If you’re a business owner, you know that unexpected events can happen anytime. Insurance coverage is crucial to protect your business and its assets. But what happens when you need to file a claim? How does the claims process work for business insurance? In this article, we’ll dive into the ins and outs of the claims process so you can clearly understand what to expect when the unexpected occurs.

When it comes to business insurance, the claims process can seem daunting. However, understanding the steps involved can help alleviate some of the stress. First and foremost, you must notify your insurance provider immediately after an incident occurs. This could be anything from property damage due to a fire, theft of equipment, or liability claims. Once you’ve reported the incident, your insurance company will assign you a claims adjuster who will be your main point of contact throughout the process. They will investigate the claim, assess the damages, and determine the coverage and compensation you’re entitled to. It’s essential to provide the necessary documentation and evidence to support your claim, such as photographs, police reports, or invoices. Remember, the more information you can provide, the smoother the claims process.

How does the claims process work for business insurance?

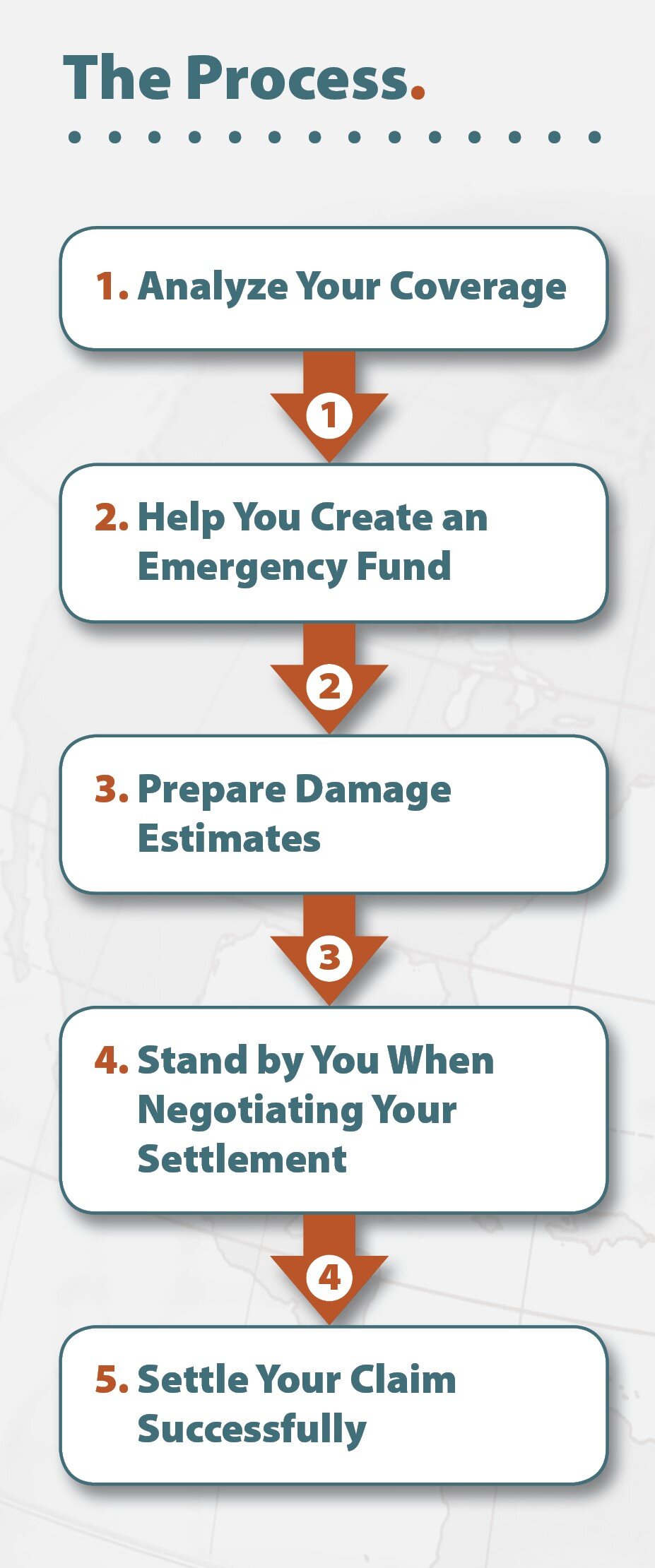

The claims process for business insurance typically involves the following steps:

- Report the claim: Notify your insurance provider immediately after an incident occurs.

