Life insurance is often seen as a way to protect your loved ones financially in the event of your untimely demise. But did you know that it can also be used as an investment tool? That’s right! Life insurance can be a valuable asset in your financial portfolio, providing protection and potential growth. This article will explore the ins and outs of using life insurance as an investment. So, please grab a cup of coffee, get comfortable, and dive in!

We often think of stocks, bonds, and real estate when investing. But life insurance can offer a unique avenue for growing your wealth. It allows you to combine the benefits of insurance coverage with the potential for accumulating cash value over time. By paying regular premiums, you secure a death benefit for your beneficiaries and build up a cash reserve that can be accessed during your lifetime. This cash value can be used for various purposes, such as supplementing retirement income, funding education expenses, or even starting a business. So, if you’re curious about how to make the most of your life insurance policy and turn it into a valuable investment asset, keep reading!

How to Use Life Insurance as an Investment

- Step 1: Understand the types of life insurance policies available, such as whole and universal life. Research their features and benefits.

- Step 2: Determine your investment goals and risk tolerance. Consider your long-term financial plans and how life insurance fits into them.

- Step 3: Consult with a financial advisor to evaluate different life insurance options and determine which policy best suits your investment needs.

- Step 4: Explore investment-linked life insurance policies that allow you to allocate a portion of your premiums to investment funds.

- Step 5: Review and adjust your investment strategy within the policy regularly to align with your changing financial goals.

How to Use Life Insurance as an Investment

Life insurance is often seen as providing financial protection for loved ones in the event of the policyholder’s death. However, life insurance can also be used as an investment tool, offering potential benefits and opportunities for growth. By understanding how to use life insurance as an investment, individuals can maximize the value of their policies and potentially achieve their financial goals. This article will explore various strategies and considerations for investing in life insurance.

Understanding Cash Value Life Insurance

Cash-value life insurance is a type of policy that includes an investment component, allowing the policyholder to accumulate cash value over time. This cash value can be accessed through policy loans or withdrawals, providing flexibility and potential growth opportunities. Different cash-value life insurance types exist, including whole and universal life insurance.

