You’ve heard about 10-year term life insurance and are wondering what it’s all about. Well, you’ve come to the right place! This article will explore the ins and outs of 10-year term life insurance. We’ve got you covered, from what it is to how it works. So, grab a cup of coffee and prepare to learn everything you need!

Let’s start with the basics before we get into the nitty-gritty details. 10-year term life insurance is a type of life insurance policy that provides coverage for a specific period – you guessed it, ten years! It falls under term life insurance, which means it offers protection for a set term rather than your entire life. This can be an excellent option for those who want coverage for a specific period, such as when their children are young or when they have a mortgage to pay off. With a 10-year term life insurance policy, you’ll have peace of mind knowing that your loved ones will be financially protected should anything happen to you during that time frame. So, let’s dig deeper and uncover the details of this fascinating type of insurance!

10-year term life insurance is a type of life insurance policy that provides coverage for a specific period, typically ten years. It offers a death benefit to the policyholder’s beneficiaries if the insured person were to pass away during the policy term. Unlike permanent life insurance, such as whole life or universal life, term life insurance does not build cash value and is generally more affordable. It is a popular choice for individuals who want coverage for a specific period, such as when they have young children or a mortgage to protect.

What is 10-Year Term Life Insurance?

There are various types of life insurance, one popular option being ten-year term life insurance. This type of life insurance covers a specific period, usually ten years. The beneficiaries receive a death benefit if the insured person passes away during the policy term. However, unlike permanent life insurance, such as whole life or universal life insurance, ten-year term life insurance does not have a cash value component.

Ten-year term life insurance premiums are typically level and do not increase during the policy term. This makes it an affordable option for individuals who want protection for a specific period, such as to cover a mortgage or provide financial support for dependents. Knowing that loved ones will be financially protected if something happens to the insured person during the 10-year term can offer peace of mind.

Benefits of 10-Year Term Life Insurance

There are several benefits to consider when it comes to 10-year term life insurance:

- Affordability: One of the main advantages of 10-year term life insurance is its affordability. The premiums are typically lower than those of permanent life insurance policies, making it more accessible for budget-conscious individuals.

- Flexibility: 10-year term life insurance provides flexibility in terms of coverage duration. It allows individuals to choose a specific period that aligns with their needs, such as until their children are financially independent or until a mortgage is paid off.

- Simplicity: This type of life insurance is straightforward to understand. There are no complicated investment components or cash value accumulation. It offers pure death benefit protection.

How Does 10-Year Term Life Insurance Compare to Other Types of Life Insurance?

When considering life insurance options, comparing different types is essential to determine which best suits your needs. Here’s how ten-year term life insurance compares to other types of life insurance:

10-Year Term Life Insurance vs. Whole Life Insurance: Whole life insurance provides coverage for the entire lifetime of the insured person and includes a cash value component that grows over time. Premiums for whole life insurance are generally higher than 10-year term life insurance. Whole life insurance offers lifelong protection and potential cash value accumulation, while ten-year term life insurance offers coverage for a specific period without any cash value component.

10-Year Term Life Insurance vs. Universal Life Insurance: Universal life insurance is another type of permanent life insurance that offers flexibility in premium payments and death benefit coverage. It also includes a cash value component that can grow over time. Although universal life insurance provides more flexibility than 10-year term life insurance, it typically comes with higher premiums.

Is 10-Year Term Life Insurance Right for You?

Choosing the right life insurance policy depends on your circumstances and financial goals. Here are some factors to consider when deciding if ten-year term life insurance is the right choice for you:

- Financial obligations: Ten-year term life insurance can provide the necessary coverage for specific financial commitments that will last for a defined period, such as a mortgage or supporting dependent children until they reach adulthood.

- Budget: If you have a limited budget and are looking for affordable life insurance coverage, ten-year term life insurance can be a suitable option because of its lower premiums than permanent life insurance policies.

- Long-term financial planning: If you are looking for a life insurance policy that offers cash value accumulation and lifelong coverage, consider permanent options like whole life or universal life insurance.

Ultimately, you should assess your needs and consult a financial advisor or life insurance professional to determine the most suitable policy.