- Provide documentation: Gather necessary documentation, such as police reports or photos, to support your claim.

- Investigation: The insurance company will assess the validity of the claim and may request additional information.

- Evaluation: Once the investigation is complete, the insurance company will determine the amount to be paid out based on policy coverage.

- Payment: If the claim is approved, the insurance company will issue payment to cover the losses.

Reviewing your policy and understanding the specific claims process outlined by your insurance provider is essential.

How Does the Claims Process Work for Business Insurance?

In business, unexpected events can occur that may cause financial loss or damage to property. This is where business insurance comes into play, providing coverage and protection for businesses in times of need. However, understanding how the claims process works for business insurance is crucial for business owners to ensure a smooth and efficient resolution. In this article, we will delve into the intricacies of the claims process for business insurance, providing you with valuable insights and guidance.

Step 1: Reporting the Claim

The first step in the claims process is reporting the claim to your insurance provider. As soon as an incident occurs that may result in a claim, you must notify your insurance company promptly. This can typically be done through a dedicated claims hotline or online portal. When reporting the claim, be prepared to provide detailed information such as the date and time of the incident, a description of what happened, and any relevant documentation or evidence.

Once the claim has been reported, your insurance provider will assign a claims adjuster to handle your case. The claims adjuster will be your main point of contact throughout the process, guiding you through the necessary steps and answering any questions.

Gathering Evidence and Documentation

After reporting the claim, gathering all necessary evidence and documentation to support your case is crucial. This may include photographs or videos of the incident, police reports (if applicable), witness statements, and any other relevant documentation. Providing comprehensive and accurate documentation will help expedite the claims process and increase the likelihood of a successful outcome.

Reviewing Policy Coverage

Once the claims adjuster has been assigned, they will review your insurance policy to determine the coverage and limitations of your specific plan. It is essential to clearly understand your policy coverage to ensure you are adequately protected. The claims adjuster will assess whether the incident falls within the scope of your policy and inform you of any potential exclusions or limitations that may affect the outcome of your claim.

Step 2: Evaluation and Investigation

After the initial reporting and documentation stage, the claims adjuster will thoroughly evaluate and investigate the claim. This may involve site visits, interviews with involved parties, and additional research or analysis. This step aims to gather all relevant information and assess the extent of the loss or damage.

During the evaluation and investigation process, it is essential to cooperate fully with the claims adjuster and promptly provide any requested information or documentation. The more cooperative and proactive you are, the smoother the claims process will likely be.

Assessment of Damages

As part of the evaluation process, the claims adjuster will assess the damages and determine the financial impact of the incident. This may involve obtaining repair estimates, consulting with experts, or using industry-standard valuation methods. The goal is to accurately quantify the loss or damage and determine the appropriate amount of compensation.

Verification of Coverage

In addition to assessing damages, the claims adjuster will verify the coverage provided by your insurance policy. This may involve reviewing policy language, exclusions, and endorsements. The claims adjuster will ensure that the loss or damage falls within the scope of the policy coverage and that all requirements have been met.

Step 3: Resolution and Settlement

Once the evaluation and investigation process is complete, the claims adjuster will work towards a resolution and settlement. This may involve negotiations with involved parties, discussions with legal counsel, or mediation services. The goal is to reach a fair and equitable settlement compensating you for the loss or damage incurred.

Claim Payment

If a settlement is reached, the insurance company will issue a claim payment to cover the agreed-upon amount. The payment may be made directly to you, a third-party vendor, or a combination of both, depending on the nature of the claim. Reviewing the payment carefully and ensuring it aligns with the agreed-upon terms is essential.

Appeals and Disputes

There may be disagreements or disputes regarding the resolution or settlement in some cases. If you are unsatisfied with the outcome of your claim, you have the right to appeal the decision or engage in a dispute resolution process. This may involve additional negotiations, arbitration, or legal action.

In conclusion, understanding how the claims process works for business insurance is crucial for business owners to navigate unexpected events effectively. You can increase the likelihood of a successful resolution by promptly reporting the claim, gathering comprehensive documentation, and cooperating with the claims adjuster. Review your policy coverage, assess damages accurately, and work towards a fair settlement. With a clear understanding of the claims process, you can protect your business and ensure its continuity in times of need.

