Curious about the cost of business insurance? Well, you’ve come to the right place! In today’s article, we will dive into business insurance and uncover the answer to the burning question: How much does business insurance cost? Whether you’re a small startup or an established company, it’s crucial to understand the financial implications of protecting your business. So, buckle up and get ready for an informative and engaging ride as we explore the factors that influence business insurance costs and provide you with some expert insights. Let’s jump right in!

Regarding business insurance, one size certainly does not fit all. The insurance cost can vary significantly depending on several factors, such as the type of business you have, the size of your company, your location, and the coverage options you choose. It’s like a customized menu where you pick and choose what suits your business best. Like how a spicy jalapeño pizza might cost more than a classic cheese pizza, insurance for a high-risk industry like construction or healthcare might be higher than that of a low-risk business like consulting or retail.

But fear not! We’re here to guide you through the maze of insurance costs and help you make an informed decision. We’ll walk you through the factors that insurers consider when determining your premium and give tips on keeping those costs in check. So, get ready to become an insurance expert and take the first step towards protecting your business without breaking the bank!

How Much Does Business Insurance Cost?

Running a business comes with certain risks; one way to protect yourself from those risks is by having business insurance. But how much does business insurance cost? Well, the answer to that question can vary depending on several factors. In this article, we will explore the different factors that can influence the cost of business insurance and provide you with a better understanding of what to expect.

Factors Affecting the Cost of Business Insurance

When determining the cost of business insurance, several factors come into play. These factors can include the size and type of your business, your industry, your location, the coverage limits you choose, and your claims history. Let’s take a closer look at each of these factors.

The size and type of your business: The size and type of your business can significantly impact the cost of insurance. For example, a small retail store generally has lower insurance costs than a large manufacturing company. The type of business you operate also matters, as some industries are riskier than others, which can result in higher insurance premiums.

