Have you ever wondered what exactly a policy number for health insurance is? It’s one of those terms you might hear thrown around when navigating the complex world of healthcare, but what does it mean? Well, fear not! This article will dive deep into health insurance policy numbers, demystifying their purpose and highlighting their importance. So, please grab a cup of coffee, get cozy, and unravel the mystery together!

Regarding health insurance, your policy number is like your personal identification code. It’s a unique alphanumeric identifier assigned to you by your insurance provider. Think of it as your insurance membership card number, allowing you to access all the benefits and coverage you’re entitled to. This magical combination of letters and numbers holds a wealth of information about your policy, including details about your coverage, deductibles, and copayments. So, the next time you receive a health insurance card or a document from your insurer, take a closer look at that policy number because it holds the key to unlocking the doors of your healthcare coverage.

Now that we’ve embarked on this journey to unravel the secrets of the health insurance policy number, get ready to become an expert in understanding what it is and why it matters. By the end of this article, you’ll have a solid grasp of the significance of your policy number and how it impacts your overall healthcare experience. So, let’s dig deeper and discover the fascinating world of health insurance policy numbers!

Understanding the Policy Number for Health Insurance

A policy number is a unique identifier assigned to an individual’s health insurance policy. It is a reference for the insurer and policyholder to identify and manage coverage quickly. The policy number contains essential information about the policy and the insured individual, making it crucial to understand its significance when dealing with health insurance matters.

What Does a Policy Number for Health Insurance Represent?

The policy number for health insurance is crucial information that helps insurance providers keep track of policyholders’ records. It typically consists of a combination of letters, numbers, or both. While the specific format and structure may vary between insurance companies, the policy number always holds vital information regarding the policyholder’s coverage.

The policy number often includes essential details such as the type of policy, the insurance provider, and the insured individual’s identification. It is a unique identifier, ensuring each policy is distinct and easily identifiable within an insurance company’s database. Understanding the components of a policy number can provide insights into the coverage and facilitate communication between the policyholder and the insurer.

Components of a Policy Number

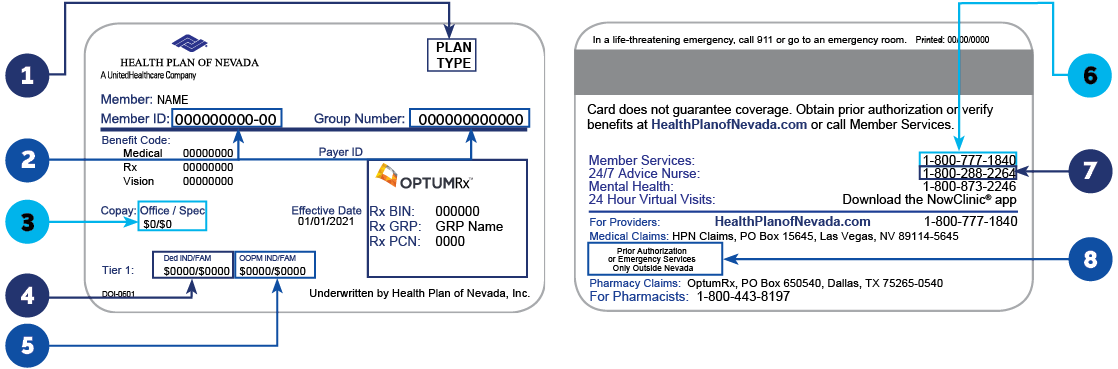

A policy number for health insurance typically consists of several components that convey specific information. While the exact structure varies among insurance providers, the following are standard components found in policy numbers:

1. Insurance Company Code: The policy number may begin with a code representing the insurance company’s coverage. This code helps identify the insurer and differentiate it from other companies.

2. Plan Type Indicator: Some policy numbers include a code indicating the type of health insurance plan. This could be a specific symbol or letter representing the plan category, such as H for health insurance or D for dental insurance.

3. Group Number: In employer-sponsored health insurance plans, a group number is often included in the policy number. This number identifies the specific group or organization associated with the policy, such as an employer or union.

4. Subscriber ID: The policy number may include a subscriber ID, uniquely identifying the primary policyholder or the subscriber. This ID helps differentiate between different members covered under the same policy.

5. Member ID: If the policy covers multiple individuals, such as dependents or family members, each member may have a separate identification number within the policy number. This member ID distinguishes between different insured individuals under the same policy.

6. Check Digit: Some policy numbers include a check digit at the end, a mathematical calculation used to verify the accuracy of the entire policy number. It helps prevent data entry errors and ensures the policy number’s validity.

Understanding the components of a policy number can assist policyholders in navigating their health insurance coverage and communicating effectively with their insurance provider. It allows for efficient record-keeping and facilitates smoother interactions when seeking healthcare services or filing claims.

How to Locate Your Policy Number

Locating your policy number is essential when dealing with health insurance-related matters. It can usually be found on various documents provided by the insurance company, including:

1. Insurance Card: The policy number is typically displayed prominently on the insurance card issued by the provider. It is often listed alongside other important information, such as the policyholder’s name and coverage effective dates.

