So, you’re starting a business, and you’ve heard about the importance of having a business insurance policy. But what exactly does it cover? Well, my friend, you’ve come to the right place. In this article, we will dive into the world of business insurance and explore what a typical policy covers. Get ready to have all your burning questions answered!

Picture this: you’ve finally started your dream business, and things are progressing. But then, disaster strikes. Maybe a fire damages your property, or a customer slips and falls in your store. Without the protection of a business insurance policy, these unexpected events could potentially ruin everything you’ve worked so hard for. But fear not! With a comprehensive business insurance policy, you can have peace of mind knowing that you’re covered in these unfortunate situations. A typical business insurance policy has your back, whether it’s property damage, liability claims, or even employee injuries.

Now that we’ve piqued your curiosity, let’s delve deeper into the specifics. In the next section, we’ll break down the critical components of a typical business insurance policy and explore how they can safeguard your business from potential risks and losses. So, buckle up and get ready to discover the world of business insurance like never before!

Understanding What a Typical Business Insurance Policy Covers

In the business world, protecting your assets and investments is essential. One crucial way to do this is by having a comprehensive business insurance policy. But what exactly does a typical business insurance policy cover? This article will explore the different aspects of a standard business insurance policy and its protection for your business.

Property Insurance

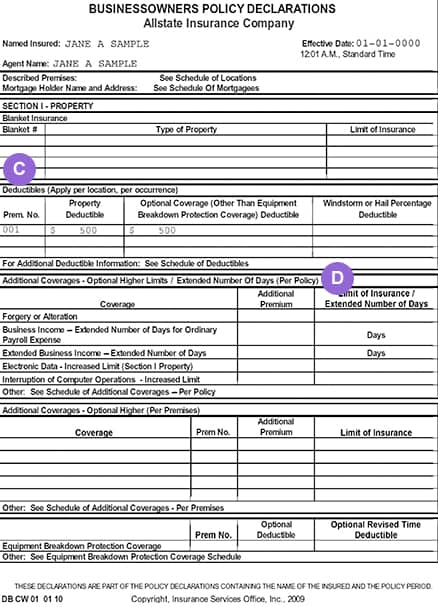

Property insurance plays a vital role in protecting your business property. This type of coverage typically includes protection for your building, equipment, inventory, and other physical assets. Property insurance provides financial compensation to repair or replace damaged property in the event of fire, vandalism, theft, or natural disasters. It ensures your business can quickly recover and resume operations without significant financial losses.

Property insurance may also cover additional expenses incurred due to property damage, such as temporary relocation costs or renting equipment while repairs are being made. It is essential to carefully review your policy to understand your business property’s specific coverage and exclusions.

Liability Insurance

Liability insurance is another crucial component of a typical business insurance policy. It protects your business from claims and lawsuits filed by third parties for bodily injury or property damage caused by your business operations or products. Whether it’s a slip-and-fall accident at your premises or a customer alleging harm caused by a faulty product, liability insurance covers legal expenses, settlement costs, and judgments.

Liability insurance is essential for businesses that interact with the public, such as retail stores, restaurants, and service providers. It offers peace of mind and financial protection against unexpected incidents that could potentially cripple your business.

Business Interruption Insurance

In the event of a disaster or unforeseen circumstances that disrupt your business operations, business interruption insurance comes into play. This type of coverage provides financial support to cover lost income, ongoing expenses, and additional costs incurred while your business cannot operate.

Whether it’s a natural disaster, a fire at your premises, or a government-mandated shutdown, business interruption insurance ensures your business can meet financial obligations and recover from the temporary setback. It can be a lifeline during challenging times, enabling you to maintain stability and minimize the long-term impact on your business.

Workers’ Compensation Insurance

Protecting your employees is paramount; workers’ compensation insurance helps you do that. This coverage provides benefits to employees who suffer work-related injuries or illnesses. It includes medical expenses, rehabilitation costs, and lost wages during recovery.

Workers’ compensation insurance not only safeguards your employees but also shields your business from potential lawsuits related to workplace injuries. It is mandatory in most states, and failing to carry this coverage can result in legal penalties and financial consequences.

Commercial Auto Insurance

If your business involves using vehicles, commercial auto insurance is a must-have. This coverage protects your business against liability claims and provides coverage for damages to your cars. Whether you have a fleet of delivery vans, work trucks, or company cars, commercial auto insurance ensures that you are financially protected in the event of an accident or damage caused by your vehicles.

Commercial auto insurance typically covers bodily injury and property damage liability, collision and comprehensive damage, medical payments, and uninsured/underinsured motorist coverage. It is essential to consider the specific needs of your business and the level of coverage required to protect your vehicles and drivers adequately.

