If you’re a sole proprietor and wondering if you can get business insurance, the answer is a resounding yes! While it may seem daunting, protecting your business is essential, and having the right insurance coverage can give you peace of mind. This article will explore the importance of business insurance for sole proprietors and how it can safeguard your livelihood. So, let’s dive in and discover why business insurance is a must-have for entrepreneurs like yourself!

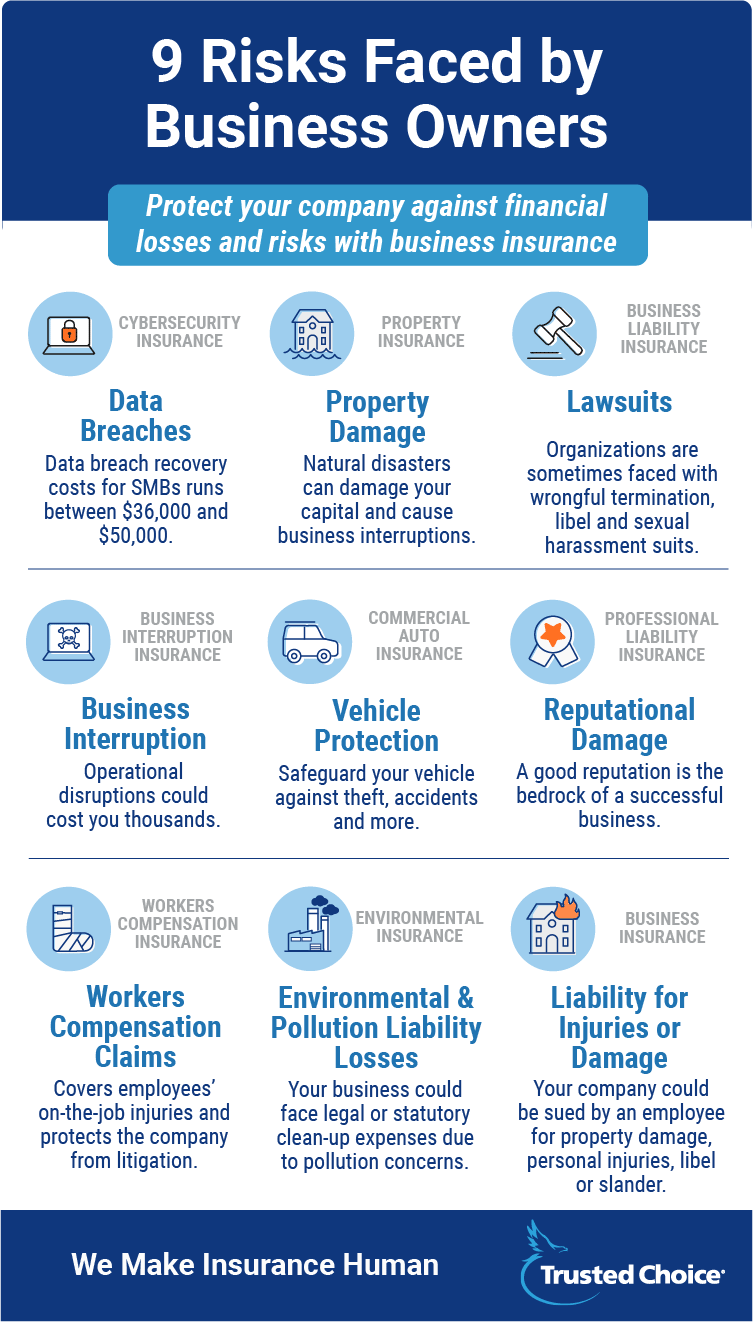

As a sole proprietor, you may wear many hats, from the CEO to the janitor. But one role you shouldn’t overlook is that of the risk manager. Business insurance acts as a safety net, protecting you from unforeseen events and potential liabilities. It covers many risks, including property damage, lawsuits, and employee injuries. Investing in the right insurance policies can shield yourself and your business from financial ruin.

Now that we’ve established the importance of business insurance for sole proprietors let’s delve deeper into the different types of coverage available and how they can benefit you. Whether you’re just starting or have been in business for years, having the right insurance is crucial for success. So, let’s explore your options and ensure you have the protection you need to thrive in the business world.