2. Explanation of Benefits (EOB): The EOB is a document that summarizes the healthcare services you have received and the corresponding insurance coverage. The policy number is usually included in this document for reference.

3. Insurance Policy Documents: The policy number is mentioned throughout the policy documents, such as the policy contract or the policyholder’s handbook. These documents contain detailed coverage and information on policy terms, making the policy number a crucial reference point.

4. Online Account: If you have an online account with your insurance provider, the policy number is displayed prominently in your dashboard for easy access and reference.

It is essential to keep your policy number in a safe and easily accessible place. Being readily available allows smoother communication with your insurance provider and ensures a streamlined process when seeking healthcare services or filing claims.

Why Is the Policy Number Important?

The policy number plays a significant role in managing health insurance coverage. Here are some reasons why the policy number is essential:

1. Identifying Coverage: The policy number allows insurance providers to identify the specific coverage associated with an individual policyholder. It helps determine the policy’s benefits, limitations, and terms.

2. Claim Processing: When filing a claim for healthcare services, the policy number is necessary to ensure accurate and timely processing. It enables the insurance company to link the claim to the correct policy and verify the eligibility of the insured individual.

3. Communication with Insurer: When contacting your insurance provider for inquiries or assistance, providing the policy number helps the customer service representative access your policy details quickly, allowing for more efficient and personalized assistance.

4. Coordination of Benefits: When a policyholder has multiple insurance coverages, the policy number helps coordinate benefits between insurance providers. It ensures that each insurer has the information to process claims accurately and avoid potential payment conflicts.

5. Policy Updates and Changes: If any changes or updates are made to your health insurance policy, the policy number serves as a reference point. It helps track and document modifications, ensuring the policyholder knows the latest coverage details.

In conclusion, the policy number for health insurance is vital information that helps manage and identify an individual’s coverage. Understanding its components and significance can assist policyholders in effectively navigating their insurance policies and ensuring seamless communication with their insurance providers.

Key Takeaways: What is a Policy Number for Health Insurance?

- A policy number is a unique identifier assigned to an individual’s health insurance policy.

- Insurance companies use it to track and manage policyholders’ information.

- The policy number is typically found on insurance cards and documents.

- Keeping your policy number handy when seeking medical services or filing claims is essential.

- Policy numbers help ensure accurate billing and communication between healthcare providers and insurers.

Frequently Asked Questions

What is a policy number for health insurance?

Regarding health insurance, a policy number is a unique identifier assigned to an individual’s insurance policy. It is a combination of letters and numbers that helps insurance providers track and manage policyholder information. This number is used to access details about the policy, such as coverage, benefits, and claims history.

The policy number is typically found on the insurance card or policy document. It is essential to keep this number handy, as it is often required when seeking medical services, filing claims, or contacting the insurance company for assistance. The policy number acts as a reference point for insurance providers to ensure accurate and efficient communication and processing of healthcare services.

How is a policy number generated?

The insurance company generates a policy number when an individual purchases health insurance. Generating a policy number may vary between insurance providers, but it generally involves a combination of unique identifiers.

Insurance companies may create a policy number using letters, numbers, or both. The specific format and length of the policy number can also vary. Some insurance providers may incorporate personal information, such as the insured person’s initials or birthdate, into the policy number to make it more unique.

Can the policy number change?

In most cases, the policy number for health insurance remains the same throughout the policy term. However, in certain circumstances, the policy number may change. The insurance company typically initiates these changes and communicates them to the policyholder.

Some common reasons for a policy number change include policy renewals, updates or modifications to the policy, or switching insurance providers. It is essential to review any correspondence or updates from the insurance company to ensure accurate record-keeping and avoid confusion regarding the policy number.

Is the policy number the same as the member ID?

No, the policy number and member ID are not the same. While both are essential identifiers in health insurance, they serve different purposes. The policy number is a unique identifier for the insurance policy, whereas the member ID is specific to the individual covered under the policy.

The member ID is typically assigned to each covered individual on a policy and is used to identify them when seeking medical services. Having the policy number and member ID readily available when interacting with healthcare providers ensures proper billing and claims processing.

What should I do if I can’t find my policy number?

If you cannot locate your health insurance policy number, you can take a few steps to retrieve it. First, check your insurance card or any policy documents you received when you purchased the insurance. The policy number is usually printed on these documents.

Contact your insurance company if you still can’t find your policy number. They can provide the necessary information and guide you through the process. Other identifying information, such as your full name, date of birth, and social security number, is essential when contacting the insurance company for assistance.

Final Summary: What is a Policy Number for Health Insurance?

Now that you understand what a health insurance policy number is let’s summarize everything we’ve learned. A policy number is a unique identifier assigned to an individual’s health insurance policy. It serves as a reference number that helps insurance companies quickly locate and access the details of your specific policy. This number is crucial when filing claims, communicating with your insurance provider, and accessing your policy information.

In conclusion, knowing your policy number is essential for managing your health insurance effectively. It’s like having a secret code that unlocks all the information and benefits associated with your policy. So, always keep your policy number handy and make sure to store it in a secure place. And remember, if you ever have any questions or concerns about your policy, don’t hesitate to contact your insurance provider for assistance. Your policy number is the key to accessing the support and coverage you need for your healthcare journey.