Are you wondering how to get health insurance without a job? It’s a common concern for many individuals in a transitional period or facing unemployment. Health insurance is essential for maintaining your well-being and peace of mind, but it can be challenging to navigate the process without the stability of a job. However, fear not! This article will explore some practical options and provide valuable tips on securing health insurance even without traditional employment.

Regarding health insurance, having a job isn’t the only path to coverage. You can explore alternative avenues to ensure you have the protection you need. From government programs to private options, we’ll delve into various possibilities that can suit your specific circumstances. So, let’s dive in and discover how you can obtain health insurance without a job, ensuring you have the coverage you deserve.

How to Get Health Insurance Without a Job?

- Research government programs: Look into Medicaid or the Children’s Health Insurance Program (CHIP) to see if you qualify for free or low-cost coverage.

- Consider COBRA: If you recently lost your job, you may be eligible for temporary continuation of your employer-sponsored health insurance through COBRA.

- Explore the Marketplace: Check out healthcare.gov for affordable plans available through the Health Insurance Marketplace.

- Other options include research professionals or trade associations, community health clinics, or short-term health insurance plans.

- Seek assistance: Reach out to insurance brokers or enrollment specialists who can help you find health insurance without a job.

How to Get Health Insurance Without a Job?

Getting health insurance can be challenging, especially if you don’t have a job providing coverage. However, options are available to ensure you have access to healthcare when needed. This article will explore different ways to get health insurance without a job, from government programs to private plans. By understanding these options, you can make an informed decision about your healthcare coverage.

Government Programs

When you don’t have a job, you may be eligible for government programs that provide health insurance. One of the most well-known programs is Medicaid, which offers coverage for low-income individuals and families. Eligibility requirements vary by state, so checking with your local Medicaid office is essential to see if you qualify.

Another option is the Children’s Health Insurance Program (CHIP), which provides coverage for children in low-income families. If you have children and are without a job, this program can be a lifeline to ensure their healthcare needs are met. Again, eligibility requirements vary by state, so check with your local CHIP office.

Private Insurance Options

If you don’t qualify for government programs or are looking for additional coverage, private insurance options are available. One option is to purchase an individual plan directly from an insurance company. This can be more expensive than employer-sponsored plans, but it provides the flexibility to choose the coverage that best suits your needs.

Another private insurance option is to join a healthcare-sharing ministry. These ministries are religious organizations that pool resources to help members pay for medical expenses. While not technically insurance, they can provide a way to access healthcare services without a traditional job.