Can a Sole Proprietor Get Business Insurance?

Running a business as a sole proprietor has unique challenges and responsibilities. A critical aspect of being a sole proprietor is considering whether or not you need business insurance. While technically not required by law, having insurance coverage for your business can provide valuable protection and peace of mind. In this article, we will explore the topic of whether a sole proprietor can get business insurance and why it may be beneficial to do so.

The Importance of Business Insurance for Sole Proprietors

As a sole proprietor, you are personally responsible for all aspects of your business. Any liabilities or risks associated with your business also fall on your shoulders. Business insurance can help safeguard you and your business from potential financial losses from accidents, lawsuits, or other unforeseen events. It provides a safety net that can protect your assets and help keep your business running smoothly.

Business insurance typically includes various coverage options, such as general liability insurance, professional liability insurance, property insurance, and business interruption insurance. Each type of coverage serves a specific purpose and can provide different forms of protection. For example, general liability insurance can cover legal fees and damages if someone is injured on your premises. In contrast, property insurance can help replace or repair your business assets in the event of a fire or theft.

The Benefits of Business Insurance for Sole Proprietors

There are several critical benefits to obtaining business insurance as a sole proprietor. Firstly, it helps protect your assets. In the event of a lawsuit or significant financial loss, having insurance can prevent your savings, home, or other assets from being seized to cover the costs. This separation between your personal and business finances is crucial for maintaining financial stability and protecting wealth.

Secondly, business insurance can enhance your credibility and reputation. When potential clients or customers see that you have insurance coverage, it signals that you take your business seriously and are committed to providing quality service. This can instill confidence in your customers and help attract new business opportunities.

Furthermore, having insurance coverage can also help you secure contracts and partnerships with other businesses. Many companies require proof of insurance before entering into any agreements or collaborations. Having the appropriate insurance policies in place allows you to meet these requirements and open doors to valuable business relationships.

In addition to these benefits, business insurance can provide peace of mind. Running a business involves taking calculated risks, but having insurance coverage protects you from the unforeseen consequences of those risks. It lets you focus on growing your business without worrying about potential financial setbacks.

Types of Business Insurance Available for Sole Proprietors

When considering business insurance as a sole proprietor, it’s essential to understand the different types of coverage available. Here are some common types of insurance that may be relevant to your business:

General Liability Insurance

General liability insurance protects your business from third-party claims of bodily injury, property damage, or personal injury. It covers legal fees, settlements, and judgments in the event of a lawsuit. This type of insurance is essential for any business, as accidents and unexpected incidents can happen anytime.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is essential for sole proprietors who offer professional services or advice. It provides coverage in case clients allege that your work or advice caused them financial harm. This insurance can help cover legal fees and damages from such claims.

Property Insurance

Property insurance protects your business assets, such as equipment, inventory, and office space, from damages or losses caused by fire, theft, vandalism, or natural disasters. It can help you recover financially by covering the costs of repairing or replacing damaged property.

Business Interruption Insurance

Business interruption insurance protects against income loss ifess operations are temporarily halted due to unforeseen circumstances, such as a fire or natural disaster. It can cover ongoing expenses and lost income during interruption, helping you stay afloat until you can resume normal operations.

Obtaining Business Insurance as a Sole Proprietor

As a sole proprietor, obtaining business insurance is relatively straightforward. You can start by researching insurance providers that offer coverage for small businesses. Comparing quotes and policies from multiple providers will help you find the best coverage options at competitive rates.

When applying for business insurance, you must provide information about your business, such as its size, industry, and revenue. The insurance provider will use this information to assess the risk associated with your company and determine the appropriate coverage and premiums.

It’s important to carefully review the terms and conditions of any insurance policy before making a decision. Consider coverage limits, deductibles, and exclusions to ensure the policy meets your needs.

In conclusion, business insurance is not legally required for sole proprietors, but it is highly recommended. The benefits of having insurance coverage far outweigh the costs, as it can protect your assets, enhance your credibility, and provide peace of mind. By understanding the different types of coverage available and selecting the appropriate policies for your business, you can ensure that you are adequately protected from potential risks and liabilities. So, suppose you’re a sole proprietor wondering whether you can get business insurance. In that case, the answer is a resounding yes – a decision that can significantly benefit your business in the long run.

