosing a voluntary health insurance plan, it’s essential to consider your specific healthcare needs, budget, and preferences. Start by assessing the coverage options available and comparing them based on factors such as premiums, deductibles, copayments, and network of healthcare providers.

Additionally, consider the reputation and financial stability of the insurance provider. Read reviews and check their customer satisfaction ratings. It’s also a good idea to consult with an insurance agent or broker who can provide guidance and help you navigate through the different plan options.

5. Is voluntary health insurance worth it?

Whether voluntary health insurance is worth it depends on your circumstances and healthcare needs. The additional coverage and peace of mind it provides can be invaluable for some individuals. It can help cover unexpected medical expenses and provide access to a broader range of healthcare services.

However, it’s essential to weigh the cost of the premiums against the potential benefits. Consider your overall health, the likelihood of needing certain medical services, and your budget. Calculating the potential savings or out-of-pocket costs may be helpful based on different scenarios.

Ultimately, whether voluntary health insurance is worth it will vary from person to person. It’s important to carefully evaluate your options and choose a plan that aligns with your needs and financial situation.

Final Summary: Understanding the Benefits of Voluntary Health Insurance

So, there you have it, a comprehensive guide to understanding the concept of voluntary health insurance. This insurance coverage allows individuals to supplement their existing health insurance plans or acquire additional coverage tailored to their needs. Throughout this article, we explored voluntary health insurance’s essential features, advantages, and considerations.

By delving into voluntary health insurance, you can access a range of benefits that your regular health insurance may not cover. From extended prescription drug coverage to specialized treatments, voluntary health insurance offers an extra layer of protection and peace of mind. It allows individuals to take control of their healthcare journey and customize their coverage to suit their unique circumstances.

Remember, assessing your personal healthcare requirements, budget, and existing coverage is crucial when considering voluntary health insurance. Doing so lets you make an informed decision and select the right voluntary health insurance plan that aligns with your needs and preferences.

In a world where healthcare costs continue to rise, voluntary health insurance can be a valuable tool in safeguarding your well-being and financial stability. So, take charge of your health and explore the possibilities of voluntary health insurance. Your future self will thank you for it!

Final Thought: Unlocking the Potential of Voluntary Health Insurance

As we conclude our exploration of voluntary health insurance, it becomes clear that this type of coverage is more than just an optional add-on. It empowers individuals to bridge the gaps in their regular health insurance plans and cater to their healthcare needs. By embracing voluntary health insurance, you can tap into a world of possibilities and unlock various benefits.

So, whether you’re seeking coverage for alternative therapies, dental care, or even mental health services, voluntary health insurance can offer the flexibility and choice you desire. It allows you to confidently navigate the complex healthcare landscape and take control of your well-being. With voluntary health insurance, you no longer have to settle for a one-size-fits-all approach to your healthcare needs.

In conclusion, voluntary health insurance is a powerful tool that puts you in the driver’s seat of your healthcare journey. It offers a personalized and tailored approach to coverage, ensuring that you receive the care you need when you need it. So, don’t hesitate to explore the world of voluntary health insurance and unlock the potential it holds for your health and peace of