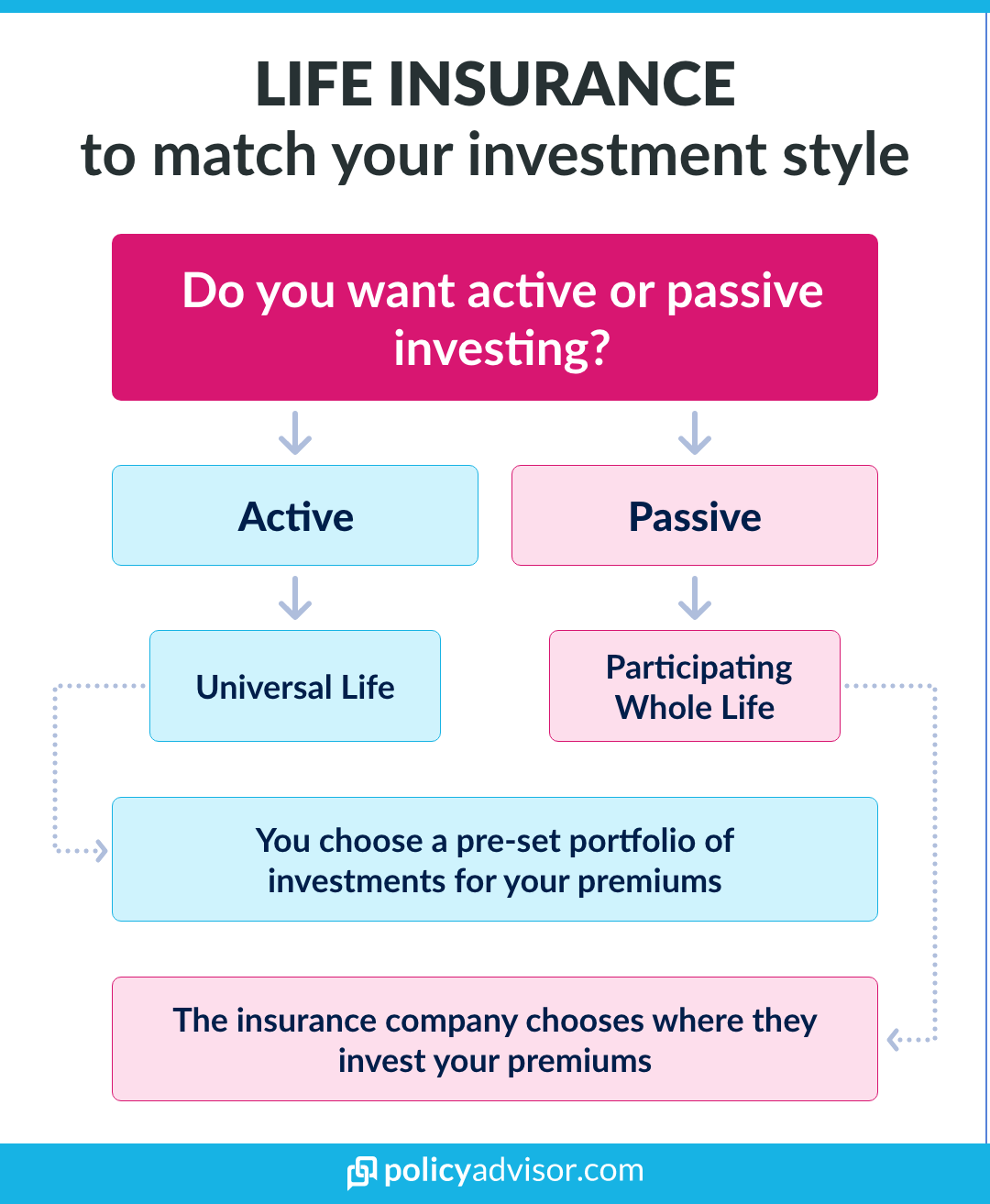

Whole life insurance offers a guaranteed death benefit, fixed premium, and a cash value component that grows over time. The cash value earns interest at a predetermined rate and can be used to fund policy loans or withdrawals. Universal life insurance, on the other hand, provides more flexibility regarding premium payments and death benefit coverage. The cash value component is invested in sub-accounts, similar to mutual funds, allowing for potential growth based on market performance.

Benefits of Using Life Insurance as an Investment

Investing in life insurance can offer several benefits for individuals looking to build wealth and secure their financial future.

1. Tax advantages: The cash value component of life insurance policies grows tax-deferred, meaning that policyholders do not have to pay taxes on the growth until they withdraw the funds. This can provide a significant advantage, allowing individuals to accumulate wealth without immediate tax implications.

2. Asset protection: In many states, the cash value of a life insurance policy is protected from creditors. This means that even in the face of financial difficulties or legal issues, the policy’s cash value remains safe and can continue to grow.

3. Flexible access to funds: Life insurance policies with a cash value component allow policyholders to access the accumulated cash value through policy loans or withdrawals. This can be useful for various purposes, such as funding education expenses, supplementing retirement income, or even starting a business.

4. growth potential: The cash value component can grow over time, depending on the type of life insurance policy and the investment options available. This growth can provide additional financial resources and contribute to long-term financial goals.

Strategies for Using Life Insurance as an Investment

When using life insurance as an investment, it is essential to consider different strategies and approaches to maximize the potential benefits. Here are a few strategies to consider:

1. Buy term and invest the difference

One strategy is to purchase a term life insurance policy and invest the difference in premiums. Term life insurance offers pure death benefit coverage for a specific period, usually 10, 20, or 30 years. The premiums for term life insurance are generally lower than those for cash-value policies. Individuals can potentially achieve higher returns by investing the difference in premiums in other investment vehicles, such as stocks or mutual funds.

2. Maximize cash value growth

For those who prefer the benefits of cash-value life insurance, maximizing the growth of the cash-value component is crucial. This can be achieved by paying premiums regularly and on time and considering policies with higher cash-value growth potential. The policy’s investment options and performance must also be reviewed to ensure alignment with financial goals and risk tolerance.

3. Utilize policy loans

Policy loans allow policyholders to borrow against the cash value of their life insurance policies. These loans can be used for various purposes, such as purchasing a home, funding education, or starting a business. The advantage of policy loans is that they generally have lower interest rates than traditional loans. However, it is essential to consider the impact of policy loans on the death benefit and the potential tax consequences.

4. Consider tax-efficient withdrawals

When accessing the cash value of a life insurance policy through withdrawals, it is essential to consider the tax implications. Policyholders can withdraw the basis (the premiums paid) without tax consequences. However, any withdrawals beyond the basis may be subject to taxes. Individuals can minimize the tax burden and maximize their investment by strategically planning withdrawals and considering tax-efficient strategies.