Key Takeaways: How Does the Claims Process Work for Business Insurance?

- When a business experiences a loss or damage covered by their insurance policy, they can file a claim with their insurance provider.

- The claims process typically begins by contacting the insurance company and providing details about the incident, such as the date, time, and location of the loss or damage.

- The insurance company will assign a claims adjuster to investigate the claim, assess the damages, and determine the coverage and compensation the business is entitled to.

- Once the investigation is complete, the claims adjuster will work with the business owner to negotiate a settlement, which may involve repairing or replacing damaged property, reimbursing for lost income, or covering other covered expenses.

- After the settlement is agreed upon, the insurance company will pay the business owner to cover the approved amount, and the claim will be closed.

Frequently Asked Questions

Understanding how the claims process works for business insurance is crucial for a business owner. Here are some frequently asked questions about the claims process for business insurance:

1. What should I do if I need to file a claim?

When you need to file a claim for your business insurance, taking immediate action is essential. Start by notifying your insurance provider as soon as possible. They will guide you through the process and provide you with the necessary forms to fill out. Make sure to document any damages or losses by taking photos and gathering any relevant evidence. Keep track of any expenses incurred as a result of the incident.

Once you submit your claim, the insurance company will assign an adjuster to assess the damages and losses. The adjuster will review your policy to determine coverage and evaluate the extent of the claim. It’s important to cooperate fully with the adjuster and provide any additional information or documentation they may require.

2. How long does the claims process usually take?

The duration of the claims process for business insurance can vary depending on the complexity of the claim and the responsiveness of all parties involved. In general, the insurance company strives to resolve claims promptly. However, some claims may require more investigation time, especially if disputes or further documentation are needed.

It’s advisable to stay in regular communication with your insurance provider to stay updated on the progress of your claim. They should be able to provide you with an estimated timeline for resolving your claim.

3. Will my business insurance cover all types of claims?

Business insurance policies typically have specific coverage limits and exclusions. Reviewing your policy carefully is essential to understand what types of claims are covered and what may be excluded. Common types of claims covered by business insurance include property damage, liability claims, and business interruption due to covered perils.

Remember that each insurance policy may have different terms and conditions, so it’s essential to consult with your insurance provider to clarify any doubts or questions you may have about the coverage.

4. How is the claim amount determined?

Several factors determine the claim amount for business insurance. The insurance company will consider the extent of the damage or loss, the coverage limits specified in your policy, and any applicable deductibles. They may also consider the cost of repairs or replacement and any additional expenses incurred as a result of the incident.

The insurance adjuster will assess the damages and losses by conducting a thorough investigation. They may consult experts or obtain multiple estimates to evaluate the claim accurately. The final claim amount will be determined based on these assessments and the terms outlined in your insurance policy.

5. What happens after the claim is approved?

Once your claim is approved, the insurance company will provide the necessary funds to cover the losses or damages. The payment can be made directly to you or the service providers involved, depending on the nature of the claim. It’s essential to review the settlement offer and ensure it aligns with the agreed-upon coverage and the extent of the damages.

If you have any concerns or disagreements regarding the settlement offer, you should discuss them with your insurance provider. They may be able to provide further clarification or assist in resolving any disputes. Once the settlement is accepted, the claims process is considered complete, and you can move forward with the necessary repairs or recovery efforts for your business.

Final Thoughts on How the Claims Process Works for Business Insurance

So, there you have it – a comprehensive understanding of how the claims process works for business insurance. It may seem daunting initially, but with the proper knowledge and preparation, you can navigate this process smoothly. Remember, when it comes to filing a claim, time is of the essence. Notify your insurance provider immediately and provide all the necessary documentation to support your claim. Be proactive and responsive throughout the process to ensure a timely resolution.

While no one wants to experience a loss or damage to their business, having the right insurance coverage can provide peace of mind. It’s important to review your policy regularly and make any necessary updates to ensure that you have adequate coverage. Additionally, consider working with a knowledgeable insurance agent who can guide you through the claims process and help you understand the fine print of your policy.

In conclusion, being informed about the claims process for business insurance is crucial for every business owner. By understanding the steps involved and being prepared, you can confidently navigate the process and increase your chances of a successful claim. Remember, each insurance company may have slight variations in their procedures, so it’s always a good idea to familiarize yourself with your specific policy. With the right approach and documentation, you can protect your business and get back on track quickly.