If you’ve ever found yourself scratching your head and wondering, “What are copayments, deductibles, and premiums in health insurance?” you’ve come to the right place. In health insurance, these terms can often feel like a foreign language, confusing and overwhelming many people. But fear not! I’m here to break it down for you in an easy-to-understand and entertaining way.

Let’s start with copayments. Imagine you’re at the doctor’s office, and it’s time to pay for your visit. A copayment is the fixed amount of money you must pay out of pocket each time you receive medical services. It’s like a little fee that helps contribute towards the cost of your care. Consider it your ticket to see the doctor, ensuring you can access the care you need without breaking the bank.

Now, let’s move on to deductibles. Picture this: you’ve been hit with an unexpected medical expense, like a broken bone or an emergency room visit. A deductible is the amount of money you must pay out of pocket before your insurance kicks in and starts covering the costs. You must cross a threshold before your insurance company joins the party. Once you’ve met your deductible, your insurance will typically begin to cover some or all of your medical expenses, depending on your specific plan.

Last but not least, we have premiums. Think of premiums as the membership fee you pay to be part of the health insurance club. It’s the amount you pay monthly to maintain your coverage, regardless of whether or not you use any medical services. Premiums can vary depending on your age, location, and the type of plan you have. It’s like paying a subscription fee to ensure you have access to the benefits and protections of health insurance.

So there you have it, a crash course on copayments, deductibles, and premiums in health insurance. Armed with this knowledge, you’ll be better equipped to navigate the often confusing world of healthcare financing. And remember, I’ll always be here to answer any questions you may have along the way. Stay tuned for more informative and engaging articles to help demystify the world of health insurance!

Understanding Copayments, Deductibles, and Premiums in Health Insurance

Health insurance is vital to our lives, providing financial protection and access to necessary medical care. However, the complexities of health insurance can sometimes be overwhelming, especially concerning copayments, deductibles, and premiums. Insurance policies often mention these terms, but what do they mean? In this article, we will delve into the details of copayments, deductibles, and premiums and explore their significance in health insurance.

What are Copayments?

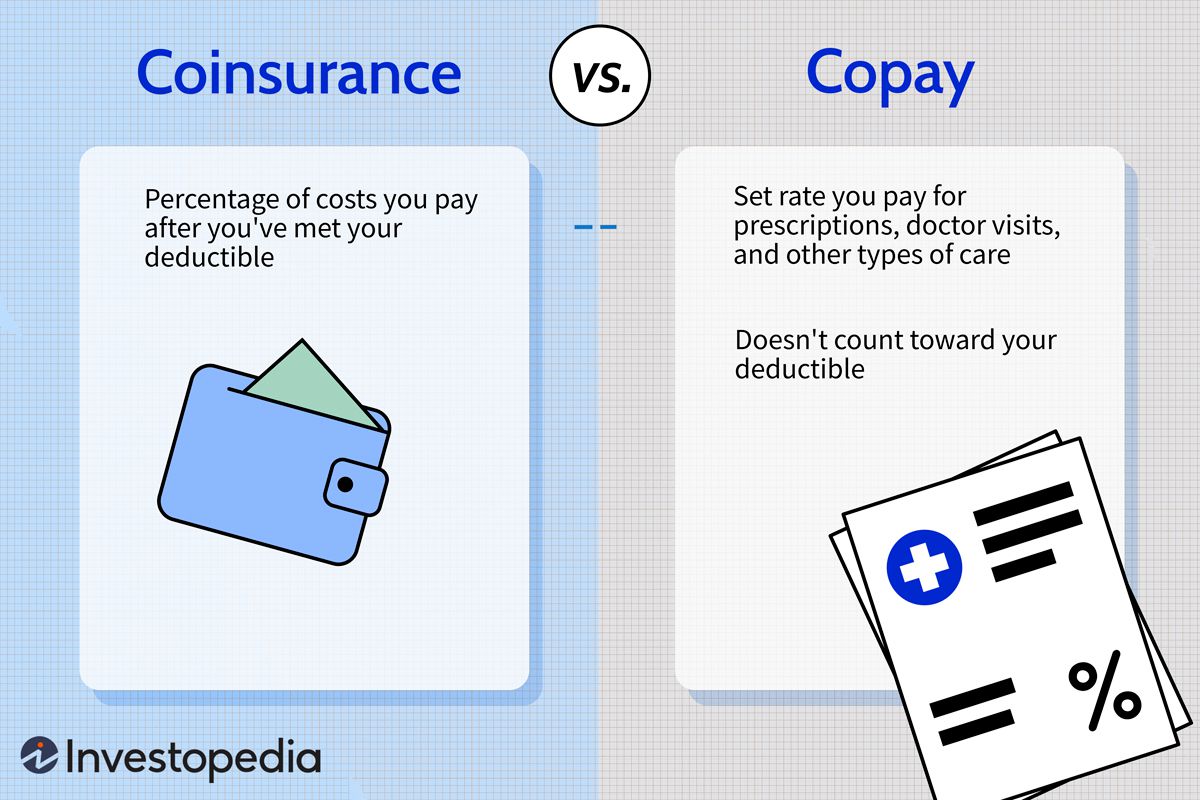

Copayments, or copays, are fixed amounts you pay out of pocket for certain healthcare services when receiving care. They are a form of cost-sharing between you and your insurance company. Copayments are typically specified for doctor visits, specialist consultations, prescription medications, and emergency room visits. The amount you need to pay as a copayment can vary depending on the type of service and your insurance plan.