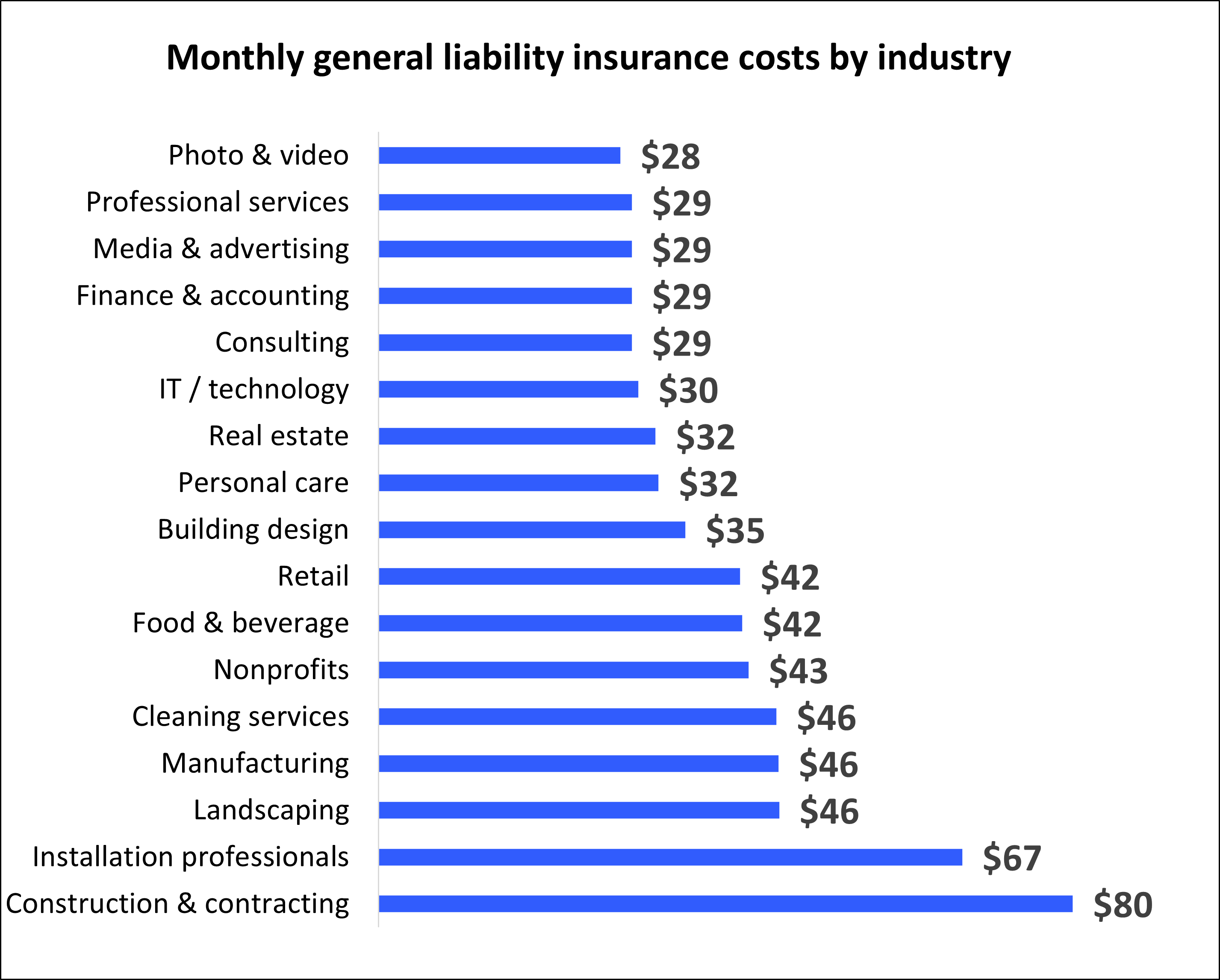

The industry you operate in The industry you work in plays a crucial role in determining your insurance costs. High-risk industries such as construction or healthcare may have higher insurance premiums due to the increased likelihood of accidents or lawsuits. On the other hand, lower-risk industries like consulting or IT services may have lower insurance costs.

Your location: Your location can affect the cost of business insurance due to varying state regulations and local risks. Some states have higher minimum coverage requirements, which can increase the overall cost. Additionally, insurance premiums may be higher if you operate in an area prone to natural disasters or high crime rates.

Coverage limits: The coverage limits you choose for your business insurance policy can impact costs. Higher coverage limits generally result in higher premiums. It’s essential to balance adequate coverage and affordability to ensure you are protected without overpaying.

Claims history: Your claims history also plays a role in determining the insurance cost. If your business has a history of frequent claims, insurance providers may consider you a higher risk and charge higher premiums. On the other hand, a clean claims history can help lower your insurance costs.

Types of Business Insurance and Their Costs

Now that we’ve discussed the factors that influence the cost of business insurance, let’s look at the different types of business insurance and their associated costs.

1. General Liability Insurance: General liability insurance covers third-party bodily injury, property damage, and advertising injury claims. The cost of general liability insurance can range from $500 to $3,000 per year, depending on the size of your business and the industry you operate in.

2. Professional Liability Insurance: Professional liability insurance, also known as errors and omissions insurance, protects professionals against claims of negligence or mistakes in their services. The cost of professional liability insurance can vary significantly depending on the profession, with premiums typically ranging from $1,000 to $5,000 per year.

3. Property Insurance: Property insurance covers damage or loss to your business property, including buildings, equipment, and inventory. The cost of property insurance depends on factors such as the value of your property, location, and the level of coverage you choose. Premiums can range from $500 to $5,000 or more per year.

4. Workers’ Compensation Insurance: Workers’ compensation insurance covers medical expenses and lost wages in the event of an employee’s work-related injury or illness. Workers’ compensation insurance costs are typically based on your payroll and the risk associated with your industry. Premiums are usually calculated as a percentage of your payroll, with rates varying between 0.5% and 5% or more.

5. Business Interruption Insurance: Business interruption insurance covers lost income and additional expenses when your business cannot operate due to a covered event, such as a fire or natural disaster. Business interruption insurance costs are typically based on your business’s revenue, ranging from $750 to $10,000 or more per year.

6. Cyber Liability Insurance: Cyber liability insurance protects businesses from the financial losses and liabilities associated with data breaches and cyber-attacks. The cost of cyber liability insurance can vary depending on factors such as the size of your business, industry, and the level of coverage you choose. Premiums can range from $1,000 to $10,000 or more per year.

It’s important to note that these cost ranges are just estimates, and the actual cost of business insurance will depend on your specific circumstances. Contacting insurance providers and discussing your business’s unique needs is recommended to get an accurate quote.

Factors to Consider When Choosing Business Insurance

When selecting business insurance, it’s essential to consider the following factors:

1. Coverage: Assess your business’s specific risks and choose coverage that adequately protects you against those risks. Consider the types of insurance mentioned earlier and determine which ones are most relevant to your business.

2. Cost: While cost is a significant factor, it shouldn’t be the sole determining factor. Balance affordability with the coverage you need to ensure you have adequate protection.

3. Insurance Provider: Research and compare different insurance providers to find one that offers competitive rates, excellent customer service, and a reputation for handling claims.

4. Deductibles: Consider the deductibles associated with your insurance policies. A higher deductible can lower your premiums but also means you’ll have to pay more out of pocket in the event of a claim.

5. Additional Coverages: Some insurance policies offer optional coverages that can provide additional protection tailored to your business’s needs. Consider these optional coverages and assess whether they are worth the extra cost.

