If you’ve ever wondered, “What is catastrophic health insurance?” you’re in the right place! Let’s dive into this topic and unravel the mysteries of this type of coverage. Catastrophic health insurance is like a safety net, ready to catch you in case of a significant medical emergency. It’s a type of health insurance plan that offers coverage for catastrophic events, such as serious illnesses or injuries that require costly medical treatments or hospitalizations.

You might be wondering why it’s called “catastrophic” insurance. Well, that’s because it’s designed to protect you from financial ruin in the face of a catastrophic event. It’s not meant to cover routine doctor visits or minor medical expenses but to provide peace of mind when faced with a severe health crisis. Think of it as a backup plan for when life throws you a curveball. So, let’s explore the ins and outs of catastrophic health insurance and see if it fits you.

Understanding Catastrophic Health Insurance: What You Need to Know

Catastrophic health insurance is a type of coverage that protects against high medical costs in the event of a severe illness or injury. It is designed to offer financial assistance for significant health emergencies, typically having lower monthly premiums than other health insurance plans. In this article, we will delve into the details of catastrophic health insurance, its benefits, drawbacks, and who it may be suitable for.

What Does Catastrophic Health Insurance Cover?

Catastrophic health insurance primarily covers medical expenses related to severe illnesses or injuries. These plans generally have a high deductible, meaning you must pay a significant amount out-of-pocket before the insurance coverage kicks in. Once the deductible is met, catastrophic health insurance typically covers most of the remaining costs, including hospital stays, surgeries, and certain preventive services.

It’s important to note that catastrophic health insurance may not cover routine doctor visits, prescription medications, or other non-emergency medical services. These plans protect individuals from financial ruin in a significant health crisis rather than providing comprehensive coverage for everyday healthcare needs.

Who is Eligible for Catastrophic Health Insurance?

Catastrophic health insurance is typically available to individuals under 30 or those who qualify for a hardship exemption. It is often chosen by young and healthy individuals who want insurance coverage in case of a significant medical event. To be eligible for catastrophic health insurance, you must meet specific criteria set by the insurance provider or the Affordable Care Act (ACA).

Benefits of Catastrophic Health Insurance

1. Protection against High Medical Costs: Catastrophic health insurance provides financial protection in a significant health crisis. It ensures you won’t be burdened with excessive medical bills that could lead to economic instability.

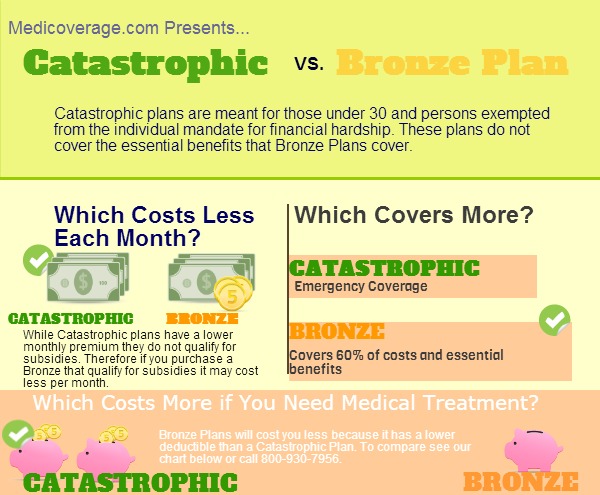

2. Lower Monthly Premiums: Compared to other health insurance plans, catastrophic coverage generally comes with lower monthly premiums. This can benefit individuals who are young, healthy, and have minimal healthcare needs.

3. Preventive Services: While catastrophic health insurance may not cover routine doctor visits, it often includes coverage for certain preventive services, such as vaccinations and screenings. These preventive measures can help detect potential health issues early on.

Drawbacks of Catastrophic Health Insurance

1. High Deductibles: Catastrophic health insurance plans typically have high deductibles, meaning you must pay a significant amount out-of-pocket before your coverage kicks in. This can be a challenge for individuals who don’t have substantial savings or cannot afford these upfront costs.

2. Limited Coverage for Non-Emergency Services: Catastrophic health insurance is primarily designed to cover major health emergencies. It may not provide comprehensive coverage for routine doctor visits, prescription medications, or other non-emergency medical services. This can be a drawback for individuals who require regular healthcare services.

3. Ineligibility for Subsidies: Catastrophic health insurance plans are not eligible for premium subsidies under the Affordable Care Act. This means you may have to bear the total cost of the premiums without any financial assistance.

While catastrophic health insurance can be a viable option for specific individuals, it’s essential to carefully consider your healthcare needs and financial situation before opting for this type of coverage.

Is Catastrophic Health Insurance Right for You?

