Ah, the world of health insurance. It can be confusing and frustrating, especially regarding out-of-network providers. You might wonder, “How does health insurance handle out-of-network providers?” Well, fret not, my friend, for I am here to shed some light on this topic.

Staying in-network is usually the best option when it comes to health insurance. It’s like having a cozy little community where your insurance plan has negotiated lower rates with certain doctors and hospitals. But what happens when you need to see a specialist or receive care from a provider not in that network? That’s where things can get a bit tricky.

Now, let’s explore the world of out-of-network providers and how health insurance handles them. Please grab a cup of tea, sit back, and unravel this mystery together. Trust me, by the end of this article, you’ll have a much better understanding of how health insurance deals with those elusive out-of-network providers. So, let’s get started, shall we?

How Does Health Insurance Handle Out-of-Network Providers?

Health insurance is vital for managing healthcare costs and ensuring access to necessary medical services. However, navigating the complexities of insurance coverage can be challenging, particularly for out-of-network providers. This article will explore how health insurance plans handle out-of-network providers and provide valuable information to help you understand your options.

Understanding In-Network and Out-of-Network Providers

Regarding health insurance, providers are categorized as either in-network or out-of-network. In-network providers contract with the insurance company, which typically results in discounted service rates. On the other hand, out-of-network providers do not have a contract with the insurance company and may charge higher rates for their services.

Your insurance plan will generally cover a significant portion of the cost when you visit an in-network provider, depending on your specific plan and coverage. However, if you see an out-of-network provider, the coverage may differ, and you may be responsible for a significant portion of the costs.

How Does Health Insurance Handle Out-of-Network Providers?

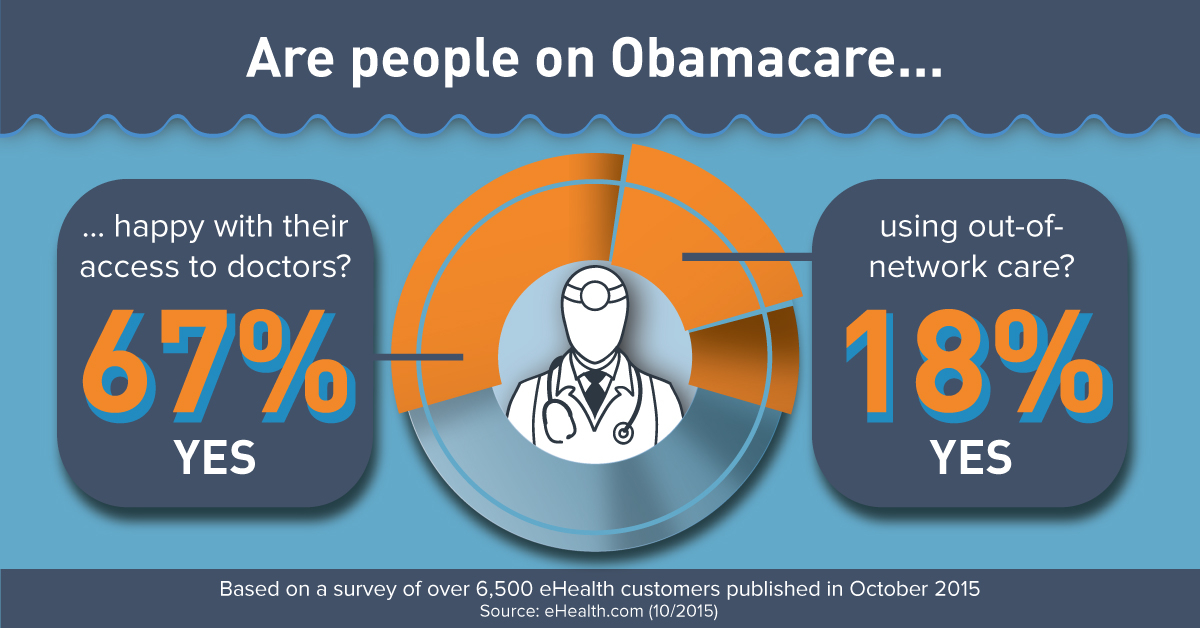

1. Out-of-Network Coverage: Most health insurance plans offer coverage for out-of-network providers. However, coverage may be limited, and you may be required to pay a higher percentage of the costs compared to in-network providers. It is crucial to review your insurance policy or contact your insurance provider to understand the specifics of your out-of-network coverage.

2. Out-of-Network Reimbursement: If you choose to see an out-of-network provider, you will typically need to pay for the services upfront and then submit a claim to your insurance company for reimbursement. The reimbursement will depend on your plan’s out-of-network coverage and applicable deductibles or copayments.

3. Balance Billing: One important consideration when dealing with out-of-network providers is the possibility of balance billing. Balance billing occurs when a provider charges you the difference between their billed amount and what your insurance plan considers reasonable. Some states have laws to protect consumers from excessive balance billing, but it is essential to be aware of this potential issue and understand your rights.