Copayments serve multiple purposes. Firstly, they act as a deterrent to prevent unnecessary utilization of healthcare services. By requiring you to contribute a portion of the cost, copayments encourage you to consider the necessity of the care you seek. Secondly, copayments help insurance companies manage the overall cost of healthcare by sharing the financial responsibility with policyholders. Lastly, copayments provide a predictable and transparent way to budget your healthcare expenses, as you know the fixed amount you will be responsible for paying.

Types of Copayments

There are different types of copayments that you may encounter in your health insurance plan. Some common types include:

1. Primary Care Visit Copayment: This is the amount you pay to visit your primary care physician, such as your family doctor or general practitioner.

2. Specialist Visit Copayment: If you need to see a specialist, such as a cardiologist or dermatologist, you must pay a copayment for the consultation.

3. Prescription Medication Copayment: When you fill a prescription at a pharmacy, you may have to pay a copayment for each medication.

4. Emergency Room Visit Copayment: In case of an emergency, when you visit the emergency room, you will likely have a copayment that is higher than a regular doctor’s visit. Reviewing your insurance policy to understand the specific copayment amounts associated with different services is essential. These amounts can vary significantly depending on your insurance plan and coverage levels.

Understanding Deductibles

Deductibles are a crucial aspect of health insurance to comprehend and make informed decisions about healthcare expenses. A deductible is the amount you must pay out of pocket for covered medical services before your insurance company starts to contribute towards the cost. For example, if your deductible is $1,000, you will be responsible for paying the initial $1,000 of your healthcare expenses before your insurance coverage kicks in.

Deductibles are typically set annually, meaning you must meet your deductible each calendar year. Once you complete your deductible, your insurance company will begin paying its share of the costs, according to the terms of your policy. It is important to note that not all services require you to meet your deductible before your insurance coverage applies. Some services, such as preventive care and certain screenings, may be covered without meeting your deductible.

Types of Deductibles

You may come across different types of deductibles in health insurance plans. Here are a few common ones:

1. Individual Deductible: The amount each individual covered under the policy must satisfy before insurance coverage begins.

2. Family Deductible: A family deductible may apply to all members covered under the policy if you have a family health insurance plan. The deductible can be satisfied by one or multiple family members.

3. Embedded Deductible: In some family plans, there may be an embedded deductible, which means that each individual has their deductible in addition to the family deductible. This allows individuals to access insurance coverage even if they have not met the family deductible.

Understanding the type and amount of your deductible is crucial for financial planning. It helps you anticipate and budget your healthcare expenses, especially if you require significant medical care.

Decoding Premiums

Premiums are the regular payments you make to your insurance company to maintain your health insurance coverage. They are typically paid monthly, although some policies offer different payment frequencies, such as quarterly or annually. Premiums are determined based on various factors, including age, location, coverage level, and the insurance company’s risk assessment.

Paying your premiums is crucial to ensure continuous coverage and access to the benefits outlined in your insurance policy. Failure to pay your premiums can result in a lapse of coverage, meaning your health insurance plan will no longer protect you. Understanding the payment schedule and non-payment consequences is essential to avoid any disruption in your coverage.

Factors Affecting Premiums

Several factors influence the amount of premiums you pay for your health insurance coverage. These factors can include:

1. Age: Younger individuals typically have lower premiums than older individuals, as they are considered at lower risk of requiring extensive medical care.

2. Location: Premiums can vary based on your geographic location. Factors such as the cost of living, healthcare provider availability, and local healthcare utilization patterns can impact the premiums in a particular area.

3. Coverage Level: The extent of coverage you choose, such as a comprehensive or high-deductible plan, can influence your premiums. More comprehensive plans generally have higher premiums.

4. Tobacco Use: Insurance companies often charge higher premiums to individuals who use tobacco products due to the associated health risks.

Understanding the factors influencing your premiums can help you make informed decisions when selecting a health insurance plan. It is essential to balance your desired coverage level with the affordability of the premiums.