In conclusion, life insurance can be a valuable investment tool. By understanding the different types of life insurance policies and their potential benefits, individuals can make informed decisions about using life insurance as an investment. Various strategies can be explored, such as maximizing cash value growth, utilizing policy loans, or considering tax-efficient withdrawals. Working with a financial professional to determine the best approach based on individual circumstances and financial goals is essential.

Key Takeaways: How to Use Life Insurance as an Investment?

- Life insurance can be used as an investment tool to build cash value over time.

- By choosing a permanent life insurance policy, you can accumulate a cash value that grows tax-deferred.

- You can borrow against the cash value of your life insurance policy to fund other investments or financial needs.

- Using life insurance as an investment requires careful consideration of fees, surrender charges, and potential risks.

- Consult with a financial advisor to determine if using life insurance as an investment aligns with your financial goals and risk tolerance.

Frequently Asked Questions

Question 1: Can life insurance be used as an investment?

Yes, life insurance can be used as an investment tool. Specific life insurance policies, such as whole life and universal life insurance, offer a cash value component. This cash value grows over time and can be accessed by the policyholder during their lifetime. It can be used as a source of funds for various purposes, including investment opportunities.

However, it’s important to note that life insurance’s primary purpose is financial protection for your loved ones during your death. Using life insurance as an investment should be done carefully and in consultation with a financial advisor.

Question 2: What are the benefits of using life insurance as an investment?

Using life insurance as an investment can have several benefits. First, it allows you to accumulate funds over time in a tax-deferred manner. Specific life insurance policies grow their cash value on a tax-deferred basis, meaning you won’t have to pay taxes on the growth until you withdraw the funds.

Additionally, life insurance policies often offer guarantees and protection against market downturns. This can provide peace of mind for investors seeking stability in their portfolios. Furthermore, a life insurance policy’s death benefit can provide a financial safety net for loved ones during your untimely demise.

Question 3: How can I use the cash value of my life insurance policy for investments?

You have several options for using the cash value of your life insurance policy for investments. One option is to take out a policy loan against the cash value. This allows you to borrow funds from the insurance company using your cash value as collateral. The loan can be used for various investment purposes, such as starting a business or purchasing real estate.

Another option is to surrender a portion or all of your life insurance policy’s cash value and use the funds for investments. However, it would help if you considered the potential tax implications and surrender charges associated with cashing out your policy.

Question 4: Are there any risks in investing in life insurance?

Yes, there are risks involved in using life insurance as an investment. The performance of your policy’s cash value component depends on the insurance company’s investment performance. If the company’s investments underperform, this can negatively impact the growth of your cash value.

Additionally, accessing the cash value of your life insurance policy through loans or withdrawals can reduce the death benefit and potentially leave your loved ones with less financial protection. Before using life insurance as an investment tool, carefully considering the potential risks and benefits is essential.

Question 5: Should I consult a financial advisor before investing in life insurance?

Yes, it is highly recommended that you consult a financial advisor before using life insurance as an investment. A financial advisor can help assess your financial goals, risk tolerance, and overall financial situation to determine whether using life insurance as an investment aligns with your objectives.

They can also help you select the correct type of life insurance policy and provide insights on optimizing the cash value component for your investment needs. Working with a financial advisor can ensure that you make informed decisions and maximize the benefits of using life insurance as an investment.

How Does Whole Life Insurance Work As An Investment?

Final Thoughts: Maximizing Life Insurance as an Investment

Incorporating life insurance as an investment strategy can be smart regarding financial planning. Throughout this article, we’ve explored how life insurance can serve as a valuable asset, providing financial protection and potential growth opportunities for the future. By understanding the different types of life insurance policies, such as whole life and universal life, individuals can tailor their investment approach to meet their specific needs and goals.

One key advantage of using life insurance as an investment is its ability to offer tax advantages. With the potential for tax-deferred growth, policyholders can accumulate cash value over time, which can be accessed through loans or withdrawals. This can provide a valuable source of funds for important milestones such as buying a home, funding education, or supplementing retirement income.

Furthermore, life insurance offers protection that other investment options may not provide. In the event of the policyholder’s death, the beneficiaries receive a death benefit, which can provide financial stability and support during a challenging time. This can be particularly valuable for individuals with dependents or those looking to leave a legacy for their loved ones.

In conclusion, utilizing life insurance as an investment tool can offer a range of benefits, from tax advantages to financial protection. Working with a knowledgeable financial advisor allows individuals to explore the various options and develop a comprehensive strategy that aligns with their unique circumstances. Remember, life insurance is not just about protecting against the uncertainties of life but also about maximizing opportunities for growth and securing a brighter financial future.