Catastrophic health insurance may be suitable for individuals who are young, healthy, and have minimal healthcare needs. Suppose you rarely visit the doctor and can afford to pay for routine healthcare expenses out-of-pocket. In that case, catastrophic coverage can provide financial protection in a significant medical emergency.

However, if you have chronic health conditions, require regular medical care, or anticipate higher healthcare expenses, it may be more beneficial to consider a comprehensive health insurance plan that offers broader coverage.

Ultimately, choosing catastrophic health insurance should be based on your circumstances, healthcare needs, and financial capabilities. It is essential to carefully evaluate your options and consult a healthcare professional or insurance agent to determine the best insurance plan for your situation.

Key Takeaways: What is Catastrophic Health Insurance?

- Catastrophic health insurance is a type of health coverage that protects major medical expenses.

- It is designed for individuals who are generally healthy but want financial protection in case of unexpected medical emergencies.

- These plans have high deductibles, meaning you pay a significant amount out of pocket before the insurance kicks in.

- Catastrophic insurance covers essential health benefits after the deductible is met, including hospital stays and emergency care.

- It does not cover routine doctor visits or prescription drugs, so it’s essential to have another form of coverage to address these needs.

Frequently Asked Questions

What is catastrophic health insurance?

Catastrophic health insurance is a type of insurance plan that covers major medical expenses in the event of a severe illness or injury. It is designed to protect individuals from high medical costs that can arise from unexpected medical emergencies.

Unlike traditional health insurance plans, catastrophic health insurance typically has lower monthly premiums but higher deductibles. This means individuals must pay more medical expenses out of pocket before insurance coverage kicks in. Catastrophic health insurance is often chosen by individuals who are generally healthy and do not require frequent medical care but want financial protection in case of a significant health event.

Who is eligible for catastrophic health insurance?

Catastrophic health insurance is available to individuals under 30 years old or who qualify for a hardship exemption. This type of insurance is not typically available to individuals eligible for other types of health insurance, such as employer-sponsored plans or government programs like Medicaid or Medicare.

It’s important to note that catastrophic health insurance is not intended to be a primary form of coverage. It is meant to provide financial protection in a significant health event but does not cover routine medical expenses or preventive care.

What does catastrophic health insurance cover?

Catastrophic health insurance covers major medical expenses, such as hospital stays, surgeries, and emergency room visits. It may also cover some preventive care services, such as vaccinations and screenings, but this can vary depending on the insurance plan.

However, catastrophic health insurance does not typically cover routine doctor visits, prescription medications, or other non-emergency medical expenses. Reviewing the details of your specific insurance plan to understand what is covered and what is not is essential.

How much does catastrophic health insurance cost?

The cost of catastrophic health insurance can vary depending on several factors, including age, location, and the specific insurance plan you choose. Generally, catastrophic health insurance has lower monthly premiums than other health insurance plans.

However, it’s essential to consider that catastrophic health insurance also has higher deductibles. This means you will have to pay more of your medical expenses out of pocket before your insurance coverage begins. It’s essential to carefully evaluate your budget and healthcare needs when considering the cost of catastrophic health insurance.

Is catastrophic health insurance right for me?

Whether catastrophic health insurance is right depends on your circumstances and healthcare needs. Catastrophic health insurance may be a good option if you are generally healthy and do not require frequent medical care but still want financial protection in case of a significant health event.

However, suppose you have ongoing medical conditions or require regular medical care. In that case, you may consider other health insurance plans that provide more comprehensive coverage for routine medical expenses. It’s important to carefully evaluate your healthcare needs and budget before choosing the right insurance plan.

Final Summary: Understanding Catastrophic Health Insurance

As we wrap up our discussion on catastrophic health insurance, it’s clear that this type of coverage serves a specific purpose in healthcare. While it may not be suitable for everyone, it can provide a valuable safety net for those who are generally healthy but want protection against unexpected medical expenses.

Catastrophic health insurance typically offers lower premiums but higher deductibles, making it ideal for individuals who don’t require frequent medical attention. It’s designed to kick in after a certain threshold of expenses has been reached, providing coverage for major emergencies or catastrophic events. This type of insurance can be particularly beneficial for young and healthy individuals seeking a more affordable option.

However, it’s important to note that catastrophic health insurance does not cover routine medical expenses or preventive care. It’s crucial for individuals considering this type of coverage to carefully evaluate their own healthcare needs and budget before making a decision.

In conclusion, while catastrophic health insurance may not be the right fit for everyone, it can be a valuable option for those in good health and looking for affordable coverage against major medical events. By understanding the benefits and limitations of this type of insurance, individuals can make an informed decision that aligns with their needs and financial situation. Remember to research and consult with a healthcare professional to determine the best insurance plan for you.