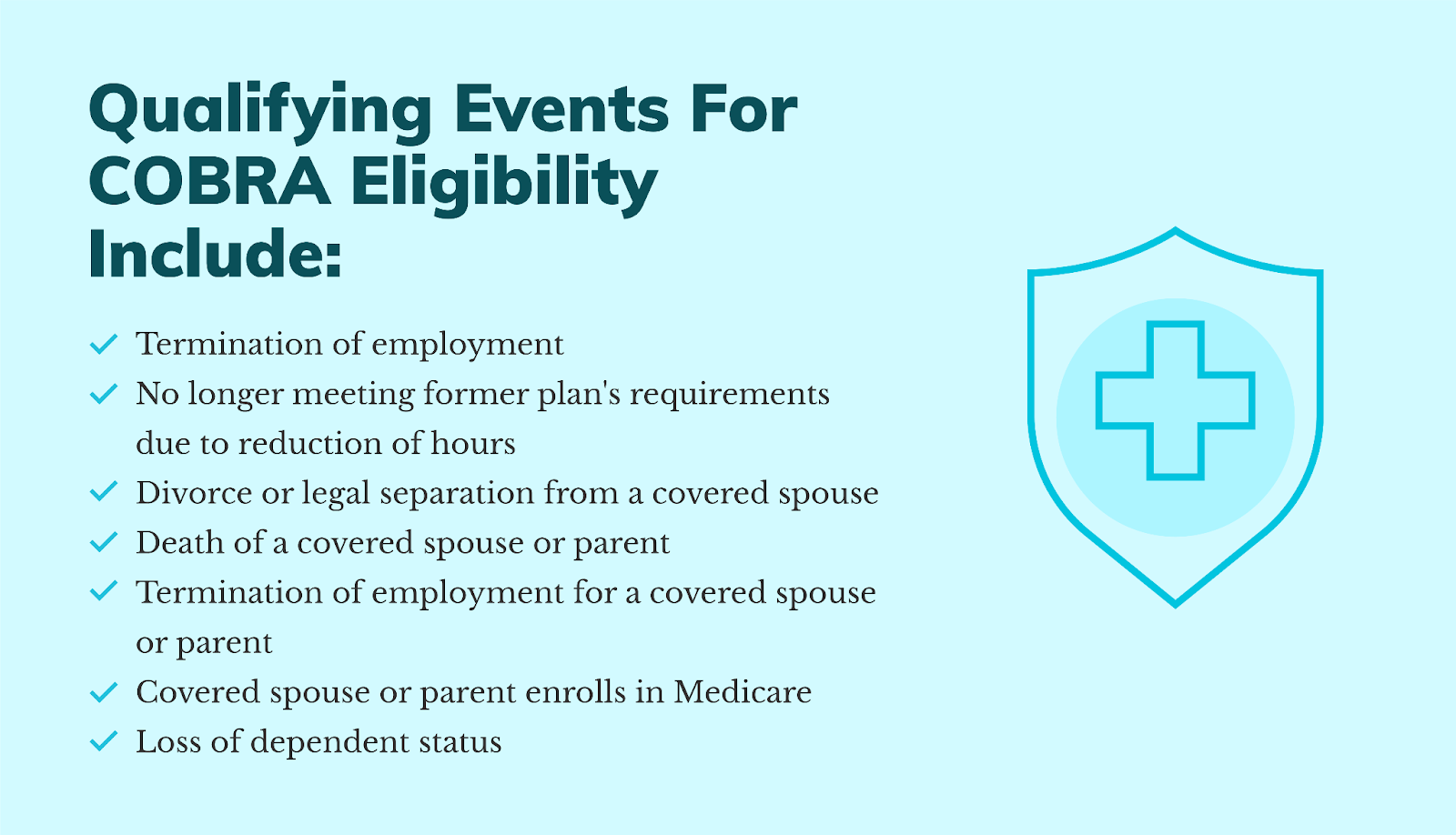

COBRA Coverage

You may be eligible for COBRA coverage if you recently lost your job. COBRA allows you to continue your employer-sponsored health insurance for a limited period, typically 18 months. While COBRA can be more expensive than other options, it can provide a temporary solution while you search for additional coverage.

Healthcare Marketplaces

The Affordable Care Act created healthcare marketplaces where individuals can shop for insurance plans. These marketplaces offer a range of options, including subsidies for low-income individuals and families. By visiting the healthcare marketplace website for your state, you can explore the available plans and determine if you qualify for financial assistance.

Benefits of Health Insurance Without a Job

Having health insurance without a job provides several benefits. First and foremost, it ensures that you have access to necessary healthcare services, including preventive care, prescription medications, and specialist visits. This can help you maintain your overall health and catch any potential issues early on.

Additionally, health insurance can provide financial protection in a medical emergency or unexpected illness. Medical bills can quickly add up without insurance, leading to significant financial strain. Having coverage can help mitigate these costs and provide peace of mind.

Additional Tips

When seeking health insurance without a job, being proactive and exploring all available options is essential. Start by researching government programs and private insurance plans to determine which ones you may qualify for. Consider cost, coverage, and network providers to find the best fit for your needs.

Additionally, take advantage of resources such as healthcare navigators or insurance brokers who can help guide you through the process. These professionals can provide valuable insights and assist you in finding the right coverage for your situation.