Additional Considerations

When purchasing ten-year term life insurance, there are a few additional considerations to keep in mind:

- Renewability: Some term life insurance policies, including ten-year term life insurance, may offer the option to renew the policy at the end of the term. However, premiums may increase upon renewal.

- Conversion: Depending on the policy, you may have the option to convert your ten-year term life insurance policy into a permanent life insurance policy later. This can provide lifelong coverage and potential cash value accumulation.

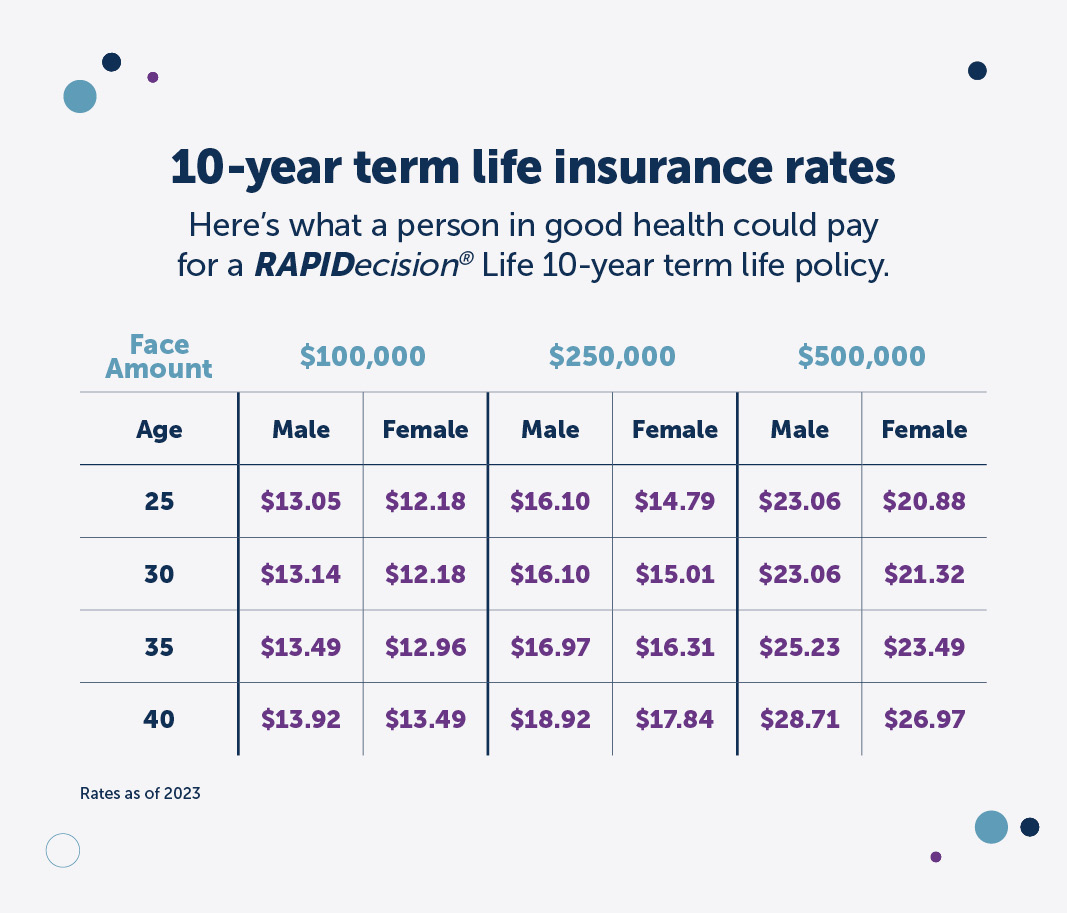

- Health and age: The cost of life insurance premiums is influenced by factors such as age and health. Obtaining more affordable premiums when you are younger and in good health is generally easier.

It’s important to carefully review the terms and conditions of any life insurance policy before making a decision. Understanding the policy details and potential limitations or restrictions can help you choose the right coverage for your needs.