Other Coverages

In addition to the main types of coverage mentioned above, a typical business insurance policy may include other essential coverages based on your business’s specific needs. Some additional coverages to consider include:

- Professional liability insurance protects against claims of professional negligence or errors and omissions.

- Data breach insurance: Covers the costs associated with a data breach, including customer notification, credit monitoring, and legal expenses.

- Employment practices liability insurance: Protects your business against claims related to wrongful termination, discrimination, or harassment.

- Product liability insurance: Provides coverage for claims related to injuries or damages caused by a defective product.

- Cyber liability insurance: Safeguards your business against losses from cyberattacks, data breaches, and other cyber-related incidents.

It’s essential to assess the unique risks faced by your business and work with an insurance professional to tailor a comprehensive coverage policy.

Conclusion

In conclusion, a typical business insurance policy covers many risks and protects your business. From property and liability insurance to workers’ compensation and commercial auto insurance, these coverages ensure that your business can weather unexpected events and continue to thrive. By understanding what a typical business insurance policy covers, you can make informed decisions to safeguard your company and its future. Remember to review your policy regularly, assess your evolving needs, and consult with an insurance professional to ensure you have the right coverage.

Key Takeaways: What does a typical business insurance policy cover?

- A typical business insurance policy covers property damage caused by fire, theft, or natural disasters.

- It also covers liability claims, such as bodily injury or property damage caused by your business.

- Business interruption coverage is included to protect against income loss due to unforeseen events.

- Insurance policies may also cover equipment breakdown, cyber attacks, and legal expenses.

- It’s essential to review and understand your policy’s specific coverage limits and exclusions.

Frequently Asked Questions

What is a typical business insurance policy?

A typical business insurance policy is a comprehensive plan to protect businesses from risks and liabilities. It combines different insurance coverages into a single policy, providing a wide range of protection for businesses of all sizes and industries.

Business insurance policies typically cover property damage, liability claims, business interruption, and employee-related risks. These policies are customizable based on the business’s specific needs, allowing owners to tailor the coverage to their unique risks and requirements.

What does property damage coverage include?

Property damage coverage is a critical component of a typical business insurance policy. It protects your business property, including buildings, equipment, inventory, and furniture, against damage or loss caused by covered perils such as fire, theft, vandalism, or natural disasters.

This coverage helps businesses recover financially by providing funds to repair or replace damaged property. It can also extend to cover additional expenses incurred during the restoration process, such as temporary relocation costs or business interruption losses.

What does liability coverage protect against?

Liability coverage is another crucial aspect of a typical business insurance policy. It protects your business from claims and lawsuits filed by third parties alleging bodily injury, property damage, or personal injury caused by your business operations, products, or services.

This coverage helps cover legal fees, settlements, and judgments, providing financial protection and peace of mind for your business. Depending on the specific policy, it can also include coverage for libel, slander, and advertising liability.

Does business insurance cover business interruption?

A typical business insurance policy often includes coverage for business interruption or loss of income. This coverage helps compensate for lost revenue and ongoing expenses if your business cannot operate due to a covered peril, such as a fire or natural disaster.

Business interruption coverage typically funds essential expenses like rent, payroll, and utility bills, allowing your business to stay afloat during the downtime. It can also include coverage for extra costs incurred to minimize the impact of the interruption and expedite the recovery process.

Are employees covered under a business insurance policy?

Yes, a typical business insurance policy may include coverage for employee-related risks. This can have workers’ compensation insurance, which benefits employees who suffer work-related injuries or illnesses.

Additionally, some policies may offer coverage for employment practices liability, protecting your business against claims related to wrongful termination, discrimination, or harassment. Reviewing your policy to understand the specific employee coverages included in your business insurance policy is essential.

Final Summary: What Does a Typical Business Insurance Policy Cover?

So, there you have it! A comprehensive rundown of what a typical business insurance policy covers. It’s like having a safety net for your business, protecting you from a wide range of risks and potential financial losses. From property damage and liability claims to employee injuries and business interruptions, a good insurance policy has got you covered.

Remember, the specific coverage and limits may vary depending on your industry, location, and the insurance provider you choose. It’s crucial to carefully review your policy and ensure it aligns with your unique business needs. Don’t hesitate to contact an insurance professional if you have questions or need assistance selecting the proper coverage.

So, whether running a small startup or managing a large corporation, investing in a business insurance policy is wise. It protects your assets and gives you peace of mind, knowing you’re prepared for the unexpected. So, take the necessary steps to safeguard your business today and focus on what you do best – running a thriving enterprise!