Supplemental life insurance – is it worth it? It’s a question that many people ponder when considering their insurance options. After all, life insurance is already in place to provide financial protection for your loved ones in the event of your passing. So, is supplemental life insurance just an unnecessary expense, or does it offer additional benefits worth considering? Let’s dive in and explore the ins and outs of supplemental life insurance to help you make an informed decision.

Regarding supplemental life insurance, the key is understanding what it brings. Unlike traditional life insurance policies, which provide a fixed payout upon your death, additional life insurance offers extra coverage that can be tailored to your specific needs. It can help bridge the gap between your existing policy and the financial needs your loved ones may have, such as paying off debts, covering funeral expenses, or even providing for future education costs. But is it worth the extra cost? That’s where weighing the benefits against your circumstances becomes crucial. Considering factors like age, health condition, and financial obligations, you can determine if supplemental life insurance’s added peace of mind and financial security are worth it.

In conclusion, deciding whether to invest in supplemental life insurance depends on your circumstances and priorities. While it may not be necessary for everyone, it can offer valuable coverage for those seeking extra protection and peace of mind. Assessing your financial situation, family needs, and long-term goals will help you make an informed choice that aligns with your needs. So, evaluate your options and consult a trusted insurance professional to determine if supplemental life insurance suits you.

Is Supplemental Life Insurance Worth It?

Understanding Supplemental Life Insurance

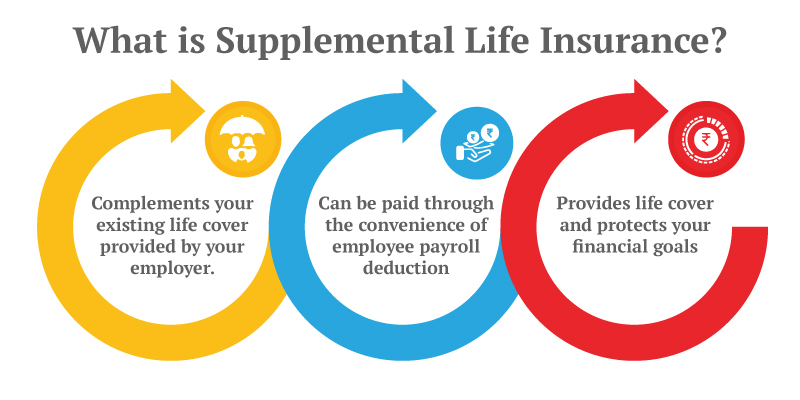

Supplemental life insurance is an additional policy that you can purchase to supplement your existing life insurance coverage. It is designed to provide extra financial protection for your loved ones during your death. While traditional life insurance policies typically provide a lump-sum payout, supplemental life insurance offers additional benefits such as increased coverage amounts, added flexibility, and the ability to customize your policy to fit your needs.

Benefits of Supplemental Life Insurance

Supplemental life insurance offers several benefits that make it worth considering. First and foremost, it provides an additional financial safety net for your loved ones. If you have dependents who rely on your income, supplemental life insurance can help ensure they are cared for financially during your passing. It can provide funds for everyday expenses, mortgage or rent payments, education costs, etc.

Another benefit of supplemental life insurance is the ability to customize your policy. Unlike traditional life insurance policies, which often have set coverage amounts and limitations, additional policies allow you to choose the coverage that best suits your needs. You can increase your coverage based on your circumstances, providing added peace of mind.

Factors to Consider

Several factors must be considered before deciding whether supplemental life insurance is worth it. One important factor is your current financial situation. Assessing your existing life insurance coverage and evaluating how much additional coverage you may need is crucial. When determining the appropriate coverage amount, consider your debts, future expenses, and dependents’ needs.

Another factor to consider is the cost of supplemental life insurance. Premiums for additional policies can vary depending on your age, health, and the amount of coverage you choose. It’s important to carefully review the costs associated with the policy and ensure that it fits within your budget.

Supplemental Life Insurance vs. Traditional Life Insurance

Benefits of Traditional Life Insurance

Traditional life insurance policies offer benefits that may suit some individuals. One significant advantage is the coverage’s simplicity. Standard policies typically provide a straightforward lump-sum payout to beneficiaries without the need to navigate complex customization options.

Another benefit of traditional life insurance is the potential for cash value accumulation. Some policies offer the opportunity to build cash value over time, which can be accessed through loans or withdrawals. This can provide additional financial flexibility during your lifetime.

Benefits of Supplemental Life Insurance

Supplemental life insurance offers unique benefits that may make it a worthwhile addition to your existing coverage. One advantage is the ability to increase your coverage amount beyond what traditional policies may offer. This can be particularly beneficial if you have significant financial obligations or your current coverage is insufficient to meet your dependents’ needs.

Additionally, supplemental life insurance often allows for customization. You can tailor your policy to your specific circumstances, choosing the coverage amount, term length, and optional riders that best suit your needs. This flexibility can provide a sense of control and ensure you have the right level of protection.

How to Determine If Supplemental Life Insurance Is Right for You

Ultimately, purchasing supplemental life insurance depends on your circumstances and financial goals. Consider the following factors when evaluating whether it is worth it for you:

Evaluate Your Existing Coverage

Start by assessing your current life insurance coverage. Consider the amount of coverage you have, the beneficiaries designated on your policy, and any limitations or exclusions. Determine whether your coverage adequately protects your loved ones and meets your financial goals.

Assess Your Financial Responsibilities

Take stock of your financial obligations, both present and future. Consider your outstanding debts, such as mortgages, loans, or credit card balances. Evaluate your dependents’ needs, including education, childcare, and living expenses. This will help you determine whether additional coverage is necessary for your loved ones.