Conclusion

Ten-year term life insurance is a popular and affordable option for individuals seeking coverage for a specific period. If the insured person passes away during the policy term, the policy offers a death benefit to beneficiaries. While it does not have a cash value component like permanent life insurance, it provides peace of mind and financial protection for loved ones. Consider your circumstances, financial goals, and budget when deciding if ten-year term life insurance suits you.

Key Takeaways: What is 10-Year Term Life Insurance?

- Ten-year term life insurance is a type of life insurance that provides coverage for a specific period of 10 years.

- It offers a death benefit to the beneficiaries if the insured person passes away during the 10-year term.

- It is more affordable than permanent life insurance because it has a shorter coverage period.

- It is suitable for individuals with temporary financial obligations or who need coverage for a specific period, such as to pay off a mortgage or fund a child’s education.

- The policy may expire once the 10-year term ends or must be renewed at a higher premium.

Frequently Asked Questions

Question 1: How does ten-year term life insurance work?

When you purchase a ten-year term life insurance policy, you are essentially buying coverage for a specific period, in this case, ten years. During this time, if the insured person passes away, their beneficiaries will receive a death benefit. However, if the insured person outlives the 10-year term, the policy will expire, and no benefits will be paid.

It’s important to note that ten-year term life insurance is a type of temporary coverage that typically offers lower premiums than term life insurance policies. It provides a financial safety net for a specific period, such as paying off a mortgage or providing for a child’s education.

Question 2: What are the advantages of 10-year term life insurance?

One of the main advantages of 10-year term life insurance is its affordability. Compared to permanent life insurance policies, the premiums for a 10-year term policy are generally lower. This makes it suitable for individuals with a limited budget who still want to protect their loved ones financially.

Additionally, ten-year term life insurance offers flexibility. If your needs change over time, you can choose to renew the policy, convert it into a permanent policy, or let it expire. This allows you to adapt your coverage as your circumstances evolve.

Question 3: Can I renew my ten-year term life insurance policy?

Yes, most insurance companies offer the option to renew a ten-year term life insurance policy. However, it’s important to note that the premiums may increase when you renew the policy. The new premiums are typically based on your age and health at the time of renewal. Reviewing your options and comparing quotes from different insurers before renewing your policy is advisable.

Renewing your ten-year term life insurance policy can provide continued coverage and peace of mind, especially if you still have financial obligations or dependents who rely on your income.

Question 4: Is ten-year term life insurance right for me?

Whether 10-year term life insurance is right depends on your specific needs and circumstances. If you have short-term financial obligations, such as a mortgage or young children, a ten-year term policy can provide the necessary coverage during that period.

However, a permanent life insurance policy might be better if you have long-term financial goals or want to leave a legacy for your loved ones. It is essential to assess your financial situation and plans and consult a licensed insurance professional to determine the most suitable coverage.

Question 5: Can I convert my ten-year term life insurance policy into a permanent policy?

Many insurance companies offer the option to convert a ten-year term life insurance policy into a permanent policy. This conversion feature allows you to extend your coverage beyond the initial 10-year term without undergoing a medical exam or providing additional evidence of insurability.

Converting to a permanent policy can be beneficial if you want lifelong coverage or if your health has deteriorated since purchasing the term policy. However, reviewing your policy’s terms and conditions and consulting with your insurance provider to understand your conversion options is essential.

Final Summary: Understanding the Ins and Outs of 10-Year Term Life Insurance

Now that we’ve delved into the world of 10-year term life insurance, it’s clear that this type of policy offers a valuable solution for those seeking affordable and temporary coverage. Its fixed premium and coverage for a decade provide a sense of security for individuals and their loved ones during critical periods of their lives.

While 10-year term life insurance may not suit everyone, it has unique benefits. It’s the perfect choice for young families looking to protect their children’s future or individuals with specific financial obligations expiring in the next decade. This flexible option can be tailored to your needs, whether you want to supplement an existing policy or provide a safety net during a transitional phase.

Remember, assessing your circumstances and financial goals is essential when considering life insurance. By understanding the ins and outs of 10-year term life insurance, you can make an informed decision that aligns with your needs and priorities. So, take the time to explore your options, consult with experts, and secure the protection you and your loved ones deserve.