Conclusion

In conclusion, copayments, deductibles, and premiums are essential elements of health insurance that contribute to the overall cost-sharing and financial protection offered by insurance plans. Copayments provide a predictable way to share the cost of specific healthcare services between you and your insurance company. Deductibles require you to pay a specified amount before your insurance coverage begins, while premiums are regular payments to maintain your coverage. By understanding these terms and their significance, you can confidently navigate the world of health insurance and make informed decisions about your healthcare expenses.

Key Takeaways: What are health insurance copayments, deductibles, and premiums?

- Copayments are fixed amounts that you pay for certain medical services or medications.

- Deductibles are the amount you must pay out of pocket before your insurance covers your medical expenses.

- Premiums are the monthly payments you make to have health insurance coverage.

- Copayments help share the cost of medical care between you and your insurance company.

- Understanding copayments, deductibles, and premiums is essential for managing healthcare costs.

Frequently Asked Questions

Question 1: What is a copayment in health insurance?

A copayment, or a copay, is a fixed amount you pay out of pocket for a specific healthcare service or medication. It is a cost-sharing arrangement between you and your health insurance provider. For example, if your health insurance plan has a $20 copayment for doctor visits, you would pay $20 each time you visit a doctor, and your insurance plan would cover the remaining visit cost.

Copayments help cover healthcare service costs and encourage responsible use of healthcare resources. They can vary depending on the type of service or medication, and they may also differ depending on whether you see an in-network or out-of-network provider.

Question 2: What is a deductible in health insurance?

A deductible is the amount you must pay out of pocket before your health insurance coverage kicks in. You are responsible for paying a fixed amount each year for specific covered services. For example, if you have a $1,000 deductible, you must pay $1,000 in medical expenses before your insurance starts covering the costs.

Deductibles are designed to share the cost of healthcare between you and your insurance provider. Once you meet your deductible, your insurance coverage will typically pay a percentage of the remaining expenses, coinsurance, until you reach your out-of-pocket maximum.

Question 3: What is a premium in health insurance?

A premium is how much you pay regularly to maintain your health insurance coverage. It is typically paid monthly, although some plans may offer other payment frequencies, such as quarterly or annually. Your premium is separate from any out-of-pocket costs like copayments or deductibles.

Premiums are based on your age, location, coverage level, and the insurance company you choose. They help fund the overall healthcare cost and ensure your insurance coverage remains active. Paying your premiums on time is essential for any disruption time average.

Question 4: How do copayments, deductibles, and premiums work together?

Copayments, deductibles, and premiums are all essential components of a health insurance plan. Copayments help you share the cost of specific services or medications with your insurance provider. Deductibles require paying a certain amount out of pocket before your insurance coverage begins. Premiums, on the other hand, are the regular payments you make to maintain your coverage.

When you receive healthcare services, you may be required to pay a copayment during service. If the service is subject to your deductible, you must meet that deductible before your insurance starts covering the costs. Once you complete your deductible, your insurance will typically cover some of the costs, and you may still be responsible for coinsurance. On the other hand, Premiums are ongoing payments you make regardless of whether or not you use healthcare services.

Question 5: How can I choose a health insurance plan with the right copayments, deductibles, and premiums?

Choosing the right health insurance plan requires careful consideration of your healthcare needs and financial situation. When comparing plans, pay attention to the copayments, deductibles, and premiums.

If you anticipate frequent doctor visits or need specific medications, a plan with lower copayments may be more suitable. If you have a chronic condition or expect higher healthcare costs, a plan with a higher premium but a lower deductible may provide better coverage. Consider your budget and the level of financial risk you are comfortable with when choosing a plan that strikes the right balance.

Final Thoughts

Now that we’ve explored the world of copayments, deductibles, and premiums in health insurance, it’s clear that understanding these terms is crucial for making informed decisions about our healthcare coverage. These financial components play a significant role in determining the cost of our medical care and the level of financial responsibility we bear.

Copayments, or copays, are the fixed amounts we pay each time we receive a specific healthcare service. They provide a predictable cost for routine doctor visits or prescription medications. Deductibles, however, are the amounts we must pay out of pocket before our insurance coverage kicks in. They can vary greatly depending on our insurance plan and significantly impact our healthcare expenses. Lastly, premiums are the regular payments we make to maintain our health insurance coverage. They are usually paid monthly and are essential for keeping our insurance active.

Understanding the interplay between copayments, deductibles, and premiums allows us to effectively evaluate different health insurance plans. By considering our healthcare needs, budget, and risk tolerance, we can select the plan that offers the right balance of cost and coverage for us. Remember, it’s essential to review the details of each plan carefully, comparing not only the premium but also the copayments and deductible amounts.

So, as you navigate the world of health insurance, armed with the knowledge of copayments, deductibles, and premiums, you’ll be better equipped to make informed decisions about your healthcare coverage. Whether you’re choosing a plan for yourself, your family, or your employees, understanding these financial components will enable you to select the right plan that meets your needs and budget. Stay informed, ask questions, and prioritize your health and economic well-being.