4. Prior Authorization: Your insurance plan may sometimes require prior authorization for out-of-network services. Prior authorization is obtaining approval from your insurance company before receiving certain medical services or treatments. It is crucial to check with your insurance provider to determine if prior approval is required and follow the necessary steps to ensure coverage.

5. Emergency Care: In emergencies, health insurance plans are generally required to cover out-of-network emergency care. Even if the provider is out-of-network, your insurance company should cover a significant portion of the costs. However, contacting your insurance provider as soon as possible after receiving emergency care is still advisable to ensure proper billing and coverage.

In summary, health insurance plans typically offer some coverage for out-of-network providers. However, the coverage may be limited, and you may be responsible for a more significant portion of the costs. Reviewing your insurance policy, understanding your out-of-network coverage, and being prepared to pay upfront and submit claims for reimbursement are crucial. Additionally, be aware of balance billing and the potential need for prior authorization. By being informed and proactive, you can navigate the complexities of health insurance and make informed decisions regarding out-of-network providers.

Key Takeaways: How Does Health Insurance Handle Out-of-Network Providers?

- Health insurance plans typically have networks of preferred providers.

- If you visit an out-of-network provider, your insurance may cover a smaller portion of the costs.

- You may have to pay a higher deductible and coinsurance for out-of-network care.

- Prior authorization may be required for out-of-network services.

- Some health insurance plans may not cover out-of-network care at all.

Frequently Asked Questions

How do health insurance plans handle out-of-network providers?

Regarding out-of-network providers, health insurance plans usually have different policies in place. In general, health insurance plans may not cover the total cost of services provided by out-of-network providers. However, they may still offer some coverage, albeit at a reduced rate.

It’s important to note that the specific coverage for out-of-network providers can vary depending on the insurance plan. Some plans may offer out-of-network coverage as part of their benefits, while others may require you to pay a higher percentage of the costs or have a separate deductible for out-of-network services.

Do health insurance plans have any restrictions on out-of-network providers?

Yes, health insurance plans often have restrictions on out-of-network providers. These restrictions may include limitations on the types of covered services and higher out-of-pocket costs for using out-of-network providers.

For example, specific elective procedures or experimental treatments performed by out-of-network providers may not be covered by insurance. Additionally, the reimbursement rates for out-of-network providers may be lower, resulting in higher out-of-pocket costs for the policyholder.

What should I do if I need to see an out-of-network provider?

If you need to see an out-of-network provider, it’s essential to understand your health insurance plan’s coverage and policies. Review your plan documents or contact your insurance provider to determine coverage for out-of-network services.

You may also want to consider obtaining a referral or prior authorization from your primary care physician. Some insurance plans require these steps to be covered by out-of-network services. Additionally, it would help if you were prepared to pay a significant portion of the costs, as out-of-network providers may not be reimbursed at the same rate.

Can I appeal a denied claim for an out-of-network provider?

Yes, you can appeal a denied claim for an out-of-network provider. If your health insurance plan denies coverage for an out-of-network service, you can submit an appeal to have the decision reviewed.

When filing an appeal, you must provide any supporting documentation, such as medical records or a letter of medical necessity from your healthcare provider. You may also want to include a detailed explanation of why you believe the service should be covered, citing any relevant policy provisions or exceptions.

Are there any alternatives to using out-of-network providers?

Yes, there are alternatives to using out-of-network providers. If your health insurance plan has a limited network of providers, you may be able to find an in-network provider who can meet your needs. This can help ensure you receive your insurance plan’s full benefits and coverage.

If you cannot find an in-network provider who meets your needs, you may also consider requesting a network exception from your insurance provider. This allows you to receive in-network benefits for services provided by an out-of-network provider, typically when no appropriate in-network providers are available.

Final Thoughts: How Health Insurance Handles Out-of-Network Providers

After delving into the intricacies of how health insurance handles out-of-network providers, it becomes clear that navigating this aspect of healthcare can be challenging and costly. Individuals must understand the potential implications of seeking care from providers outside their insurance network.

Health insurance plans typically offer limited coverage or none for out-of-network providers, meaning individuals may have to bear a significant portion of the costs themselves. However, emergencies are often an exception to this rule, as health insurance plans are legally required to provide some coverage for emergency care regardless of whether the provider is in-network or out-of-network.

To avoid unexpected expenses, individuals must familiarize themselves with their health insurance plans and understand the extent of their coverage. This includes knowing which providers are considered in-network and the potential financial consequences of seeking care from out-of-network providers. Open communication with healthcare providers and insurance companies can help navigate complex landscapes and find solutions.

In conclusion, being proactive and well-informed about how health insurance handles out-of-network providers is vital for managing healthcare costs and ensuring the best coverage. Understanding the limitations and potential financial implications can help individuals make more informed decisions about their healthcare choices. Remember, knowledge is power when navigating the world of health insurance and protecting one’s financial well-being.