In conclusion, while getting health insurance without a job may require some effort and research, finding coverage that meets your needs is possible. Whether through government programs, private insurance options, or COBRA, avenues are available to ensure you have access to healthcare when needed. By exploring these options and being proactive in your search, you can secure the coverage you need for a healthier future.

Key Takeaways: How to Get Health Insurance Without a Job?

- Consider applying for Medicaid, a government program that provides healthcare coverage for low-income individuals and families.

- Explore the COBRA option, which allows you to continue your previous employer’s health insurance plan for a limited time after losing your job.

- Research if you qualify for the Special Enrollment Period to get health insurance through the Affordable Care Act marketplace.

- Look into short-term health insurance plans that provide temporary coverage until you find a job with benefits.

- Consider joining a spouse or partner’s health insurance plan if they have one available.

Frequently Asked Questions

Can I get health insurance without a job?

Yes, it is possible to get health insurance without a job. While many individuals obtain health insurance through their employers, alternative options are available for those unemployed. Here are a few options you can explore:

1. Medicaid: If your income falls below a certain threshold, you may qualify for Medicaid, a government program that provides health insurance to low-income individuals and families.

2. Affordable Care Act (ACA) Marketplace: You can enroll in health insurance through the ACA Marketplace, even if you don’t have a job. Depending on your income, you may be eligible for subsidies that can help lower the cost of your premiums.

What is COBRA coverage, and can I get it without a job?

COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage allows you to continue the health insurance coverage you had through your previous employer, even after you leave the job. This can be an option for those who recently lost their job and want to maintain their health insurance.

However, it’s important to note that COBRA coverage can be expensive as you will be responsible for paying the entire premium without any employer contribution. If you cannot afford the cost, you may want to explore other options, such as Medicaid or ACA Marketplace coverage.

Can I qualify for Medicaid if I don’t have a job?

Yes, you can qualify for Medicaid even if you don’t have a job. Medicaid eligibility is based on your income and household size. Each state has its specific guidelines, so it’s essential to check the requirements in your state.

Unemployment does not automatically disqualify you from Medicaid. If your income falls below the threshold set by your state, you may be eligible for Medicaid coverage. It’s worth noting that Medicaid expansion under the Affordable Care Act has made coverage more accessible to low-income individuals in many states.

What are short-term health insurance plans, and can I get them without a job?

Short-term health insurance plans provide temporary coverage for individuals between jobs or needing temporary coverage for other reasons. These plans usually have a limited duration, ranging from a few months to a year.

You can apply for short-term health insurance plans even if you don’t have a job. However, it’s essential to remember that these plans may not offer the same comprehensive coverage as long-term health insurance plans. They often have limitations and exclusions, so it’s necessary to carefully review the terms and conditions before enrolling.

Are any community or nonprofit organizations offering health insurance assistance for those without a job?

Yes, community and nonprofit organizations offer health insurance assistance for individuals without a job. These organizations may provide resources and guidance on finding affordable health insurance options or offer assistance with the application process.

Some examples of such organizations include local health clinics, community health centers, and nonprofit advocacy groups. It’s worth exploring these resources in your area to see if they can provide any assistance or information on obtaining health insurance without a job.

Final Summary: How to Get Health Insurance Without a Job?

So, there you have it! We’ve explored various options for obtaining health insurance without a job, and hopefully, you now have a clearer picture of what steps to take. Remember, even though it may seem daunting, options are available to ensure you can still access the healthcare you need.

One important avenue to explore is government assistance programs such as Medicaid or the Affordable Care Act. These programs are designed to provide affordable coverage for individuals who may not have access to employer-sponsored plans. Additionally, you can consider purchasing private health insurance directly from insurance companies or through insurance marketplaces. Some companies offer unique plans for those who are unemployed.

While it may take some research and effort to find the right solution for your specific situation, it’s crucial not to neglect your health. Remember to assess your needs, explore all available options, and contact professionals who can guide you. With determination and resourcefulness, you can find a way to obtain health insurance even without a job. Take charge of your well-being and prioritize your health because you deserve peace of mind with proper coverage.