Weigh the Costs and Benefits

Carefully review the costs associated with supplemental life insurance. Compare premiums from different providers and consider how the additional expense will fit into your budget. Evaluate the benefits of increased coverage and customization options to determine if they outweigh the cost.

In conclusion, supplemental life insurance can be a valuable tool for providing additional financial protection to your loved ones. You can decide whether supplemental life insurance is worth it by assessing your existing coverage, considering your financial responsibilities, and weighing the costs and benefits. Remember to consult a trusted financial advisor or insurance professional who can guide you through the process and help you choose the best policy for your needs.

Key Takeaways: Is Supplemental Life Insurance Worth It?

- Supplemental life insurance can provide additional coverage beyond your primary life insurance policy.

- It can be worth considering if you have dependents or financial obligations that your existing policy may not fully cover.

- Supplemental life insurance can help bridge the gap and provide added peace of mind.

- However, assessing your needs and evaluating the cost-benefit ratio before purchasing supplemental coverage is essential.

- Consulting with a financial advisor can help you make an informed decision based on your circumstances.

Frequently Asked Questions

What is supplemental life insurance?

Supplemental life insurance is an additional coverage you can add to your existing life insurance policy. It provides an extra layer of financial protection for you and your loved ones in the event of your death. This type of insurance is optional and typically requires an additional premium payment.

Supplemental life insurance can help bridge the gap between your coverage and financial needs. It can provide a higher death benefit, cover specific expenses like funeral costs or outstanding debts, or offer additional coverage for a particular period.

How does supplemental life insurance work?

Supplemental life insurance provides an additional death benefit on top of your existing life insurance policy. When you purchase extra coverage, you pay an additional premium to the insurance company. In the event of your death, your beneficiaries will receive the combined death benefits from your primary and supplemental policies.

It’s important to note that supplemental life insurance is not a standalone policy. It is meant to enhance your coverage and provide extra financial support for your loved ones. The terms and conditions of the supplemental policy may vary depending on the insurance provider and the specific plan you choose.

Is supplemental life insurance worth it?

Whether supplemental life insurance is worth it depends on your circumstances and financial goals. It can be a valuable option if you have specific financial needs that are not fully covered by your primary life insurance policy. For example, suppose you have outstanding debts or want to ensure your loved ones are financially secure in the event of your death. In that case, supplemental coverage can provide the extra protection you need.

However, you must carefully evaluate your coverage and financial situation before purchasing supplemental life insurance. Consider your age, health, dependents, and overall financial goals. You may also want to compare different insurance providers and policies to find the best option that suits your needs and budget.

How much does supplemental life insurance cost?

The cost of supplemental life insurance can vary depending on several factors, including age, health, occupation, and the coverage you need. Generally, the younger and healthier you are, the lower your premiums will be. Additionally, the more coverage you require, the higher your premiums will likely be.

It’s best to request quotes from multiple insurance providers to determine the cost of supplemental life insurance. This will allow you to compare prices and coverage options. Remember that while extra coverage may be an additional expense, it can provide valuable financial protection for you and your loved ones in the long run.

How do I choose the right supplemental life insurance policy?

Choosing the right supplemental life insurance policy involves considering your needs and financial goals. Here are some factors to consider:

1. Assess your existing coverage: Evaluate your primary life insurance policy and identify any gaps in coverage that may need to be filled by supplemental insurance.

2. Determine your financial needs: Consider your outstanding debts, future expenses, and the economic well-being of your loved ones. This will help you determine the amount of supplemental coverage you require.

3. Compare insurance providers: Research different insurance companies and compare their supplemental life insurance policies. Look for reputable providers with competitive rates and strong financial stability.

4. Read the fine print: Carefully review each policy’s terms and conditions, including any exclusions or limitations. Make sure you understand what is covered and what is not.

By taking these steps and consulting with a trusted insurance advisor, you can make an informed decision and choose a supplemental life insurance policy that meets your needs and provides financial protection.

Final Thoughts: Is Supplemental Life Insurance Worth It?

After considering the benefits and drawbacks of supplemental life insurance, it’s clear that this type of coverage can be a valuable addition to your financial plan. While it may not be necessary for everyone, it offers a range of advantages that can provide peace of mind and economic security for you and your loved ones.

One of the main advantages of supplemental life insurance is the additional coverage it provides. It can help fill in the gaps left by your primary life insurance policy, ensuring that your loved ones are well-protected in case of your untimely passing. This extra coverage can be especially beneficial if you have dependents or significant financial obligations, such as a mortgage or other debts.

Furthermore, supplemental life insurance often offers flexibility and customization options. You can tailor the coverage to your specific needs and circumstances, whether increasing the death benefit, adding riders for critical illness or disability, or adjusting the policy term. This flexibility allows you to adapt the coverage as your life evolves, providing ongoing protection that aligns with your changing needs.

Of course, you must carefully consider the cost of supplemental life insurance and ensure it fits your budget. While the premiums may be higher than those of a basic life insurance policy, the added benefits and peace of mind may outweigh the extra expense. Investing in supplemental life insurance depends on your circumstances, financial goals, and risk tolerance.

In conclusion, supplemental life insurance can be a worthwhile investment for those seeking additional protection and customization options. By carefully evaluating your needs, considering the costs, and weighing the potential benefits, you can decide whether it is worth it. Remember, it’s always a good idea to consult with a trusted financial advisor or insurance professional who can provide personalized guidance based on your unique situation.