In conclusion, the cost of business insurance can vary depending on factors such as the size and type of your business, your industry, your location, the coverage limits you choose, and your claims history. It’s essential to assess your business’s needs carefully, consider different insurance options, and select coverage that provides adequate protection at a reasonable cost. By taking the time to research and compare insurance providers, you can find the right coverage for your business’s unique requirements.

Key Takeaways:

- Business insurance costs can vary based on factors like the type of business, coverage limits, and location.

- Small businesses expect to pay around $500 to $3,000 annually for general liability insurance.

- Professional liability insurance, or errors and omissions insurance, can cost around $500 to $5,000 annually.

- Industry-specific insurance, such as restaurant or construction insurance, may have different pricing.

- Getting multiple quotes from insurance providers to compare prices and coverage options is essential.

Frequently Asked Questions

Question 1: What factors determine the cost of business insurance?

When determining the cost of business insurance, several factors come into play. Firstly, the type of business you operate plays a significant role. Different industries have varying levels of risk, and insurance providers consider this when calculating premiums. Additionally, the size of your business and its revenue also impact the cost. A more significant business with higher income may have more assets to protect, resulting in higher insurance costs.

Furthermore, the coverage options you choose and the limits you set will influence the cost of your business insurance. You can expect to pay more if you opt for comprehensive coverage with higher limits. Finally, your claims history and risk management practices can affect the cost. Businesses with frequent claims or poor risk management history may face higher premiums.

Question 2: Are there any average costs for business insurance?

Providing an average cost for business insurance is complex and varies greatly depending on the factors mentioned earlier. However, to give you a general idea, small businesses in low-risk industries can expect to pay around $500 to $1,500 per year for basic coverage. Medium-sized companies in moderate-risk industries may pay between $1,500 and $5,000 annually. Prominent companies operating in high-risk sectors can have premiums exceeding $10,000 annually.

Remember that these are just rough estimates, and the actual cost will depend on the unique characteristics of your business. Requesting quotes from multiple insurance providers is always recommended to better understand the costs specific to your business.

Question 3: Can I reduce the cost of business insurance?

Yes, there are several ways to reduce the cost of your business insurance potentially. One strategy is to bundle multiple policies with the same insurance provider. Many insurers offer discounts for bundling, such as combining general liability insurance with property insurance. Additionally, implementing risk management practices and maintaining a claims-free history can help reduce premiums.

Another option is to consider a higher deductible. By choosing a higher deductible, you may be able to lower your premiums. However, assessing the financial impact of a higher deductible is essential, as well as ensuring you can comfortably cover it in the event of a claim.

Question 4: Should I compare quotes from different insurance providers?

Yes, it’s highly recommended to compare quotes from multiple insurance providers. Each insurer has its underwriting criteria and pricing structure, so getting quotes from different companies allows you to compare costs and coverage options. Keep in mind that the cheapest option isn’t always the best choice. It’s essential to consider the reputation and financial stability of the insurance provider, as well as the specific coverages and limits offered.

By comparing quotes, you can find the right balance between cost and coverage that best suits your business’s needs. Don’t hesitate to ask questions and seek clarification from insurance agents to ensure you’re making an informed decision.

Question 5: Can I negotiate the cost of business insurance?

While it may be challenging to negotiate the actual cost of business insurance, you can work with an insurance broker or agent to find the most competitive rates available. These professionals have relationships with multiple insurance providers and can leverage their expertise to negotiate on your behalf.

It’s important to remember that insurance rates are based on risk assessments, so significant negotiation may not be possible. However, brokers and agents can help you explore different coverage options and identify discounts or savings opportunities that may be available to you.

Final Summary: How Much Does Business Insurance Cost?

So, you’re running a business and want to protect yourself from potential risks and liabilities. That’s where business insurance comes in. But the burning question on your mind is, “How much does it cost?” Well, my friend, let’s dive into business insurance premiums and find out!

Regarding the cost of business insurance, several factors are at play. The type of coverage you need, the size of your business, your location, and even your industry all come into play. Insurance companies consider these factors to determine your premium. It’s like a puzzle with multiple pieces that fit together to create your unique insurance cost.

Now, don’t fret! It’s not as complicated as it may seem. To give you a ballpark figure, small businesses can expect to pay anywhere from a few hundred dollars to a few thousand dollars per year for basic coverage. Of course, this can vary greatly depending on the factors above. Getting multiple quotes from different insurance providers is always a good idea to ensure you get the best possible rate tailored to your needs.

Remember, investing in business insurance is like investing in peace of mind. It’s a way to protect yourself, your employees, and your assets from unexpected events that could derail your business. So, while the cost of business insurance may vary, its value is immeasurable. Take the time to understand your insurance needs, shop for the best rates, and make an informed decision. Your business will thank you in the long run!