Key Takeaways: Can a Sole Proprietor Get Business Insurance?

- Yes, as a sole proprietor, you can get business insurance to protect your personal and business assets.

- Business insurance covers liability claims, property damage, and other risks specific to your business.

- It’s essential to assess your business’s risks and choose insurance coverage accordingly.

- Insurance options for sole proprietors include general liability insurance, professional liability insurance, and property insurance.

- Working with an insurance agent can help you understand your options and find the best coverage.

Frequently Asked Questions

Question 1: What is business insurance for sole proprietors?

Business insurance for sole proprietors is specifically designed to protect the assets and interests of individuals who own and operate their businesses. It provides financial protection against potential risks and liabilities while running a business.

Business insurance for sole proprietors typically includes coverage for property damage, liability claims, loss of income, and legal expenses. It helps safeguard the owner’s assets and provides peace of mind in unforeseen circumstances or accidents.

Question 2: Why do sole proprietors need business insurance?

Sole proprietors need business insurance to protect themselves and their businesses from potential financial losses. While sole proprietors have complete control and ownership of their companies, they bear all the associated risks and liabilities.

Business insurance can help cover the costs of property damage, lawsuits, and other unforeseen events that could otherwise result in significant financial burdens. It also gives sole proprietors credibility and reassures clients and customers that they are reliable and responsible business owners.

Question 3: What types of insurance coverage are available for sole proprietors?

Several types of insurance coverage are available for sole proprietors, depending on the nature of their business. Some common types of coverage include:

– General liability insurance: Protects against bodily injury, property damage, and advertising injury claims.

– Property insurance: Covers damage or loss to business assets, such as buildings, equipment, and inventory.

– Professional liability insurance: Protects against negligence claims or errors in professional services.

– Business interruption insurance: Covers loss of income and expenses during a period of business interruption, such as due to fire or natural disasters.

Sole proprietors need to assess their specific risks and consult an insurance professional to determine the most appropriate coverage for their business.

Question 4: How can sole proprietors find affordable business insurance?

Finding affordable business insurance as a sole proprietor can be challenging, but there are ways to minimize costs without compromising coverage. Here are some tips:

– Compare quotes from multiple insurance providers to find the best rates.

– Consider bundling multiple insurance policies with the same provider for potential discounts.

– Opt for a higher deductible, which can lower monthly premiums.

– Take steps to minimize risks in your business, such as implementing safety measures or investing in security systems.

– Review your insurance coverage regularly to ensure it aligns with your business needs and make adjustments as necessary.

Question 5: Can sole proprietors get health insurance through business insurance?

Sole proprietors typically cannot get health insurance coverage through their business insurance. However, they may have options to obtain health insurance through individual health insurance plans or government programs such as the Affordable Care Act (ACA) marketplace.

Sole proprietors must explore their options and consider their health insurance needs separately from their business insurance coverage.

Final Summary: Can a Sole Proprietor Get Business Insurance?

So, can a sole proprietor get business insurance? The answer is a resounding yes! While many may think that business insurance is only for larger companies or corporations, sole proprietors can benefit from this coverage. It can provide vital protection for their business and personal assets.

By obtaining business insurance as a sole proprietor, you can safeguard yourself against various risks. Whether it’s liability claims, property damage, or even legal expenses, having the right insurance coverage can give you peace of mind and protect you from financial ruin. Additionally, business insurance can enhance your professional reputation and give your clients or customers confidence in your services.

So, if you’re a sole proprietor, don’t overlook the importance of business insurance. It’s a valuable investment that can protect your livelihood and assets in the face of unexpected events. Various options are available to suit your specific needs, from general liability insurance to professional liability coverage. Remember, taking the time to research and compare different insurance policies can help you find the best coverage at the most affordable price.

Ultimately, business insurance for sole proprietors is not just a luxury – it’s a necessity. It’s a proactive step towards safeguarding your business and ensuring its long-term success. So, don’t hesitate to explore your options and consult with insurance professionals who can guide you in making the right choices. Investing in business insurance lets you focus on what you do best while knowing you’re protected from potential risks and liabilities.